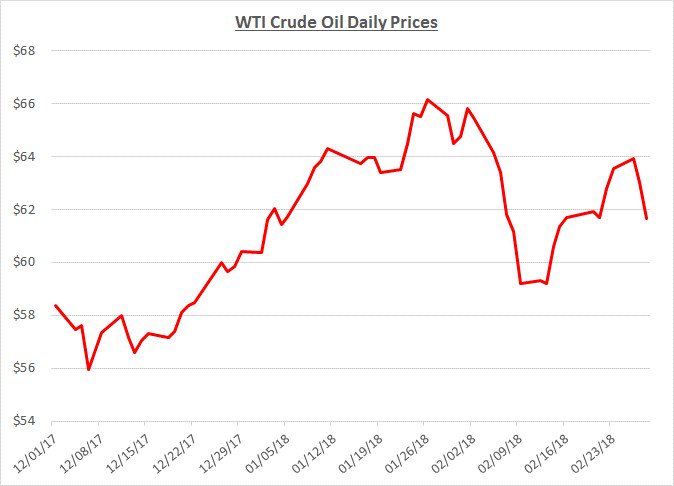

During February 2018, crude oil prices went on a roller coaster ride following a similar track as the stock market. Shortly after the start of the month, prices fell by approximately 10%. Prices remained at that lower level for a brief period and then started to rise again. By the end of February, prices netted to be about 10% lower than where they started the month. The following graph shows the daily price movements over the past three months:

The volatility of crude oil prices during February was primarily driven by the turmoil in the financial markets. News about inflation and rising interest rates raised concerns about weakening future demand for oil. As interest rates rose, the US dollar became stronger and the value of oil declined as it typically moves inversely to the dollar. During the second half of the month, interest rates retreated and financial markets began rising again along with oil prices. By the end of the month, financial markets fell again with oil following. Oil also continued to face headwinds generated by record levels of US oil production and inventory levels that have been slow to decline.

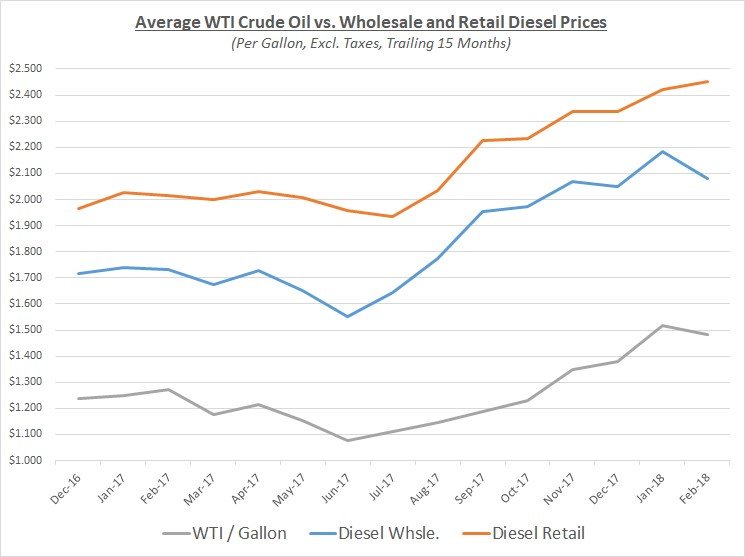

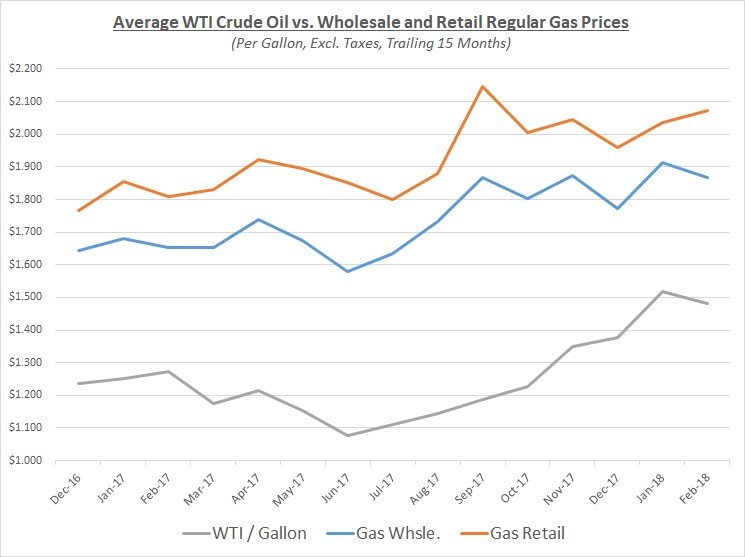

As oil prices fluctuated throughout February, wholesale prices for diesel and gas generally followed with net declines. However, retail prices continued increasing as they are typically slower to react to market changes. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

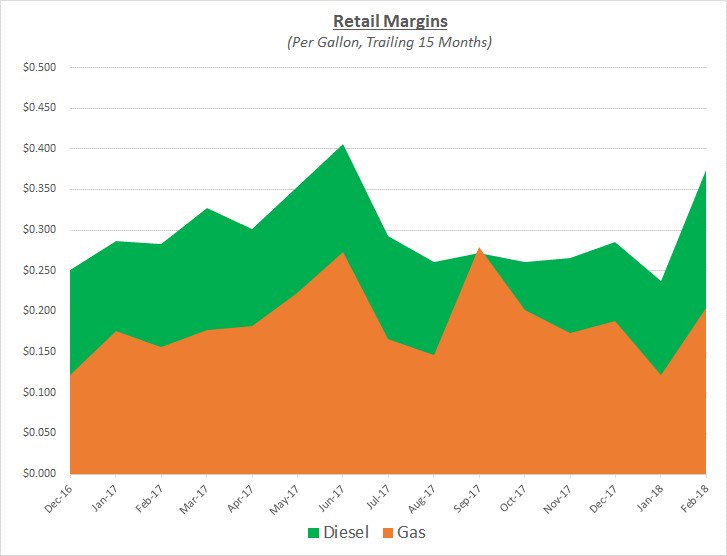

As wholesale prices fell, fuel marketers took advantage of the opportunity to continue increasing their retail prices and rebuild margins after several months of significant pressure caused by rapid wholesale price increases. In fact, retail margins for February reached levels not seen in over six months. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates crude oil prices will continue to fluctuate in a range from the high-50’s/barrel to the mid-$60’s for the foreseeable future. There is still potential for prices to increase beyond that range if inventory levels decline consistently over multiple weeks. However, US production is at record levels and additional growth is expected. This should limit further price increases and could possibly cause prices to fall below our anticipated range.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.