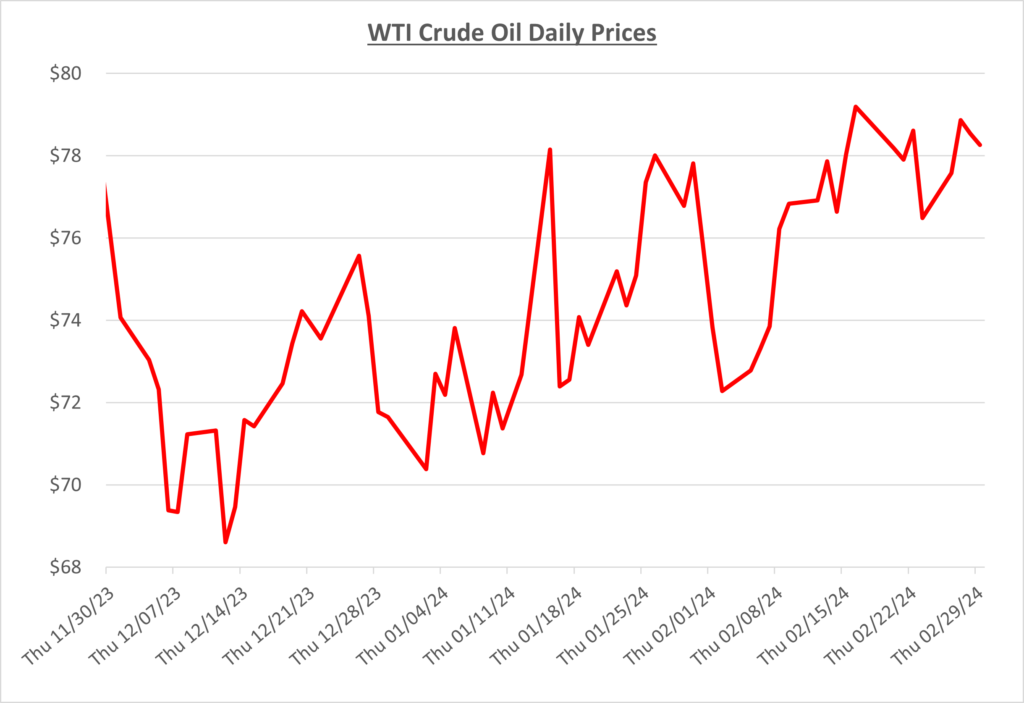

Oil prices began February heading toward the lower $70s per barrel, after finally spending some time above the mid-$70 mark to end January. Some positive news about the possible ceasefire in Gaza helped cool prices down early in February, but that would be short lived. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices were back to approaching $80/barrel due to the continuation of the Houthis attacking ships delivering oil. Several missiles were launched at U.S. ships, but luckily there were no damages as anti-ballistic missiles were sent to deflect their attempts. As mentioned in last month’s Fuel Flash, any diversions to avoid these conflicted waters will cause delays to transit time, slow down supply, and in turn cause fuel prices to inflate.

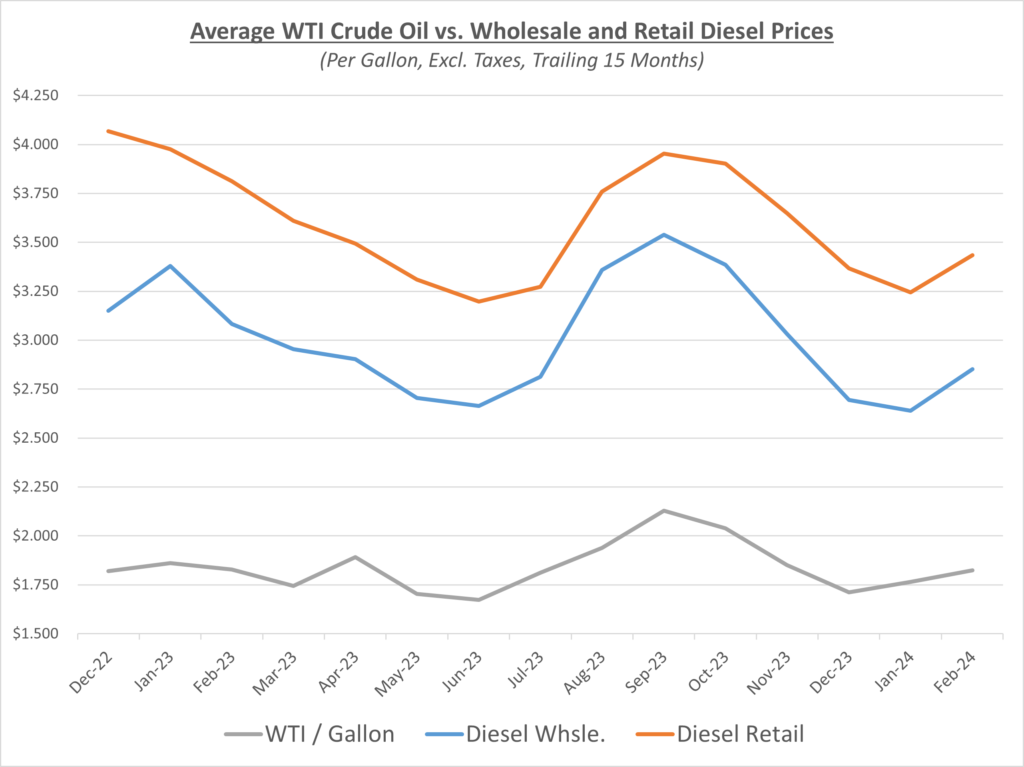

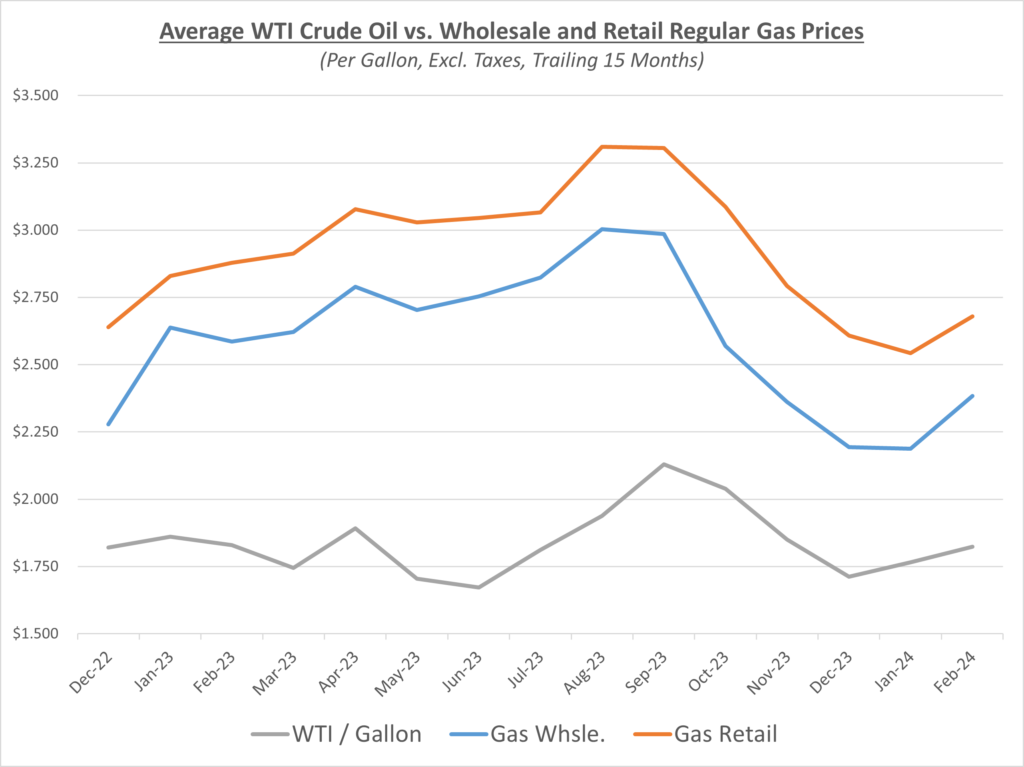

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

Diesel and gas prices took a turn heading higher in February. Diesel wholesale and retail prices were on similar trajectories, but wholesale was up slightly more than retail, resulting in a marginally lower profit margin for suppliers. Gasoline wholesale’s increase was a little sharper than retail this month, causing profit margins to decrease. The following graph shows the retail margins over the trailing 15 months:

According to AAA, gas prices finished at approximately $3.32/gallon in February, a surge of $0.18/gallon compared to last month. Diesel prices increased $0.13 in February, finishing at $3.94/gallon.

Oil finished February above $78/barrel. Potential disruptions continued throughout the month as more than 12 major shippers are redirecting transport elsewhere from the Red Sea. OPEC+ extended their production cuts and are rumored to be keeping them in place through all of 2024. The continued production cuts are not surprising, but the likelihood of them continuing that far out into the future caused the market to fear supply tightening. February crude oil reached the highest level seen since mid-November.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will range between $75-85/barrel in the near term.