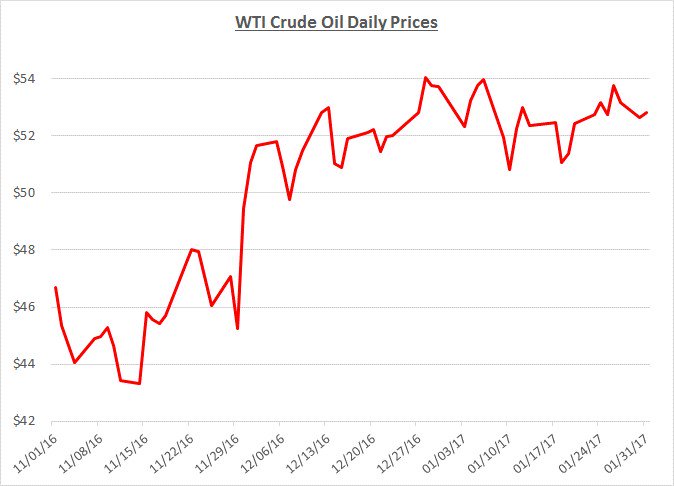

Oil prices continued to trade in a narrow range near $52/barrel during January just as they did in December. This pattern followed a significant spike at the end of November primarily attributable to the agreement by OPEC and other foreign countries to reduce oil production beginning January 2017. The following graph shows the daily price movements over the past three months:

November’s agreement to cut production was implemented during January and compliance has been stronger than expected so far. Prices have remained relatively steady because the supply reduction was anticipated and priced into the market. However, additional competing factors have led to some fluctuations. President Trump’s desire to lower the value of the US dollar compared to other currencies has provided some support for oil prices. However, this has been counterbalanced by abundant inventory levels along with the President’s pursuit of policies that support increased domestic production. And, while prices have only reached the low $50’s, this level has already provided enough financial motivation to restart some US domestic production rigs.

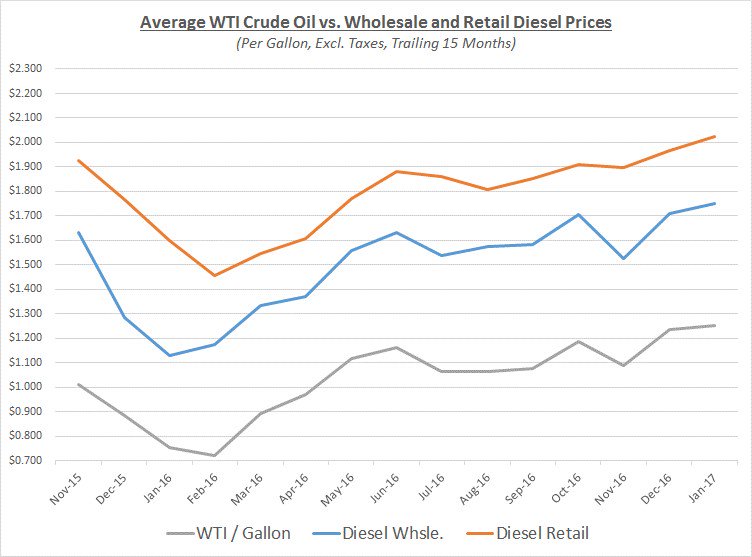

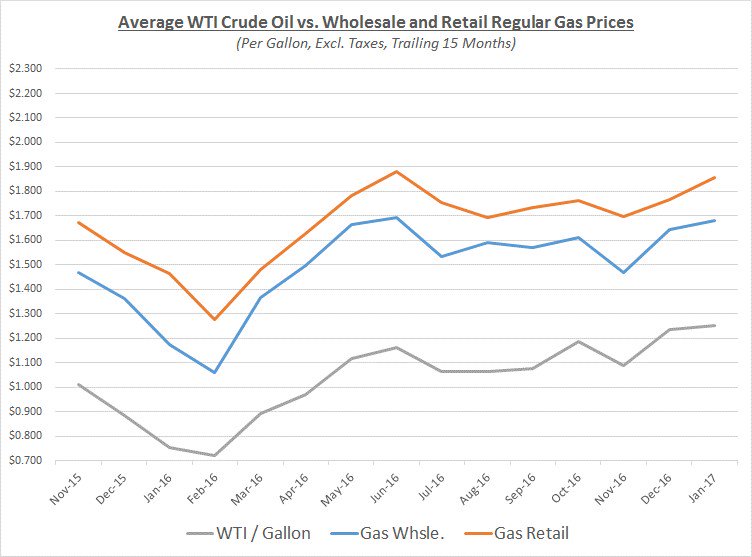

Despite the flattening trend of crude prices during January, wholesale fuel prices continued increasing modestly along with retail prices. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

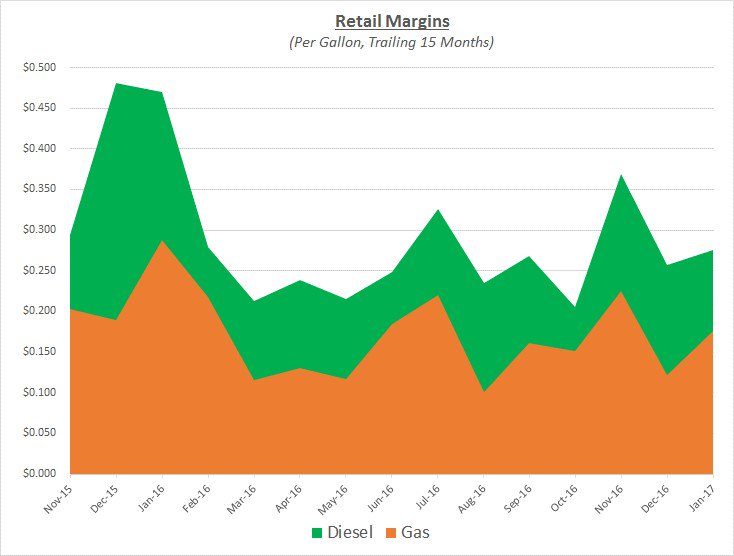

As diesel retail prices moved almost in sync with wholesale, retail margins increased slightly. Gas margins reflected a larger increase due to retail prices rising faster than wholesale. Retail margin trends for both products are shown in the following graph:

As a result of the market changes in January, most fleets would have seen modest increases in their prices regardless of whether they purchased fuel at retail or had deals based on wholesale prices.

Looking beyond January, Sokolis anticipates oil will continue to trade near the mid-$50s/barrel for the next several months assuming OPEC and other foreign oil producers continue to adhere to their production cuts. In addition, relative stability may be supported by other factors such as currency valuations and potentially increasing domestic production. However, we are in a period of rapid political policy changes so the potential exists for greater instability of prices if tensions should rise between the US and other nations.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.