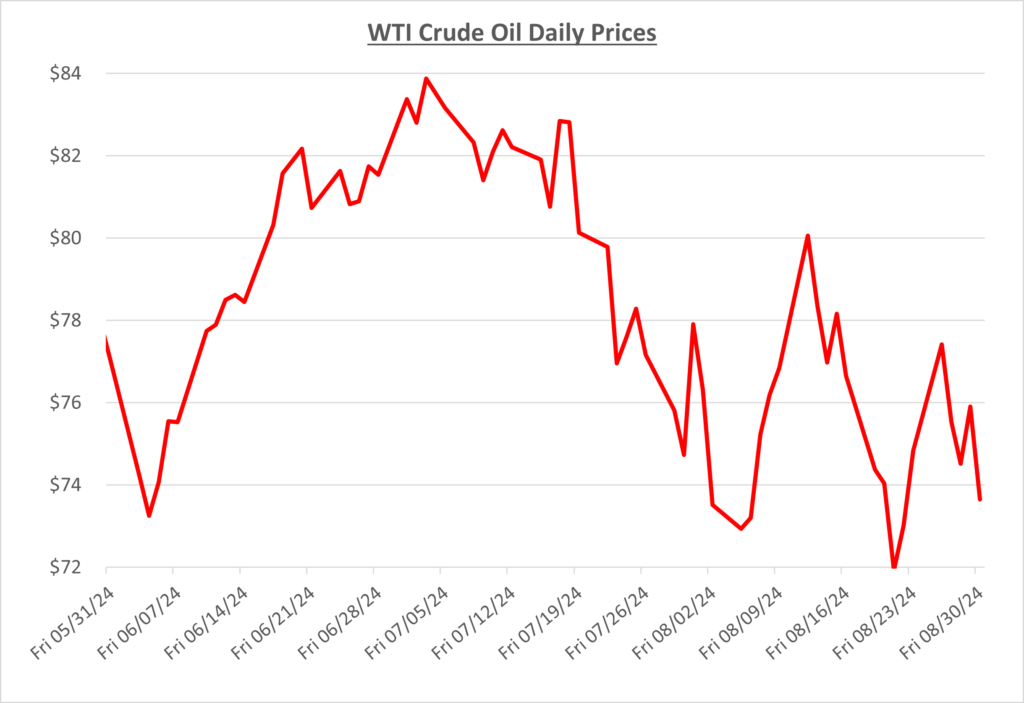

Oil prices spiked to start August but spent the rest of the month on a rollercoaster with peaks and valleys. The market is struggling with the threat of a major escalation in the Middle East and poor global demand, which is resulting in prices going up and down like a yo-yo. The following graph shows the daily price movements over the past three months:

With demand being weak due to China’s disappointing economic numbers and the U.S. showing signs of a possible recession, OPEC+ may be forced to adjust their strategy. The original plan was to slowly start increasing production some time in Q4 of this year. Members of the panel claim that is still their intention, but it could change if gains are not made in oil consumption soon.

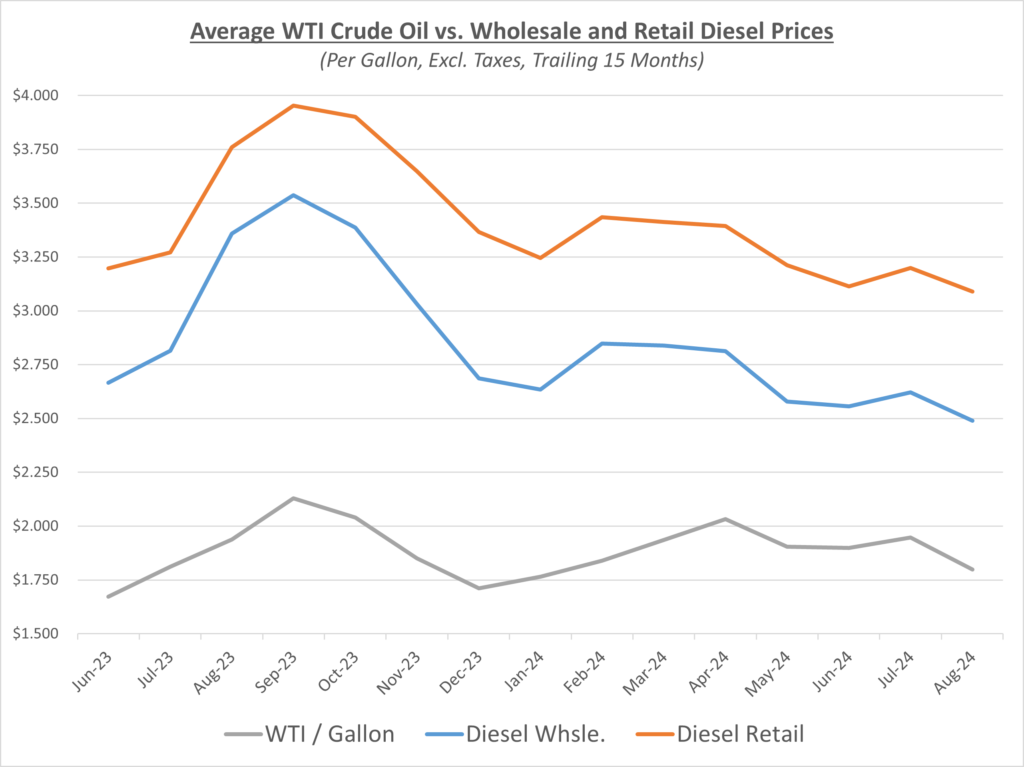

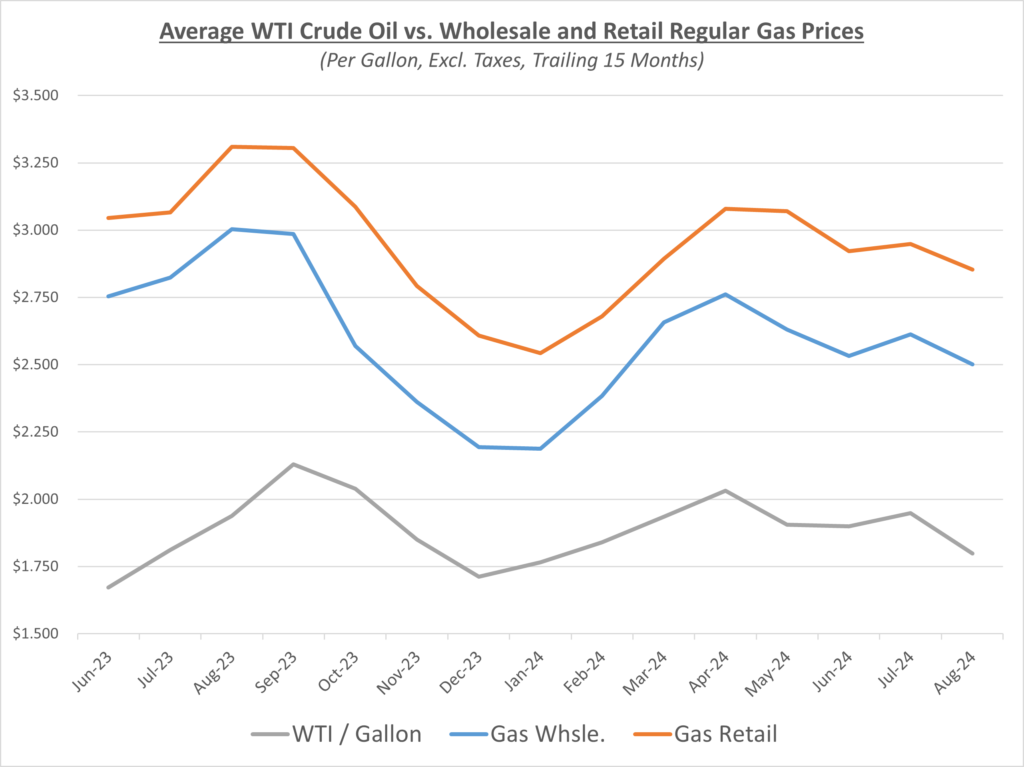

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

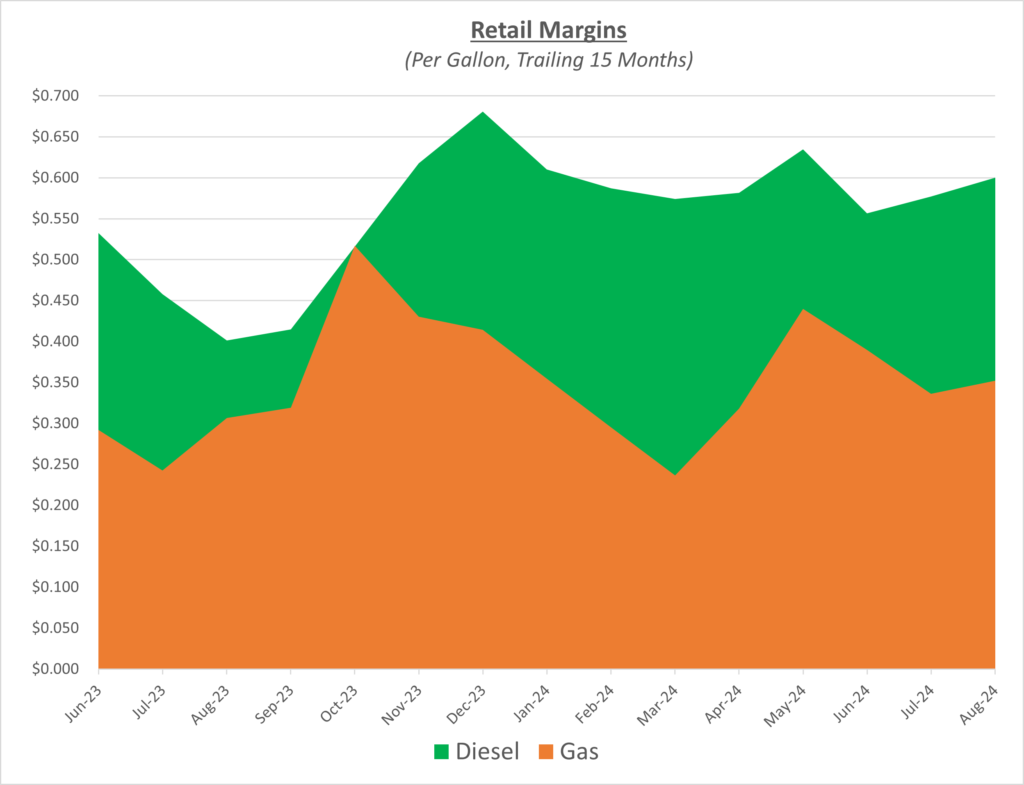

Diesel wholesale and retail prices both decreased in August. Wholesale prices fell slightly more than retail prices, which resulted in increased profit margins for suppliers. Gas had very similar results to diesel. Gas wholesale and retail prices declined, with wholesale falling slightly further than retail causing profit margins to rise. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished at about $3.33/gallon in August, which is a decrease of about $0.16 compared to last month. The national average for diesel prices finished at roughly $3.68/gallon, ending August $0.14 less than July’s average price.

Oil prices saw one last spike toward the end of August with positive news from the U.S. about interest rates seeing their first cut along with supply worries with Libya’s oilfields being shut down. This bullish news would be short lived as reports suggest OPEC+ will move forward with their slow increase in production during October. This offsets any losses seen from Libya being offline, and once fully back up and running, supply will be even stronger causing downward pressure on oil prices.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $70-80/barrel in the near term.