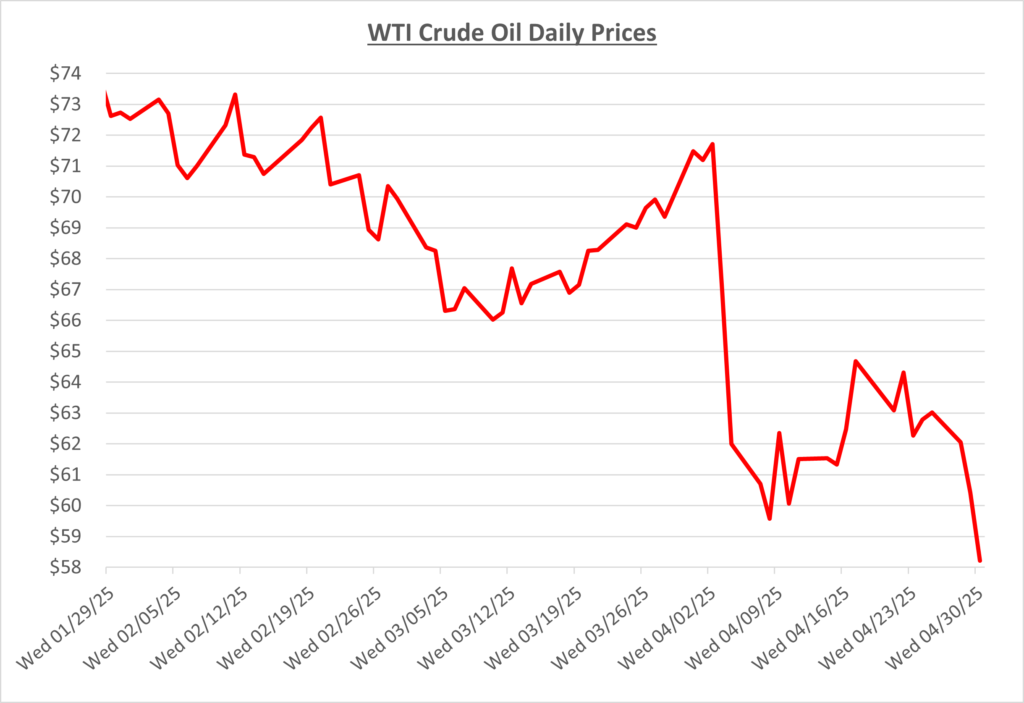

Oil prices began April relatively strong at $71/barrel. A flurry of tariff announcements, coupled with OPEC+’s decision to reverse planned production cuts, sent oil futures plummeting to $59/barrel within the first seven trading days of the month. Increased recession risks and slumping demand prevented any immediate recovery in oil prices. The following graph shows the daily price movements over the past three months:

By mid-April, a small price recovery was underway, spurred by newly announced sanctions against Chinese companies participating in oil trading with Iran. However, this small rally was short-lived; by the end of April, oil sank to new lows for the month, closing just above $58/barrel. Continued concerns about the Trump administration’s tariffs, increasing crude stockpiles, decreasing oil demand and the ongoing economic downturn all conspired to keep prices depressed heading into May.

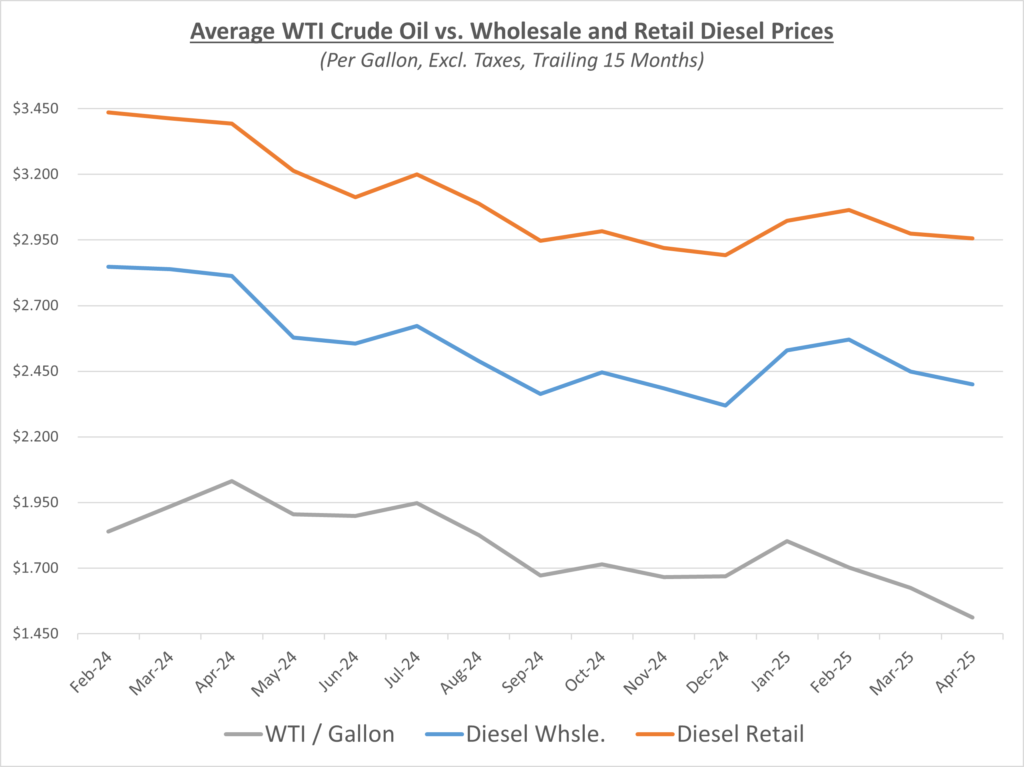

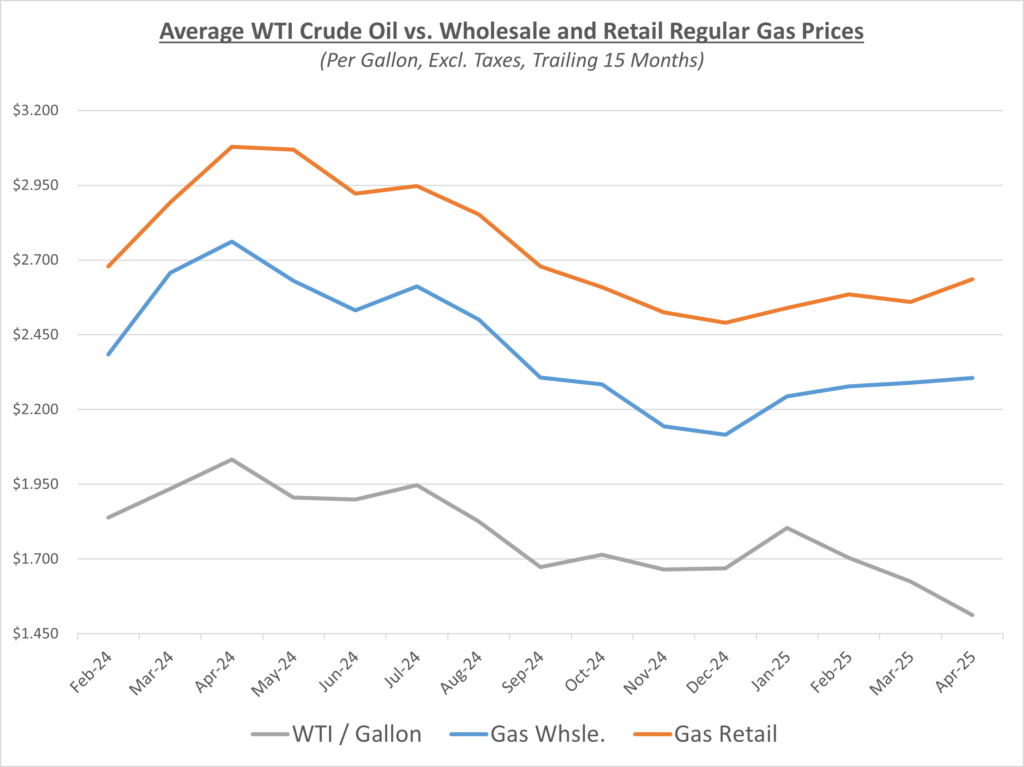

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

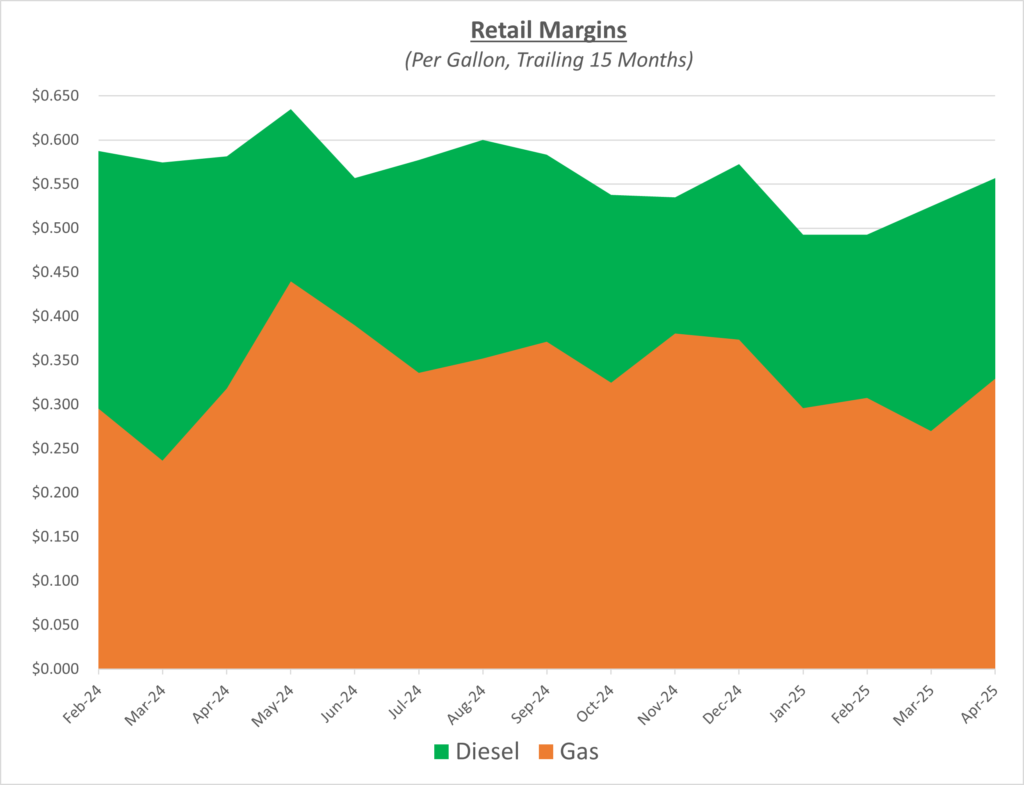

In April, diesel profit margins remained generally flat due to both wholesale and retail prices decreasing on similar trajectories. Gasoline remained on a modest upward path, with wholesale/retail spreads widening slightly in April. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average retail price for gas increased slightly from last month, finishing April at $3.17/gallon. The national average retail price for diesel finished April at $3.57/gallon, relatively flat compared to $3.59/gallon in March.

April saw the deepest monthly decrease in oil prices since November 2021, with WTI crude losing 16% of its value within the 30-day period. The specter of oversupply looms on the horizon, thanks to OPEC+ cancelling its previously announced production cuts and the ongoing global economic downturn keeping demand muted.

Sokolis currently anticipates that oil prices will range between $55-$70/barrel, although recession risks, tariffs, sanctions and the unpredictable economic environment make price projections particularly challenging. Sokolis will continue to monitor the oil and fuel markets and keep you informed in this unprecedented economic climate.