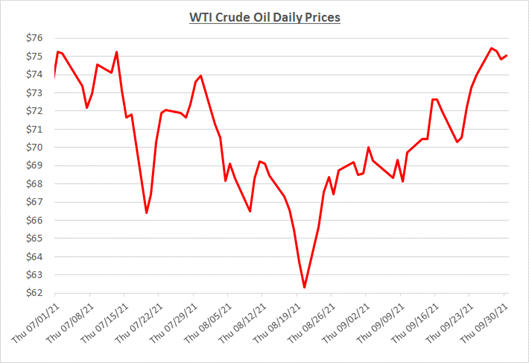

Although Hurricane Ida made landfall August 29th, it continued to wreak havoc into September as it moved up the east coast smashing the northeast. Well into the month, Louisiana suffered with power outages from the category 4 hurricane which caused long haul deliveries due to local refineries and terminals being offline. Oil began September at just over $68/barrel and ended the month just over $75/barrel, roughly a 10% increase. The following graph shows the daily price movements over the past three months:

As we approached the middle of August, fuel supply in Louisiana remained scarce due to remnants from Hurricane Ida and Tropical Storm Nicholas. GasBuddy reported that 50% of fuel stations in New Orleans had no gas and 33% of those were out of diesel. Hurricane season has been very detrimental to the Gulf Coast refineries resulting in larger than expected draws of U.S. inventories. Ida was responsible for the largest ever initial loss of crude oil production in the U.S.

Some positive news showed COVID cases starting to decrease from their highs resulting in increasing demand. With supply tight and optimism for demand, oil prices got back over the $70/barrel hump and appear to be heading higher.

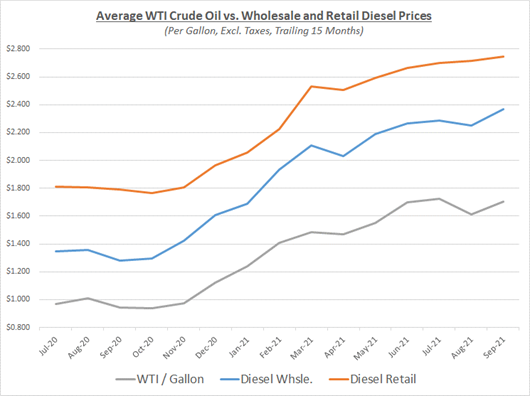

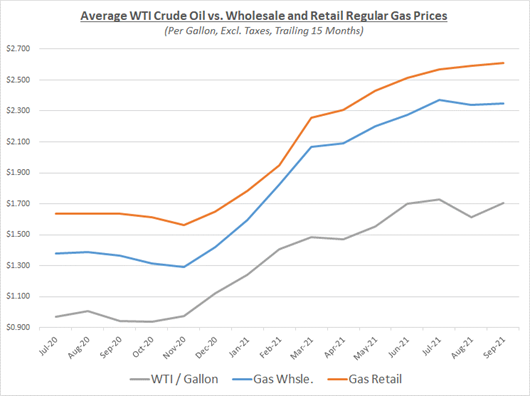

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

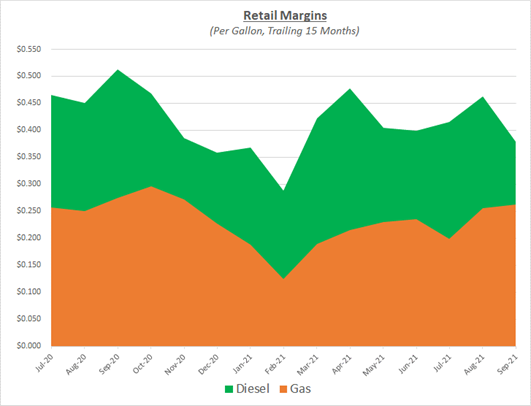

Diesel retail margins subsided to more normal levels in September as wholesale prices rose quickly throughout the month and retail prices reacted slower. Gas wholesale and retail prices remained mostly flat resulting in almost identical retail margins to the previous month. The following graph shows the retail margins over the trailing 15 months:

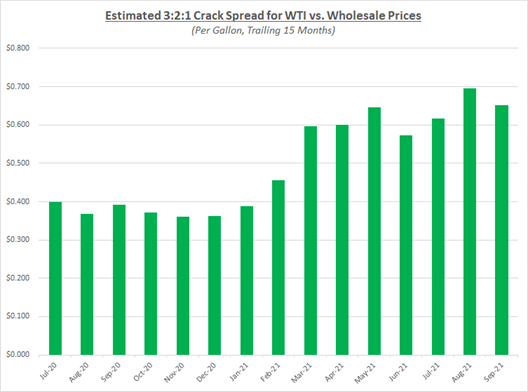

Crack spreads remain at levels above $0.60 for the past three months. As shown in the graph below, this upward trend has continued since the beginning of the year. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. With demand for refined fuels continuing to be high and supplies getting tighter, we should expect to see these spreads at extremely high levels.

Since hitting a bottom in mid-August, oil prices have risen in September to levels not seen in three years. Even with the agreed upon increase in OPEC+ production, supply was still behind due to this year’s hurricane season. Oil inventories have seen their largest daily drawdowns ever, giving analysts like Goldman Sachs reason to believe prices will continue to rise throughout the year.

Another factor that is causing demand to be strong for oil is the increase in pricing of natural gas and a potential global shortage. Natural gas prices haven’t been this high in over seven years. This may force alternative fuel buyers to shift back to oil which would only increase demand and support higher oil prices even further.

The second half of September saw US COVID cases declining and gave hope that we may be riding the end of the latest wave. Of course, winter is around the corner and we could see a new surge. However, demand continues to be strong and, as mentioned above, supply issues are prevalent. Sokolis believes that oil will range in the $70s for the remainder of the year with the possibility of breaking through the $80 mark.