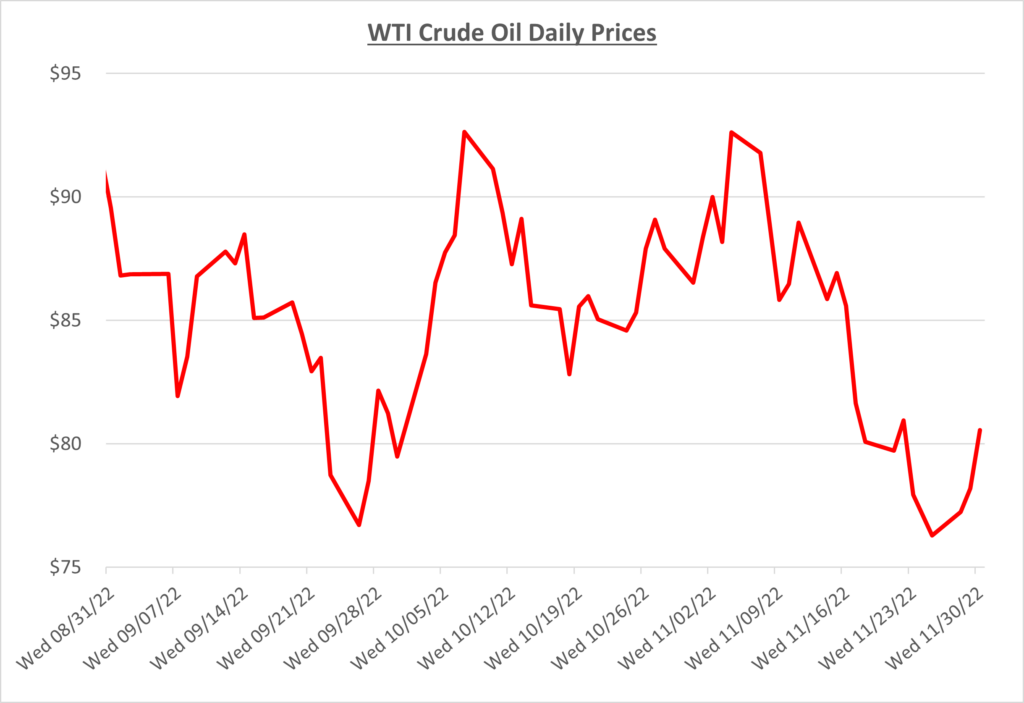

Oil prices climbed back to the $90/barrel range briefly in November before quickly falling back to just above $80/barrel by the end of the month. With tight supply and OPEC+ announcing a production cut last month, all signs pointed to prices rising. Just more proof that it’s virtually impossible to know exactly where fuel prices are going to end up! The following graph shows the daily price movements over the past three months:

Early in November, large crude draws along with positive news of COVID restrictions easing in China pushed oil prices back above $90/barrel. Supply was already tight, especially with diesel, and if China were to open back up, global demand would be expected to increase.

As November unfolded, news about COVID in China had a significant impact on prices. As COVID cases continued rising, lockdowns were extended as part of the Chinese government’s “zero COVID” policy. Rare public protests along with overall concerns about China’s economic direction and future demand for oil.

In addition, according to Wall Street Journal, OPEC+ was considering an increase in output which led prices down in anticipation of additional supply. Saudi Arabia later denied this claim, but it already had its effect on the market. Ultimately, a decision by OPEC+ on supply changes could not be confirmed leaving uncertainty in the market.

These two factors caused oil prices to plummet into the high-$70’s/barrel over the course of November. However, near the end of the month, reports showed oil inventories had declined significantly giving a late boost to prices with the month ending just over $80/barrel.

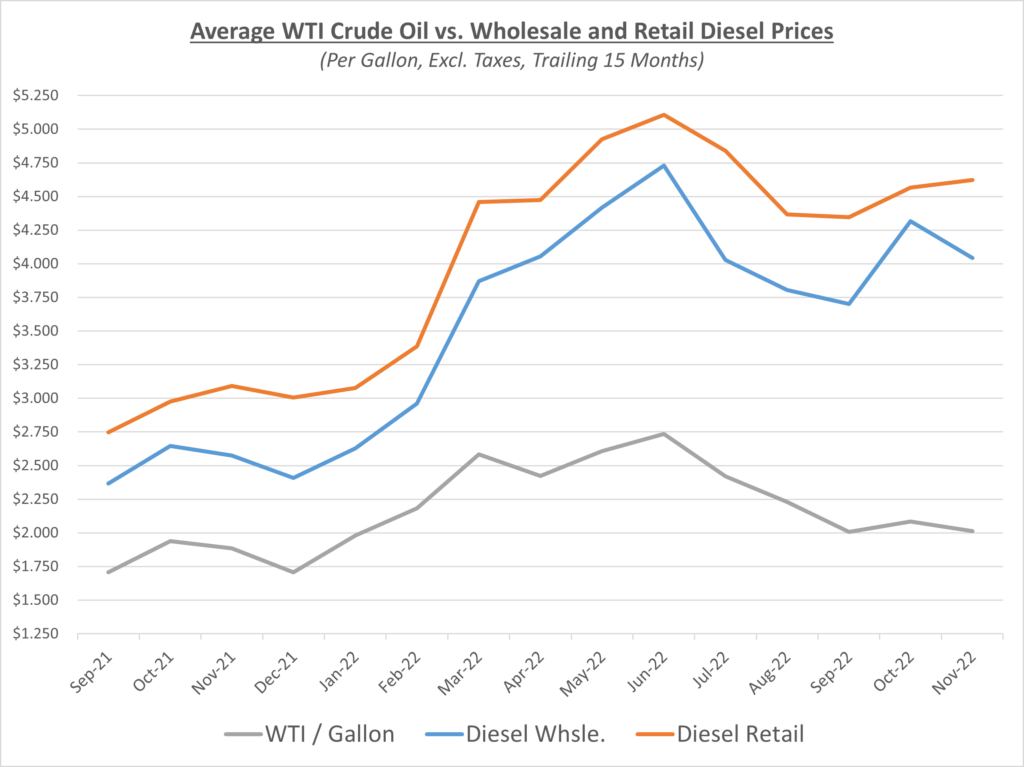

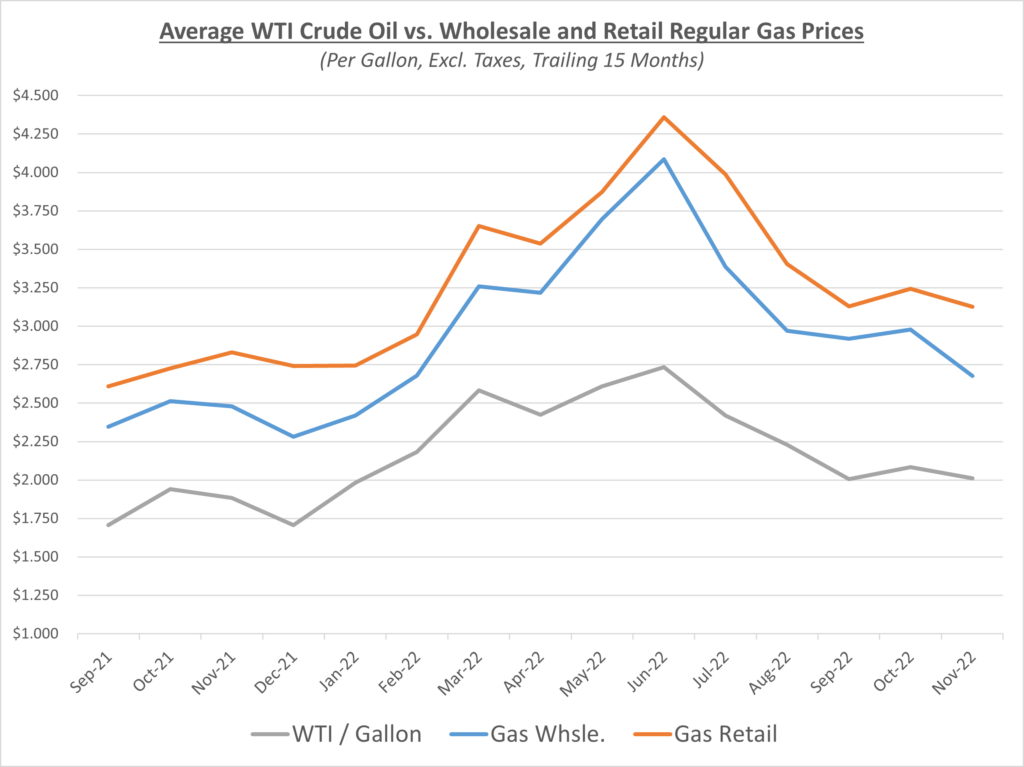

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

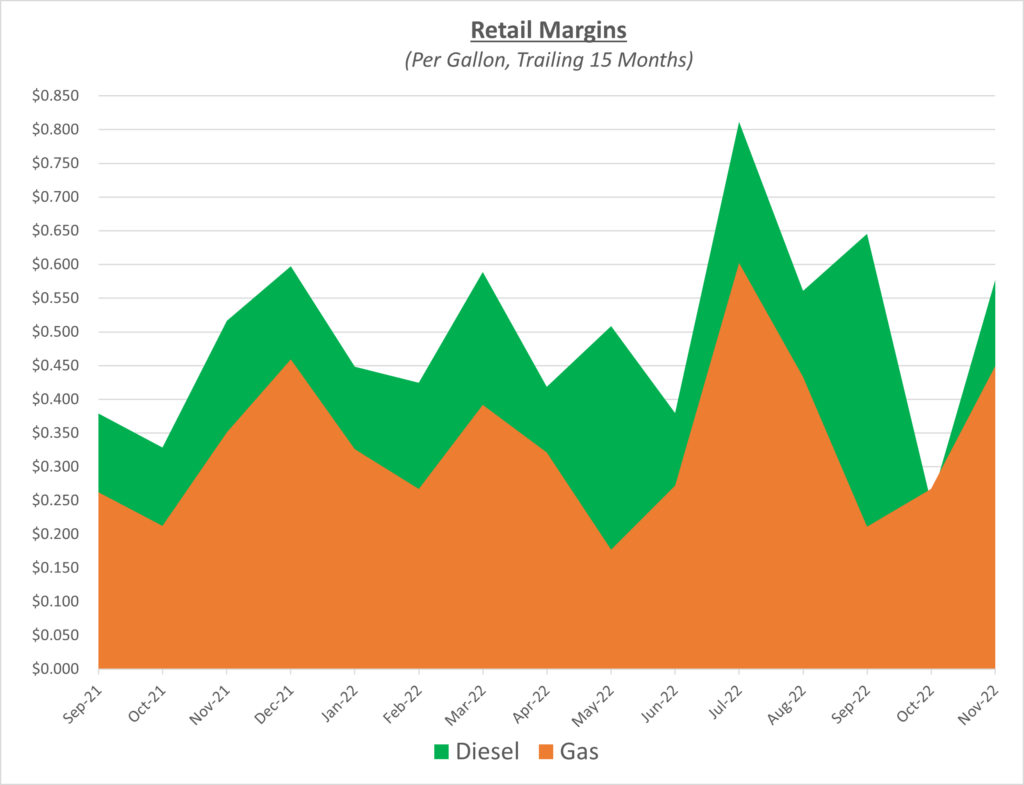

Diesel wholesale prices fell in November while retail prices remained relatively flat. This resulted in a large increase in retail margins, especially compared to low margins seen in October. Retail gas and wholesale prices both declined in November, but wholesale outpaced retail which caused a substantial increase in profit margins for gas retail suppliers. The following graph shows the retail margins over the trailing 15 months:

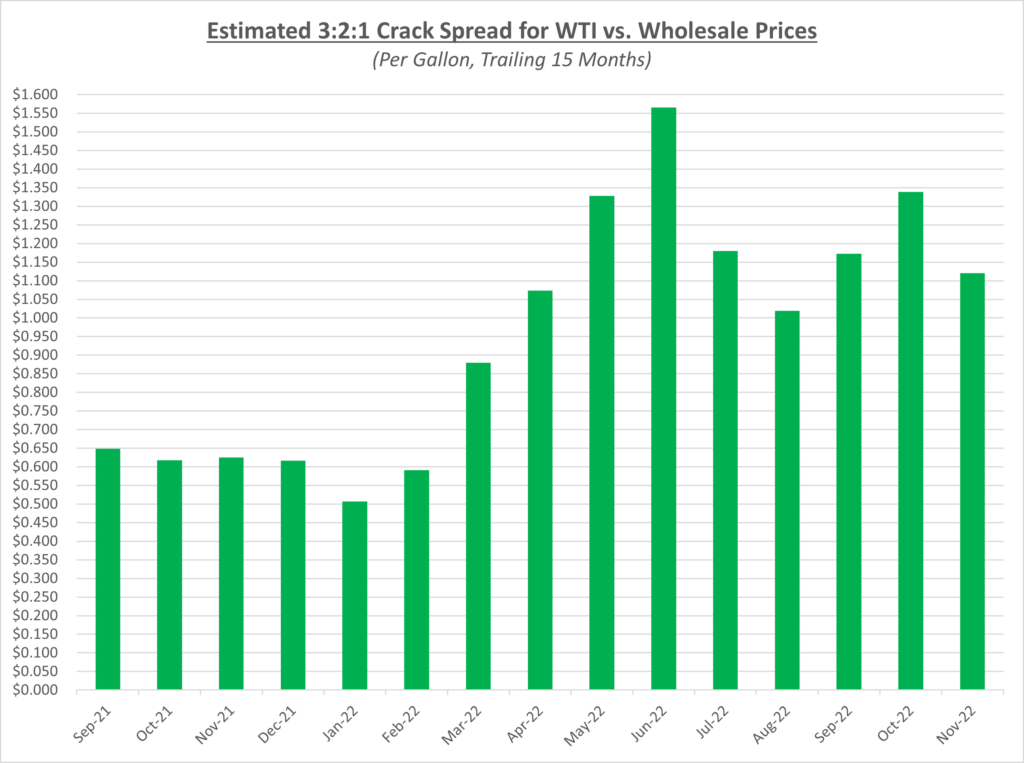

Crack spreads declined in November but remain elevated as show in the graph below. This has been the case for much of 2022.

With oil finishing November at just over $80/barrel, it represented a 7% decline compared to where it ended in October. According to AAA, the national average gas price declined to $3.495/gallon, a drop of approximately $0.27/gallon. Diesel prices finally caught a break declining by about $0.14/gallon to a national average of $5.17/gallon.

As mentioned above, one of the factors pushing oil prices downward during November was a report indicating OPEC+ might increase production. We will find out more when they have their meeting in early December. With what we know presently, Sokolis believes that oil prices will remain in the $80-90/barrel range. We will do our best to keep you updated with the latest news.