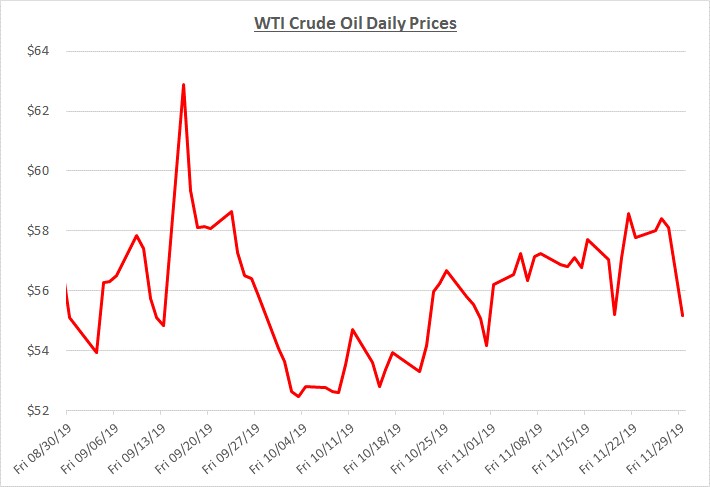

Oil prices slowly climbed higher throughout November but gave back most of their gains at the end of the month. Prices opened the month near $54 and closed just over $55 per barrel. The following graph shows the daily price movements over the past three months:

There were no significant developments in November that drove prices gradually higher. The main reason was attributable to cautious optimism that the US and China would reach a Phase 1 agreement toward resolving their trade war. However, prices sank at the very end of the month as President Trump signed a bill supporting pro-democracy demonstrators in Hong Kong in defiance to China’s threats of retaliation. Oil traders worried that any resolution to the continuing trade war would become less likely than previously anticipated. As a result, the outlook turned pessimistic for future economic growth and demand for oil.

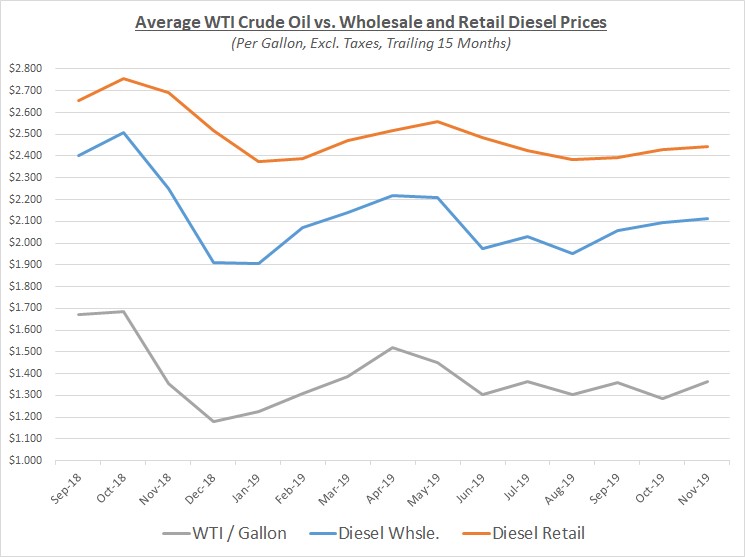

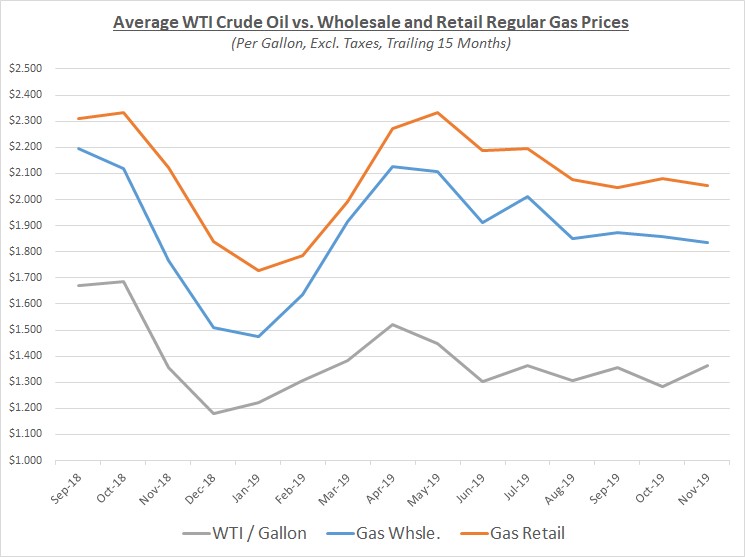

Despite the decline in prices at the very end of the month, November’s overall average price for oil increased slightly compared to October. Average wholesale and retail prices for diesel also increased slightly as demand remained strong. Meanwhile, gas wholesale and retail prices declined slightly as demand slowed. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

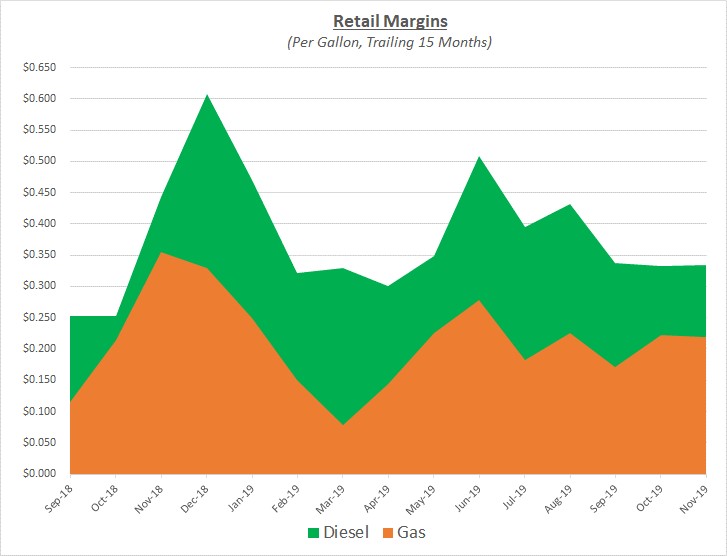

Since retail and wholesale prices for diesel and gas moved in sync, margins were relatively unchanged. For both fuels, retail margins continue to run at their typical levels. The following graph shows the margins for over the trailing 15 months:

As we wind down 2019 and look forward the start of 2020, Sokolis anticipates oil prices will continue to trade in the mid-$50’s with the potential to move toward $60 or more per barrel. The biggest drag on any price increases continues to be the US-China trade war. Mid-December will bring a significant indication of any progress as additional tariffs are scheduled to go into effect but could be called off. Oil prices will be very sensitive to this decision.

In addition, OPEC and Russia will meet in December to discuss the possibility of making deeper production cuts to support higher prices. It is likely they will not take any further action until 2020 is underway but a surprise move to lower production would likely cause prices to increase. Another factor that has not fully impacted prices yet is the IMO 2020 maritime fuel transition which takes effect on January 1st. Demand for oil and diesel fuel is expected to increase from IMO 2020 while demand for heating oil (essentially diesel fuel) will be increasing during the colder months.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.