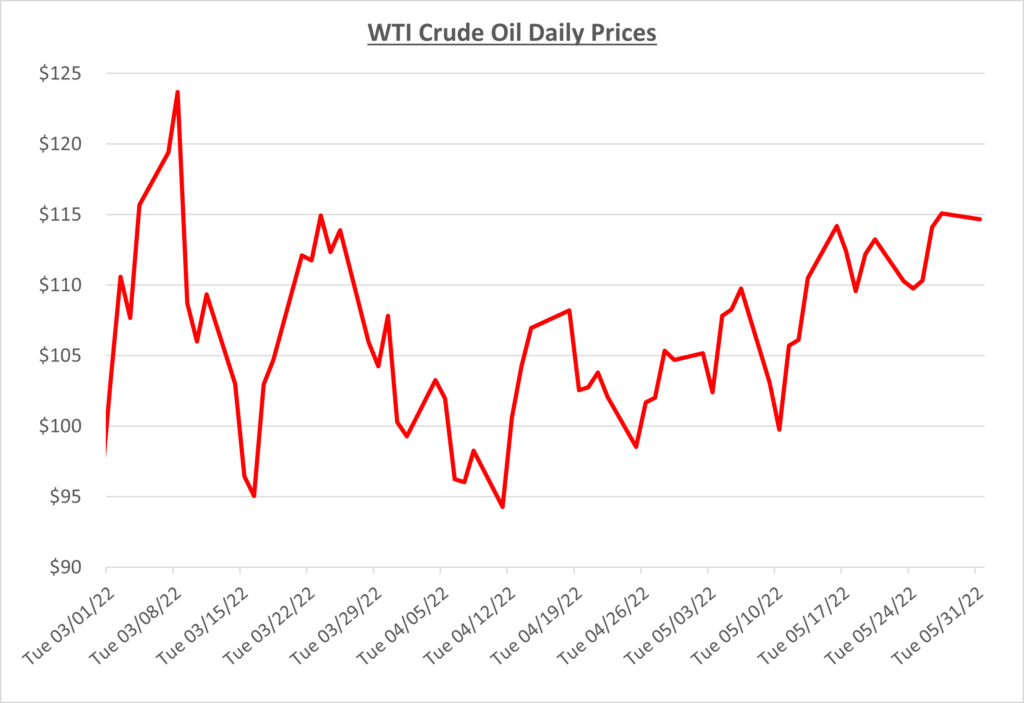

Since the beginning of April and a brief dip here or there for a day, oil prices have remained above $100/barrel. We have not seen a peak as high as we did in early March, yet in May, diesel and gas prices continued to hit all-time highs. The following graph shows the daily price movements over the past three months:

A major reason for elevated fuel prices is the supply issue pummeling the East Coast which Sokolis communicated in our “East Coast Diesel Fuel Supply Alert” released in May. The spread between fuel prices on the East and Gulf Coast is typically just a few pennies. However, due to tight supply that spread had increased to above 70 cents per gallon. The situation is primarily attributable to the disruption in global supplies caused by Russia’s invasion of Ukraine. Refiners along the US Gulf Coast have been shipping more product to foreign markets where higher margins can be obtained rather than shipping it to domestic locations. In addition, less refined product is being received from foreign sources at terminals in the northeast.

Refinery capacity is also contributing to supply constraints. Even though refineries are operating above 90% utilization, the loss of six refineries on the East Coast over the past few years has been detrimental to the overall amount of production possible. The biggest of the six was the closure of Philadelphia Energy Solutions, which was the oldest and largest. There doesn’t seem to be any signs of real relief as we have yet to feel the full reduction of Russian supply globally.

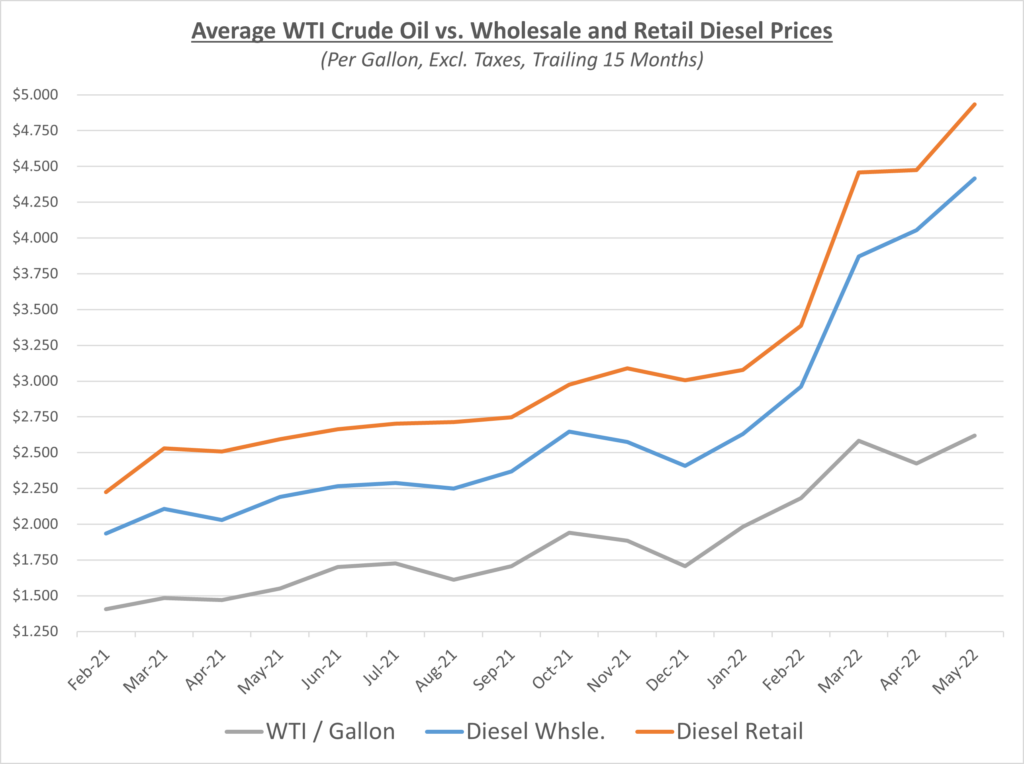

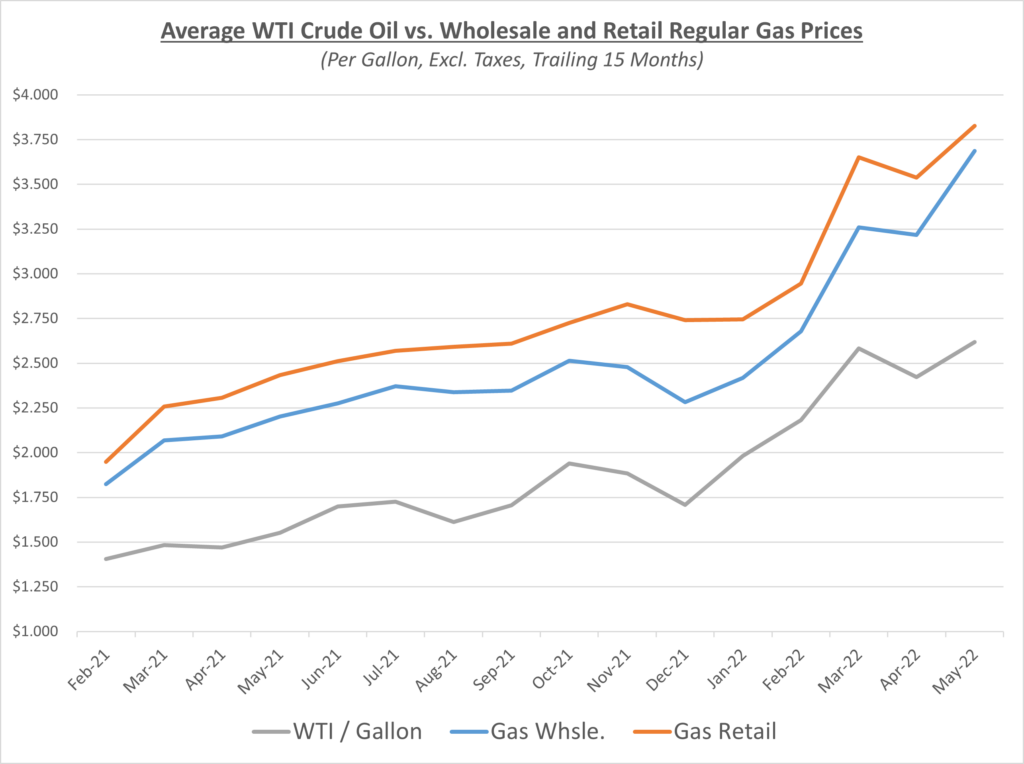

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

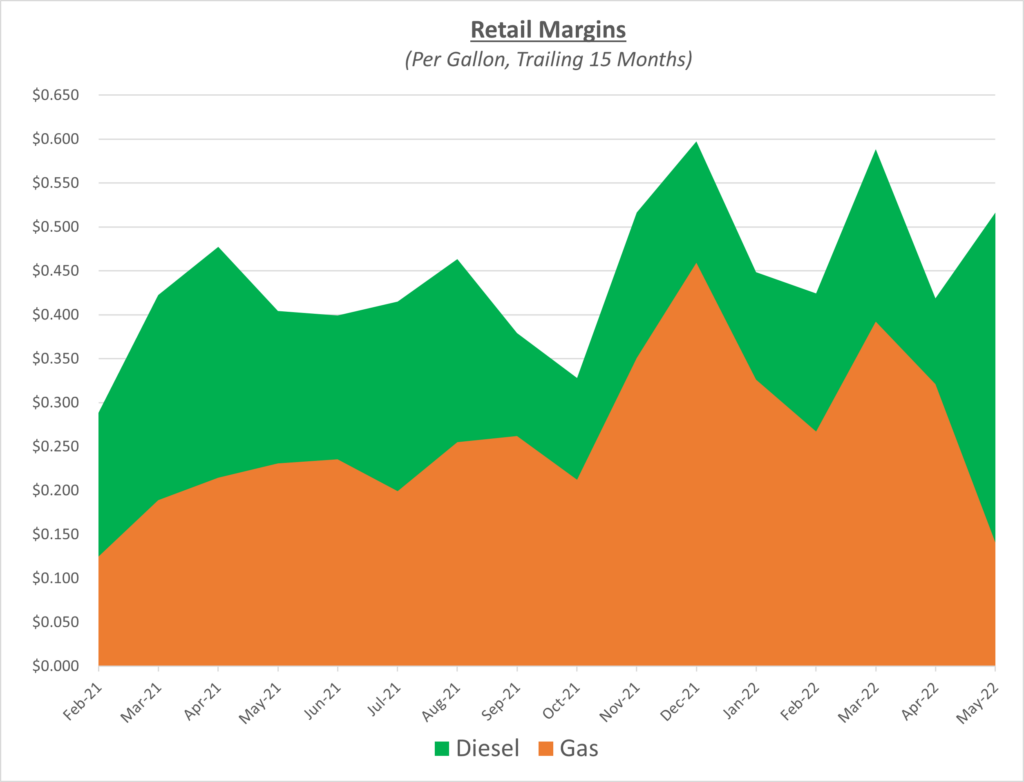

In May, diesel wholesale prices increased, but not as quickly as retail prices which created some large profit margins for fuel suppliers. Gas retail margins had an opposite effect even though wholesale and retail prices were both on the upswing. Wholesale outpaced retail prices creating lower margins. With summer driving season taking off and gas prices already so steep, fuel suppliers must be more prudent with price increases to remain competitive. The following graph shows the retail margins over the trailing 15 months:

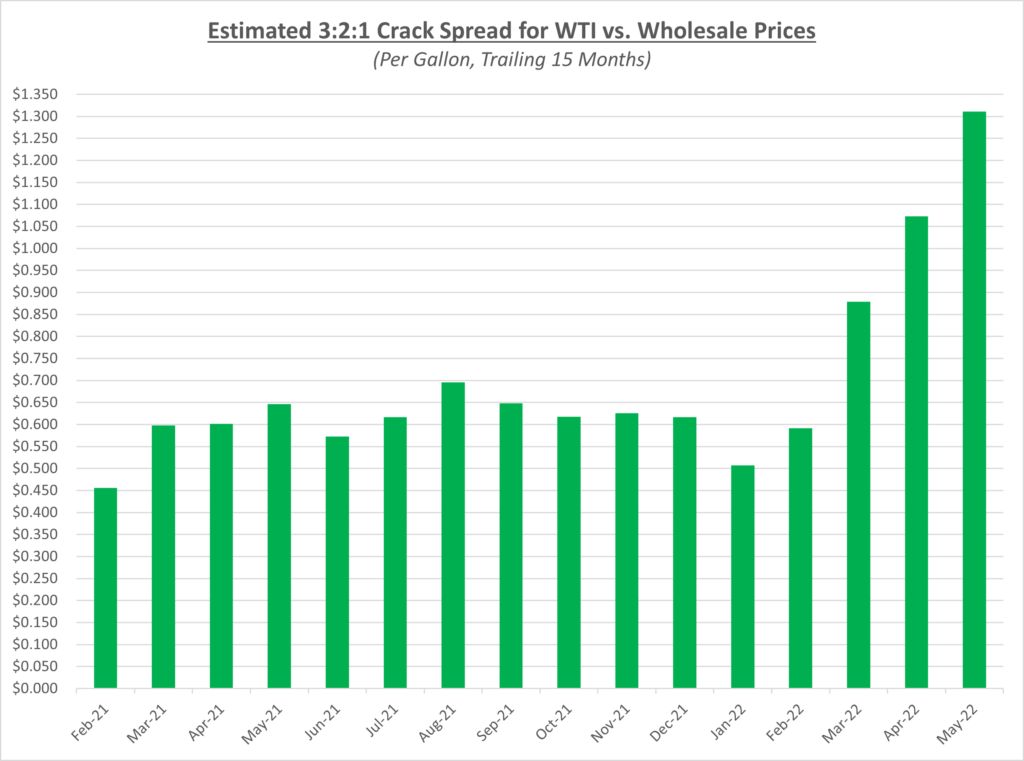

Crack spreads had another robust increase from April to May, now sitting at over $1.30/gallon as shown in the graph below, indicating the increasing profitability for companies making gas, diesel, jet fuel, etc. The refineries who have survived shutdowns from storms, demand destruction from COVID, or financial troubles, are finally seeing a nice pay day.

Oil finished May just under $115/barrel, a 10% increase from where it started the month. In addition to the tight inventories mentioned earlier, the European Union which had been working a deal to sanction Russian oil for several weeks, finally came to an agreement on May 31st. While it will take the rest of 2022 to ban 90% of Russian imports, the sanctions will remove roughly 70% of oil into Europe right away. The hope here is that this will negatively affect Russia’s economy and put an end to the war in Ukraine. However, Russia will probably shift their efforts to sell oil to countries like China and India at a discounted price to keep their economy afloat.

Sokolis believes that oil prices will remain well above $100 for the foreseeable future. With Memorial Day past, the unofficial start of summer driving season has begun. China’s lockdown is starting to ease which will only cause even more demand. The supply issues are plenty, and about to get more difficult with the loss of more Russian oil and not enough refinery space to fill the gap in lost production.