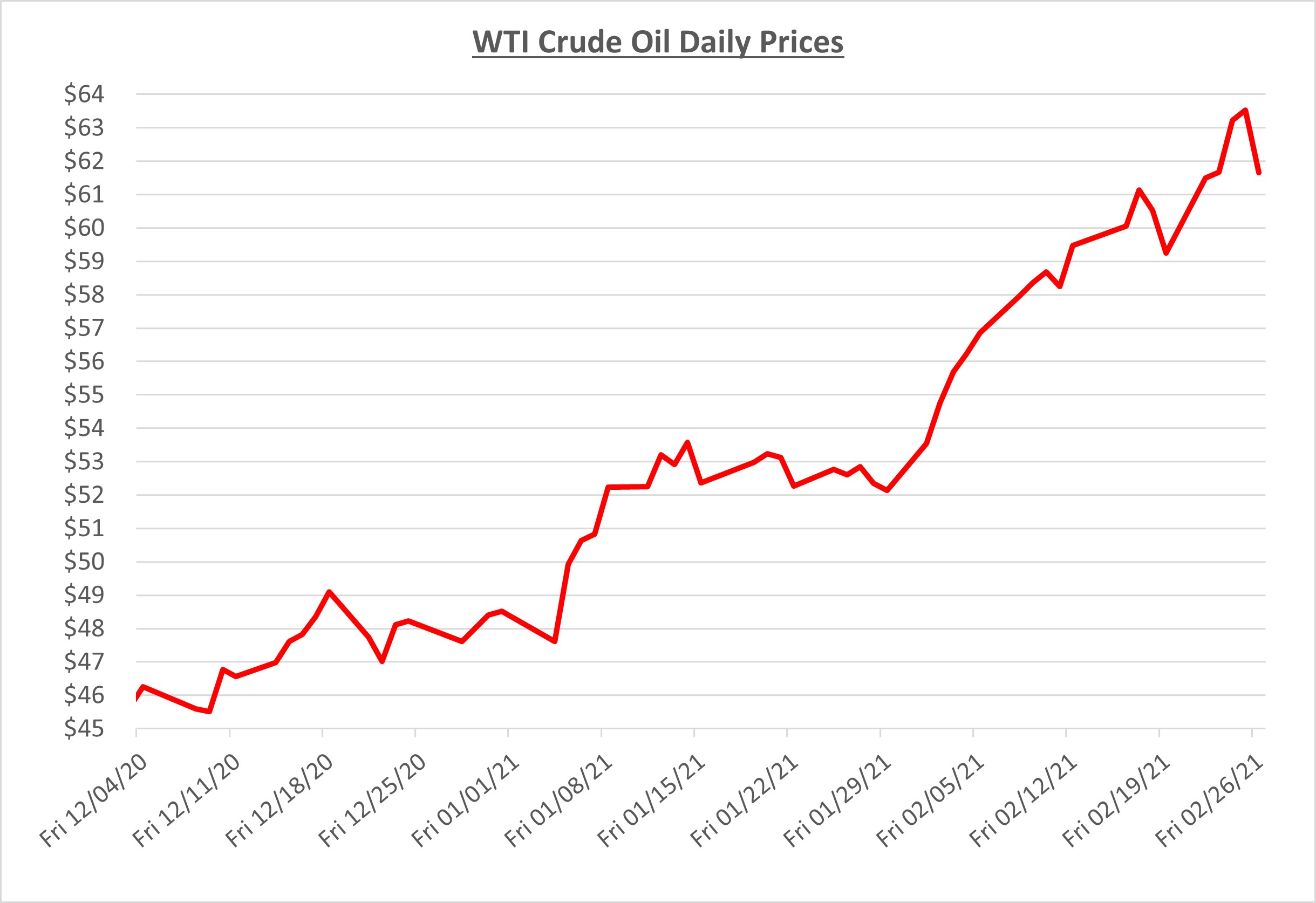

Oil prices soared 18% higher in February, starting the month near $54 per barrel and ending just under $62. Prices have increased almost 30% since the start of the year and are almost 40% higher compared to the same time last year. The following graph shows the daily price movements over the past three months:

Following a flat trend in January, oil prices rose quickly in February as COVID vaccines continued to roll out and the number of new cases began to decline. As the middle of the month approached, unusually severe back-to-back winter storms resulted in treacherous travel conditions and extended power outages throughout Texas. The storms and power outages caused significant disruptions to oil production, fuel refining, and distribution resulting in a sudden decline in supply from the area. Oil and fuel prices increased throughout the US due to the impact on the supply chain.

In addition to the US domestic supply disruptions, OPEC+ had already been limiting their production in response to an extended period of weakened global demand for oil caused by COVID. Meanwhile, demand for oil and fuel (primarily diesel) had been growing over the past few months. Growing demand with restricted supply resulted in rapidly increasing prices. However, by the end of February, rising prices stalled as supply from Texas began to slowly come back online.

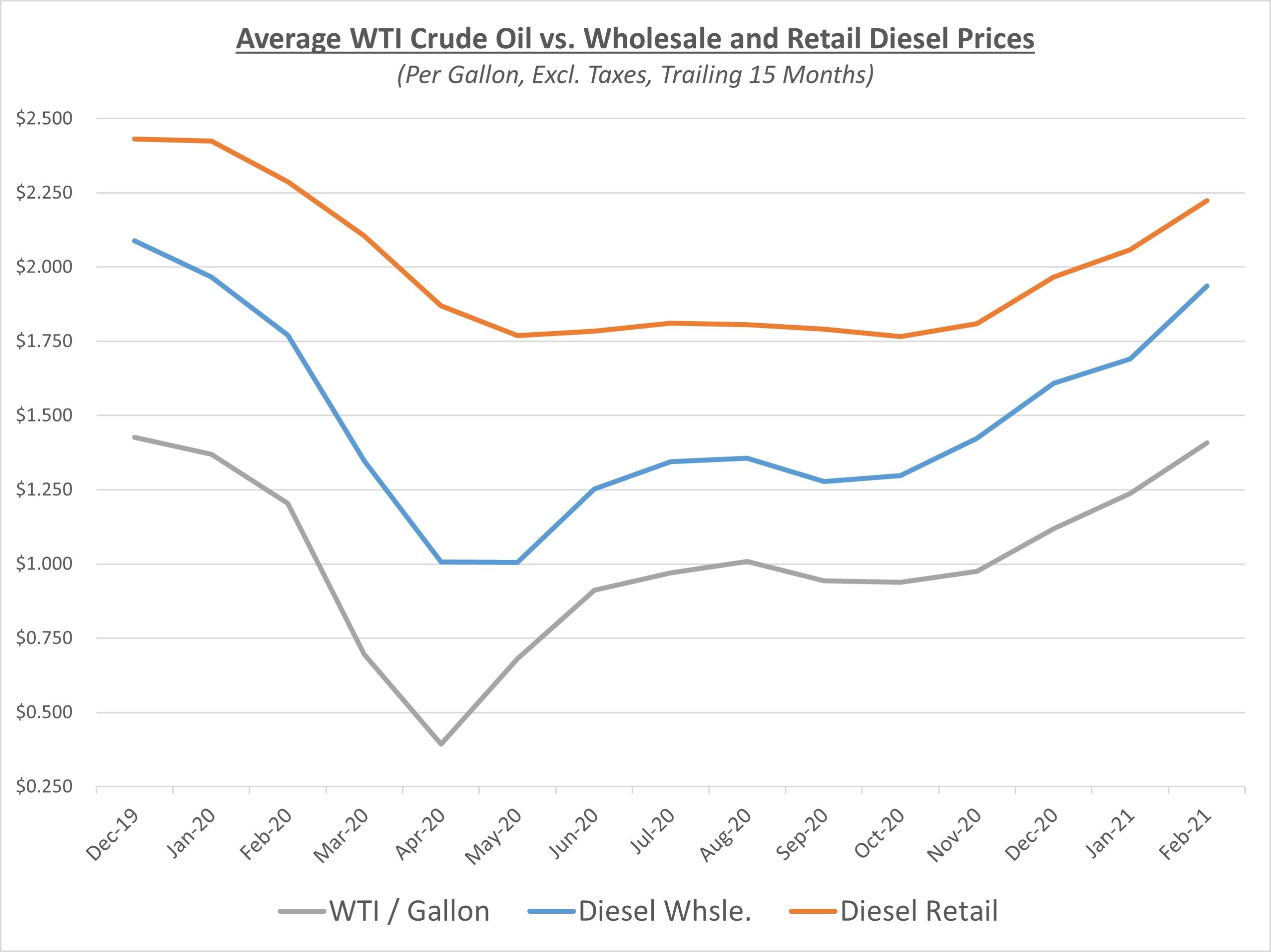

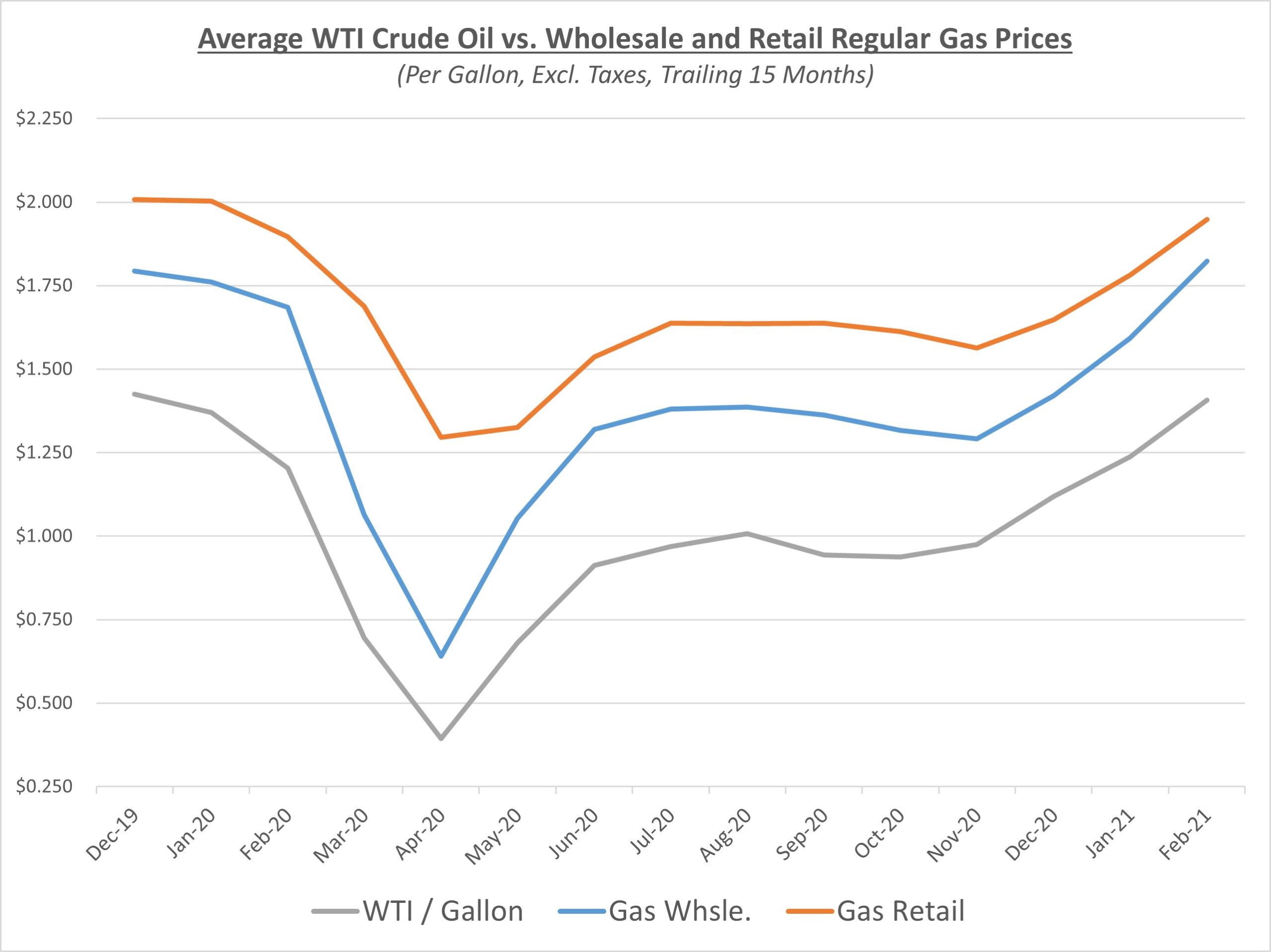

Due to the rapid increase in oil prices during February, the overall average price for the month was higher compared to the prior month. Wholesale and retail prices for refined fuels also moved higher. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

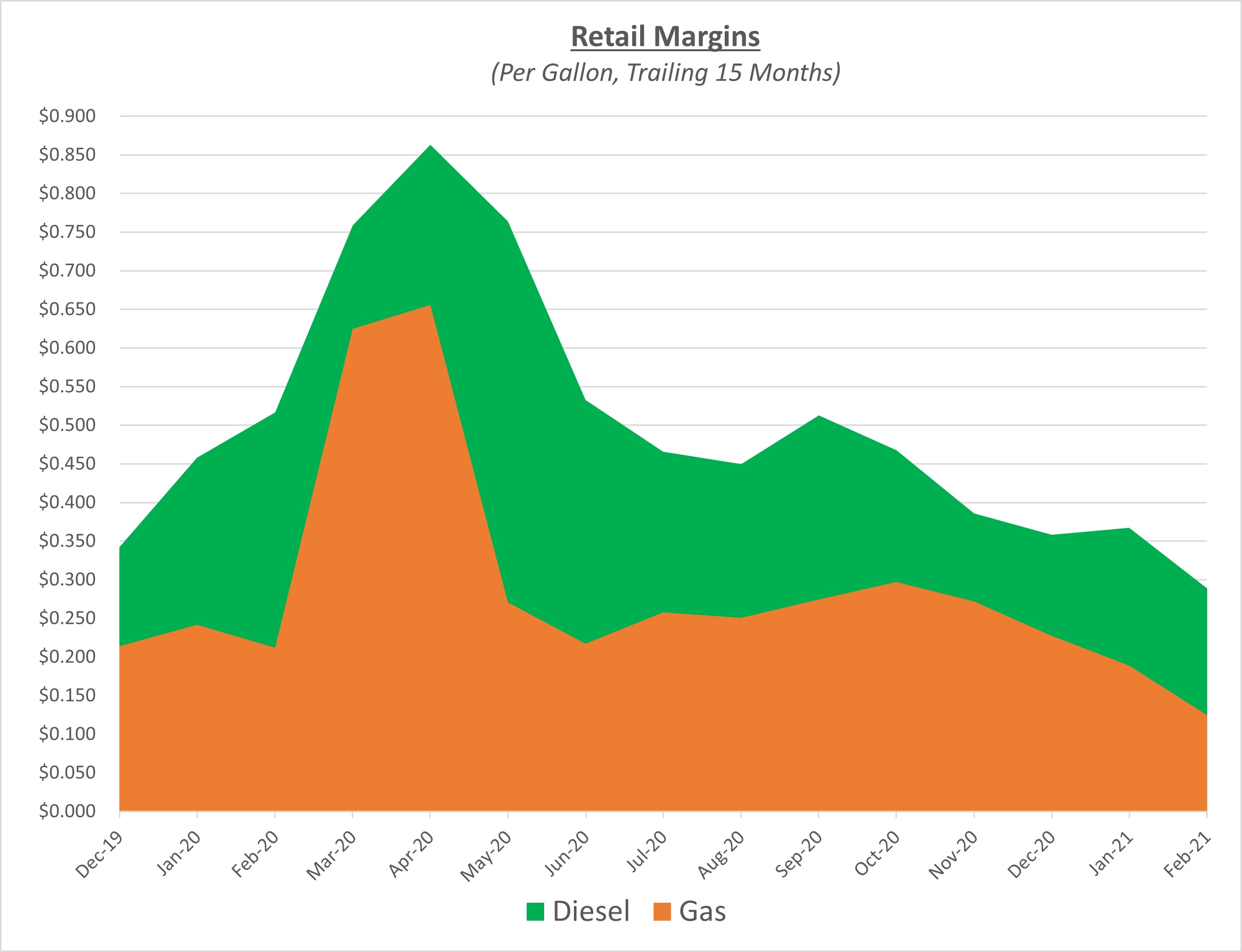

Retail prices for fuel did not increase as fast as wholesale prices in February which caused retail margins to decline. For gas, it was the fourth straight month of declines and margins have become very tight. Gas retailers have struggled to limit their price increases to stay competitive during a time when demand hasn’t fully rebounded from the impact of the pandemic. The following graph shows the retail margins over the trailing 15 months:

Although fuel prices have increased much faster than previously anticipated, Sokolis believes the pace will slow down. Oil will likely remain above $60 per barrel with the potential to approach $70 as demand continues to grow due to improved mobility from the vaccine rollout. However, supply in Texas should normalize throughout March and the warmer spring temperatures will reduce demand for heating oil. In addition, when OPEC+ meets again in March, the group could likely decide to begin loosening their production restrictions which would bring more supply to the market.