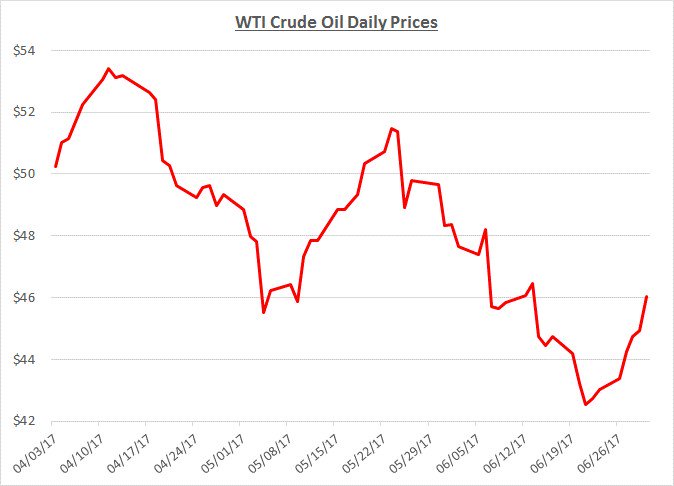

Oil prices fell approximately 10% during June as the decline that began toward the end of May continued throughout the month. Prices at the beginning of June were just over $48/barrel and decreased to $43 near the end of the month. During the last few days of the month, prices managed to stage a comeback and ended the month at $46. The following graph shows the daily price movements over the past three months:

Near the end of May, prices began to decline as OPEC announced an extension to their production cuts implemented back in January 2017. This move was expected but still disappointed the market because deeper cuts were not announced. As June began, growth in oil and refined product inventories came as a surprise to the market which was anticipating a declining trend to develop. Meanwhile, US production rig counts continued to increase which reinforced concerns that balancing supply and demand would be a challenge to accomplish within the next year.

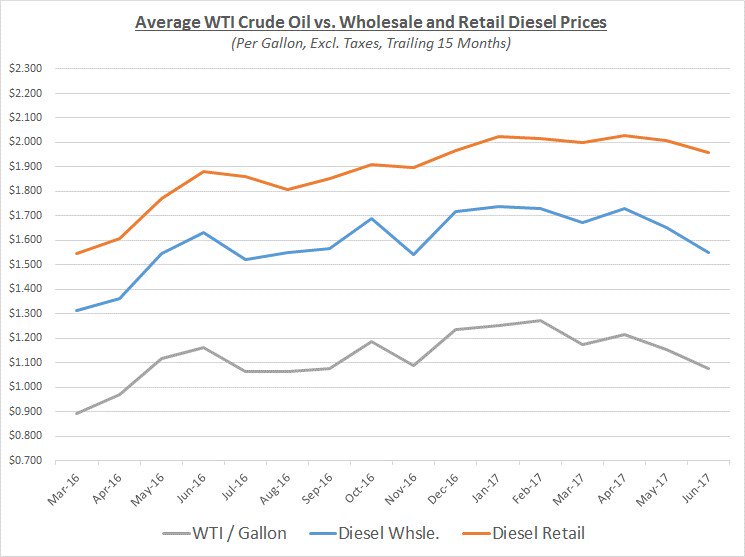

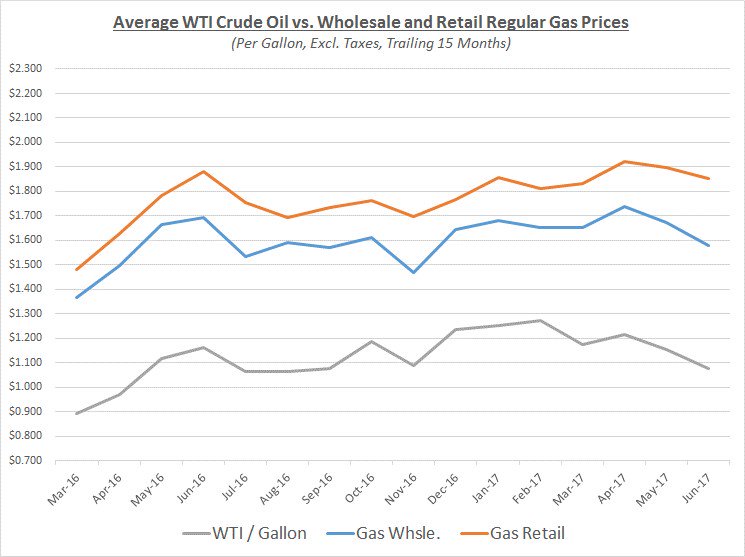

As crude prices declined during June, wholesale fuel prices showed similar decreases. However, retail prices were relatively slow to react which is common during periods of rapid wholesale declines as merchants take advantage of the opportunity to maximize their retail margins. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

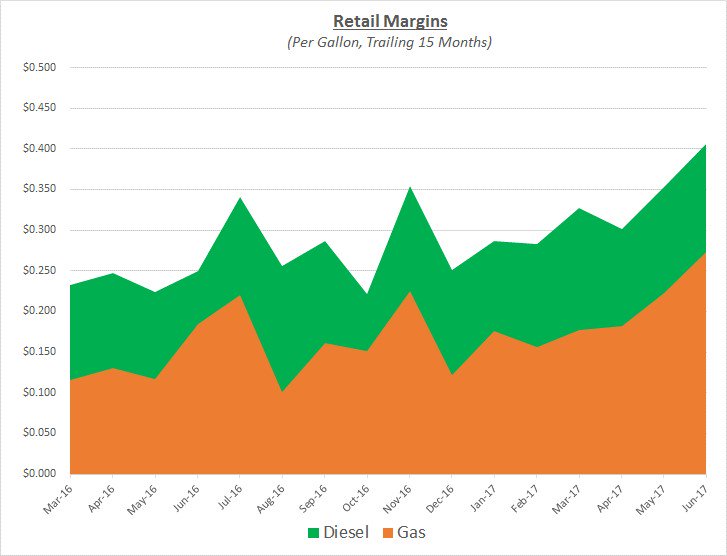

While June wholesale prices for diesel and gas decreased faster than retail prices, retail margins grew to their highest level over the past 15 months. The following graph shows the margin trends over that period:

Because of the market changes in June, fleets with retail-based purchasing deals would have only seen modest declines while fleets with deals based on wholesale prices would have seen significant declines.

Looking beyond June, Sokolis anticipates prices will likely remain in the high $40’s/barrel with the possibility of climbing back over $50 within the next month or two. Nevertheless, this is highly dependent on seeing more consistent weekly reports of inventory reductions. Any indications of weak demand, further growth in US rig counts, or unyielding inventory levels will continue to provide strong headwinds for any major price increases.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.