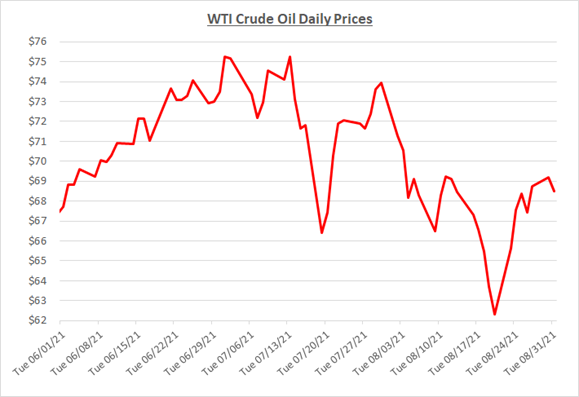

Oil started August above $70/barrel but fell below the mark just a few days into the month. By the 9th of the month, oil fell by 4% to its lowest point since May, mainly due to China’s surge in COVID cases from the Delta variant, imports being down, and a strong US dollar. The following graph shows the daily price movements over the past three months:

Oil prices tried to rally over the next week, but it was short lived as the negative factors outweighed the positive factors. The downward slide continued mid-month surpassing the previous low, to a new low since May. COVID cases continued to increase (especially in China, the world’s largest oil importer) which resulted in fears about demand diminishing. August 20th saw oil finish at just over $62/barrel.

Fuel prices are always volatile whenever there is instability in the Middle East, which we now have with the Taliban overthrowing the Afghanistan government. The US has ended their 20-year presence in Afghanistan and surprisingly there haven’t been any big movements in fuel prices correlated to it so far. We’ll keep an eye on this topic as turmoil could spread to other Middle Eastern countries and cause spikes to pricing.

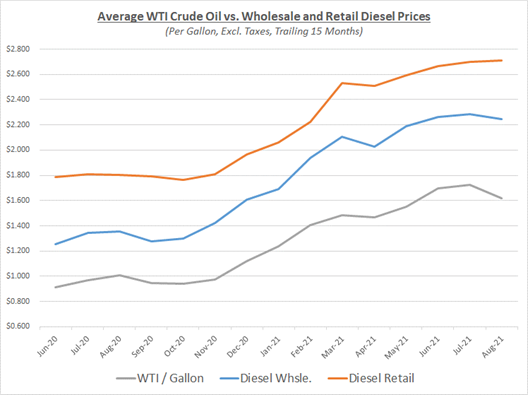

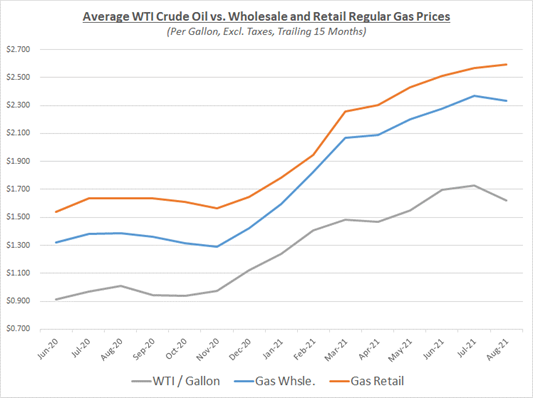

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

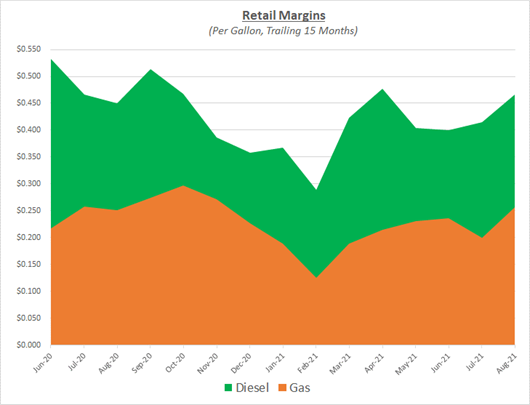

Diesel and gas retail margins had similar patterns in August. Wholesale prices fell, and retail margins for both products continued to rise, creating large spreads at the pumps. With significant drops in oil prices at the beginning and middle of the month, both diesel and gas margins saw their highest marks in 2021. As mentioned before, it is typical to see large retail margins when wholesale prices fall drastically. The following graph shows the retail margins over the trailing 15 months:

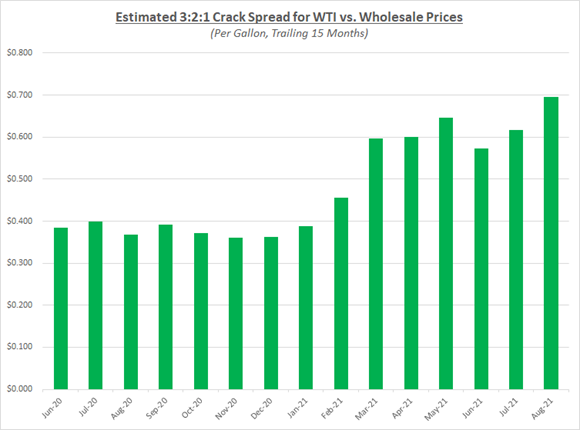

Another month, another new high this year for crack spreads! While July was over $0.60, August approached topping $0.70 as shown in the 3-2-1 crack spread graph below. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. Demand for refined fuels continues to be high while supplies are tight which has kept the spread at extremely high levels.

Towards the end of August, oil prices began to rise again. The increase could be attributed to fuel purchasers buying the dip and locking in some fixed pricing. There was also some hope provided with the FDA giving full approval to Pfizer’s vaccine. The market may have taken this as a sign that more people will get vaccinated, and demand will continue to improve.

Hurricane Ida made landfall Sunday August 29th hitting Louisiana hard and closing the Colonial Pipeline temporarily. The category 4 hurricane caused widespread power outages and flooding to the region. There will be a direct impact of rising fuel prices in the southeast, but since the Colonial Pipeline was able to restore service a day later, this shouldn’t cause higher prices or a shortage in other markets.

August finished the month at just under $69/barrel. OPEC+ met on September 1st and reaffirmed their plans to gradually increase production for the remainder of the year. As a result, oil prices were relatively stable. Most analysts have lowered their expectations for where oil prices will finish 2021. There are too many concerns with demand due to the surging Delta variant and plenty of supply ready to hit the market if needed. Sokolis believes that oil will hover in the $60s for the remainder of the year.