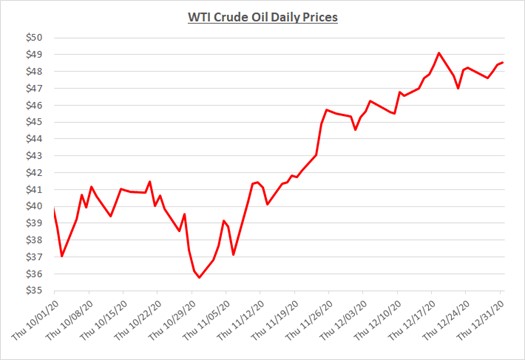

Oil prices continued to increase throughout December and gained another 7% following a sharp increase during November. Prices ended the year near $50/barrel but remain about 20% lower from where they started the year. The following graph shows the daily price movements over the past three months:

The continued rise in prices during December was primarily driven by optimism as the distribution of several COVID vaccines began. While only a small fraction of vaccinations had been completed by the end of the month, rollout plans indicate a much larger percentage of the population will be inoculated over the next several months. Oil and fuel prices have increased in anticipation of greater demand that will accompany a resurgence in economic activity.

In addition to the positive impact of the vaccines on future demand, prices were also supported by OPEC’s decision in December to continue limiting production of oil, although not quite as restrictive as their previous limit. Prior to OPEC’s meeting, there were some concerns that existing production limits would expire and a rapid increase in supply might occur during a period of weakened demand. OPEC decided to extend the restrictions again in early January with a slight increase to the limit. However, Saudi Arabia followed that meeting saying it would voluntarily reduce production effectively allowing other members to increase production while maintaining the overall limit as a group.

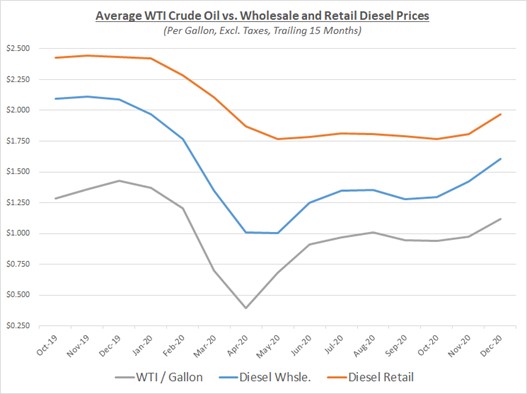

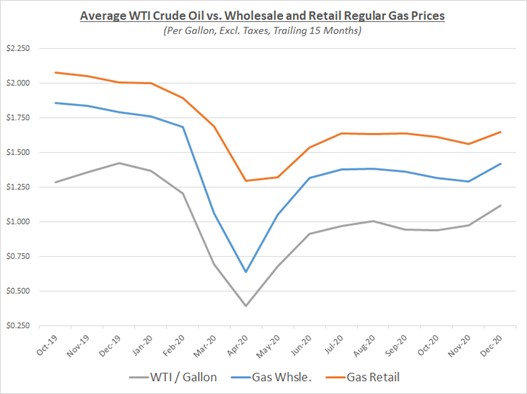

Due to the rise in oil prices throughout December, the overall average price for the month was higher compared to the prior month. Wholesale and retail prices for refined fuels also moved higher with oil. However, the upward slope for retail prices was slightly lower as merchants hesitated to pass through increasing costs during a period of lower demand. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

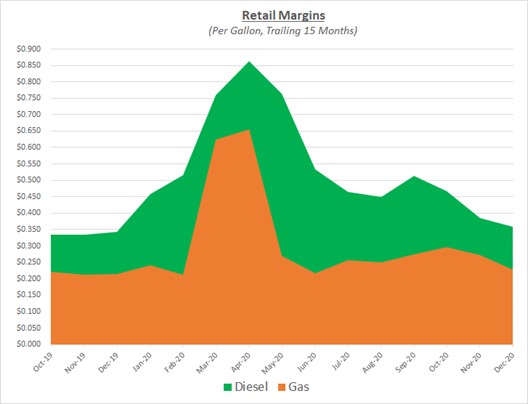

Since the increase in retail prices lagged wholesale for refined fuels, retail margins declined slightly in December. Despite the decline, margins are still within their historical typical ranges. The following graph shows the retail margins over the trailing 15 months:

As we continue into the new year, Sokolis anticipates oil prices will continue to trade near $50/barrel. This assumes there are no major setbacks with rolling out the COVID vaccines, and no new mutations of the virus are resistant to the vaccines. Further price increases are anticipated as wide-spread inoculations enable greater mobility and demand for fuel.

As demand improves, OPEC and US shale companies will continue to reevaluate their production levels as they anxiously look for opportunities to increase production. Additional supply in the market will help offset demand growth which will moderate prices. Nevertheless, the potential exists for oil to continue rising through the $50’s and approach $60 later in the year.