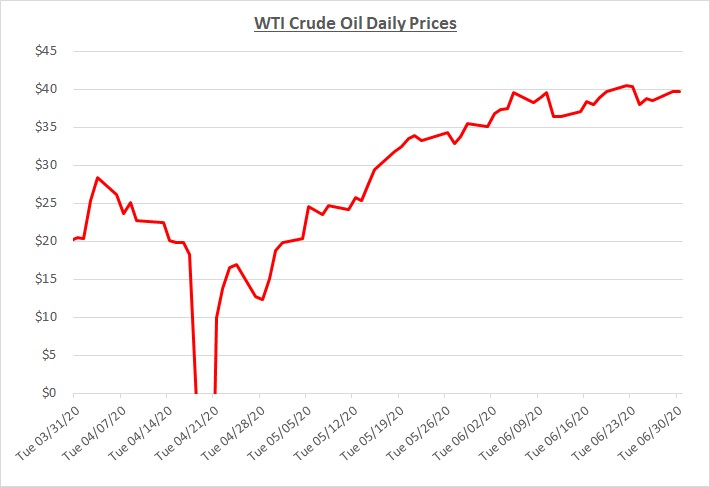

Oil prices traded in a narrow range throughout June following the significant rebound that began in May. Although prices broke through $40 per barrel very briefly, they were mainly in the high-$30’s for the entire month. The following graph shows the daily price movements over the past three months:

When COVID-19 restrictions started easing during May, businesses reopened and travel began to increase resulting in growing demand for oil and fuel. In addition, OPEC+ extended their production limits to help offset the global oil supply glut that had built up over the past few months. As demand increased with limits on production, oil and fuel prices began rising steadily throughout May.

As June began, concerns grew about a resurgence of the virus with the number of cases still rising in some countries. In the US, a significant increase in cases was seen in many states that had loosened their restrictions earlier in May. The uncertainty surrounding continued economic growth along with future demand caused oil prices to flatten in the high $30’s throughout most of June.

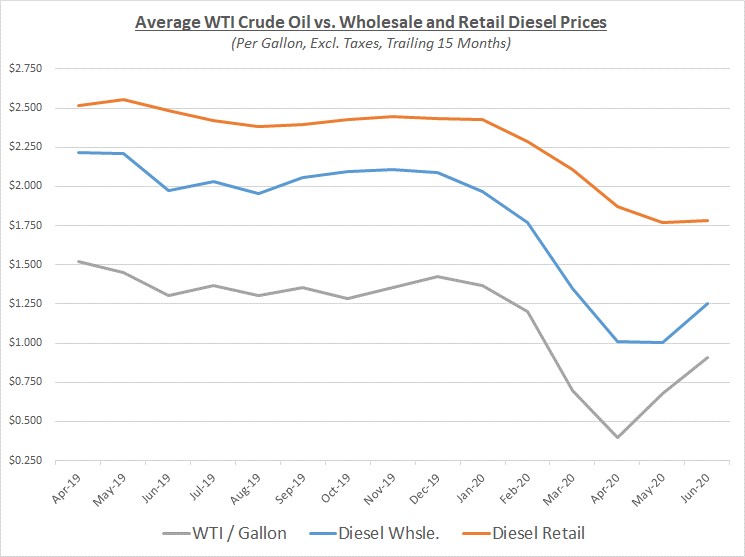

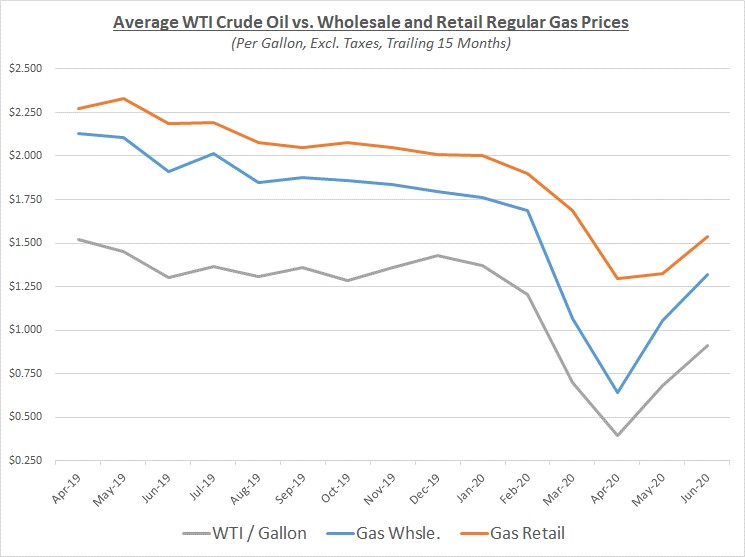

The overall average monthly oil prices for June compared to May showed a significant increase. Wholesale prices for diesel and gas followed oil closely. However, retail prices for diesel were relatively flat as demand lagged, primarily related to commercial trucking. Meanwhile, retail prices for gas rose with wholesale prices as demand from individual consumers continued increasing. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

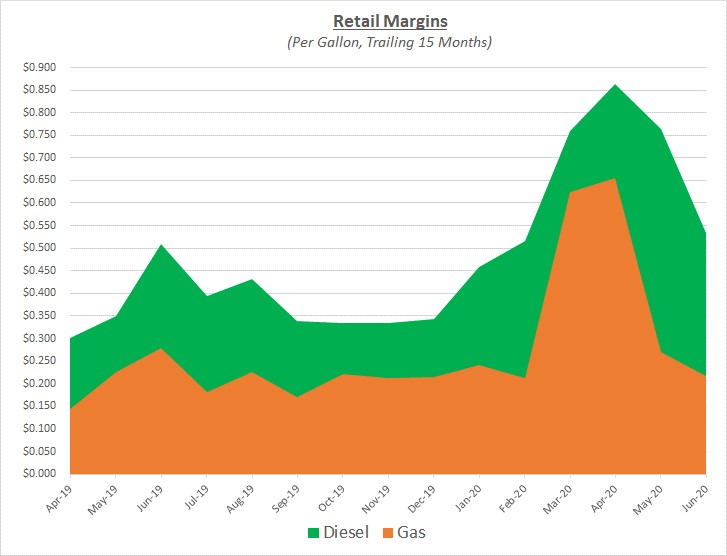

As the graphs above show, retail prices for diesel were flat compared to the prior month as retailers absorbed wholesale price increases and sacrificed some of their margins which have been running at very high levels. For gas, margins had already declined significantly last month, and retailers were forced to increase their prices to keep pace with wholesale so their margins could be sustained. The following graph shows the retail margins over the trailing 15 months:

Looking out over the next few months, Sokolis believes oil prices will continue to hover near $40 per barrel with some variability based on COVID-19 developments. The potential exists for prices to continue climbing toward the mid-$40’s and beyond if restrictions in many states continue to be eased and demand increases further. However, as we have recently seen, significant new virus cases have emerged resulting in some restrictions being reinstated. If the situation worsens, it could cause demand to stall and prices may fall back toward the mid- to lower-$30’s.