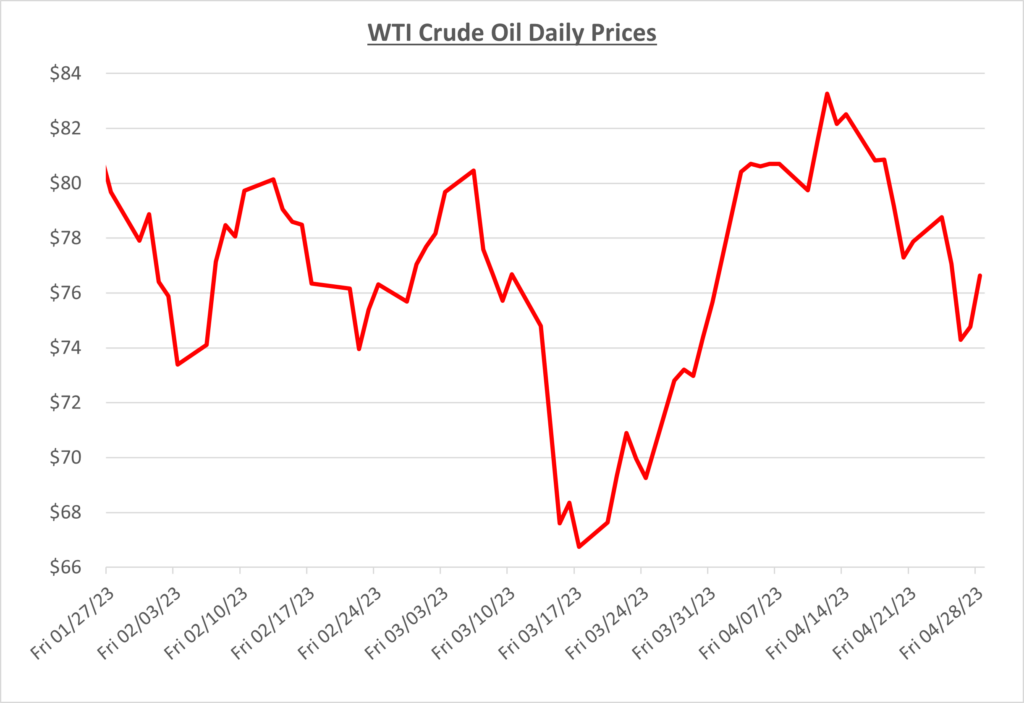

Oil prices continued their rise back above $80/barrel in the first half of April after OPEC+ announced additional supply cuts. Supply has been getting tighter on its own with recent drops in inventory levels. Now analysts find themselves raising their price forecasts for 2023. The following graph shows the daily price movements over the past three months:

Historic flooding in South Florida was the cause for some major supply issues in the Sunshine State during the month of April. With terminals shutdown from the water damage, suppliers were forced to long haul deliveries from the northern parts of the state. Many stations from Fort Lauderdale to Miami experienced fuel outages. As we head into May things appear to be back to normal in Florida now that water has departed.

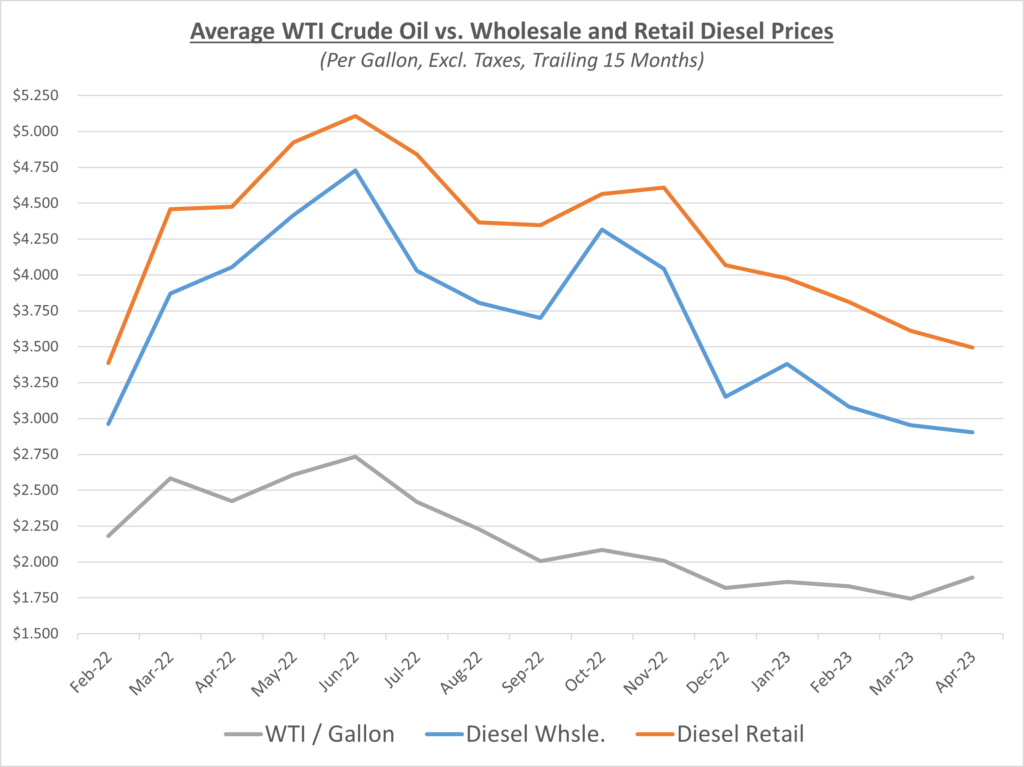

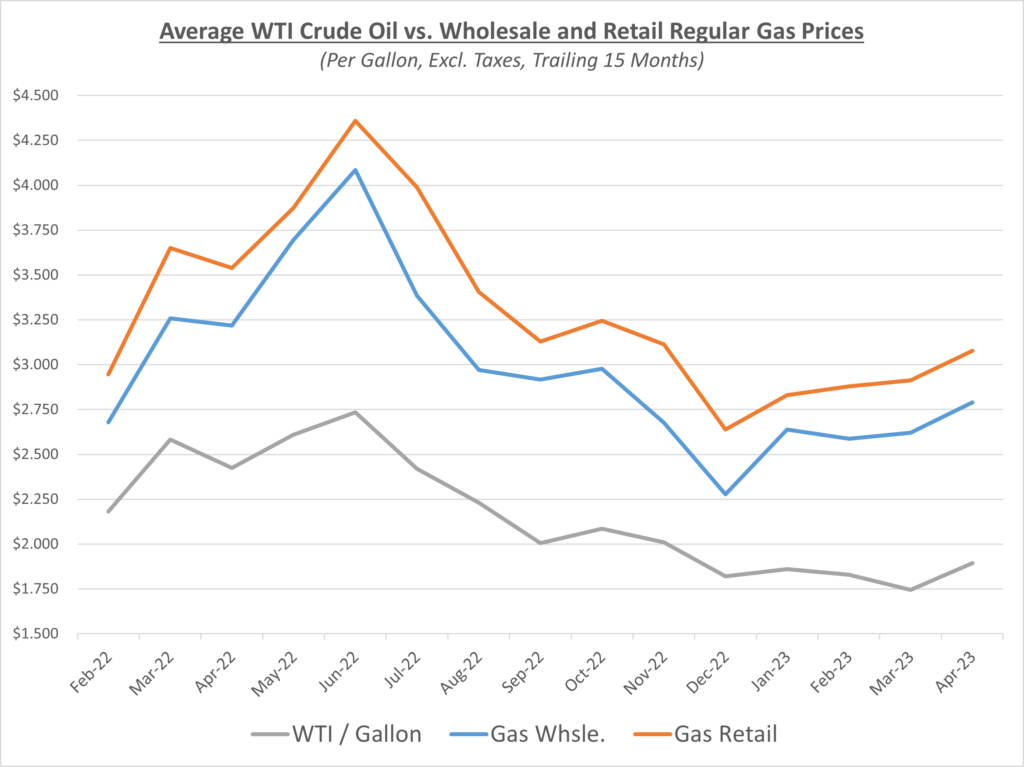

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

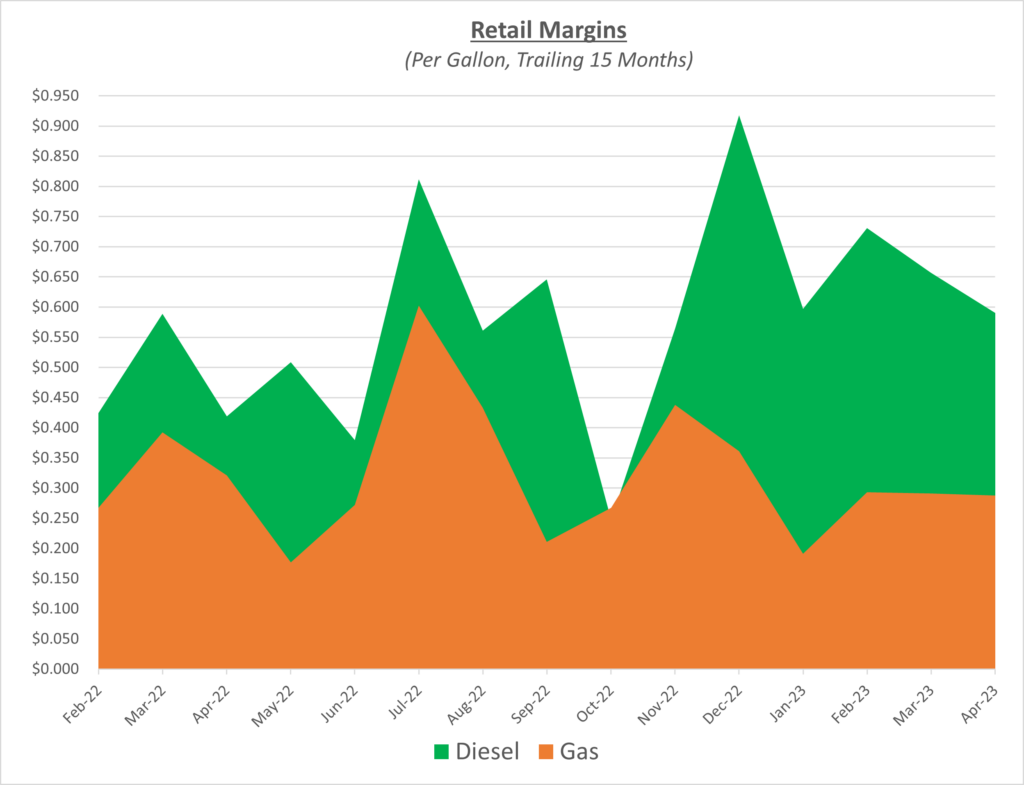

Diesel and gas prices continue to head in opposite directions the past few months. For diesel, wholesale and retail prices have been decreasing most of 2023. Retail margins came down slightly, but still stay strong. For gas, wholesale and retail prices extended their increase in April as we head into the summer driving season. Gas margins remain flat the last few months. The following graph shows the retail margins over the trailing 15 months:

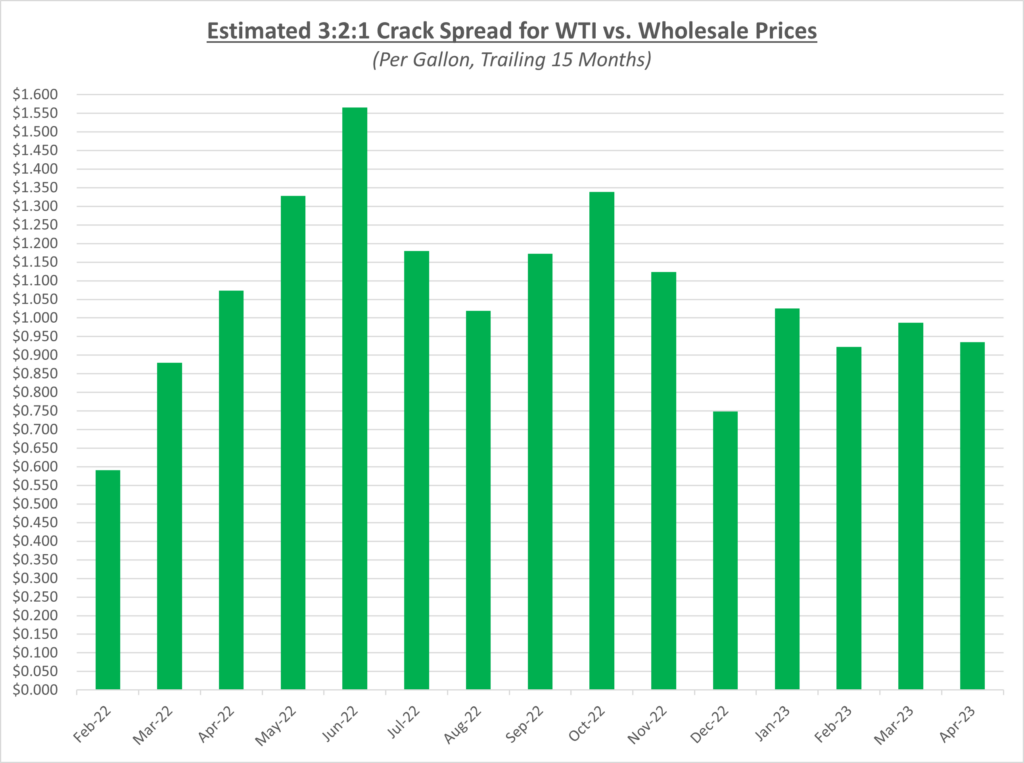

Crack spreads have been relatively flat from the start of 2023, but that doesn’t mean suppliers are disappointed. Most anticipated these profits to fall, but that hasn’t been the case thus far.

According to AAA, the national average gas prices increased again in April by roughly $0.10 to $3.61/gallon compared to last month. The national average diesel price also decreased like last month by about $0.10/gallon to $4.11/gallon.

After topping $83/barrel, oil fell to the mid-$70s to finish April. Banking fears once again resurfaced with the news reported that First Republic was in trouble. There is also speculation that the Fed will continue to raise interest rates. Additionally, putting pressure on fuel prices is China’s weaker than expected numbers being reported. All these factors have oil analysts pessimistic on prices shooting up higher for the time being.

Sokolis anticipates that oil prices will remain in the $75-90/barrel range. We will do our best to keep you updated with the latest news.