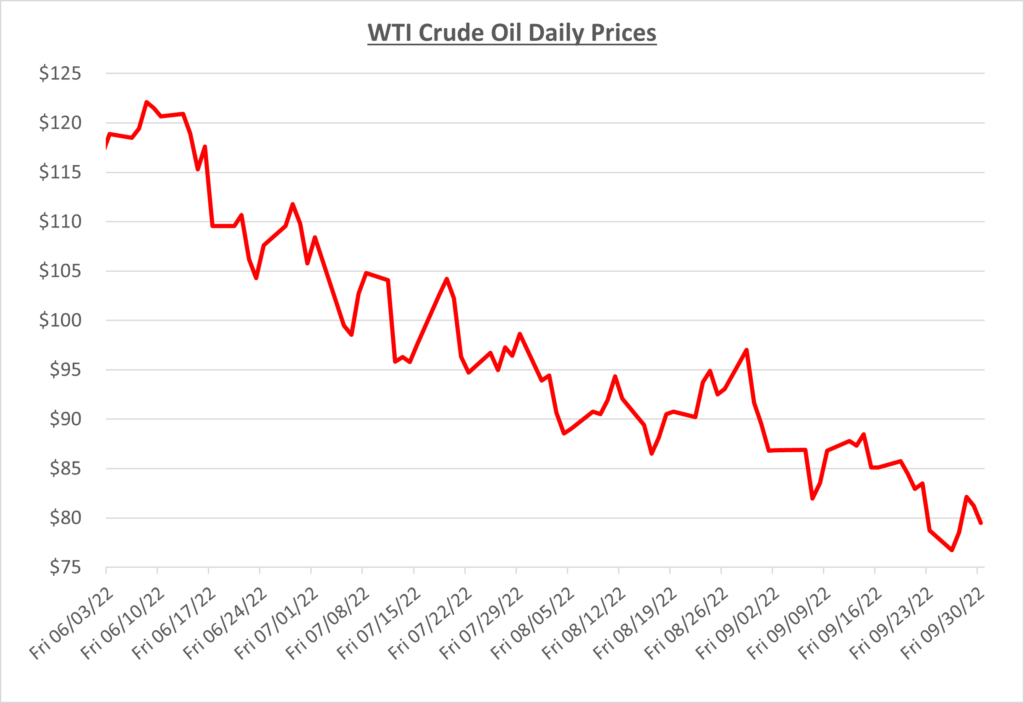

Oil prices continue to drop, falling below $80/barrel in September. As we close out the summer and move into fall, the story has not changed. There are still fears of a global recession and demand in China has not increased due to their COVID lockdown. The following graph shows the daily price movements over the past three months:

OPEC+ met early in September and agreed on a 100,000/barrel per day cut for October. The results of these actions should be minimal, as OPEC was already struggling to hit quotas. The meaning however can be construed that oil producing countries are interested in keeping oil prices higher, despite pressure from the U.S. government to help ease fuel prices.

Mid-month there was a fear of a rail strike that sent oil prices upward. In an already tight transportation industry, a disruption to a source of moving petroleum would be hard to duplicate elsewhere. Ultimately the crisis was averted, and oil prices fell lower.

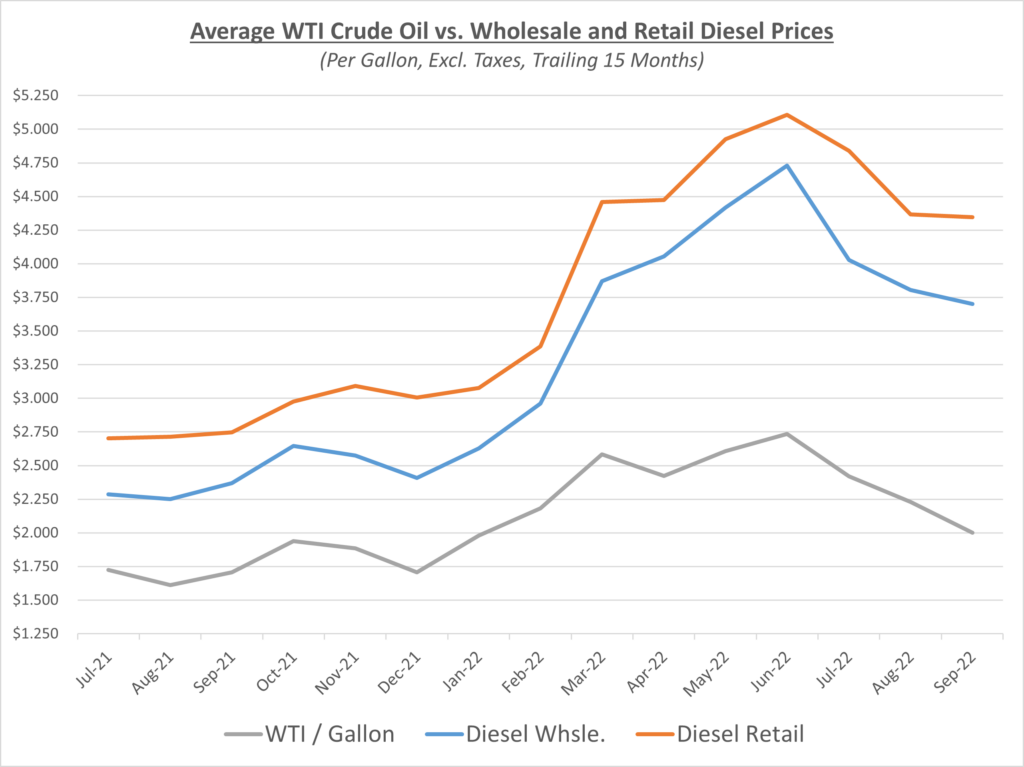

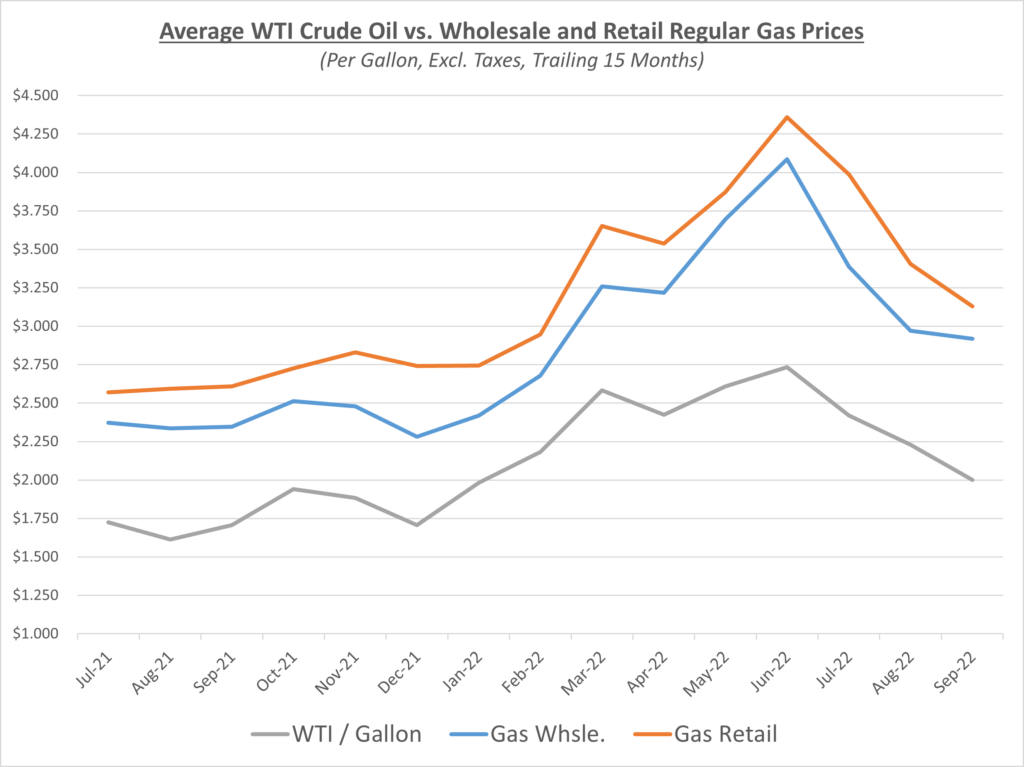

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

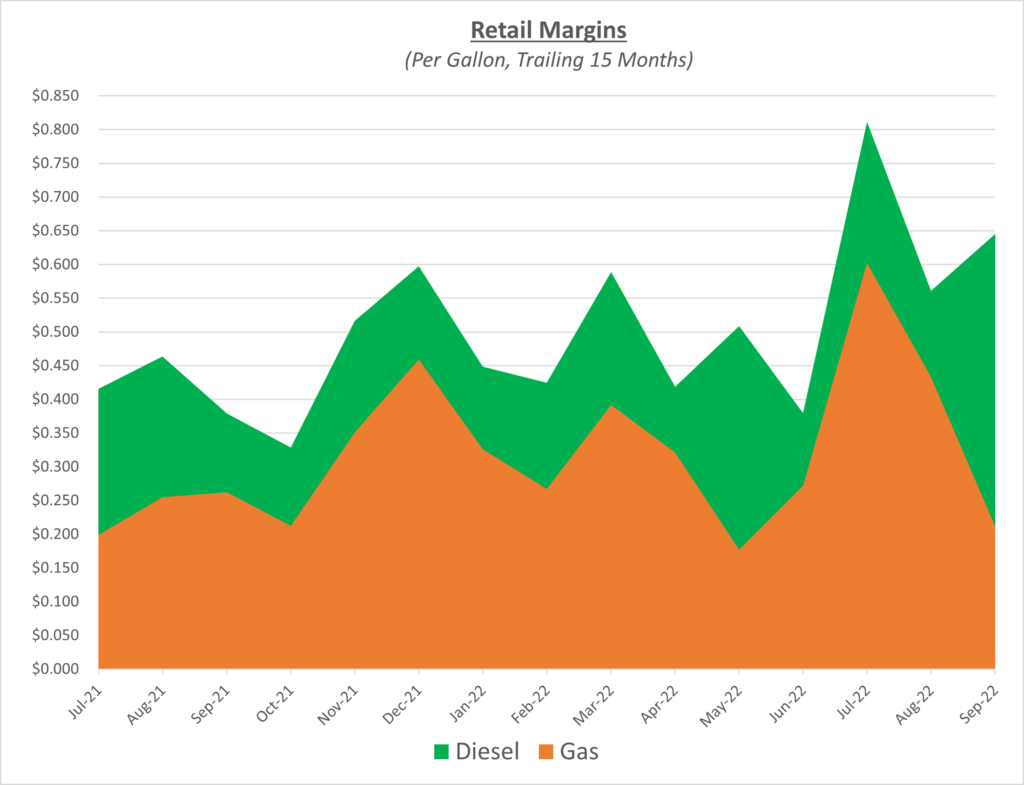

Diesel retail prices flattened in September while wholesale continued its decline. This created some nice profit margins for diesel retail suppliers. Retail gas prices and wholesale declined, but retail outpaced wholesale slightly which tightened profit margins for gas retail suppliers. For the third month in a row, margins remained high for diesel, but gas saw a big decline compared to August. The following graph shows the retail margins over the trailing 15 months:

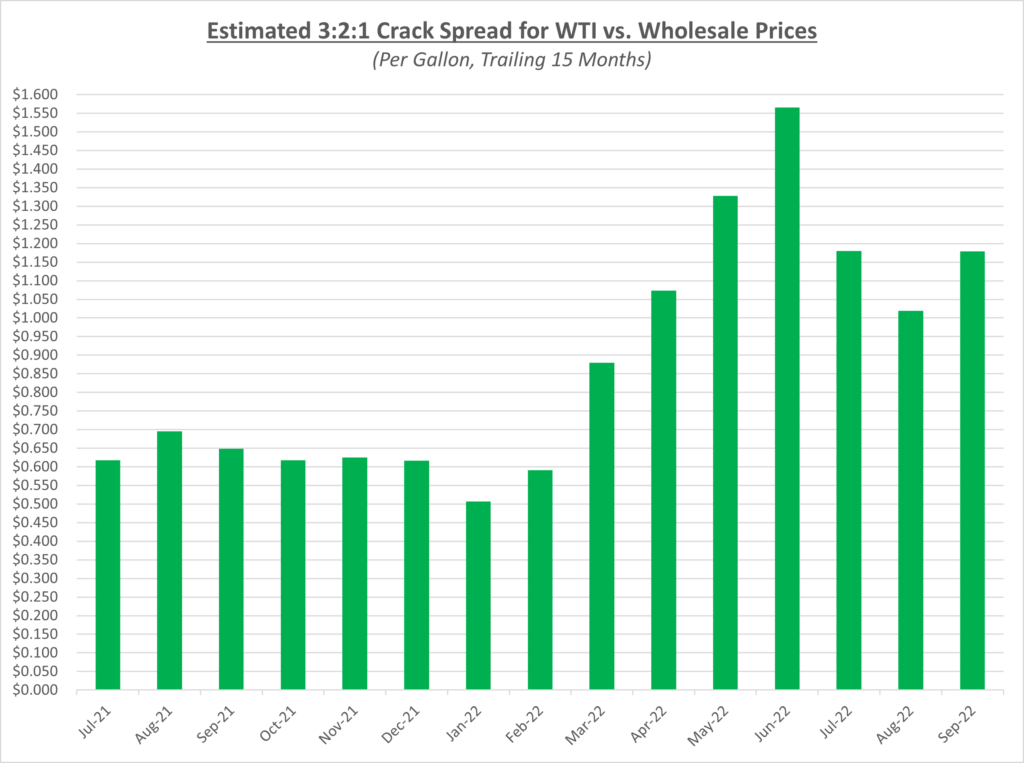

The story with crack spreads hasn’t wavered for most of 2022. Crack spreads remain higher than usual at well over $1/gallon. September finished just under $1.20/gallon as show in the graph below.

As we mentioned, oil finished September at just under $80/barrel, which was about 11% lower from where August ended. Oil prices are now about 35% lower from the highs seen in June. The national average gas price remained relatively unchanged compared to last month, while diesel fell by about $0.20/gallon to a national average of $4.87/gallon, according to AAA.

Hurricane Ian hit the gulf coast of Florida hard and is estimated to be one of the costliest storms in U.S. history. We previously warned that any disruptions to production could cause oil prices to spike. While Hurricane Ian did halt gulf coast production of roughly 500k barrels/day, it was short lived as production was able to restart just a few days later. Florida receives most of its supply via barge so the horrific damage that Hurricane Ian brought to the state did not have a major effect on oil supply.

As always, it’s been tough to predict where oil and fuel prices will go. Overall supplies remain tight, and China is still frequently experiencing lockdowns which is limiting demand. A recession is approaching if not already here. Sokolis believes that oil prices will remain in the $80-90/barrel range, but there are many moving parts and we’ll do our best to keep you updated with the latest updates.