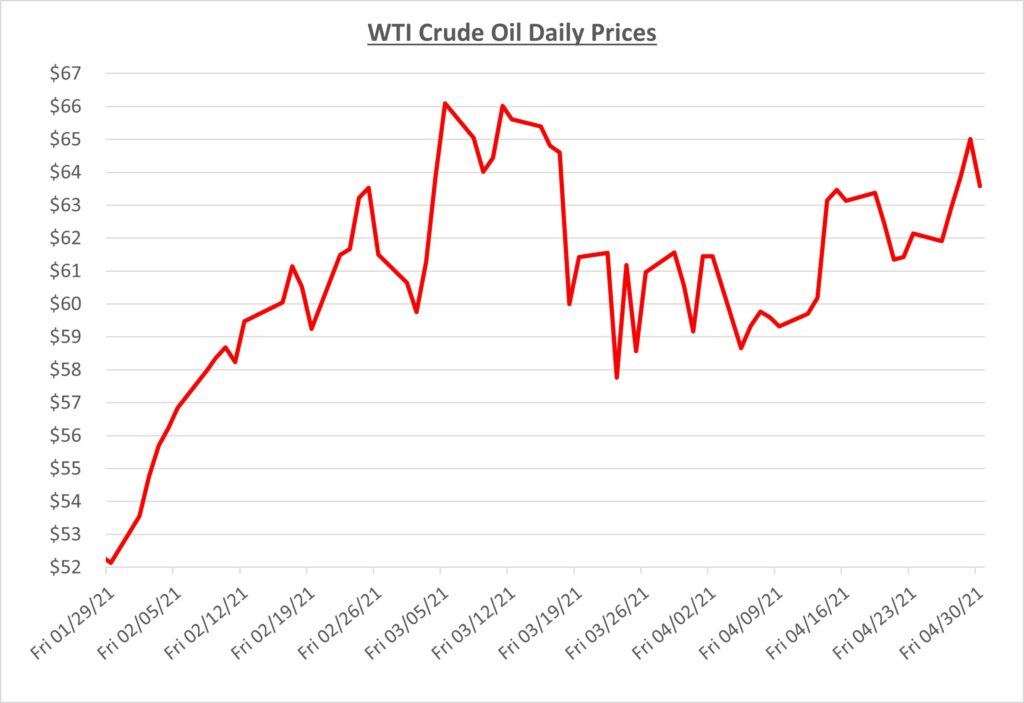

Oil prices started April flat, but gained some steam mid-April and reached a high of $65 per barrel near the end of the month before cooling off slightly. Compared to March, the overall price of oil was slightly lower for April, but prices are trending upwards as we head into May. The following graph shows the daily price movements over the past three months:

During March, oil prices were on a roller coaster soaring as high as $66 per barrel and as low as $57 per barrel. April was off to a smooth start until a sudden spike during the third week of the month. There was an unexpected decline of crude inventory, both gasoline and diesel demand seemed to be climbing towards their pre COVID-19 levels, and there was some turmoil in the Middle East with Houthi rebels attacking a Saudi petroleum terminal.

India, which is the world’s third largest oil importer, is causing major concerns with the resurgence of the virus. Cases have been hitting record highs and hospitals are overwhelmed. This caused prices to fall towards $61 per barrel. It was short lived as OPEC+ met at the end of April and decided to continue moving forward with their supply increases as planned. Your gut reaction might think the market would take this news as bearish and prices would retreat, however the focus remains on the overall growth potential in 2021 and prices pushed upwards to end the month.

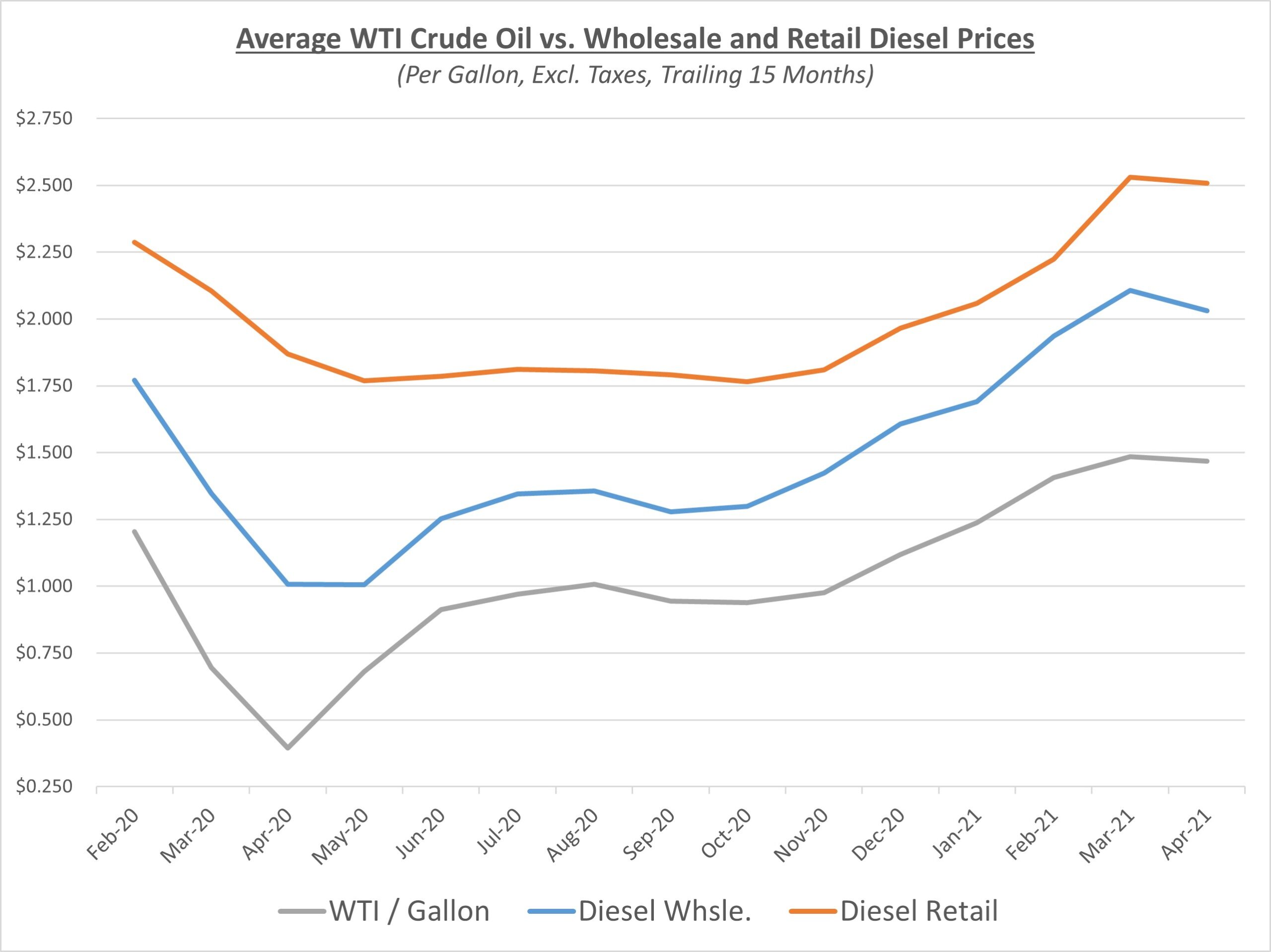

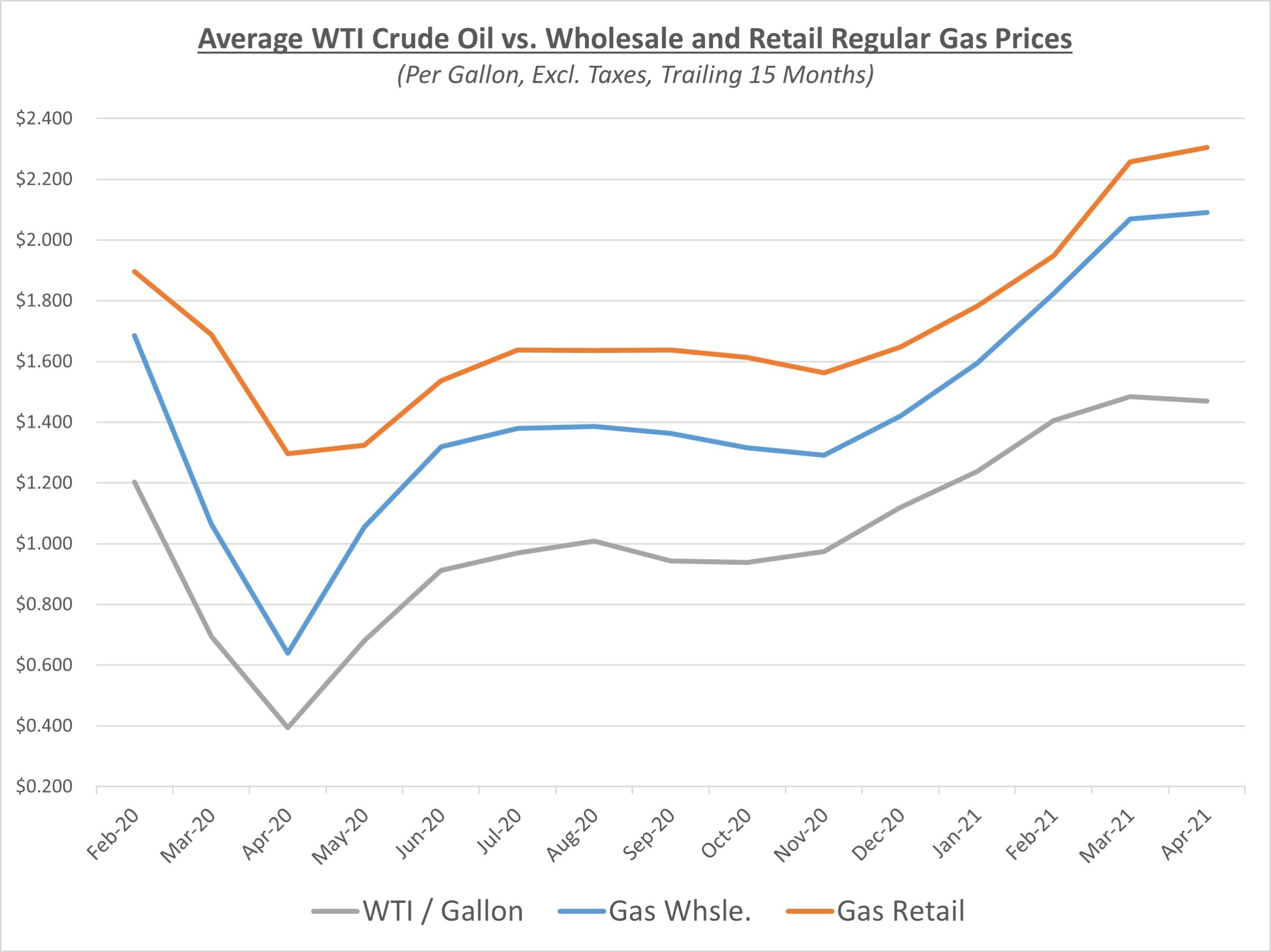

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

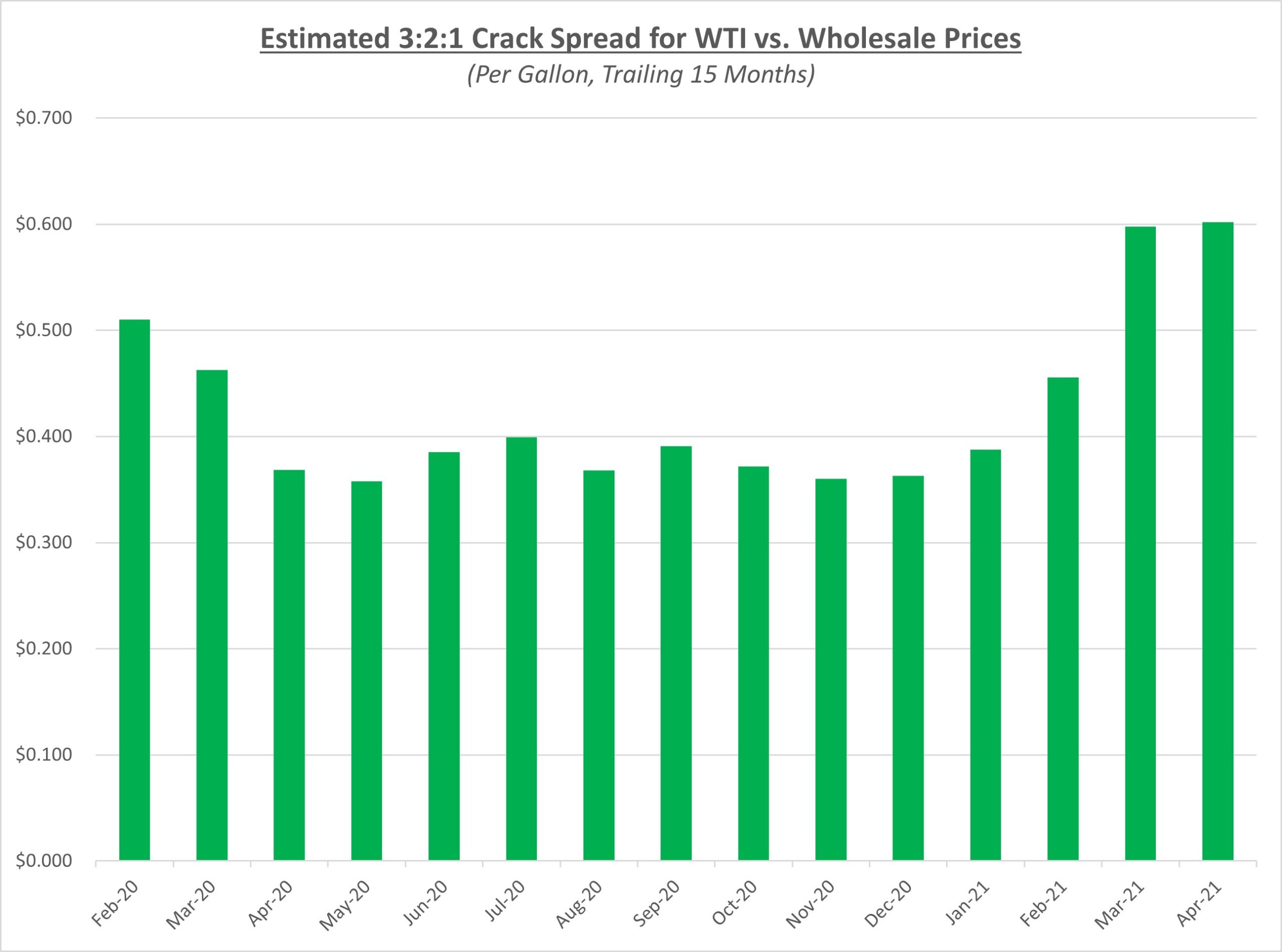

As we pointed out last month, refined fuel prices versus oil have been elevated, as indicated by the 3-2-1 crack spread graph shown below. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. The crack spread has remained high primarily due to increasing demand for refined fuels, particularly for gas in April.

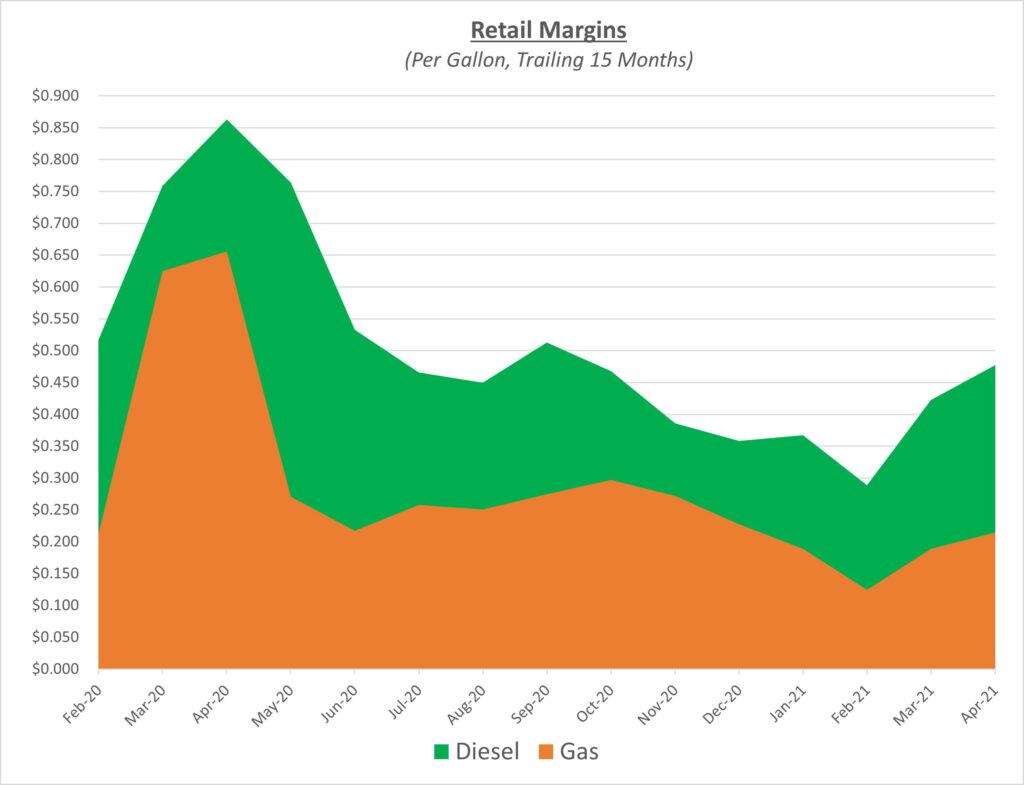

Although refined fuel prices were relatively flat in April, retail gas prices slightly increased causing margins for gas to widen. This could be due to increasing demand as we get closer to normalcy and summer driving season. Diesel margins saw about a 14% increase compared to last month, as they get closer to what we would consider an average margin level. Retail prices are almost always slower to follow wholesale prices down, creating larger margins. The following graph shows the retail margins over the trailing 15 months:

Even with recent factors in April that would typically drag down oil prices, oil still finished the month at just over $63 per barrel. The market seems to believe that the worst is over, and we are heading towards normal summer demand. Sokolis believes prices will hover in the low-to-mid $60s per barrel in the near term. As inoculation continues to happen and people get more comfortable with travel, it’s safe to assume prices have room to rise through the $60’s and approach $70 before the year is over. It would take multiple factors of negative news such as COVID outbreaks and underwhelming demand to get oil prices back towards $50.