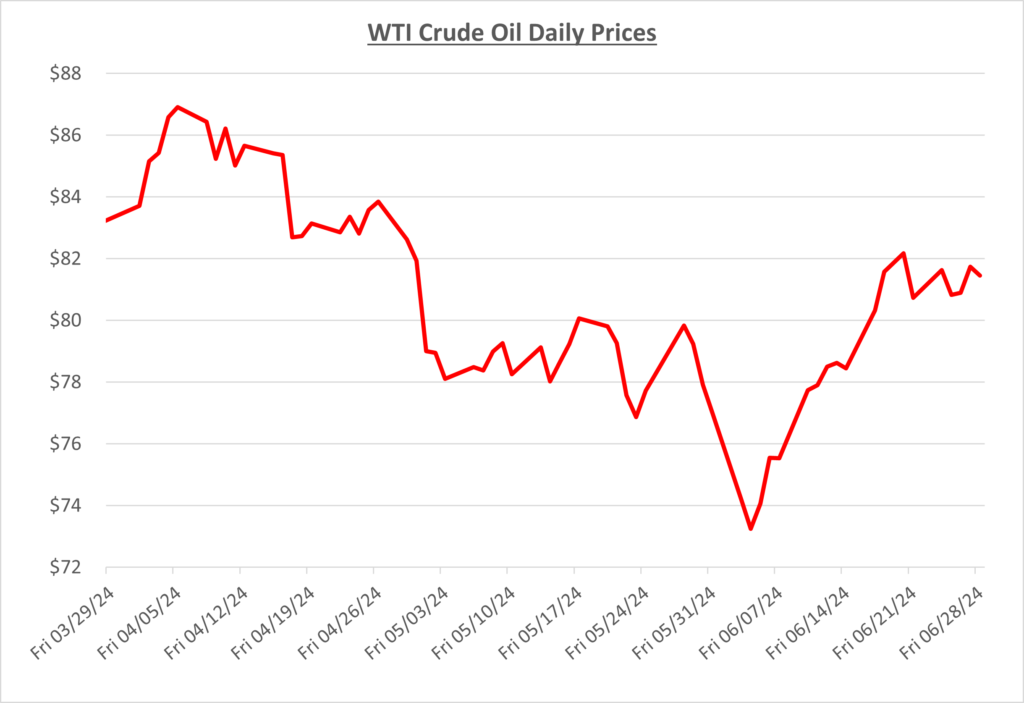

Oil prices were on a steady decline that began in April and continued through early June when prices fell below $74/barrel. Even after the OPEC+ meeting early in June where the cartel agreed to extending production cuts, demand had not been strong enough to help prices stabilize or increase. The following graph shows the daily price movements over the past three months:

By the second week of June, oil prices reversed course and started increasing rapidly. It’s difficult to pinpoint specific factors that caused the market to change suddenly. Some analysts believed the rising prices were linked to increasing demand for gas during the summer driving season. Others felt it was growing optimism about global economics which could lead to increased demand for oil in the future. Meanwhile, increasing tensions in the Middle East have been raising concerns about potential disruptions to oil supplies. All these factors contributed to the recent increases in oil prices which wrapped up June just over $81/barrel.

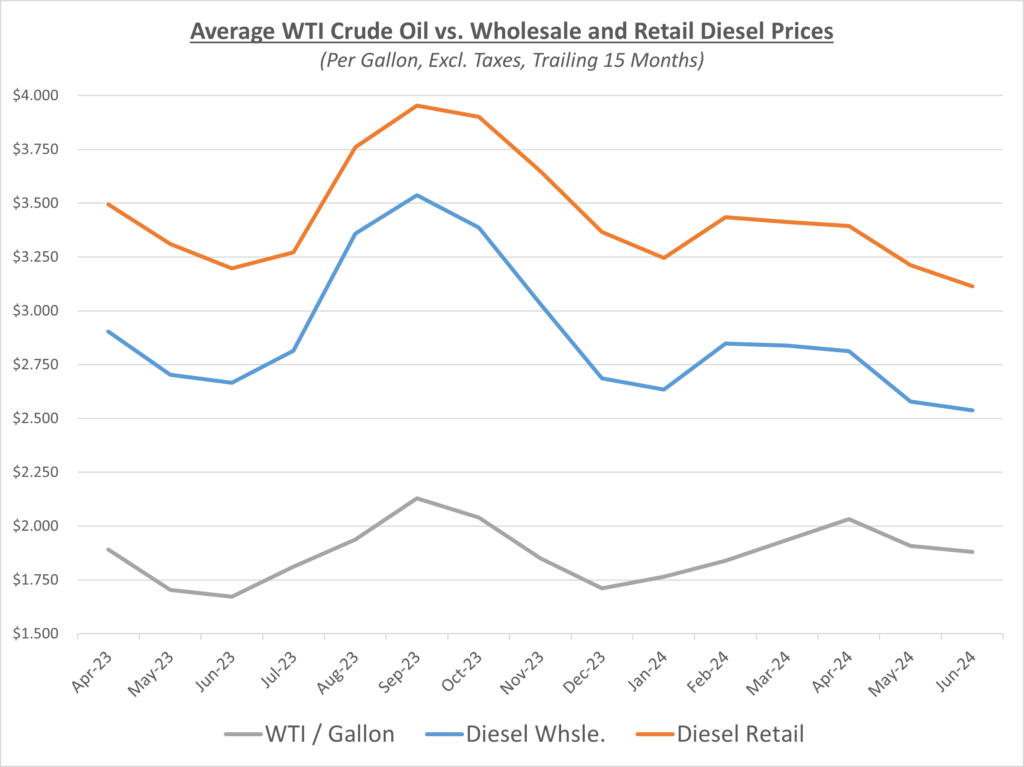

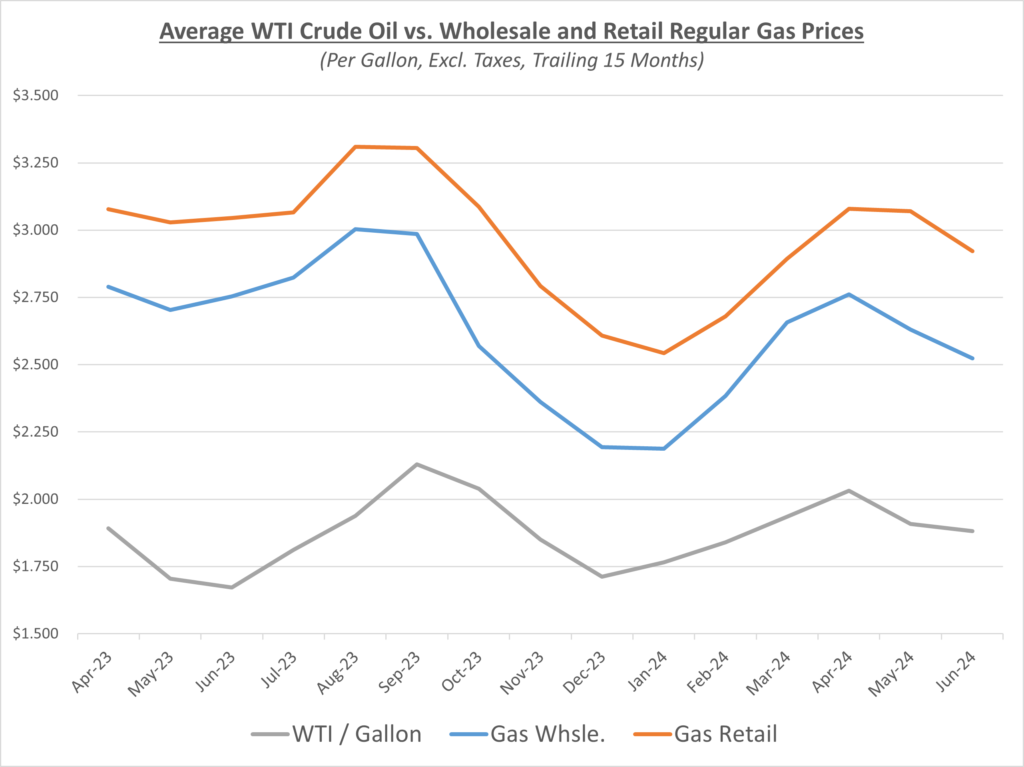

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

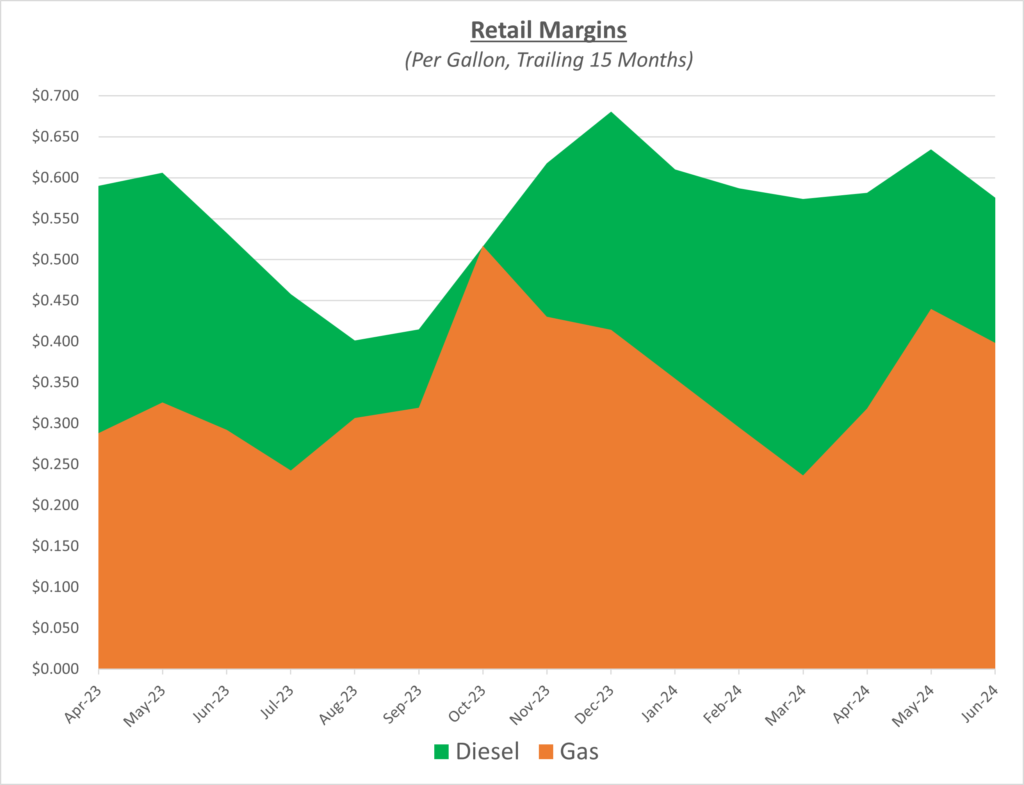

Wholesale and retail prices both decreased in June for diesel and gas, but retail’s drop was slightly faster than wholesale resulting in lower profit margins for suppliers. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished at about $3.50/gallon in June. This was a decrease of $0.05/gallon compared to last month. Diesel prices also dropped by a similar amount, ending June near $3.82/gallon. AAA is projecting 4th of July holiday travel will be extremely busy which would give demand a much-needed boost. In addition, increasing tensions in the Middle East have the potential to push oil prices higher.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $75-85/barrel in the near term.