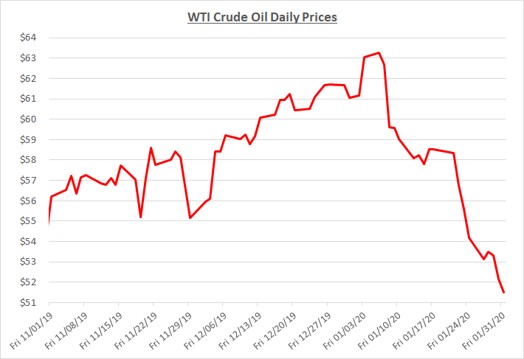

Oil prices dropped sharply and unexpectedly in two stages during January. Prices declined by 16% from the start of the year to close January just above $51 per barrel. The following graph shows the daily price movements over the past three months:

The dramatic decline in January followed a tense period in December with rising oil prices. Near the end of 2019, the US and Iran appeared to be moving toward a major military confrontation following the US’ assassination of one of Iran’s top military generals. 2020 began with anticipation that Iran would retaliate against the US leading to a potential all-out war in the Middle East. However, Iran’s actual retaliation in early January was significantly less than expected, providing an opportunity for both sides to scale back tensions. Oil prices reacted to the decreased risk of supply disruptions by falling rapidly during the first half of January.

Shortly after prices began to settle at a lower level during the middle of January, the next rapid decline began. The cause of this decline was highly unusual; the Coronavirus outbreak originating in China. The number of cases of the virus, along with the death toll, continued to increase in China during January. In addition, outbreaks in other countries started to emerge. Significant travel restrictions were implemented in China during a major holiday travel period, while other parts of the world also started to limit travel to contain the spread of the virus. Oil prices, along with other financial market indexes, fell rapidly as future economic activity and demand for oil were anticipated to be much lower due to these limitations.

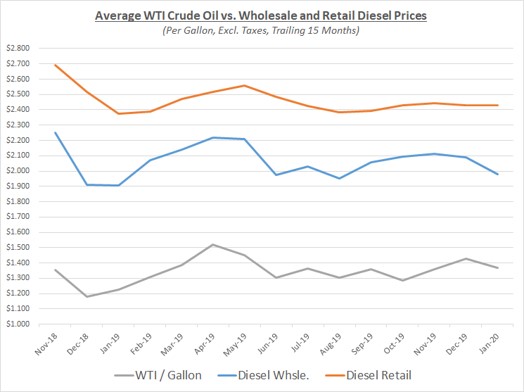

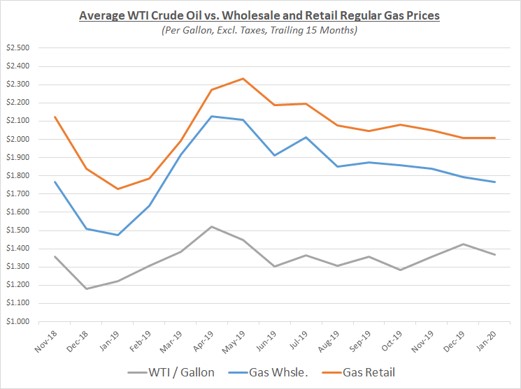

As a result of the rapid decline throughout January, the overall average price for oil fell compared to December. Wholesale prices for refined products also fell while retail prices remained flat. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

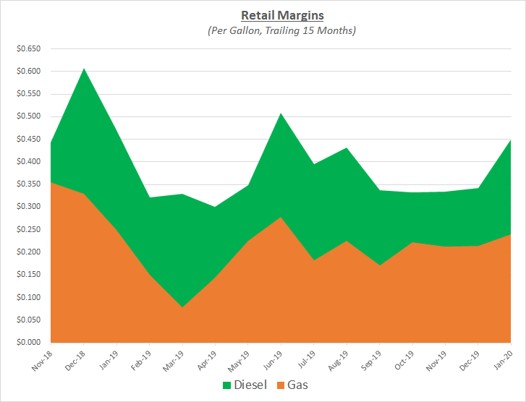

For the refined fuels, retail prices barely moved which is typical during periods of rapid wholesale declines. The result was that retail margins increased, particularly for diesel. The following graph shows the retail margins over the trailing 15 months:

Any prediction for where oil prices may go over the next few months depends heavily on progress to contain the Coronavirus. Sokolis believes oil prices will likely remain in the low-$50’s with the potential to fall into the high-$40’s for a short period. This assumes there are no other significant developments that negatively impact supply and cause prices to spike. When new cases of the virus appear to have peaked, and optimism returns regarding travel and economic activity, oil prices should begin to recover their losses. Increasing oil prices would typically not be a welcome change for fleets, but in this unique situation, it would be a positive sign from a humanitarian perspective.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.