During April, crude oil prices continued increasing for the second month in a row and closed the month at approximately $46/barrel. April was an active month with a number of factors that influenced pricing. Most notable was the meeting in Doha, Qatar during mid-April where many oil producing nations gathered in an attempt to rein in supply production. No agreement came out of that meeting and prices responded with a quick decline.

The price decline following the failed Doha meeting did not last long as traders found an assortment of encouraging reasons to support prices above $40/barrel. A prominent, but short-lived, factor was an oil workers’ strike in Kuwait that threatened production. That strike was quickly settled. In addition, several refinery and pipeline incidents also caused concerns about supply disruptions. Other factors included flattening inventory levels for crude and refined products, sporadic signs of improvement in worldwide demand and a weakening dollar which typically drives up the price of oil.

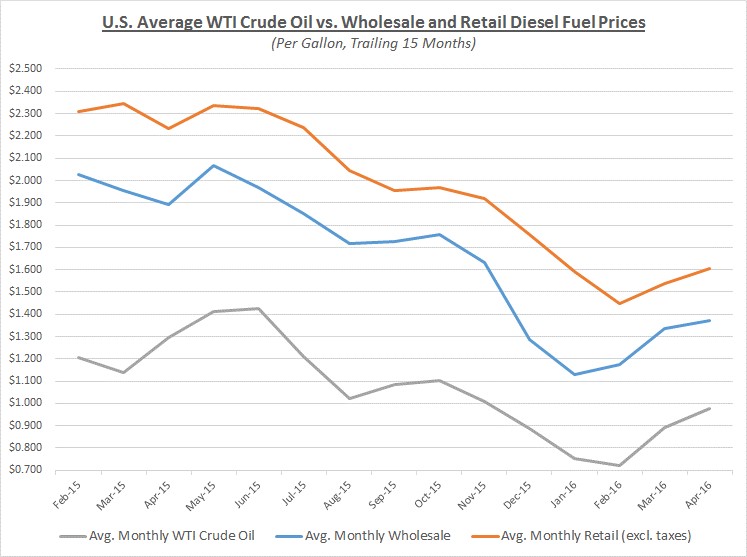

As oil prices continued to increase, wholesale and retail prices followed. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

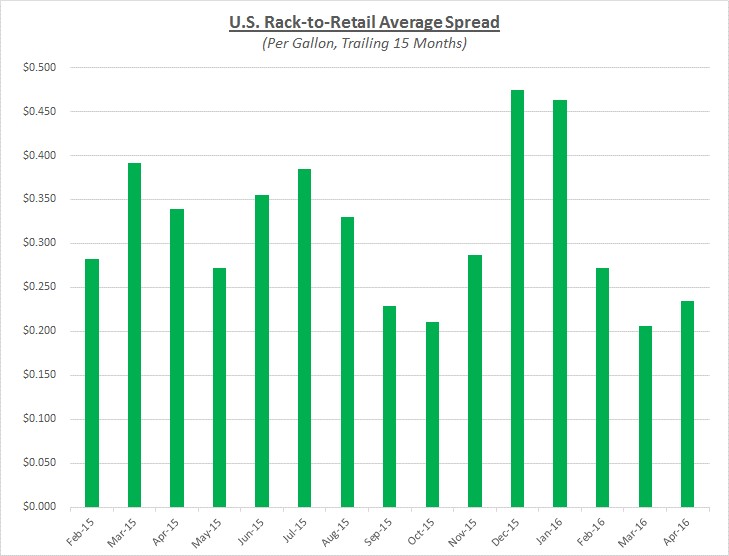

As this graph shows, retail prices increased slightly faster than wholesale prices in April. Retail’s quicker advance allowed margins to increase slightly higher. However, those margins still remain at a relatively low level compared to the preceding year as shown in the following graph:

Due to the market changes in April, almost all fleets would have seen a modest increase in their fuel costs. Looking beyond April, Sokolis anticipates prices will continue to fluctuate near their current levels. There is still some potential for a decline followed by a gradual increase over the next few months. However, any significant increases remain dependent on a major shift in global supply and demand factors.

While there were some preliminary indications in April that demand may start catching up with supply, it is still too soon to anticipate any rapid increase in prices. In addition, it is important to keep in mind that a large amount of domestic production capacity was taken off-line over the past year. If prices increase further, this capacity can be quickly redeployed which would dampen the potential for rapid price increases.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.