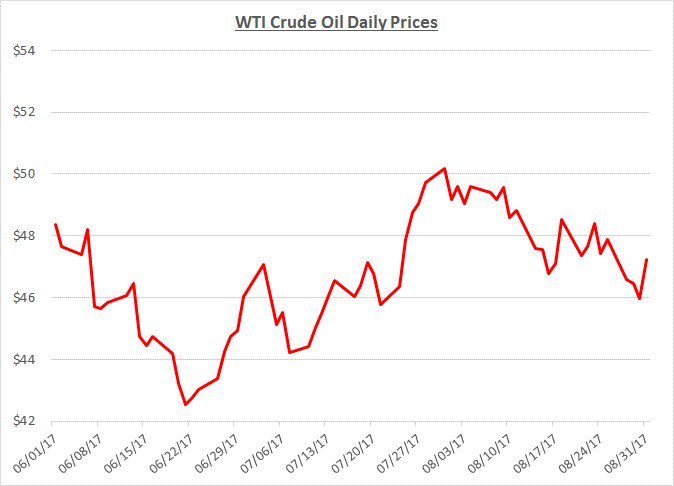

August’s crude oil prices traded in a narrow range between the mid- to high-$40’s/barrel. They opened the month just over $49 and closed the month just over $47. The following graph shows the daily price movements over the past three months:

It was somewhat surprising to see relatively stable oil prices throughout August despite reports of inventory declines along with slowing growth of US production rigs. These trends would normally provide support for increasing prices but were offset by concerns of slowing global demand for oil, particularly in China. Toward the end of the month, US demand for oil was also curtailed by Hurricane Harvey which forced a large percentage of US refineries in the Gulf Coast region to shut down.

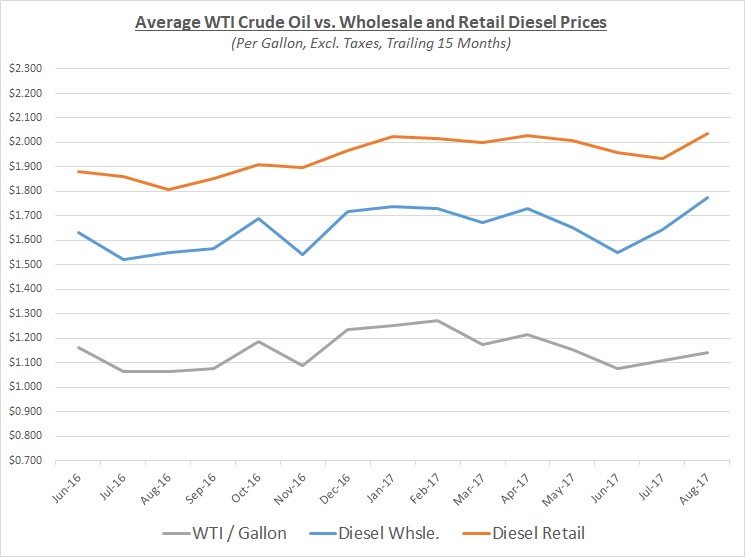

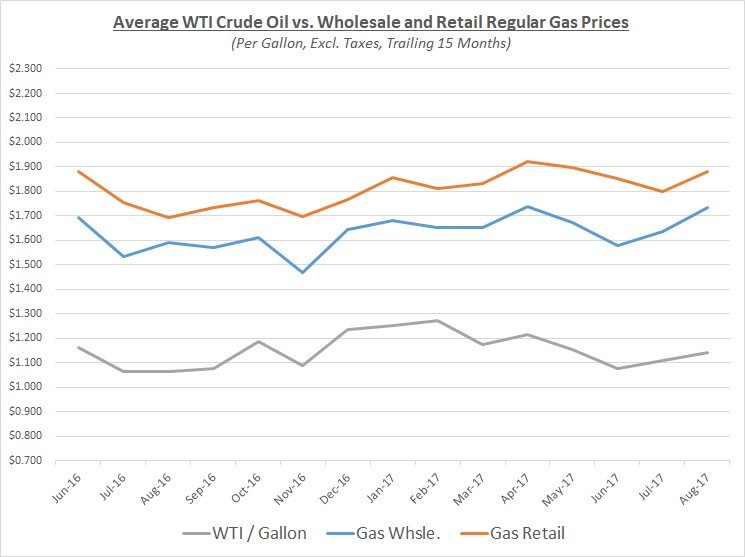

Hurricane Harvey’s closure of refineries caused significant increases in prices for diesel and gas. Prices were already moving higher over the past two months as demand increased during the summer driving season. When the refineries closed, shortages of products occurred in many Gulf Coast markets that were hit hardest by the storm. In addition, many regions of the US receive diesel and gas through pipelines that originate from refineries in the Gulf Coast. This created a ripple effect of higher prices throughout the US, especially in the Southeast and Mid-Atlantic regions, where availability of diesel and gas was reduced along the pipelines. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

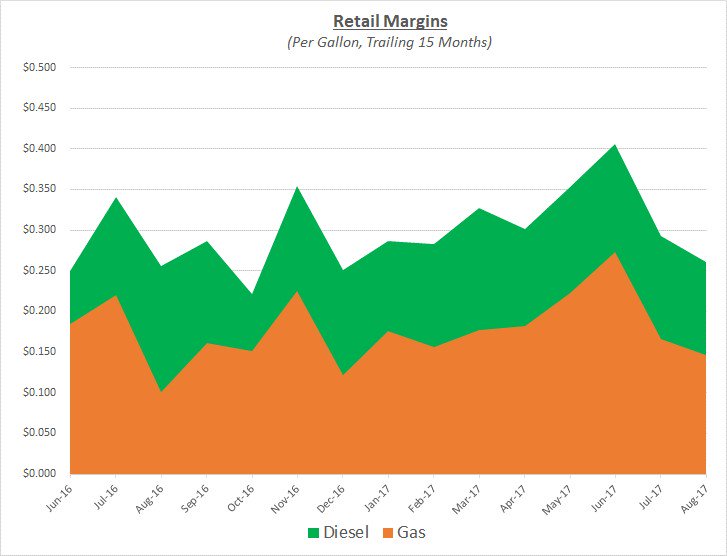

Since August’s retail prices for diesel and gas increased at a similar rate as wholesale prices, retail margins did not change significantly. The following graph shows the retail margin trends over the last 15 months:

Based on the market changes in August, all fleets would have seen modest increases in prices regardless of whether they had deals based on retail or wholesale indexes. These increases may have been more significant for fleets operating in the areas of the US that were impacted most by Hurricane Harvey.

Looking beyond August, Sokolis anticipates prices for diesel and gas will remain elevated through most of September in many parts of the US until refinery and pipeline operations recover from the disruptions they experienced from the storm. Crude oil prices will likely continue to hover near $50/barrel through September. However, as refineries recover and inventories are drawn down to meet the backlog of demand for refined products there is some potential for oil prices to climb slightly higher. In addition, as colder weather emerges later in the fall, demand for heating oil will begin to increase which may also provide support for higher oil prices.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.