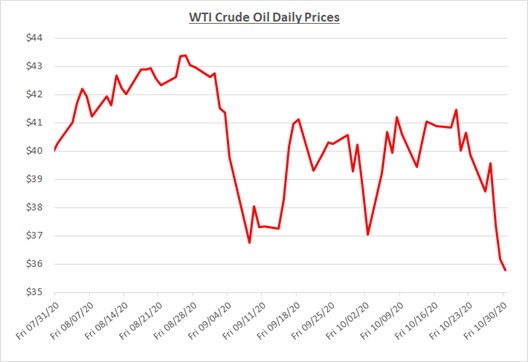

Oil prices fell by 11% during October, from a starting point near $40/barrel. Shortly after the month began, prices dropped to $37 followed by a quick recovery toward $41. However, the momentum was lost during the second half of the month as prices declined sharply to close the period under $36. The following graph shows the daily price movements over the past three months:

The volatility of oil prices and financial markets continues to be driven by COVID-19 concerns. During October, virus cases surged around the globe and new lockdowns were implemented in many countries. Although the US also experienced a large increase in daily cases, wide-spread lockdowns had been avoided. However, increasing cases coupled with US legislators’ inability to reach a compromise on a stimulus package raised concerns about the near-term future of the economy and demand for fuel.

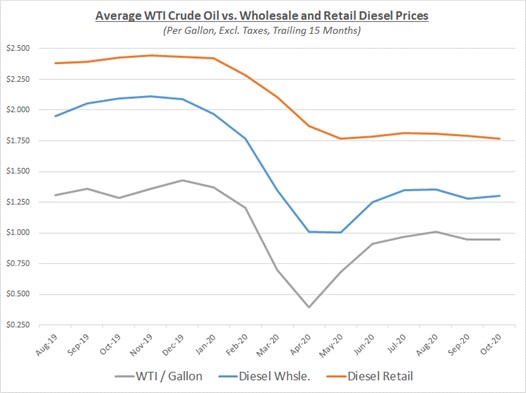

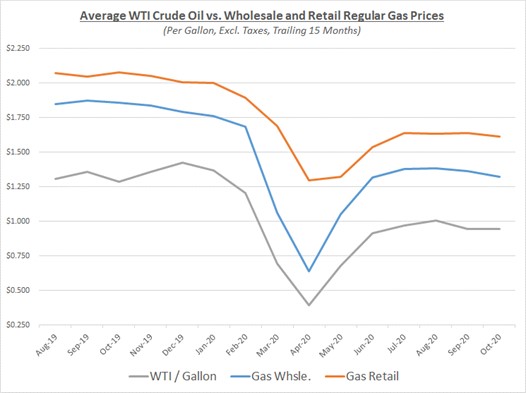

Despite the volatility of oil prices during October, the overall average price for the month was just under $40/barrel which was relatively flat compared to the prior month. Wholesale and retail prices for refined fuels did not show any significant changes either. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

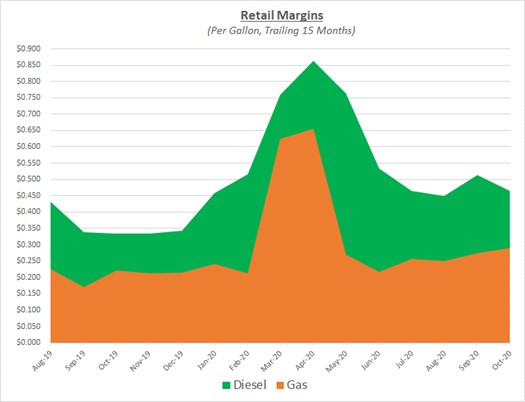

Retail margins for October reflected some small changes with diesel margins declining slightly while gas increased. The following graph shows the retail margins over the trailing 15 months:

For the remainder of this year, Sokolis anticipates oil prices will trade in the mid- to high-$30s per barrel based on the continued uncertainty about COVID-19’s economic impact. The potential for prices to decline even further is possible as restrictions expand to fight the virus. However, several vaccines are nearing the end of their test phase with a chance that at least one could obtain approval for distribution before the end of the year. If any of the vaccines are approved, oil and fuel prices could rise based on optimism that economic activity and demand for fuel will improve.