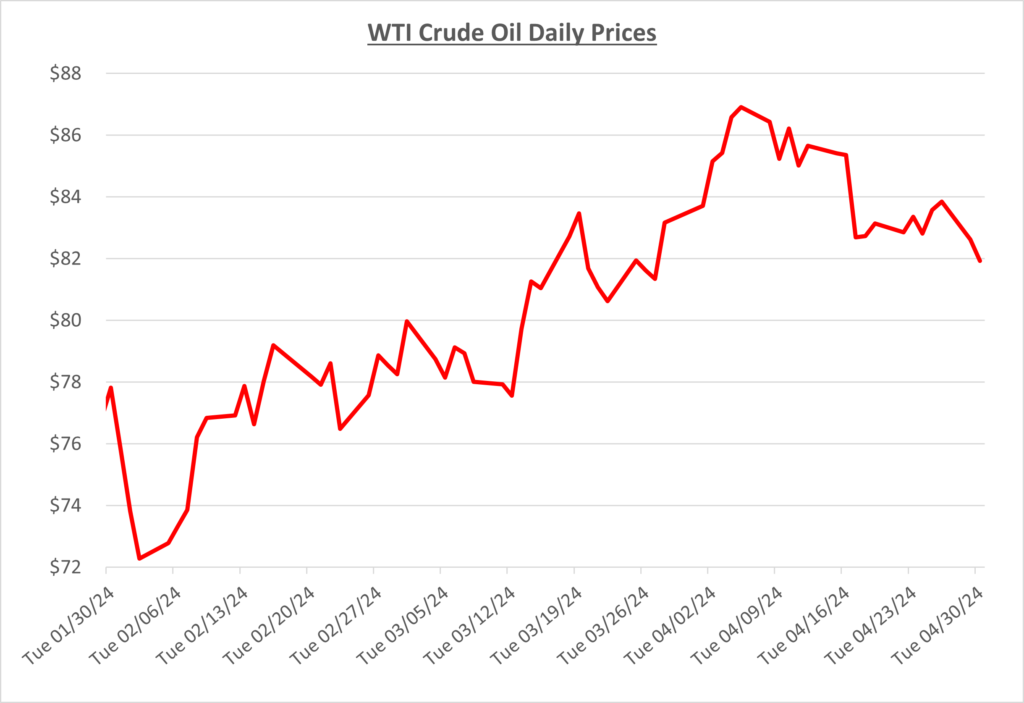

Oil prices started April with a big spike as they quickly approached the mid-$80s per barrel. With U.S. inventories showing draws and continued turmoil in Russia/Ukraine as well as the Middle East, prices were forced to go up with uncertainty surrounding oil. The following graph shows the daily price movements over the past three months:

After hitting just under $87/barrel, oil prices would cool down a bit as we approached the midpoint of April. Disappointing inflation reports were released showing inflation heading in the wrong direction (higher). Analysts and traders fear this as a potential setback for the Federal Reserve’s plan to begin cutting interest rates. Oil is mostly traded in U.S. dollars and traders were selling on another likely delay in rate cuts. Things also seemed to settle a bit in the Middle East between Iran and Israel. Less tension in the Middle East was also a factor resulting in oil prices heading lower as the fear of escalation was previously causing prices to head higher.

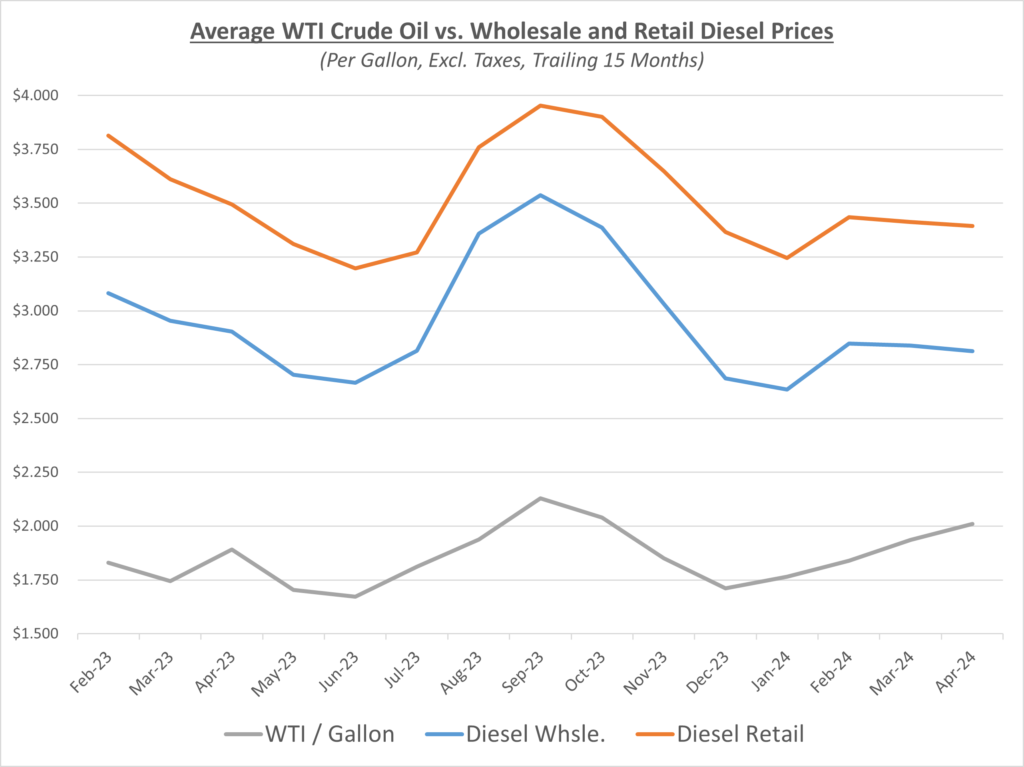

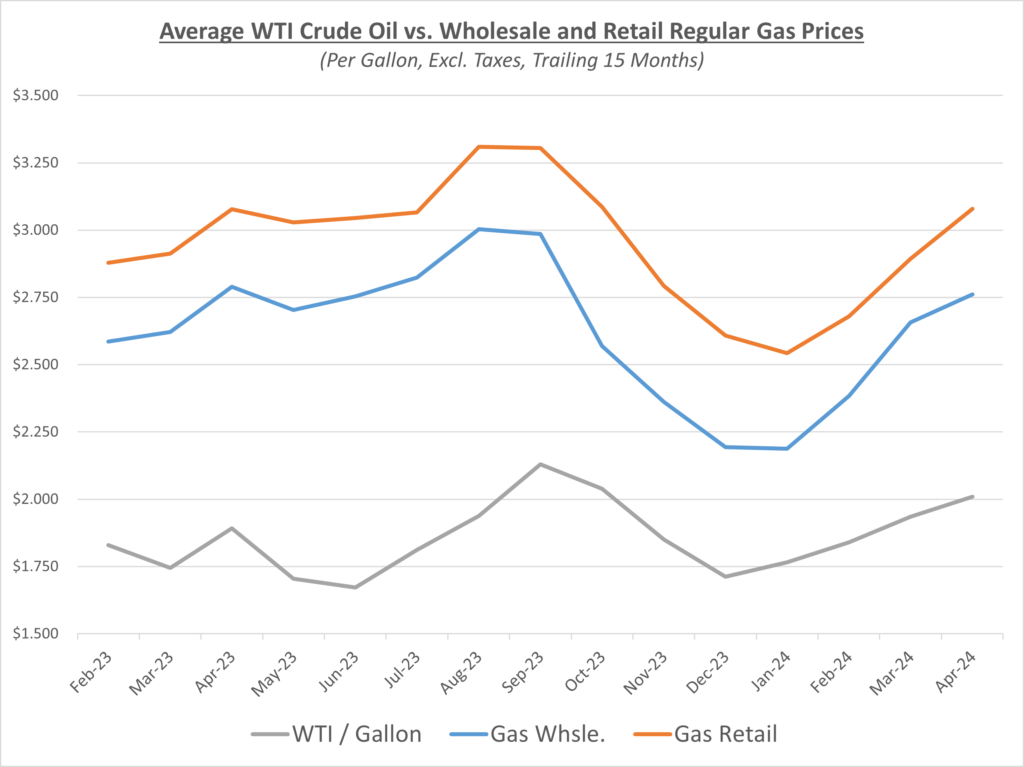

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

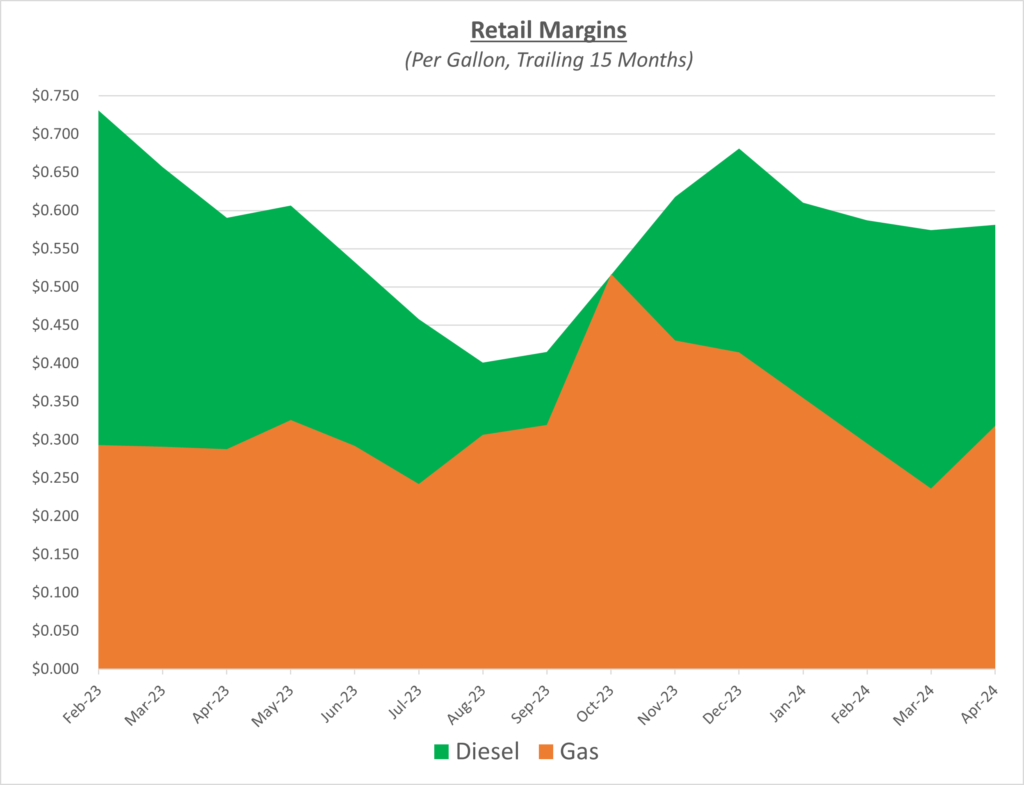

Diesel wholesale and retail prices were similar again this month, remaining relatively flat. Profit margins for suppliers were up marginally. Gasoline wholesale and retail prices were both climbing in April. Retail accelerated quicker than wholesale, causing margins to increase for suppliers. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished at approximately $3.66/gallon in April. This was an increase of $0.14/gallon compared to last month. Diesel prices were basically flat in April compared to March, down a penny and finishing at $4.01/gallon.

After the surge towards $90/barrel, oil prices finished April just under $82/barrel. OPEC+ will meet again on June 1st and remain committed to controlling supply to keep oil prices elevated. For now, demand remains weak and supply concerns have subsided for the time being causing oil prices to be on the downswing. However, gas prices have continued to rise the past few months and we are now approaching driving season. Have they peaked early this year, or will they continue to swell during the summer months?

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $75-85/barrel in the near term.