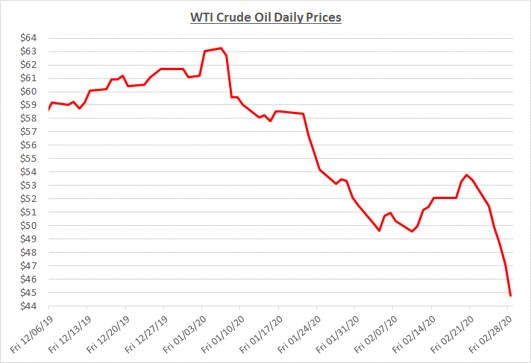

Oil prices began to show some potential to recover in early February following their sharp drop in January. However, by the middle of the month, another sharp decline occurred with prices closing February just under $45 per barrel. Oil prices have now fallen almost 27% since the beginning of the year and are about 22% lower than the same time last year. The following graph shows the daily price movements over the past three months:

The rapid decline which started during the second half of January was caused by the Coronavirus outbreak. As February began, optimism towards containment of the virus stabilized prices and they moved upwards. However, by mid-February, new cases of the virus appeared in parts of the world that were not previously impacted, including a few cases with no clear connection to explain how it spread. Fear grew about the contagiousness of the virus resulting in a reduction of global travel and economic activity. As a result, prices dropped rapidly along with financial markets around the world.

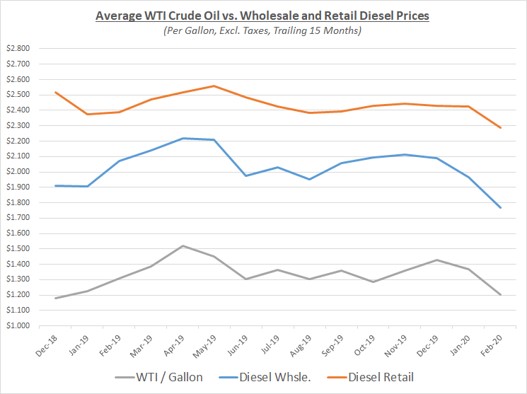

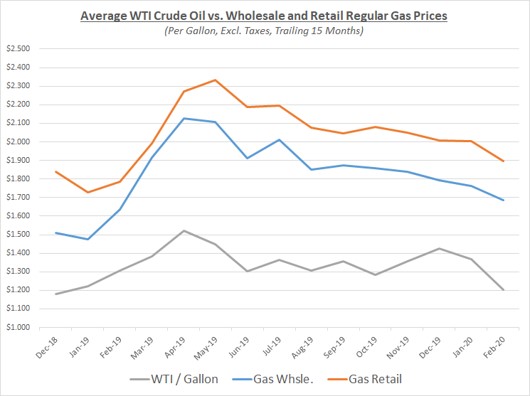

Due to the significant decline during February, the overall average price for oil fell even further compared to January. Significant declines also occurred for refined products. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

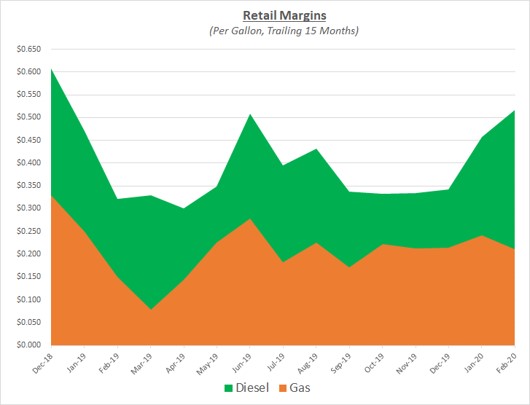

For refined fuels, retail prices did not show much change during the previous month but did start to fall in February. The decline for diesel lagged wholesale while gas was quicker to catch up. The result was that retail margins for diesel continued to increase to a very high level while gas margins declined toward a more typical range. The following graph shows the retail margins over the trailing 15 months:

Future oil prices will continue to be heavily dependent on developments with the Coronavirus. As the spread of the virus appears to be widening, future global economic activity and the demand for oil will continue to decline. Sokolis believes oil prices will likely remain in the $40 -$50 range for the foreseeable future until the spread of the virus declines. Although OPEC+ is considering further reductions to their supply output to keep prices from declining much further, it may not be enough to offset the large reduction in demand caused by the spread of the virus.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.