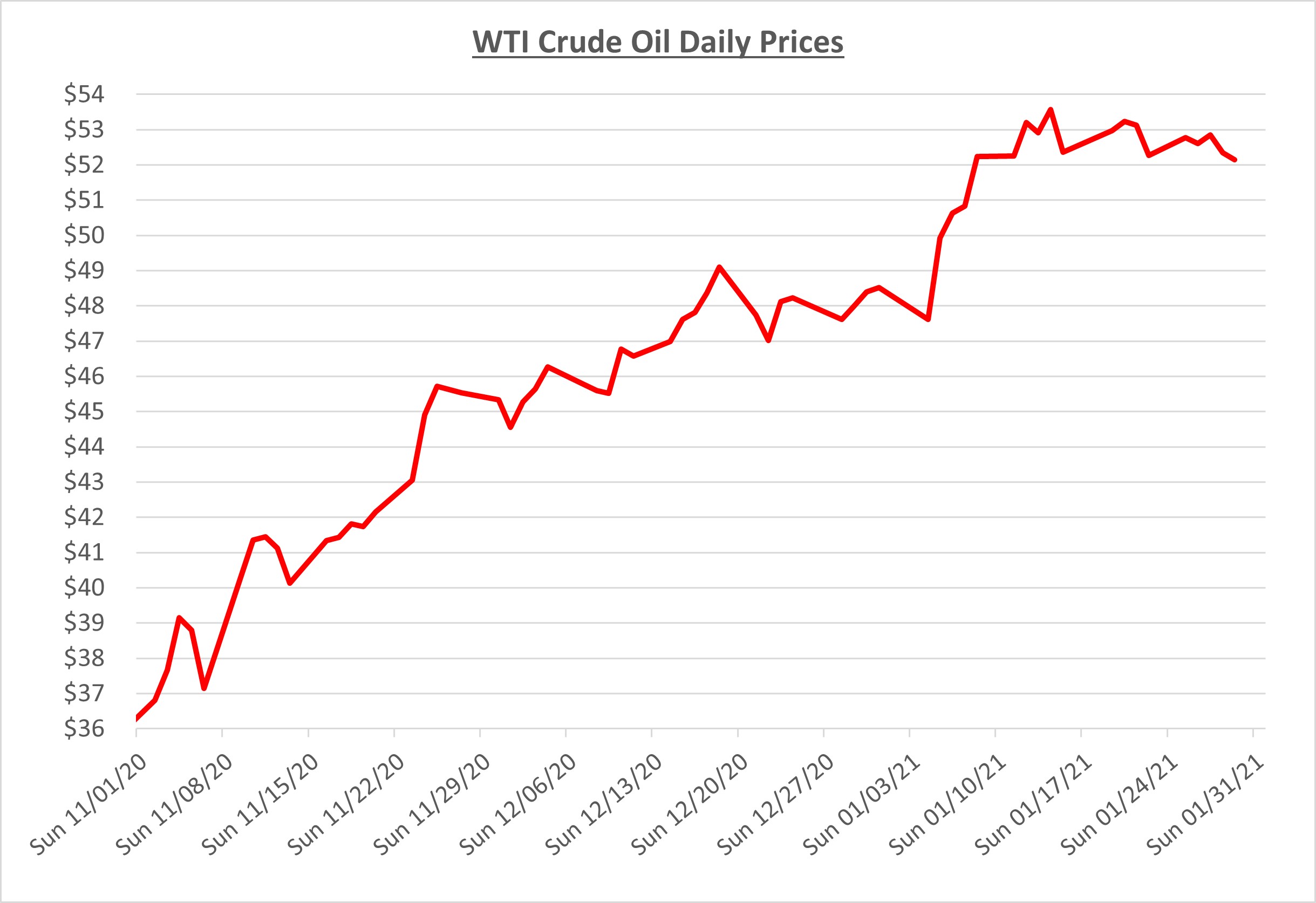

As the new year began, oil prices quickly leaped from the high-$40’s per barrel to just over $52. For the remainder of January, prices remained at that level as they traded within a narrow range. The following graph shows the daily price movements over the past three months:

The jump in oil prices at the start of January continued to be driven by optimism related to the distribution of several COVID vaccines. Oil and fuel prices have increased in anticipation of greater demand that will accompany a resurgence in economic activity after wide-spread inoculations have been completed.

A little more than a week into January, oil prices flattened as vaccine supply constraints significantly limited the pace of distribution. In addition, news of virus mutations raised concerns about the efficacy of the vaccines. The combination of the hobbled pace of the vaccinations along with the uncertainty caused by mutations dampened traders’ optimism.

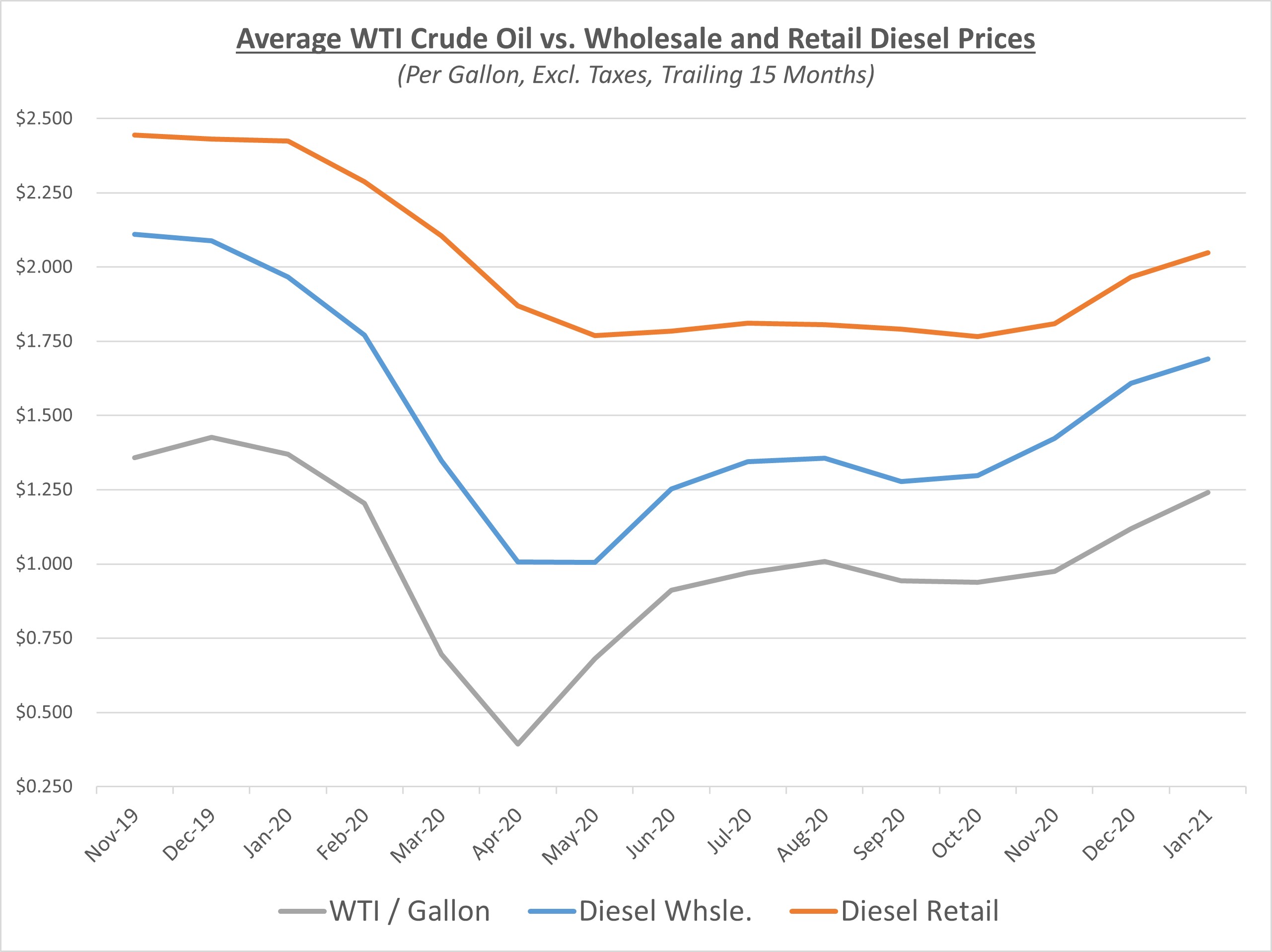

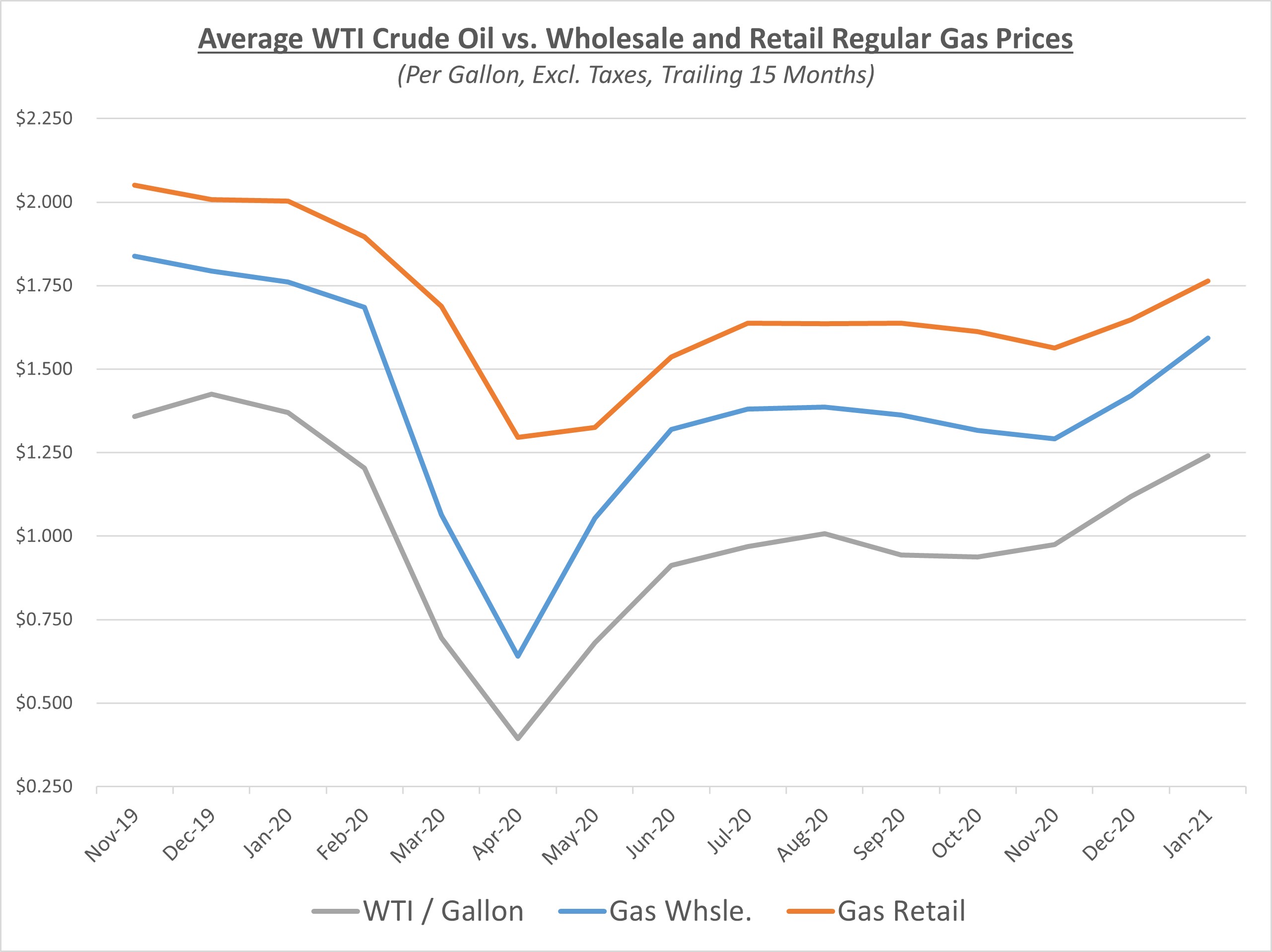

Due to the increase in oil prices during the early part of January, the overall average price for the month was higher compared to the prior month. Wholesale and retail prices for refined fuels also moved higher. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

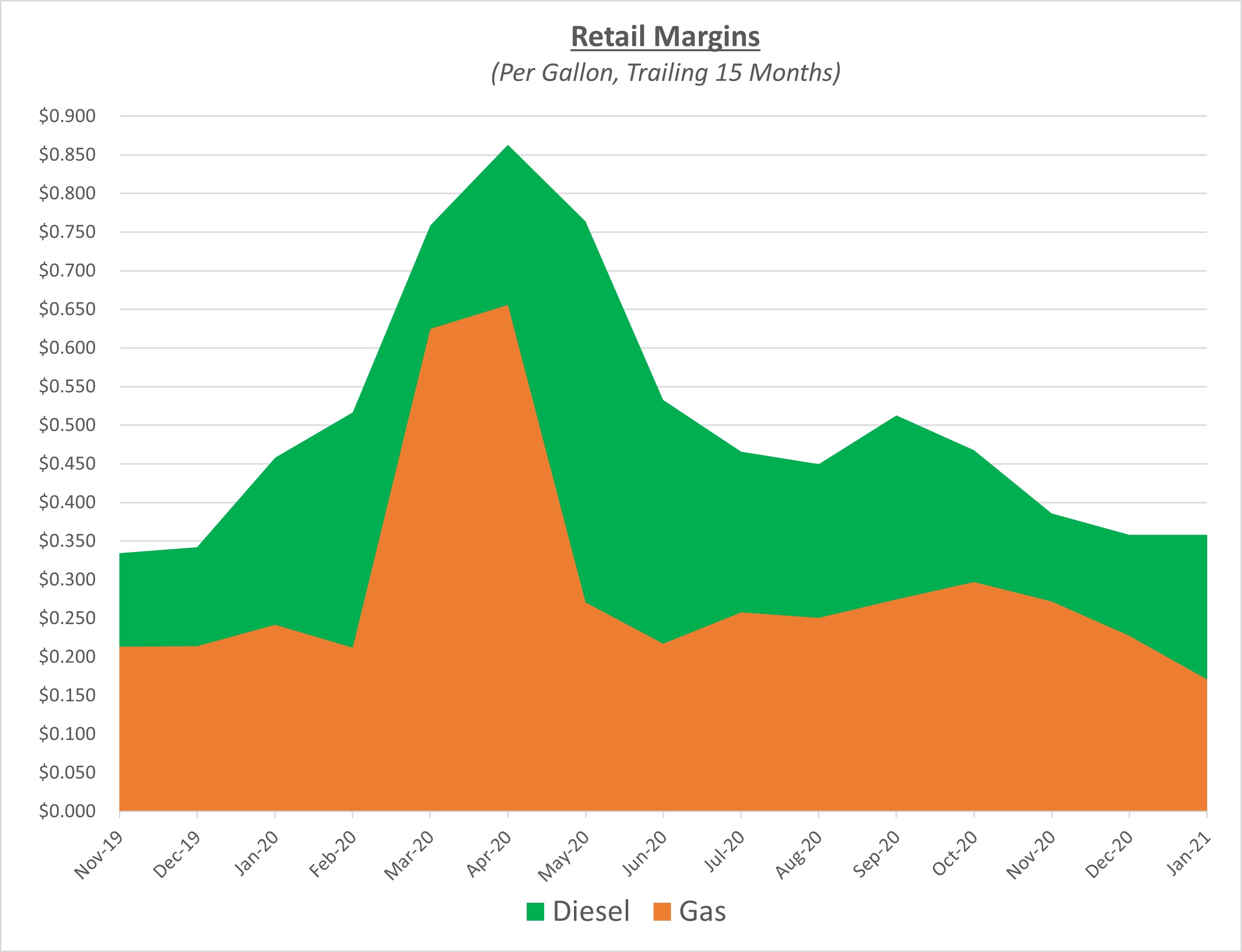

Wholesale and retail prices moved upward in sync for diesel so retail margins were unchanged. For gas, the increase in retail prices continued to lag wholesale causing retail margins to fall to their lowest levels in over a year. The following graph shows the retail margins over the trailing 15 months:

Sokolis anticipates oil prices will continue to trade in the low-$50’s/barrel as long as progress continues to be made with the rollout of the COVID vaccines. If mobility improves along with demand for fuel over the next few months, prices are likely to continue rising through the $50’s and could break through $60 later in the year.