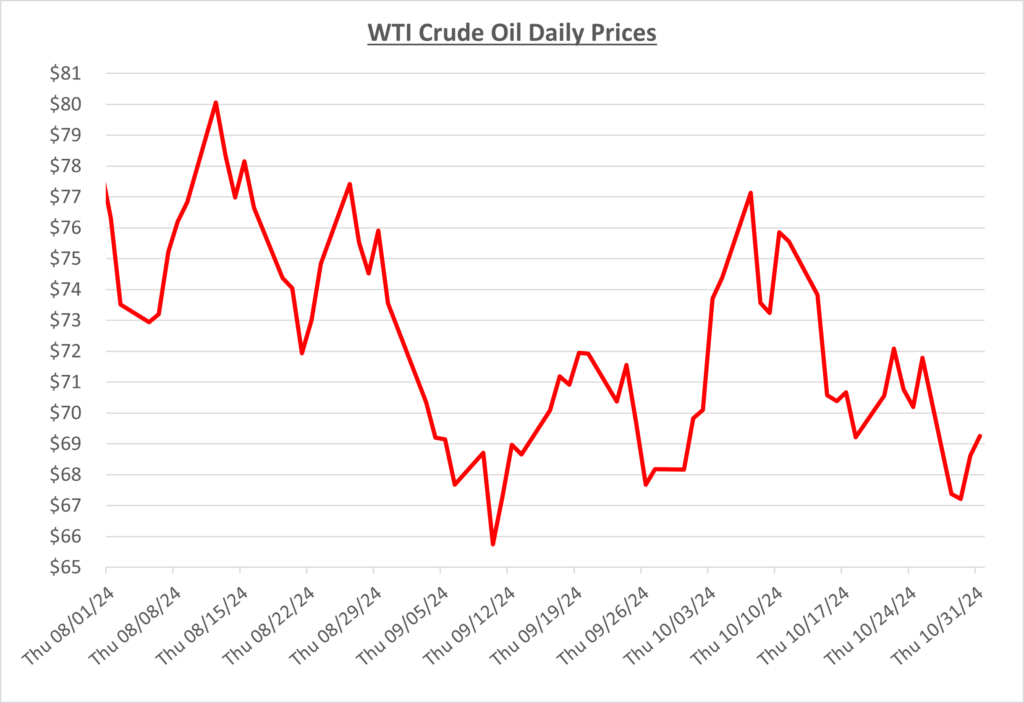

Fuel prices reversed their recent trend as oil prices elevated back into the $70s/barrel due to Iran’s missile attack on Israel. Fears of retaliation, specifically on Iran oilfields, caused prices to spike early in October as high as $77/barrel. The following graph shows the daily price movements over the past three months:

By mid-month, the premium built into oil prices from war in the Middle East was fizzling out by poor global economic numbers. Demand concerns were back on the forefront as China implemented a stimulus package (the largest since the pandemic) to try and boost their economy and in turn increase oil consumption which has been heading the opposite direction.

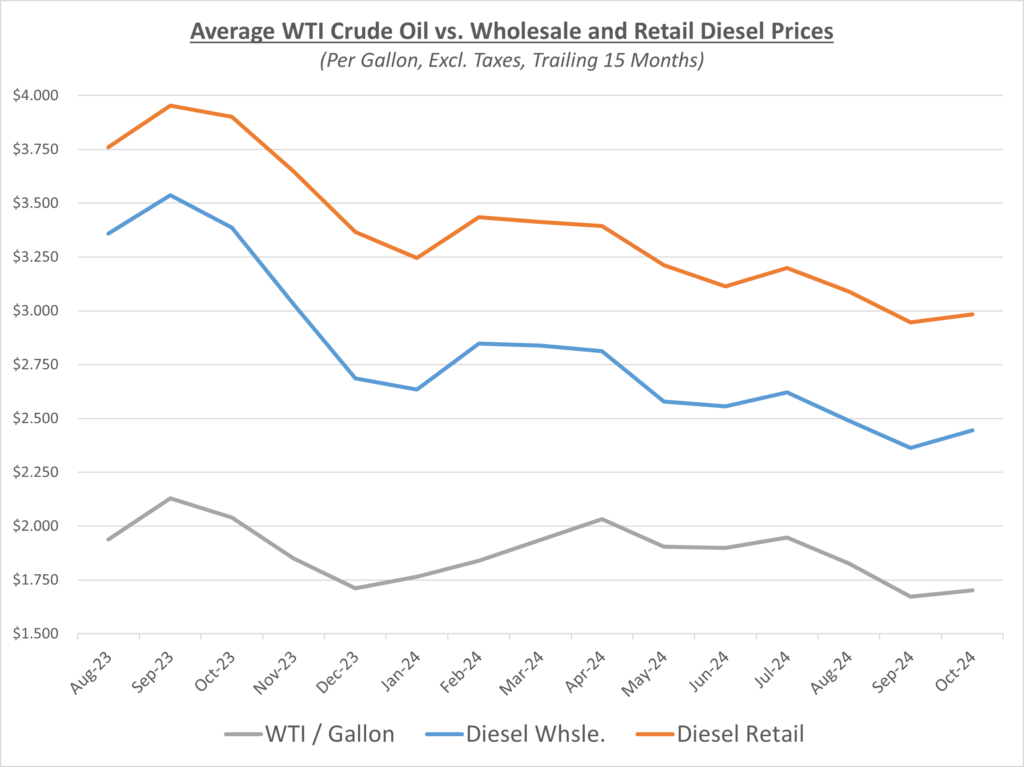

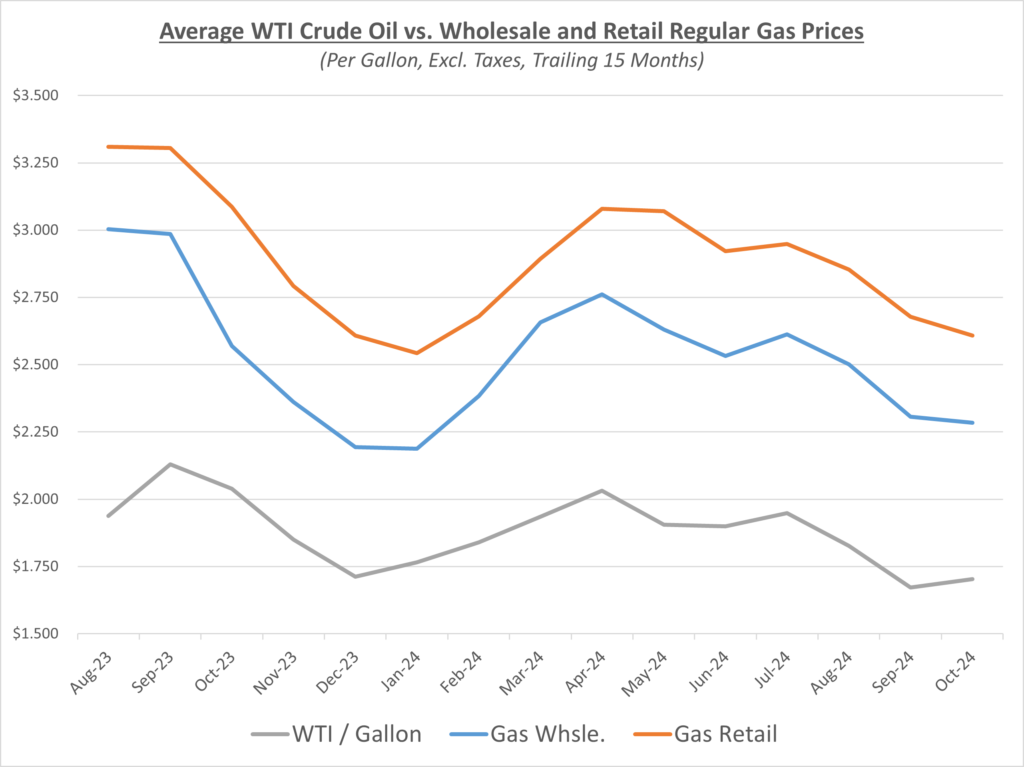

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

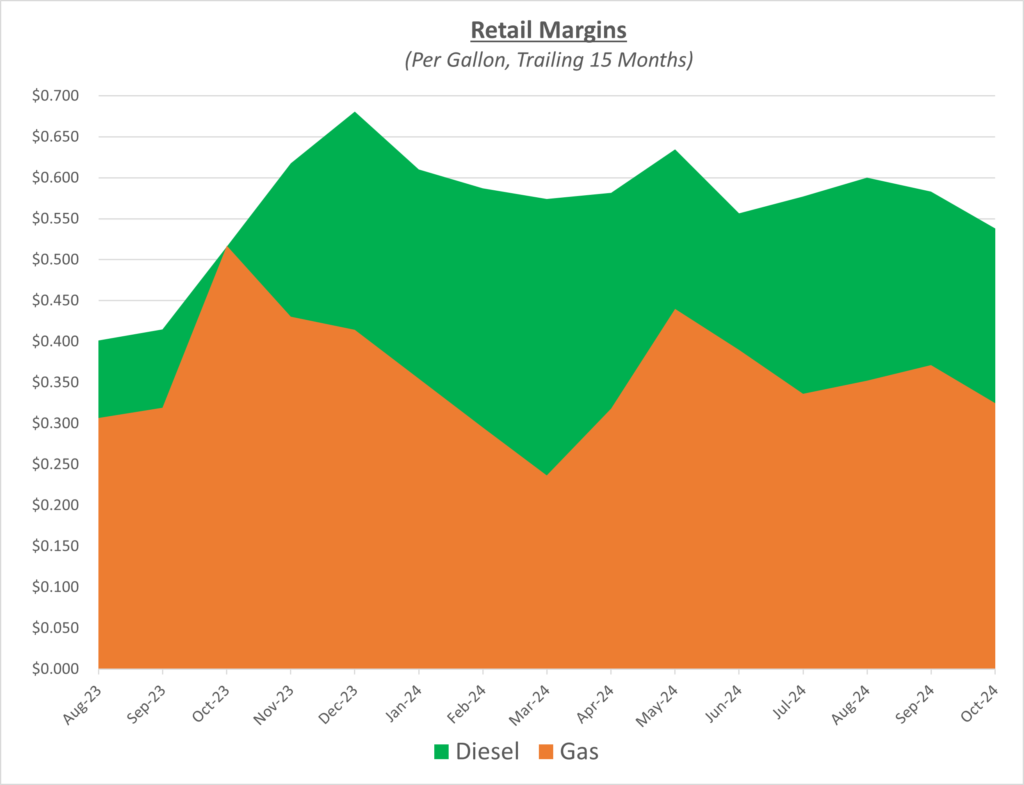

In October, diesel wholesale rose faster than retail, resulting in another month of decreased profit margins for suppliers. Gas prices were falling in October, but retail outpaced wholesale’s decline and caused lower profit margins. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished October at $3.13/gallon, which is a decrease of about $0.09 compared to last month. The national average for diesel prices finished at roughly $3.57/gallon, which is exactly where it concluded in September.

October saw some peaks and valleys with oil prices as traders weighed conflict in the Middle East versus the recent ongoing picture of weak global demand. One major factor that should support oil prices for the short term was OPEC+ deciding to delay their production increase until at least January 2025. They have continued to show themselves to be cognizant of the current state of oil prices when deciding on whether to add or subtract supply. Oil finished the month below $70/barrel but was already trending above that mark with the OPEC+ announcement.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $65-75/barrel in the near term.