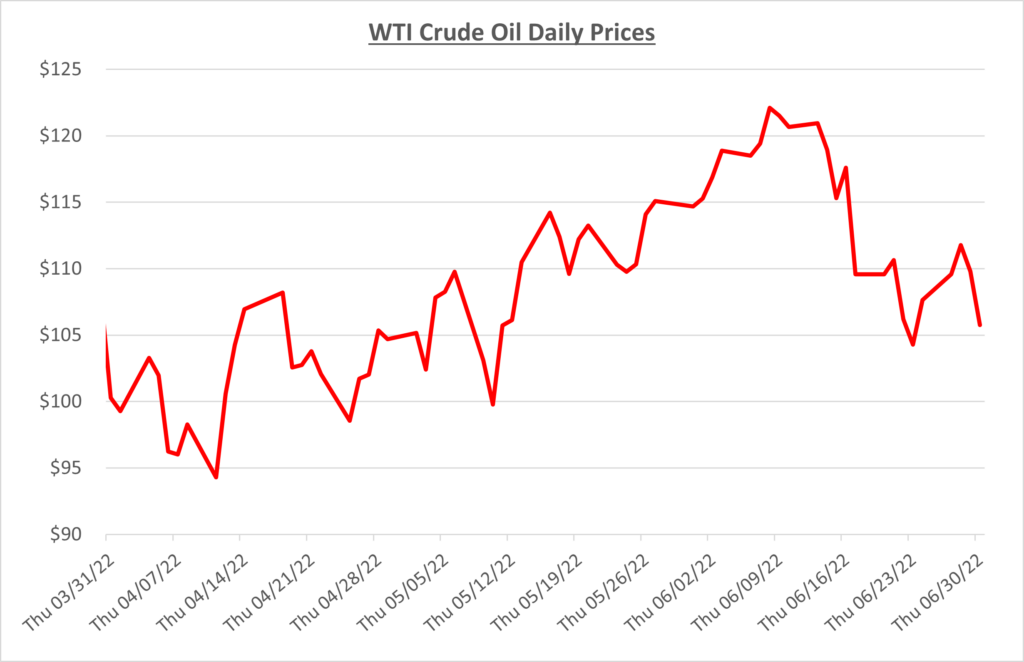

Oil prices extended their climb from the end of May into June until they hit a ceiling (for now) at $122/barrel. Diesel and gas prices continue to hit record highs for both products at the pump. Investment banks such as Goldman Sachs have floated the idea of oil reaching $150/barrel before the end of 2022. The following graph shows the daily price movements over the past three months:

With the European Union agreeing to a deal to sanction Russian Oil, as we mentioned last month, Saudi Arabia and OPEC began talking about ramping up supply. In months past, OPEC has struggled to meet their production increase promises, but Saudi Arabia might be the one country with actual room to grow. However, the rest of the OPEC countries are so far below their quotas that Saudi Arabia won’t likely be able to make up that difference and improve the supply situation.

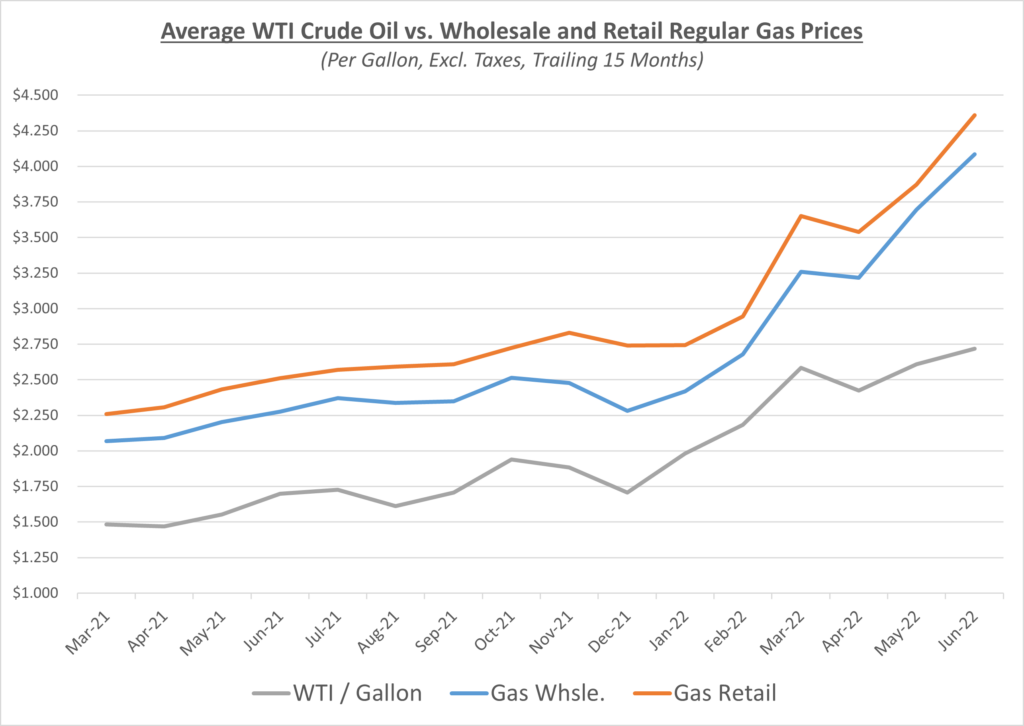

During the month of June, the national average for gas jumped above $5/gallon. According to Patrick De Haan, the head of petroleum analysis at GasBuddy, Americans are now spending $730 million more every day on gasoline than they were a year ago. President Biden continues to exhaust almost any method possible to help lessen the pain at the pump as we have entered the summer driving season. Biden is looking at a 3-month suspension of the federal diesel and gas tax, although this seems unlikely to get through Congress. If it were implemented, it would save drivers just over $0.24 and $0.18 per gallon for diesel and gas, respectively. This is following in the footsteps of several states that have suspended their state taxes on fuel for a brief period.

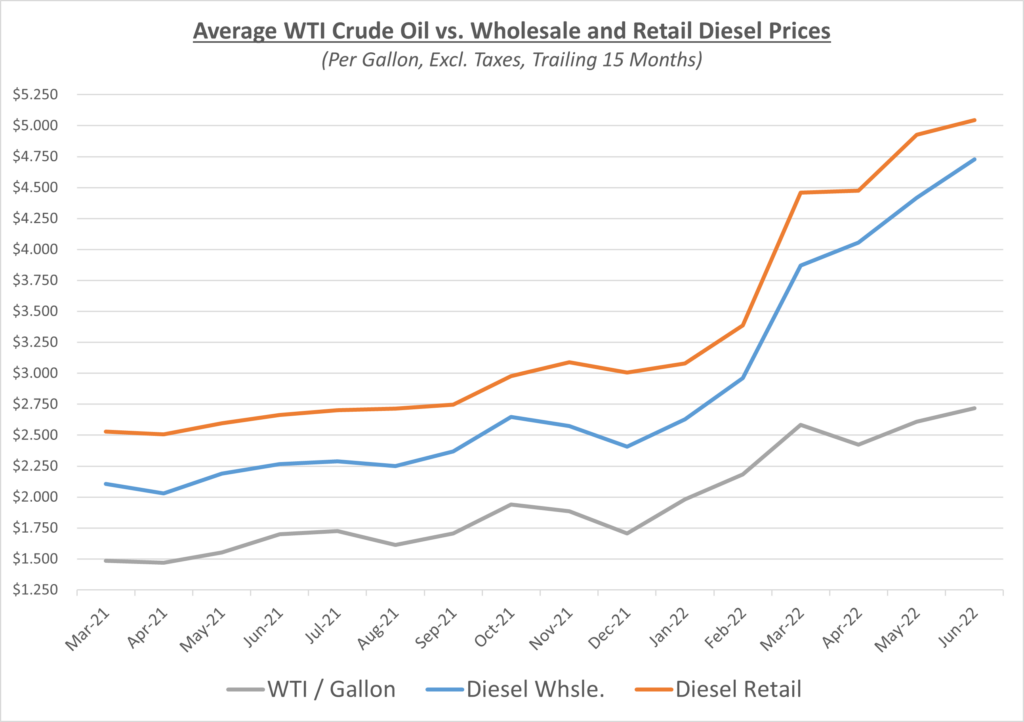

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

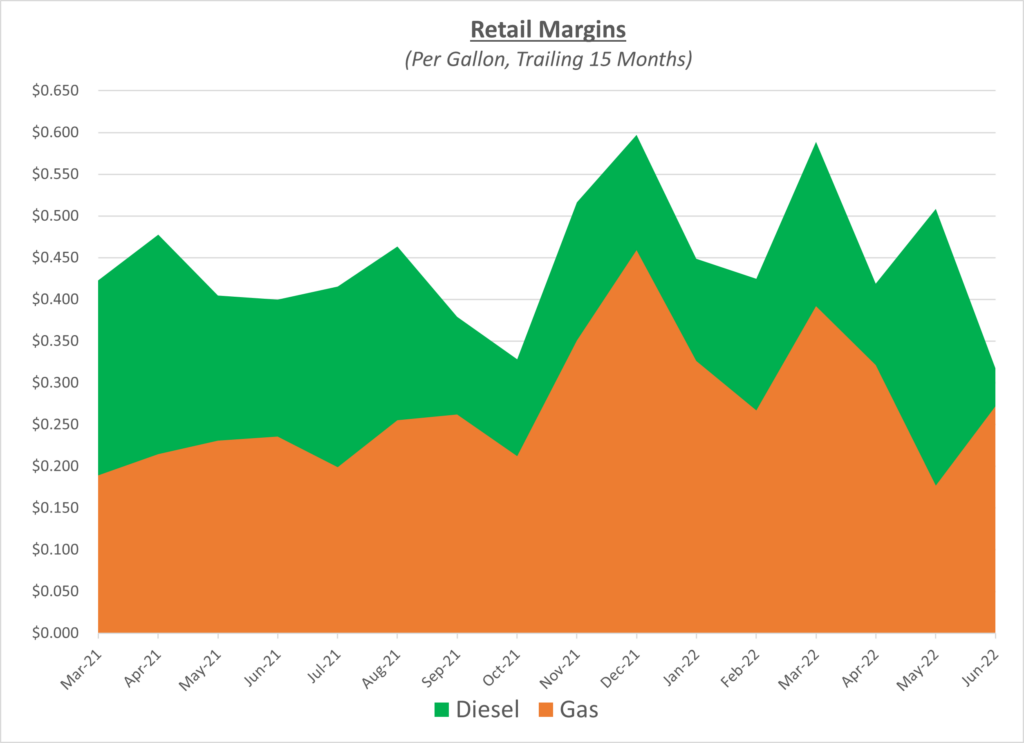

In June, diesel wholesale prices had a steeper incline than retail prices which caused a drop in profit margins for fuel stations. Gas wholesale and retail prices were both on the upswing, but retail prices rose slightly quicker to create some larger margins for gas retailers. The following graph shows the retail margins over the trailing 15 months:

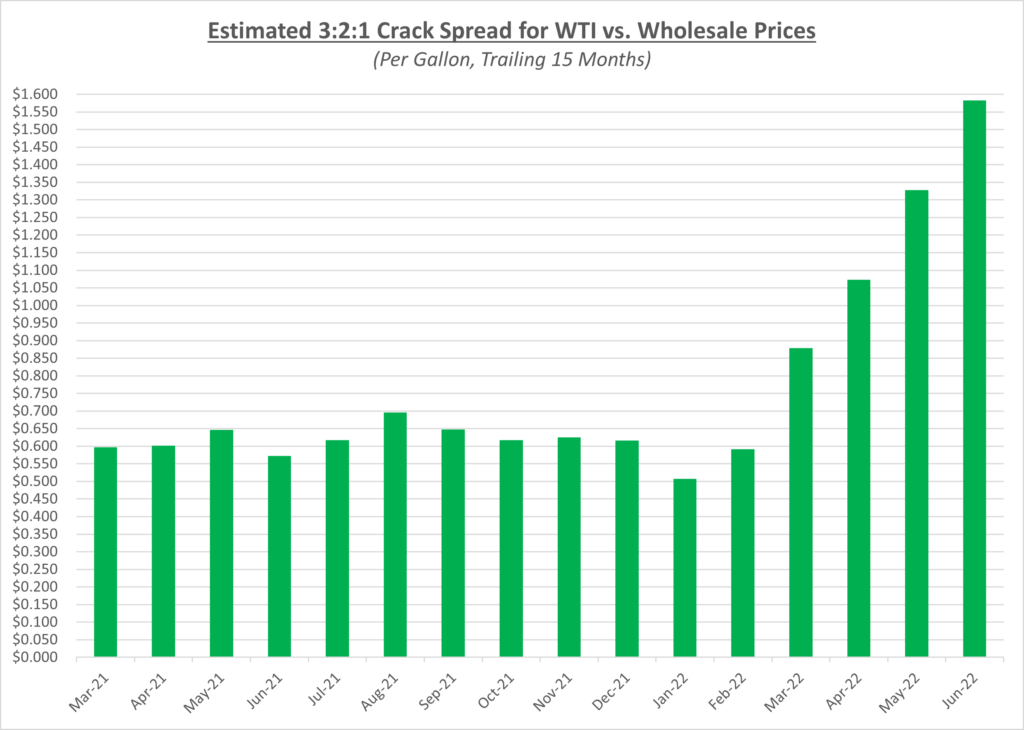

Crack spreads continued their torrid pace with another large increase in June, now approaching $1.60/gallon as shown in the graph below. The market continues to be very profitable for companies refining gas, diesel, jet fuel, etc. It appears it will be quite some time until we see crack spreads at more normalized levels.

Since the high of $122/barrel in June, oil prices have continued to cool off. Oil finished June just under $106/barrel, which was about 8% lower from where it started the month. This was primarily due to the American Petroleum Institute (API) reporting large back-to-back weeks of inventory level gains versus expected draws. Typically, the Energy Information Agency (EIA) would release their data shortly after the API which acts as a good comparison tool, but the EIA has had system issues recently which has disrupted their reporting. The decline in oil, combined with concerns about an economic slowdown, has resulted in some relief at the pump. Gas prices fell to roughly $4.85/gallon nationally by the end of the month.

Sokolis believes that oil prices will remain above $100/barrel for the foreseeable future, but there are a lot of scenarios that could send oil upward or downward. We are starting to see some relief in fuel prices, but keep in mind that along with summer vacations (driving season) we are now entering hurricane season. Any disruption to refineries could cause fuel prices to spike due to already tight fuel supply. At the same time, there are recession concerns with the economy that could cause oil prices to decline further. Unfortunately, no one has a crystal ball so we will continue to monitor the situation closely.