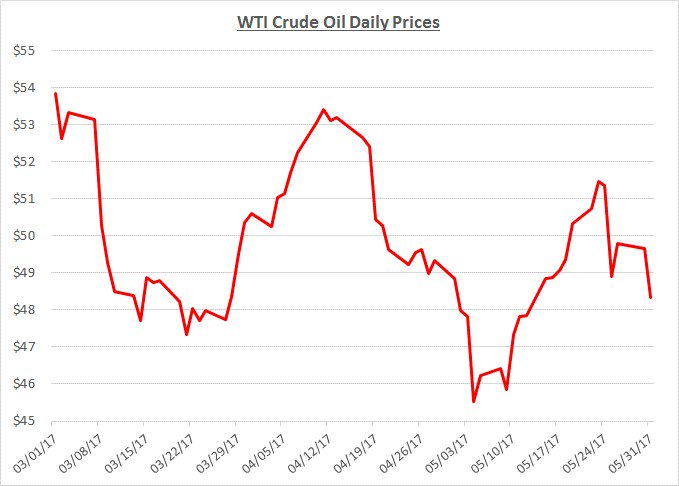

May was a choppy month for oil prices which started just below $50/barrel and wound up almost in the same place by the end of the month. The following graph shows the daily price movements over the past three months:

During the start of May, prices continued their rapid decline which began in April as inventory levels remained stubbornly high coupled with weaker than expected demand for gasoline. Near mid-May, a more consistent trend of declining inventory levels provided support for prices to start increasing. In addition, reports from OPEC indicated they might not just extend lower production levels implemented at the beginning of the year, but they were also considering deeper reductions. As the month wrapped up, OPEC announced the expected extension but disappointed the market by not cutting further. Prices sagged based on concerns that just extending the deal might not be enough to rebalance supply and demand by the end of the year.

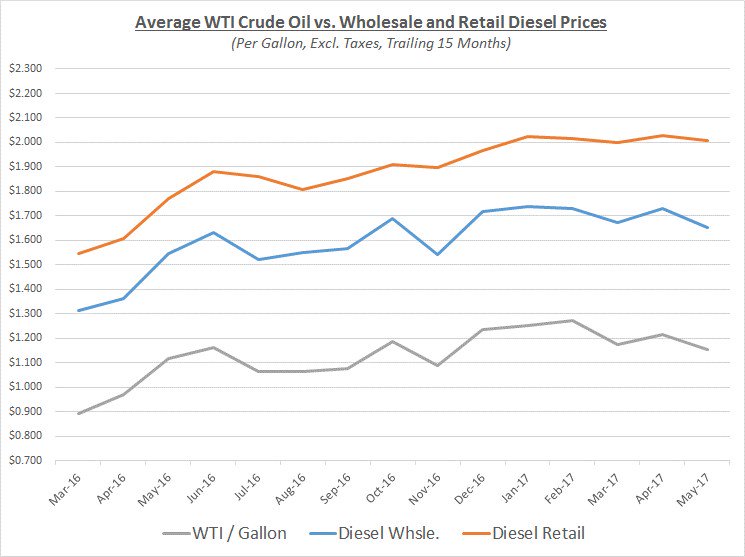

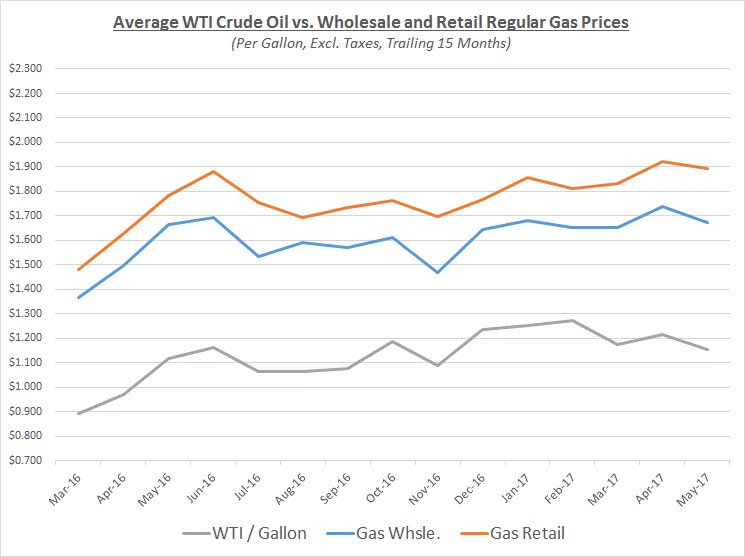

Despite the overall volatility in crude prices during May, the average price for the month decreased modestly compared to April. Wholesale fuel prices also showed similar decreases while retail prices were relatively unchanged. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

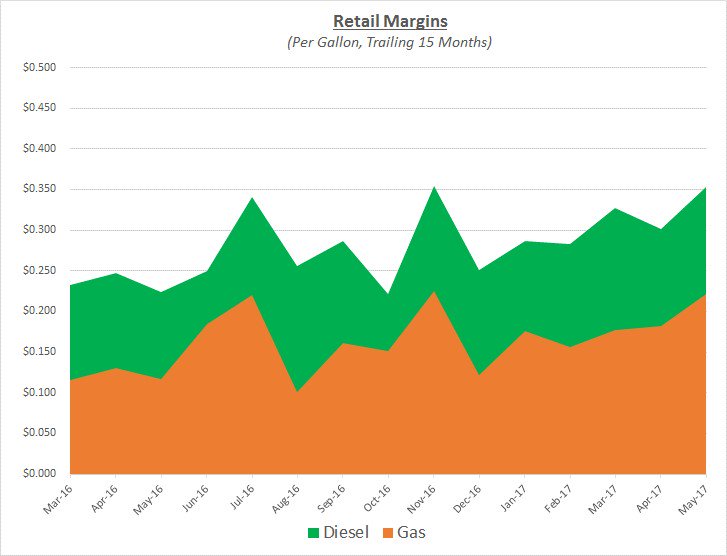

As May wholesale prices for diesel and gas decreased faster than retail prices, retail margins grew to their highest level of the year. The following graph shows the margin trends over the trailing 15 months:

Because of the market changes in May, fleets with retail-based purchasing deals would not have seen any significant changes while fleets with deals based on wholesale prices would have seen modest declines.

Looking beyond May, Sokolis anticipates prices will continue to trend near the $50/barrel level provided OPEC and other foreign oil producers continue to show strong compliance with their extended production cuts. In addition, further reductions in inventory levels will be needed to support prices at the current level. Any news that indicates non-compliance with the OPEC deal or increases in inventories could lead to further declines in prices.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.