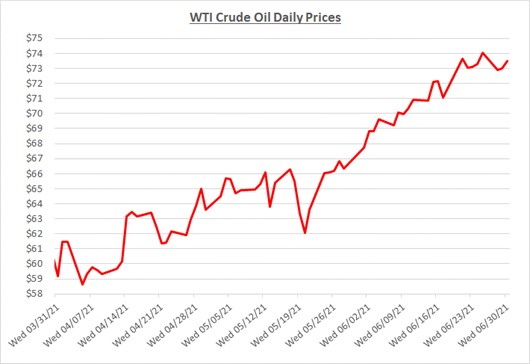

Oil prices have been on a steady climb since the end of May. June saw even larger increases as oil hit a two year high to start the month. Fuel prices should continue to rise as we are now into summer and analysts expect demand to get back to 2019 levels and possibly even surpass those levels. The following graph shows the daily price movements over the past three months:

June was relatively quiet for news headlines, especially compared to May, but that could change quickly as we head into hurricane season. Oil started the month hovering between $68-$70 a barrel, before taking off and getting over the $73 mark. The main cause for prices increasing was the belief that demand will continue to improve globally throughout the summer months and the recent draws in crude inventories causing worries about supply.

Many analysts are starting to predict that we could see $100/barrel prices within the next year. One thing that could get in the way of that would be OPEC+ increasing production, which is anticipated through the end of the year assuming demand continues to grow. In the past, today’s pricing point would have enticed many shale producers to come back online. However, a lot of them were put out of business during the boom and busts of the past decade.

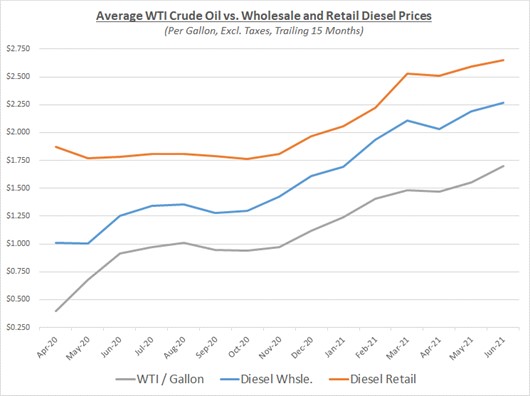

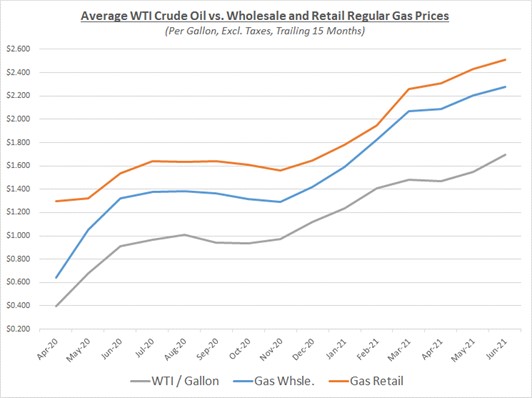

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

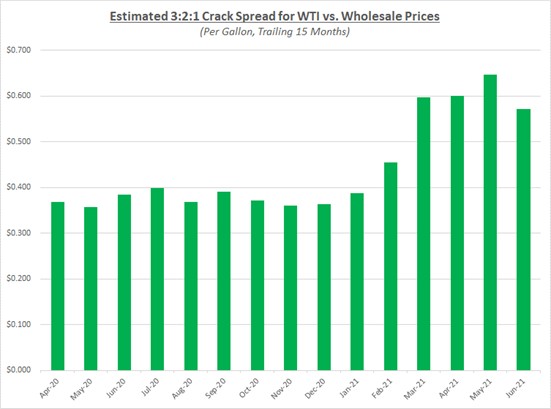

Refined fuel prices versus oil remain high based on the 3-2-1 crack spread trends, but June reflected the first decline in several months. June’s spread is closer to what we saw in March and April, as you’ll see in the 3-2-1 crack spread graph shown below. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. The crack spread has remained high primarily due to increasing demand for refined fuels.

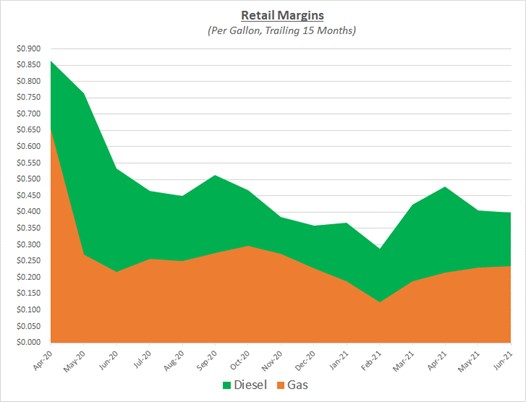

Refined fuel prices continued to rise in June but retail margins for both gas and diesel stayed relatively even with May. We would expect to see margins stay at these levels unless there is a sudden drop in oil prices which would cause margins to spike higher. The following graph shows the retail margins over the trailing 15 months:

After starting the month at just under $68/barrel, oil finished strong rising above $73. Demand continues to ramp up and the market seems to be bullish for the next several months. The 4th of July holiday and the remainder of the summer is expected to add many travelers on the road. However, there is some concern over the new Delta variant of COVID-19 that could cause demand to slow globally, as some countries decide to put restrictions back in place. As mentioned earlier, we have entered hurricane season too. Hurricanes tend to be more disruptive to demand than supply, but if they hit the right (or wrong) spots they can greatly affect supply. While these factors could cause prices to increase, anticipated production growth from OPEC+ may provide some moderation of prices. Sokolis sees oil continuing to hover in $70s, with some likelihood of breaking through the $80 mark, in the near future.