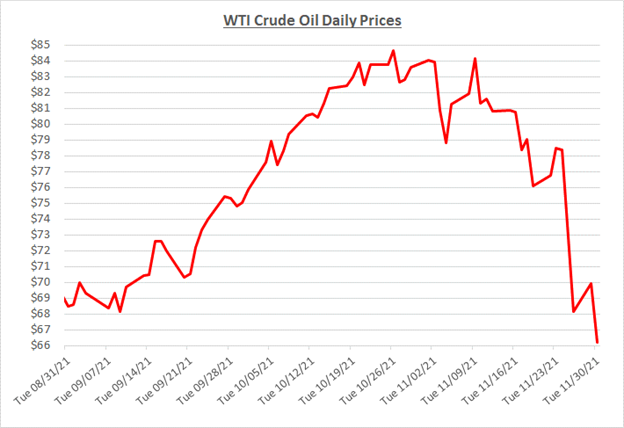

November oil prices started the month at $84/barrel. Certain analysts such as Bank of America were once again predicting prices well over $100 by mid-2022. Inventory levels were tight, and demand was still strong. OPEC+ has maintained their plan to increase production and winter is just around the corner. All signs pointed to higher fuel prices until a new variant of COVID popped up in South Africa. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices started to retreat from their high of $84/barrel. Concerns about high inflation and OPEC+ warning that US shale could come back online and flood the market, caused oil to fall below $80/barrel. What caused an even sharper decline in prices was the announcement that Europe would be increasing restrictions again due to COVID cases rising. On November 19th oil closed at $76/barrel, a 10% decline from where it started the month. Any negative news connected to COVID will always send the market spiraling downward with the fear that there is potential for lockdowns and big hits to demand.

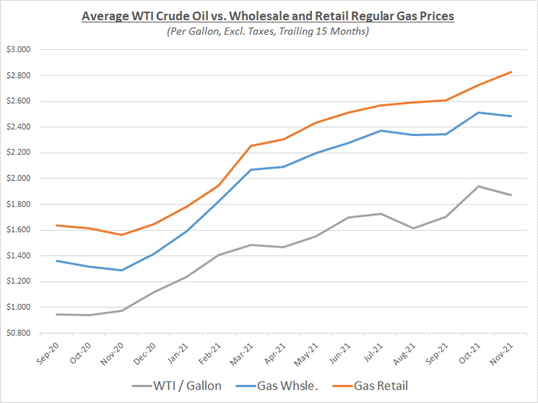

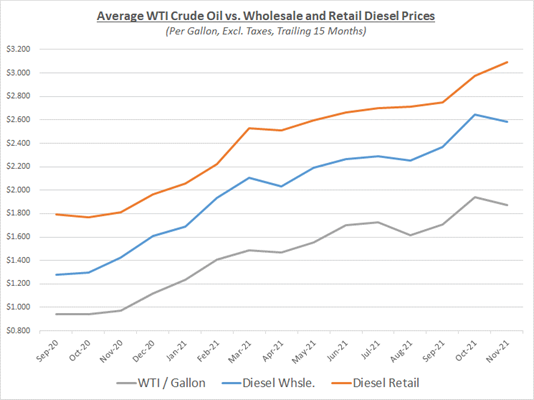

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

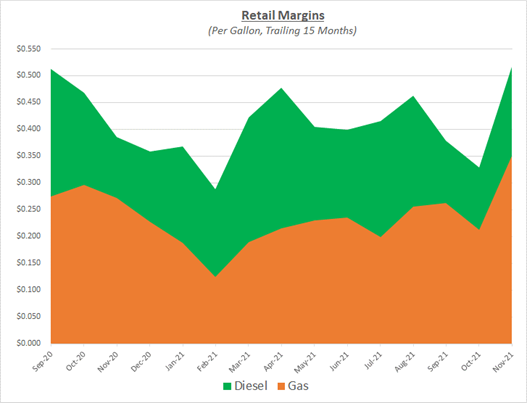

In November, diesel retail margins saw a massive increase. Wholesale prices fell due to COVID cases, but retail didn’t blink as it continued its upward trend. Gas margins had a very similar pattern as wholesale prices also fell while retail continued to rise. The following graph shows the retail margins over the trailing 15 months:

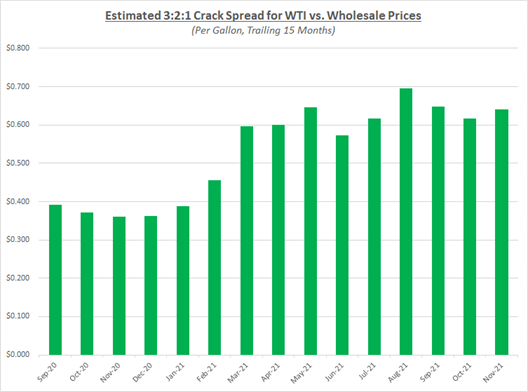

Crack spreads continued their trend at above $0.60. As shown in the graph below, crack spreads remain elevated since March. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel. With the current fears surrounding demand with the new variant, we’ll continue to monitor the spreads to see if they begin to fall to lower levels.

Oil finished November at just above $66/barrel, a decrease of over 20% from where it started the month! Moderna’s CEO said that vaccines are likely to be less effective against the new Omicron strain of COVID, causing an uproar in the market that demand will decline due to potential lockdowns. OPEC+ meets early in December to discuss keeping their plan of a 400k barrels/day increase in production. Besides the potential loss in demand, they’ll be weighing the decision on November 23rd by the US and other countries to release 50 million barrels from the Strategic Petroleum Reserve to try and curtail high fuel prices.

As often the case with fuel price speculation, there are a lot of factors to consider when attempting to predict where prices will go. There have been drastic changes, and there will undoubtedly be more in the coming weeks and months. Depending on how serious this new Omicron COVID strain is, fuel prices could go either way. The current belief is that lockdowns would be a last resort only used if the virus gets out of control. Sokolis believes that oil will range in the high $60s to low $70s for the remainder of the year. There is a possibility of breaking through the $80 mark if we continue to get positive news about the Omicron strain, as well as a sharp decline if negative news surfaces.