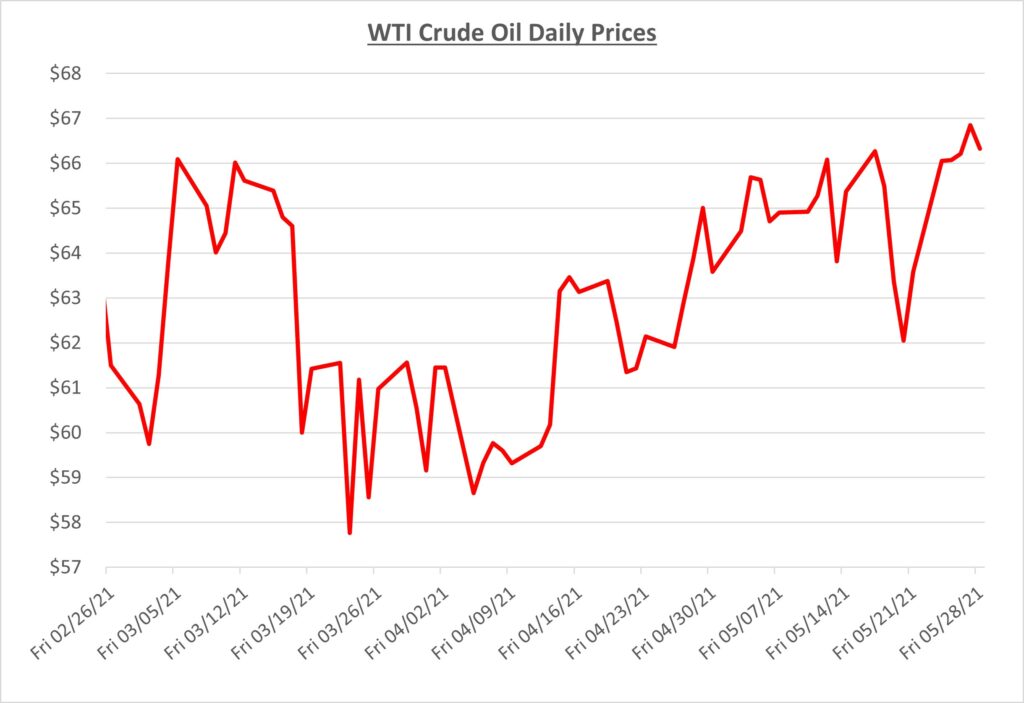

May was a busy month, the major headline being the Colonial Pipeline outage. Compared to April, the overall price of oil was much higher in May, and prices should continue to trend upwards as we head into June and the summer driving season takes off. The following graph shows the daily price movements over the past three months:

May started the month with positive news as the US, Europe, and China loosened their travel restrictions. The reopening of these countries led the belief that demand will soon follow as things attempt to get back to normal. This caused prices to surpass $65/barrel.

Shortly after that, things took a turn for the worse with a cyberattack on the Colonial Pipeline. The pipeline runs from Houston through some southeast states and all the way up the East Coast toward New York. Millions of gallons of refined fuels are transported through the pipeline each day. As a result, many markets depend on its supply and this caused logistical nightmares in the southeast. Colonial was able to restart production May 12th at 5PM ET, but it took another 7-10 days for the markets to recover and normalize.

In mid-May after the pipeline situation calmed, oil prices dipped briefly. The reasons for the short relief with pricing were due to the US and Iran progressing on the nuclear deal, as well as inflation concerns with the CPI rising by 4.2%. After the dip, prices continued to rise in May before oil hit a multi-year high at about $67/barrel.

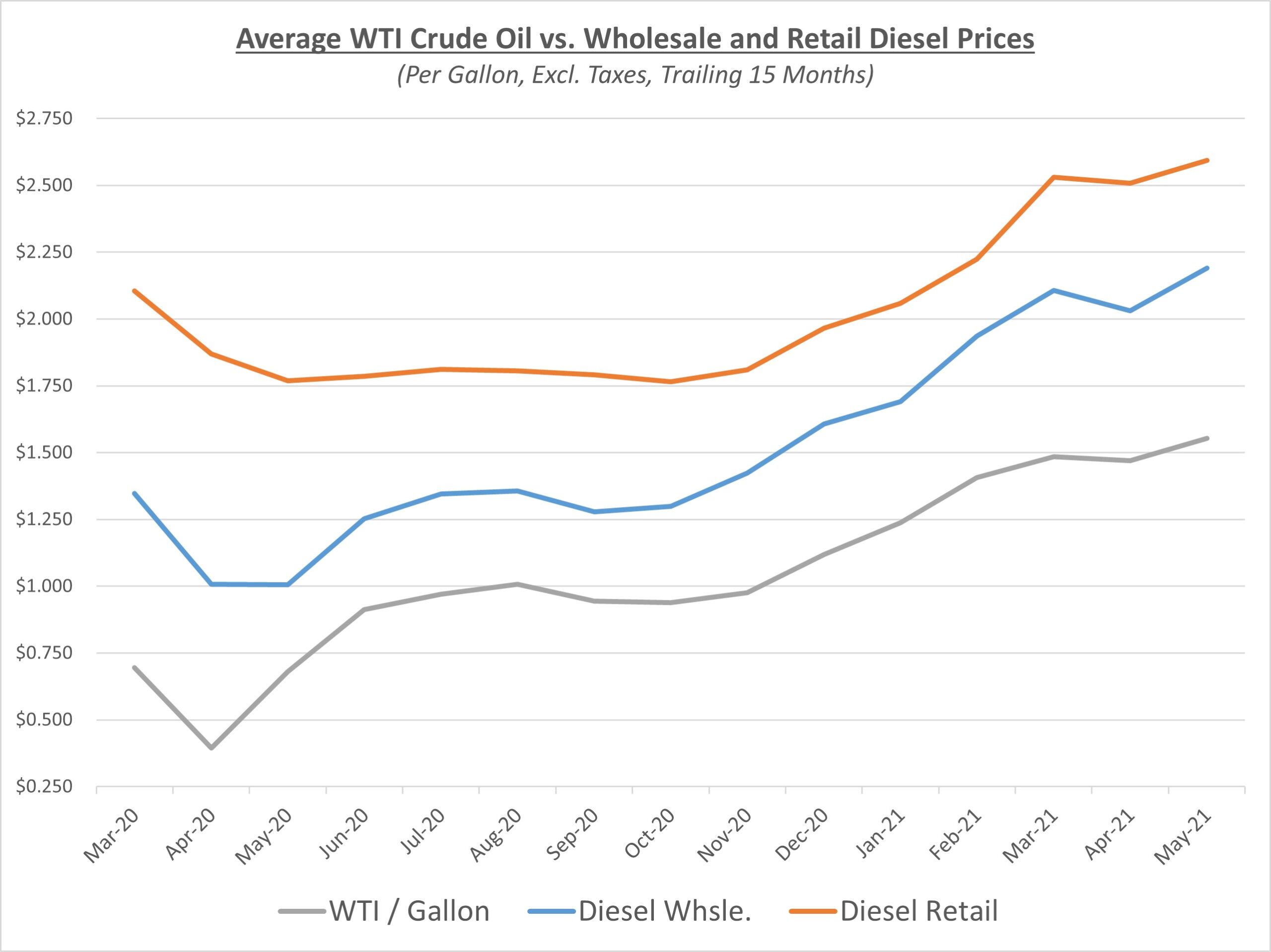

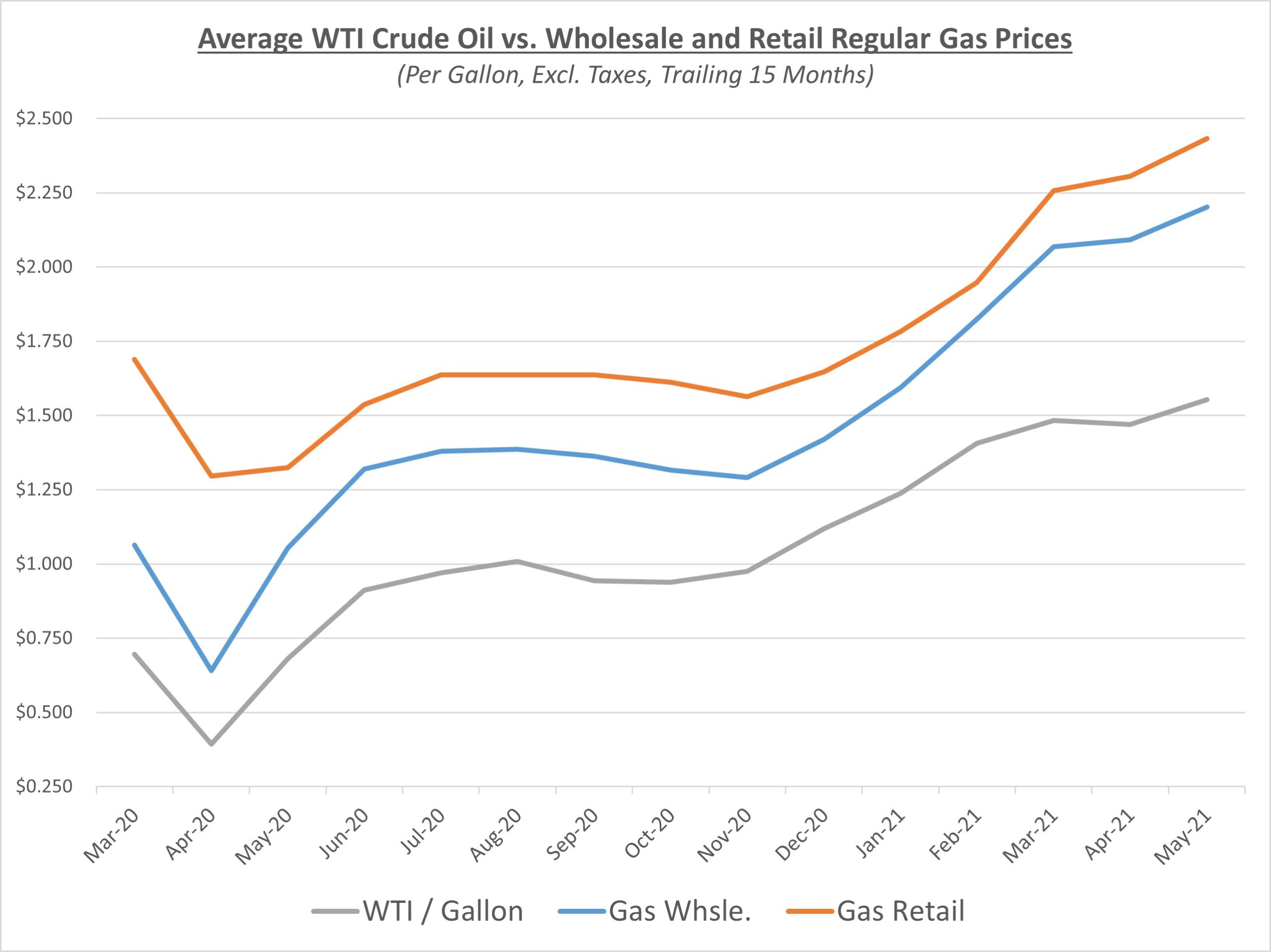

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

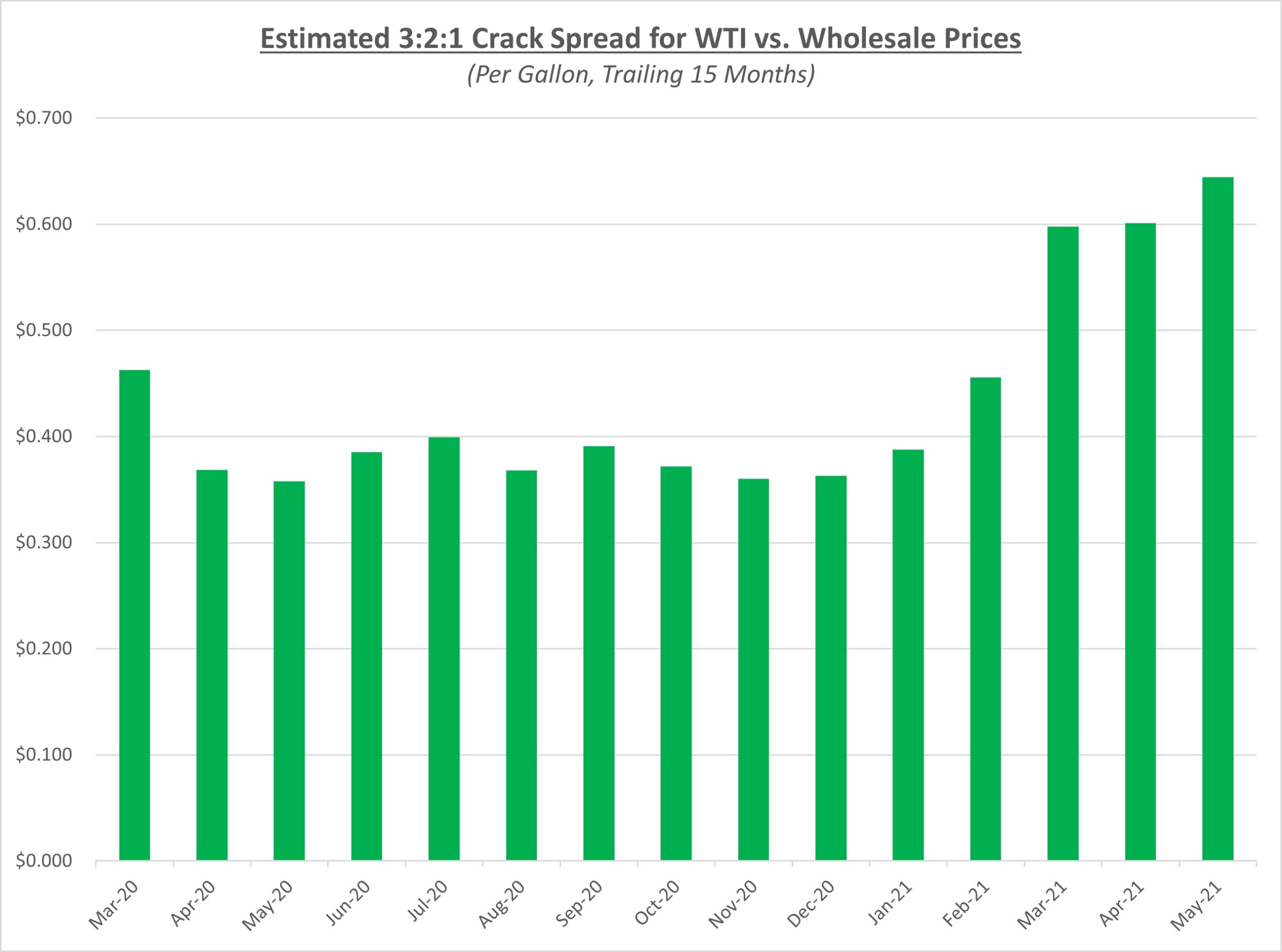

Refined fuel prices versus oil continue to be elevated as they rose further in May, as indicated by the 3-2-1 crack spread graph shown below. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. The crack spread has remained high primarily due to increasing demand for refined fuels.

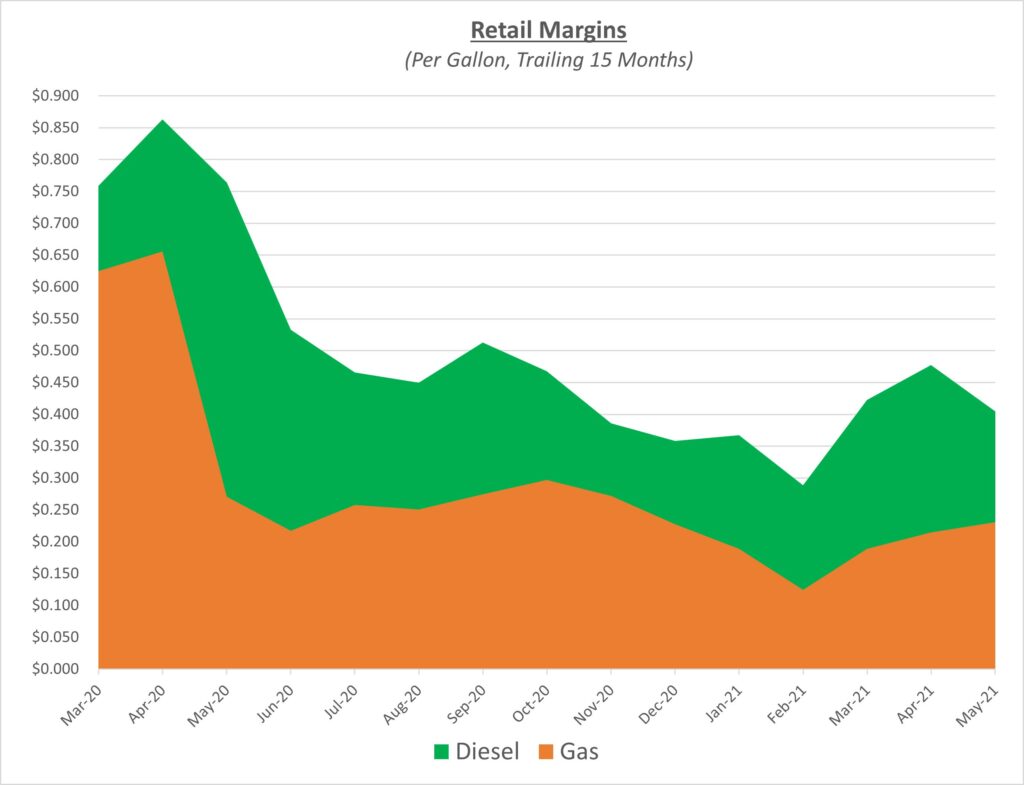

Refined fuel prices rose in May compared to April. Although retail gas and diesel prices increased in May as well, they did not rise as quickly causing margins for both products to slightly lessen compared to the previous month. We typically don’t see large margins when prices are increasing, as the pumps are quick to adjust their pricing up, but not so quick to move their prices down when prices fall. The following graph shows the retail margins over the trailing 15 months:

There was a flurry of activity in the month of May which concluded with oil finishing around $67/barrel. The unofficial start of summer has given the market hope as evident with increasing prices. Even though we might not see pre COVID-19 demand levels with gas, numbers are exceeding projections so far. Oil is inching towards $70/barrel, which is around where Sokolis has believed it will finish the year. A few factors that might keep it from getting much higher include OPEC+ meeting June 1st and Iran supply coming back online. The current assumption is that OPEC+ will leave their plans unchanged, but if oil prices continue to rise, they could revisit allowing more supply back into the market.