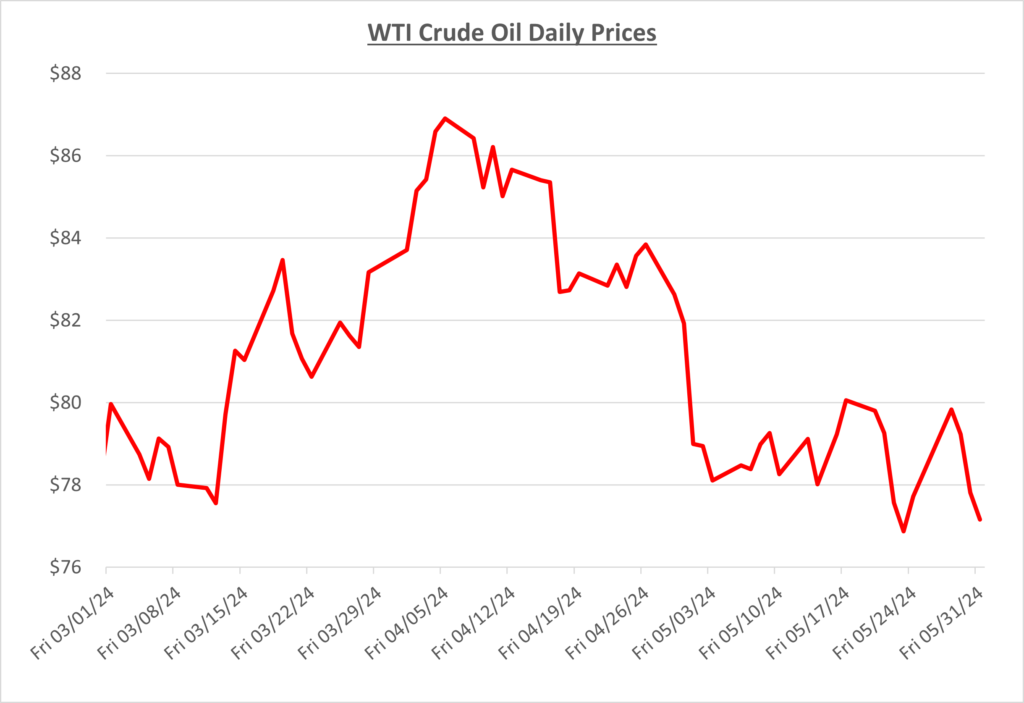

Oil prices continued their downward trend from April into May as they fell below $80/barrel. Easing tensions in the Middle East and the Federal Reserve keeping interest rates steady instead of cutting them are some factors contributing to bearish sentiment in the market. The following graph shows the daily price movements over the past three months:

Positive economic news for China caused oil prices to rise briefly mid-month. China, being at the top of largest economies and oil consumers in the world, will always directly affect oil prices with positive or negative news surrounding their status.

However, the U.S. which is also a top economy and oil consumer, had other plans that would restrict oil prices from heading higher. The DOE announced the sale of 1M barrels of gasoline from the nation’s supply reserve ahead of Memorial Day Weekend and the unofficial start of summer driving. The holiday weekend was expected to be the most traveled in many years.

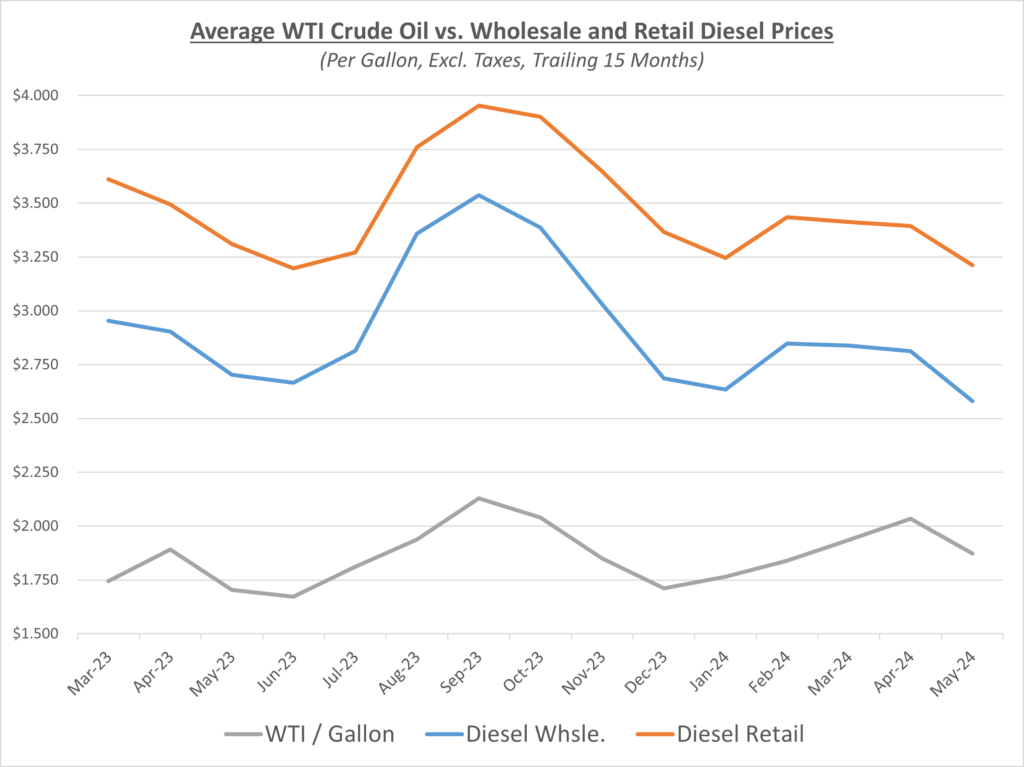

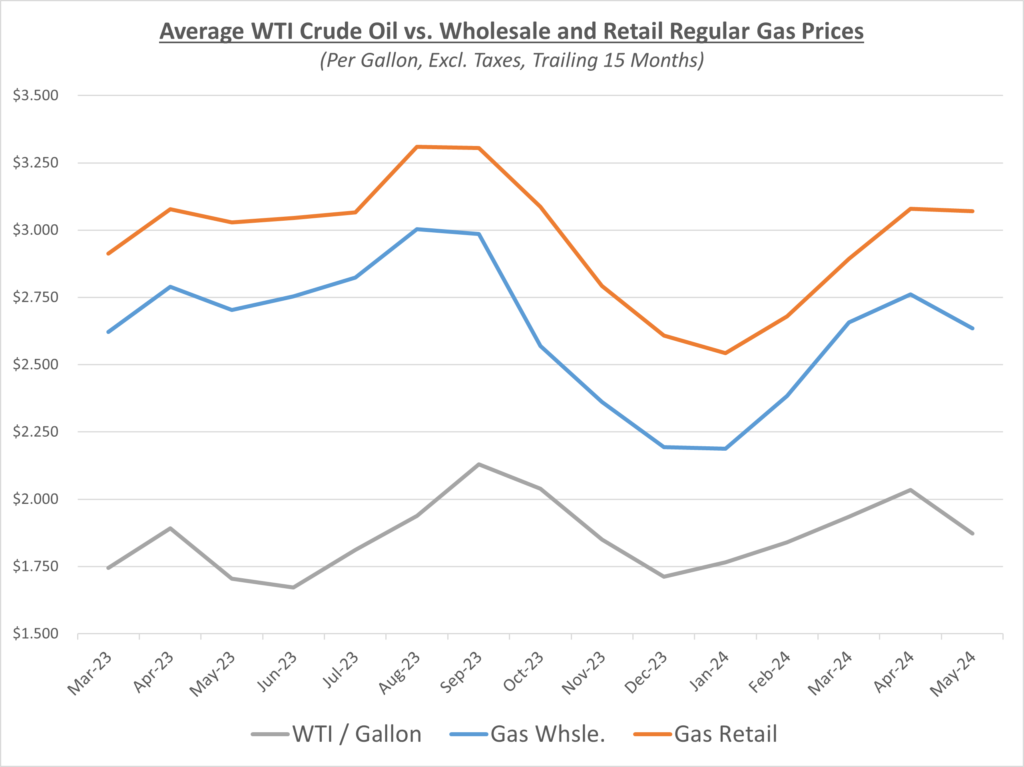

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

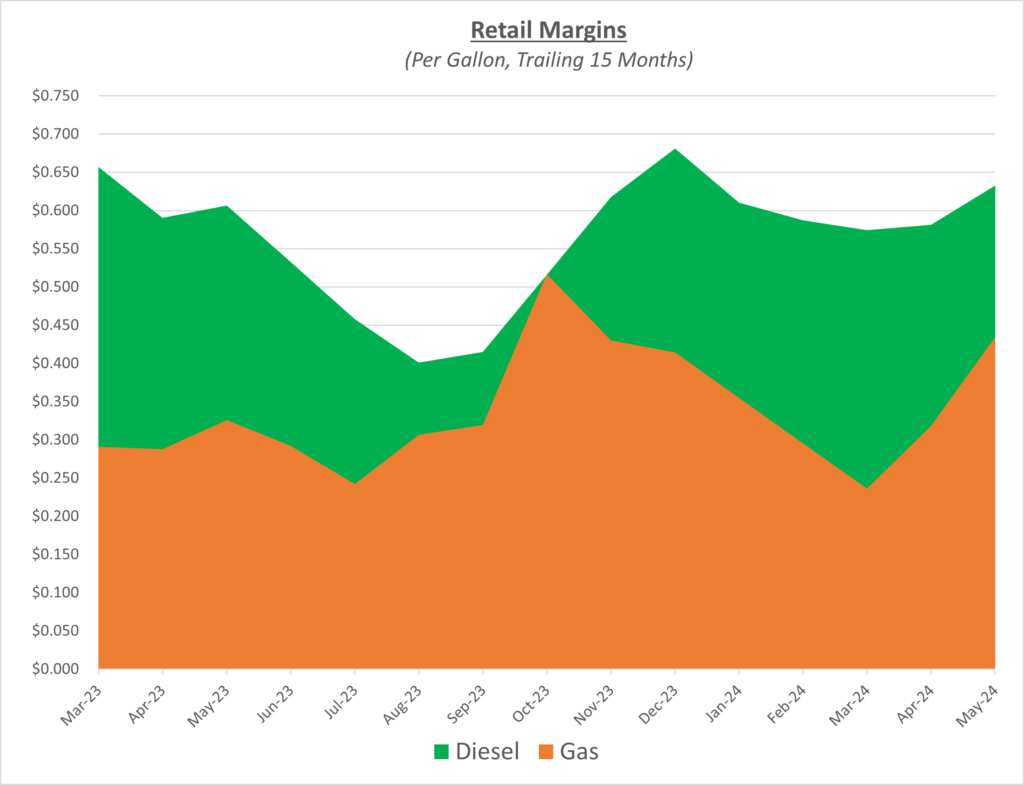

Diesel wholesale and retail prices both declined in May. Wholesale outpaced retail resulting in an increase in profit margins for suppliers. Gasoline wholesale had a sharp decline while retail prices were relatively flat causing a substantial increase in profit margins during May. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished at $3.55/gallon in May. This was a decrease of $0.11/gallon compared to last month. Diesel prices were also down in May compared to April, falling $0.13 to $3.87/gallon.

Oil finished May just above $77/barrel. Weak global demand continues to be the main cause for lower oil prices. OPEC+ met early in June and agreed to keep cuts in place for the foreseeable future. If it wasn’t for their production cuts, oil prices might be struggling to stay above $70/barrel.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $70-80/barrel in the near term.