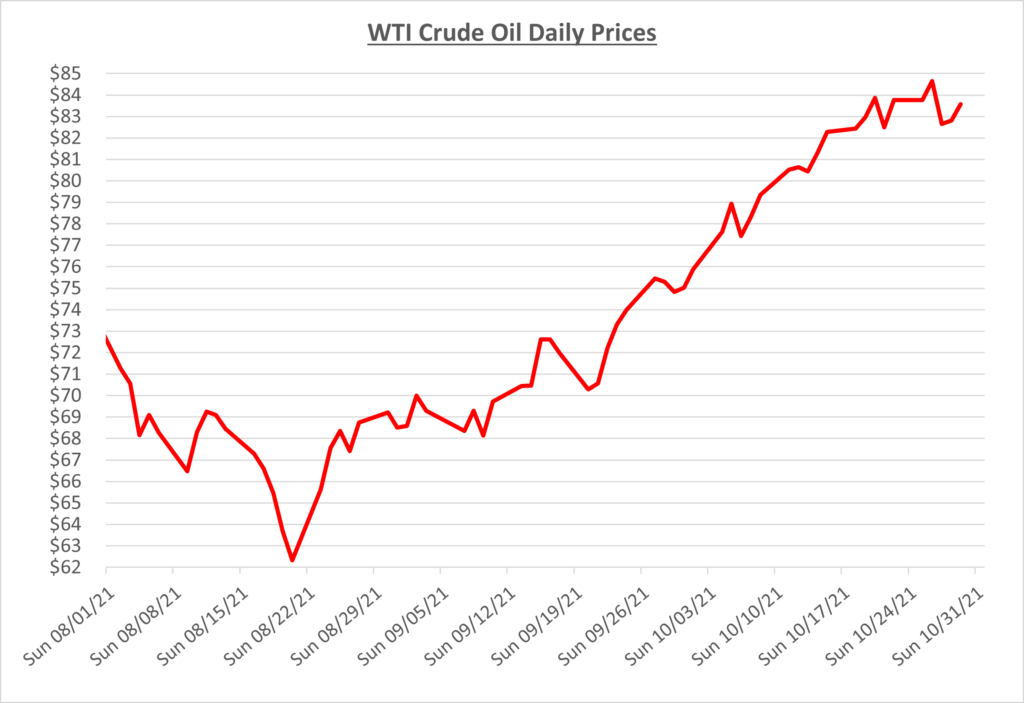

Oil markets started October at roughly $75/barrel and prices would not stop there. OPEC+ had met and the oil giants concluded they would keep the same level of output despite increasing demand. Oil prices continued to inch higher and higher until finally passing the $80 mark. This was the highest seen in seven years. The following graph shows the daily price movements over the past three months:

Towards the middle of October, oil continued rising past $81/barrel, another new seven year high. We saw a slight dip due to rumors of the US releasing strategic reserves but ultimately, they decided against it and prices continued to increase.

As more and more countries get COVID cases in check, we see releases on COVID restrictions, which brings optimism and belief that demand is only going to surge. Goldman Sachs is predicting that these price increases are far from over, and higher oil prices could last several years.

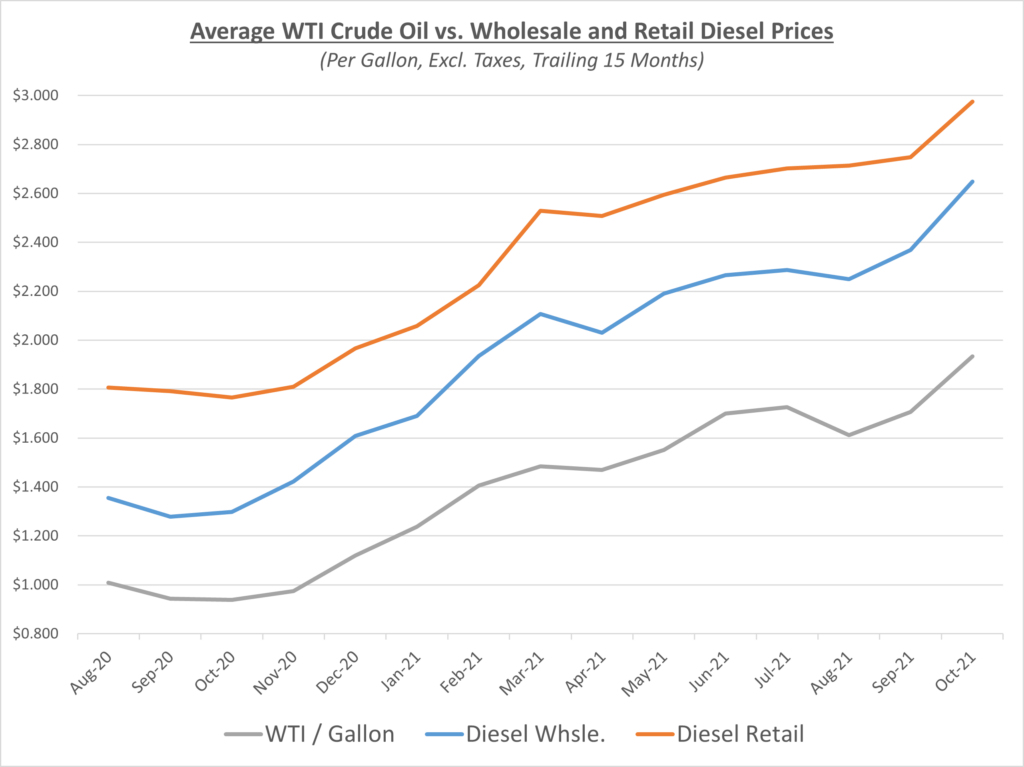

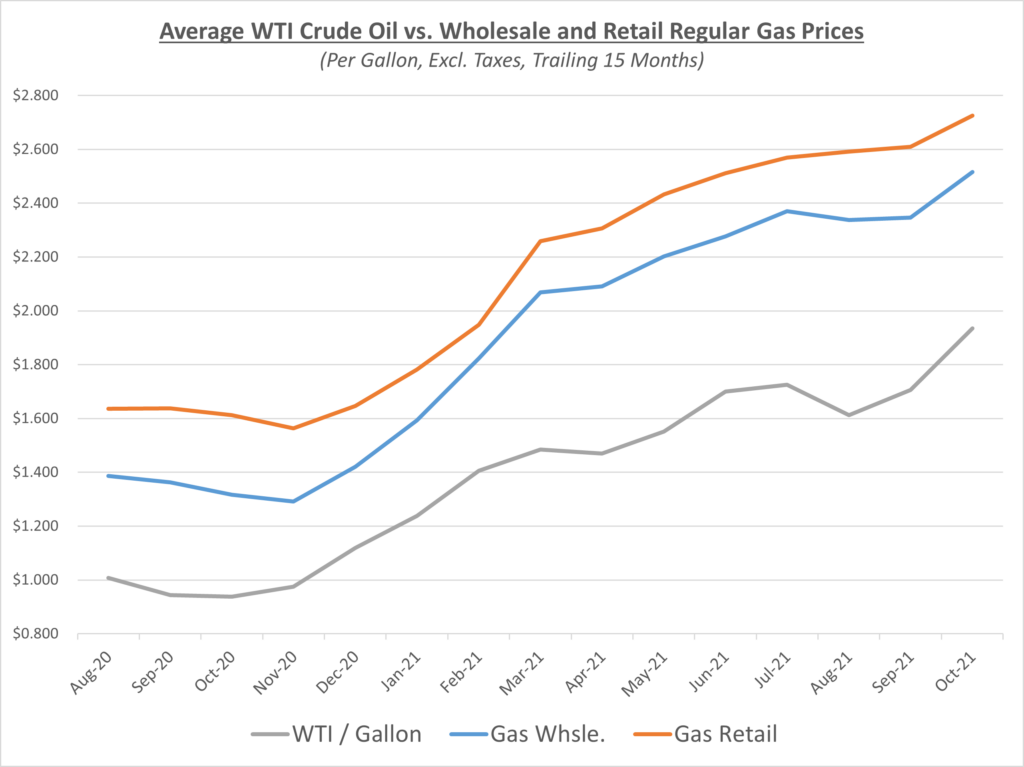

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

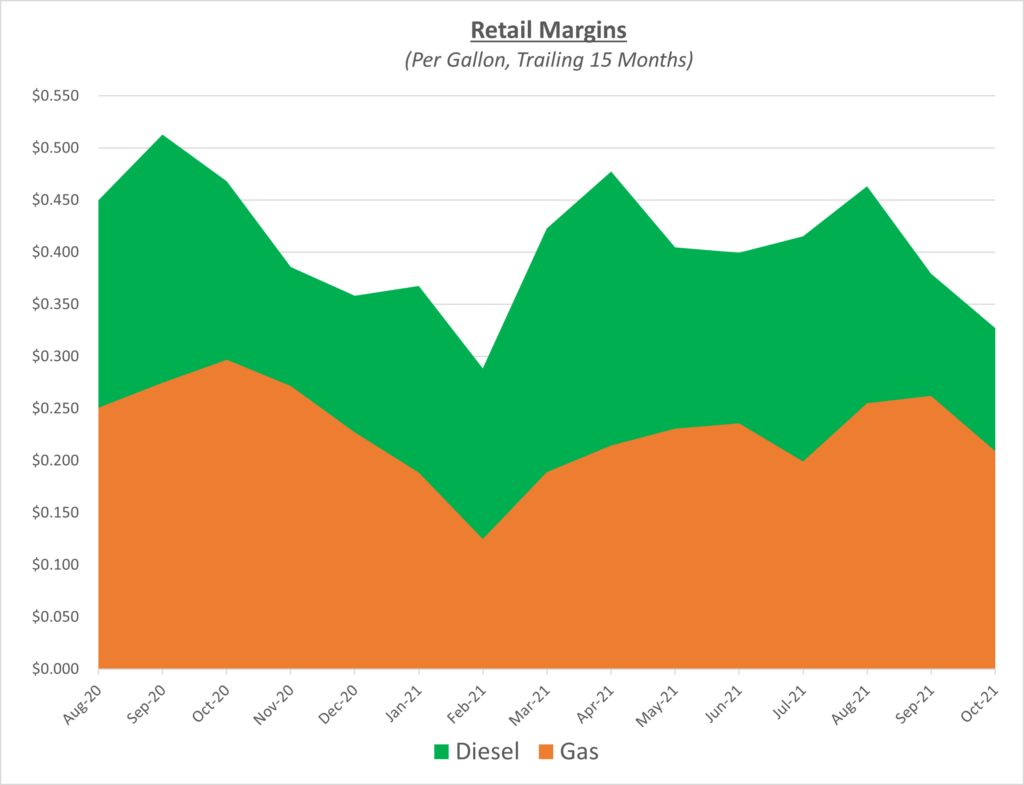

In October, diesel retail margins continued their decline as wholesale prices continued to rise throughout the month and retail prices didn’t react quickly enough at the pumps. Gas margins had an even sharper decline as wholesale prices shot up and retail couldn’t keep up. The following graph shows the retail margins over the trailing 15 months:

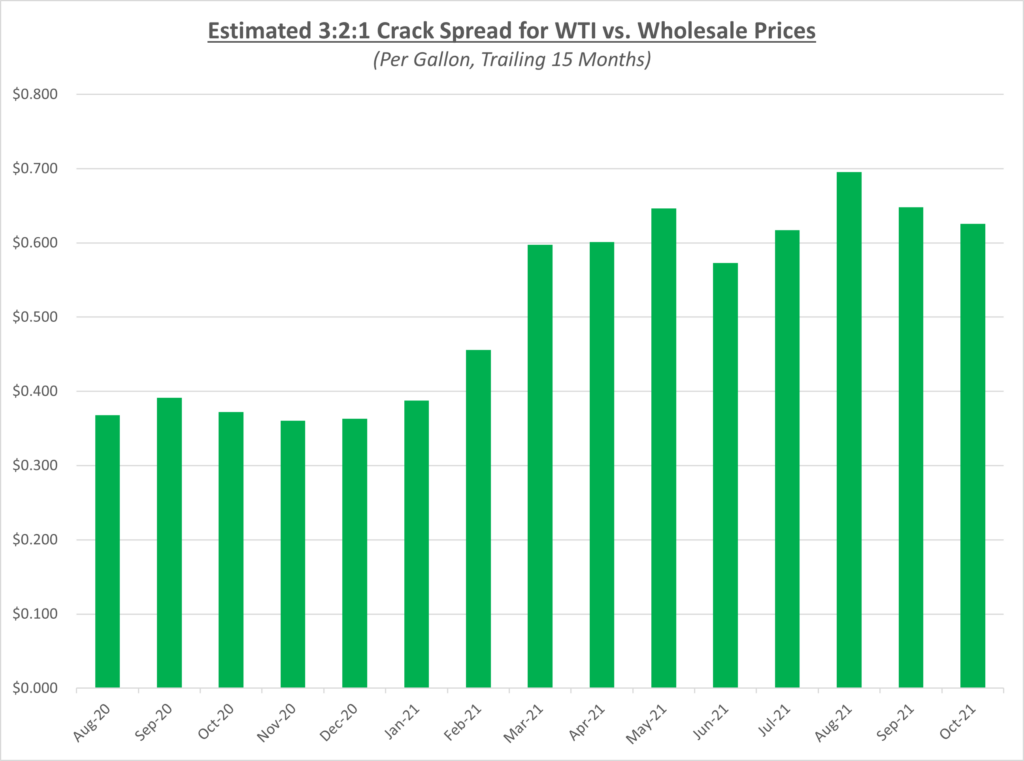

Crack spreads remain at levels above $0.60 for five of the past six months. As shown in the graph below, crack spreads are still elevated but have slightly lowered since hitting their high in August. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. With demand for refined fuels high and supplies tight, we should expect to see these spreads at high levels.

Oil finished the month at just under $84/barrel, another 10% increase. There was a point during daily trading where oil hit $86/barrel before retreating. Fuel prices continue to accelerate, and the main reasons tie back to Economics 101: supply and demand. Inventory levels continue to fall as supplies are tight. Demand continues to improve as COVID news is positive along with worries about the winter season which is quickly approaching. Heating oil season creates extra stress on supply, an already touchy subject with oil.

Iran has been in discussions with the US and allies on reentering the nuclear deal which would bring back much needed supply to the market and help elevate higher fuel prices. As promising as this seems, it would still take months for any results to develop. Sokolis believes that oil will range in the high $70s to low $80s for the remainder of the year with the possibility of breaking through the $90 mark if we have a rough winter.