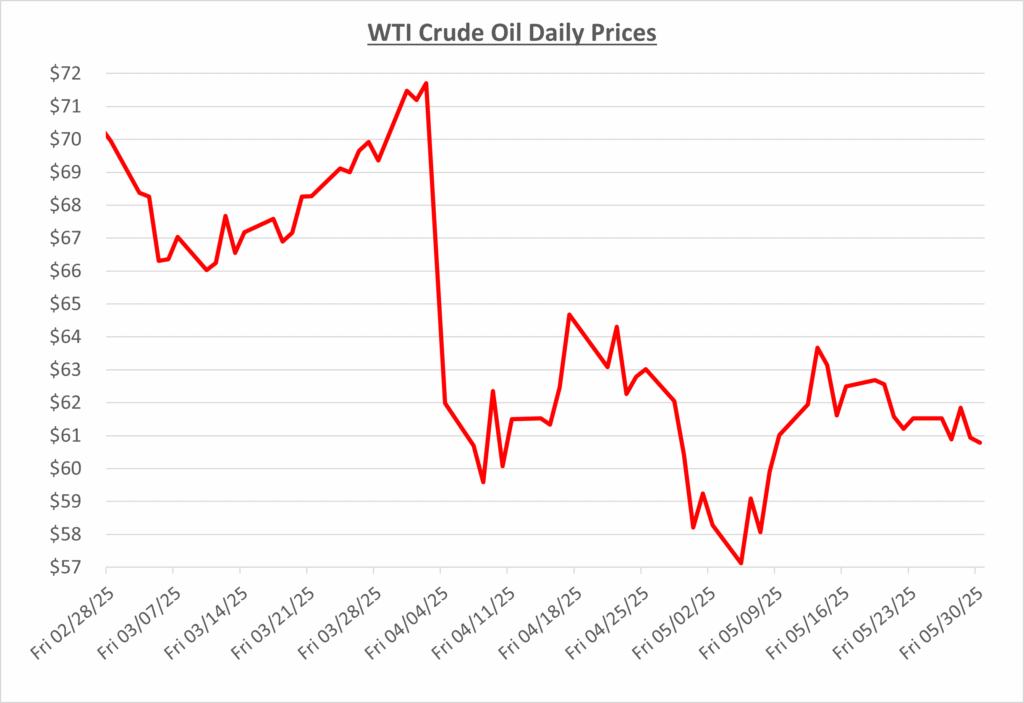

Oil prices entered May at a subdued $58/barrel, nearly dipping below $57 on May 5. This would prove to be WTI’s lowest price point of the month. Lower prices helped foster a demand increase, with reports in early May of U.S. crude inventories dropping at a faster-than-expected rate, boosting prices higher. However, the following week brought reports of a higher-than-expected increase in domestic crude inventory, although several bullish international trade headlines in the second week of May helped the market temporarily brush off concerns of a supply glut. The following graph shows the daily price movements over the past three months:

Crude prices reached their May high point on the 13th, cresting $63/barrel and boosted by the U.S. and China agreeing to sideline new tariff actions for 90 days. The market also welcomed news of a new energy partnership between the U.S. and Saudi Aramco, the first of several energy deals announced with various Middle East nations in the following week. However, news of rising domestic crude inventory and rumored OPEC+ production increases this summer caused the upward price trend to stall out by mid-month. After oil reached its monthly high, these concerns over increased supply ushered in a slight downward trend for the rest of the month. Oil wrapped up May just below $61/barrel, with news of U.S. crude production reaching all-time highs combining with ongoing demand concerns to keep prices on a short leash.

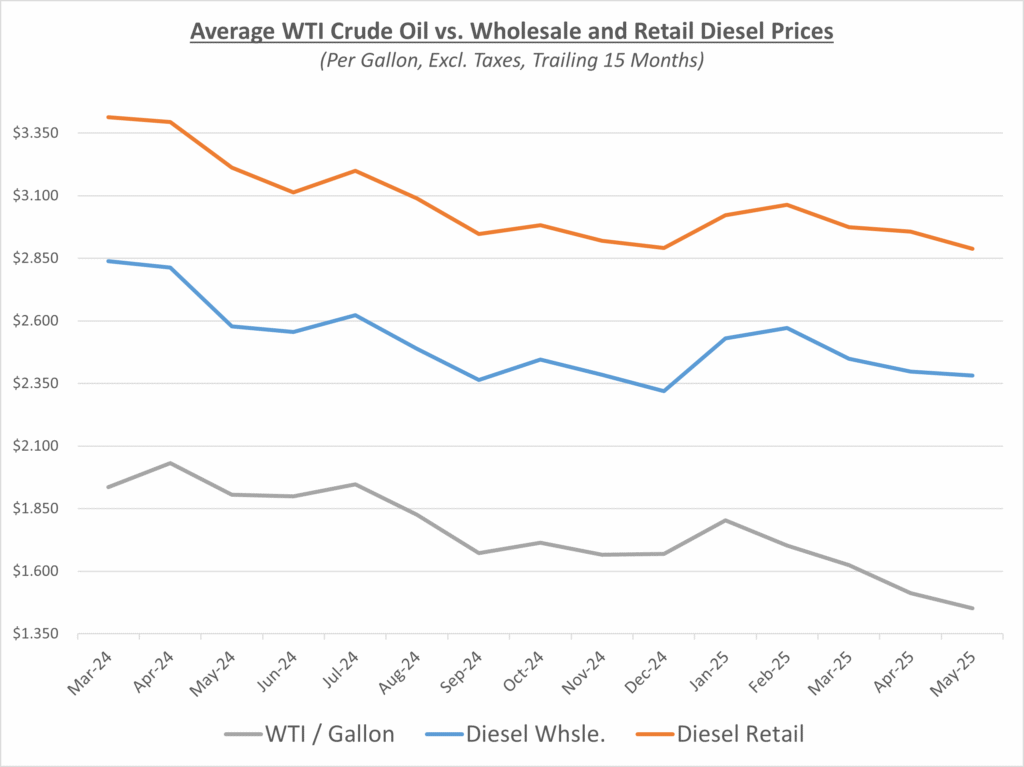

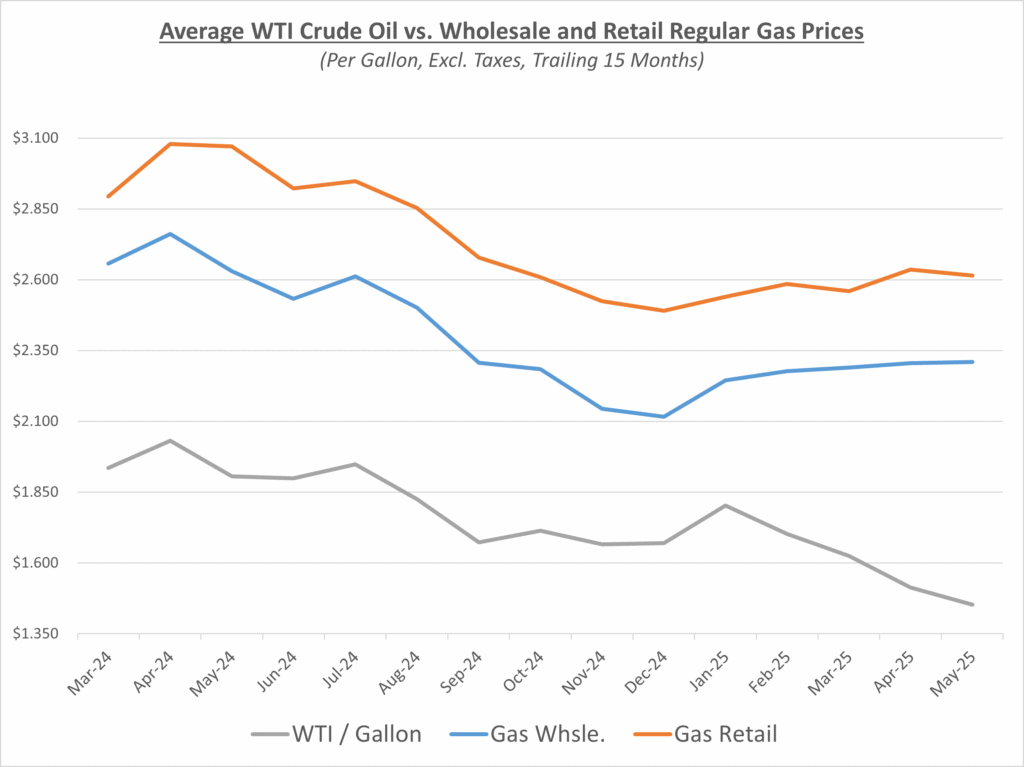

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

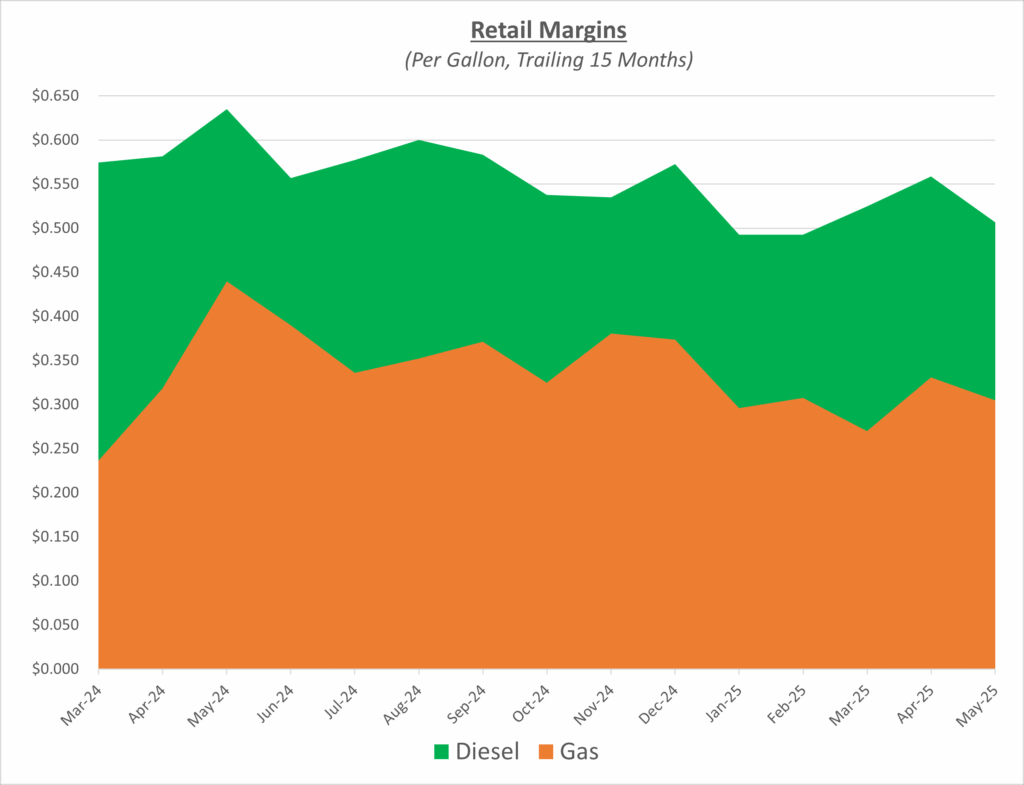

In May, diesel profit margins shrank by about 5 cents at the pump as retail prices fell faster than wholesale. Gasoline retail margins shrank by about 2 and a half cents compared to April as wholesale prices continued a slow, steady increase that began around the first of the year, with retail trending slightly down over the last 30 days. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average retail price for gas dropped slightly from last month, finishing May at $3.15/gallon. The national average retail price for diesel finished May at $3.49/gallon, down from $3.57/gallon in April.

The month of May managed a slight increase in crude prices, with WTI crude rising 4.4% within the 30-day period. However, crude prices remain weighed down by fears of oversupply, lower demand and an uncertain global economic outlook, with the value of crude still down -15% for the year to date.

Sokolis projects that oil prices will continue to range between $55-$70/barrel, with headwinds such as soft demand and rising output (both domestically and within OPEC+) combining to keep prices muted for the near future. The fuel pricing team at Sokolis will continue monitoring the oil and fuel markets as we enter the summer driving season.