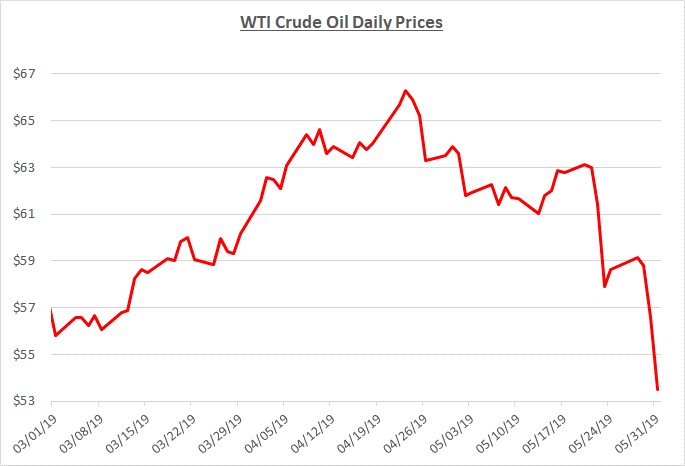

Oil prices traded in a narrow range near $62 per barrel for most of May, then quickly fell back to the high-$50’s on May 23rd. Prices collapsed even further at the end of the month, closing May at $53.50. Overall, prices fell by 16% during May but are still up by 13% since the start of the year. The following graph shows the daily price movements over the past three months:

Despite ongoing tensions in the Middle East, the stage was set for May’s price decline as a result of the breakdown in trade talks between the US and China. However, the main catalyst for the rapid decrease on the 23rd was unexpected news that global oil inventory levels had increased. Analysts had been expecting declines based on seasonality along with OPEC’s production cuts.

Prices declined because inventory levels were not shrinking as fast as expected from OPEC’s production cuts and this was compounded by the bearish outlook for future oil demand due to the ongoing trade tensions. The situation with the US and China continued to worsen throughout the end of the month. Then, things got worse as a new front of trade tensions began with the US and Mexico. The overall pessimism about global economic activity and weakening demand for oil ultimately caused prices to collapse.

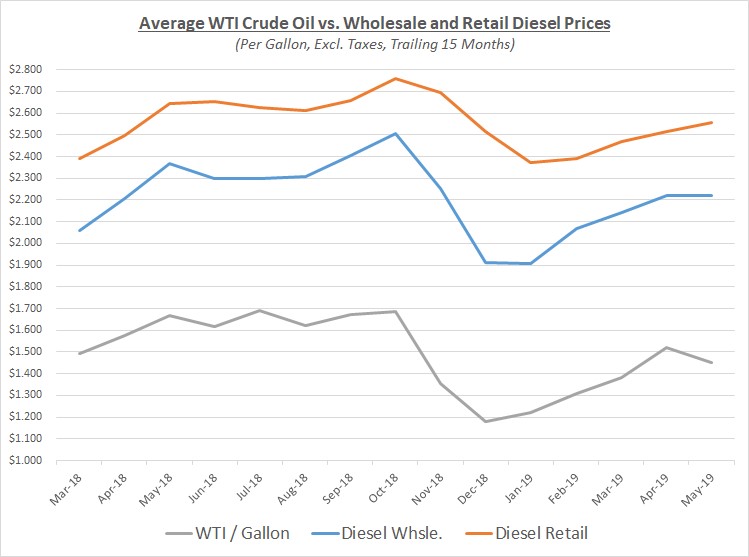

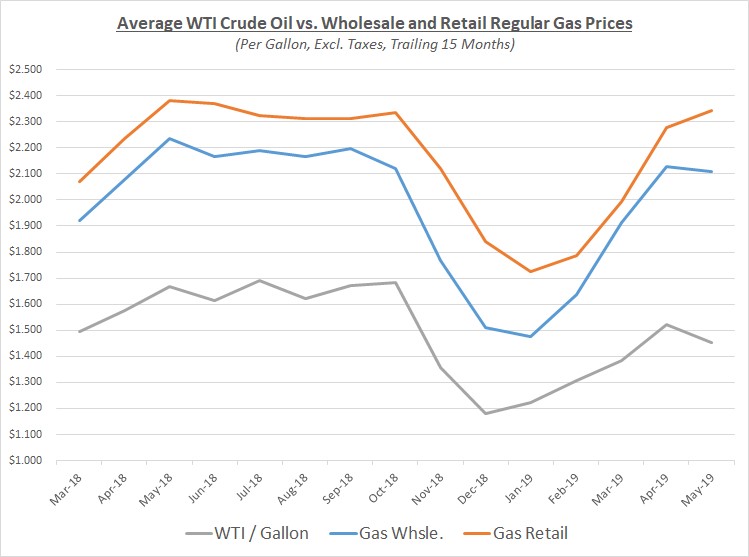

As oil prices fell quickly during the end of May, average wholesale and retail prices for diesel and gas did not keep pace. The overall wholesale averages for these refined products were relatively unchanged compared to April. May’s average retail prices, which are typically slow to respond rapid changes, continued to increase compared to April. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

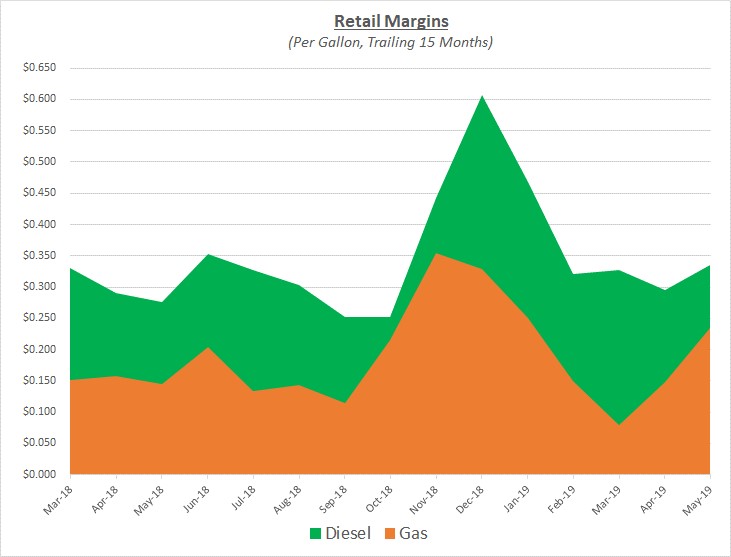

Due to the way wholesale prices remained steady while retail increased slightly in May, average retail margins also increased slightly. Any declines in retail prices probably won’t be noticeable until a week or two into June. And during this period, above average retail margins will likely occur until the market stabilizes at its new lower level. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Sokolis anticipates oil prices will remain in the mid-$50’s per barrel through the summer months unless any trade agreement breakthroughs are announced. Assuming no positive changes to trade, prices are still likely to begin climbing again during the second half of the year. Significant factors to continue to watch include production cuts by OPEC and Russia that may start to have an impact on balancing global supply, tensions in the Middle East could worsen, and compliance with IMO 2020 requiring ships to burn cleaner fuel will increase demand for diesel fuel.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.