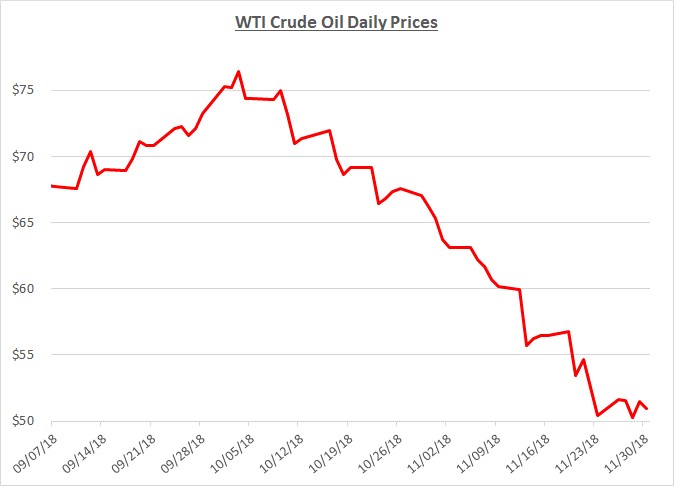

The collapse of crude oil prices continued throughout November as they fell 20% compared to the beginning of the month. November’s closing price of just under $51/barrel is 33% lower than the recent peak of $76/barrel at the beginning of October. The following graph shows the daily price movements over the past three months:

The increase in prices leading to their peak in early October was primarily driven by concerns about tightening supplies due to the scheduled implementation of economic sanctions on Iran near the start of November. Despite the anticipated sanctions, prices turned downward in early October as oil inventories started increasing. In addition, trade disputes and rising interest rates led to pessimism about future global economic activity which caused a significant decline in financial markets. The potential for an economic slowdown and weakening demand for oil depressed prices further.

As November got underway with Iranian sanctions looming, the United States announced it would grant exemptions to eight countries allowing them to continue purchasing Iranian oil for a limited period without being penalized. The primary reason for granting these exemptions was to prevent the price of oil from rising again. This move significantly lowered concerns about supplies tightening and oil prices continued dropping through the end of the month.

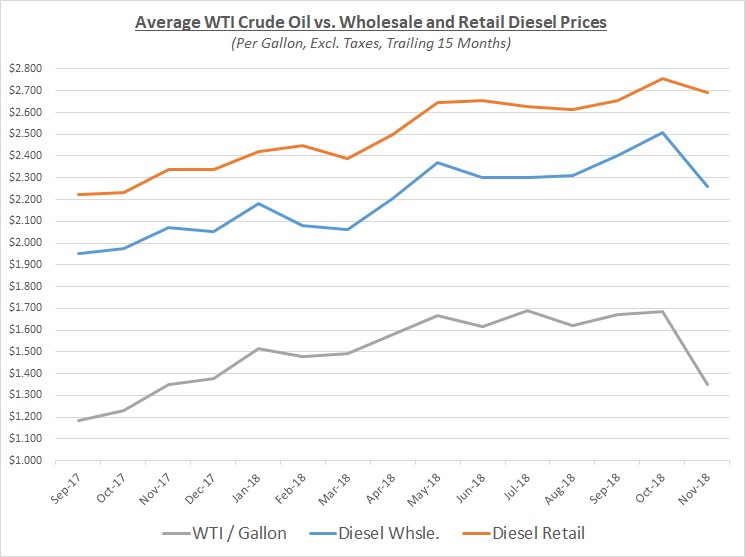

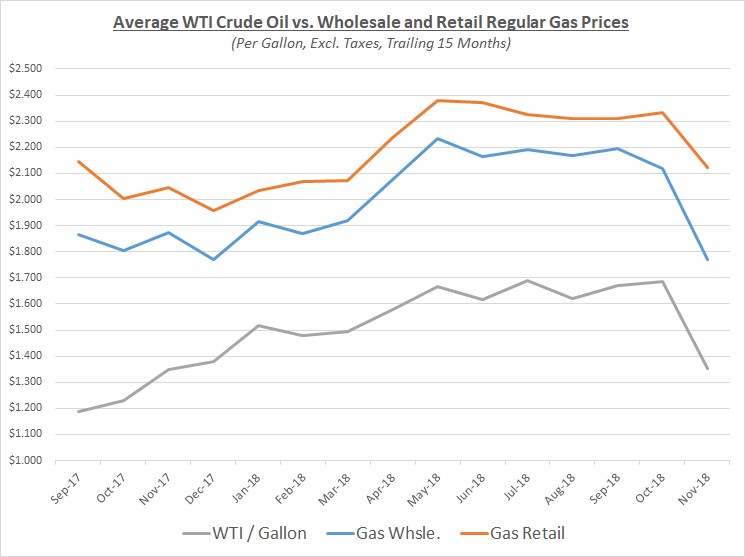

Wholesale prices for diesel and gas followed oil’s decline during November. However, retail prices for diesel only fell modestly compared to retail prices for gas. Diesel demand has continued to be very strong and will likely continue through the winter heating season while demand for gas has been softening. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

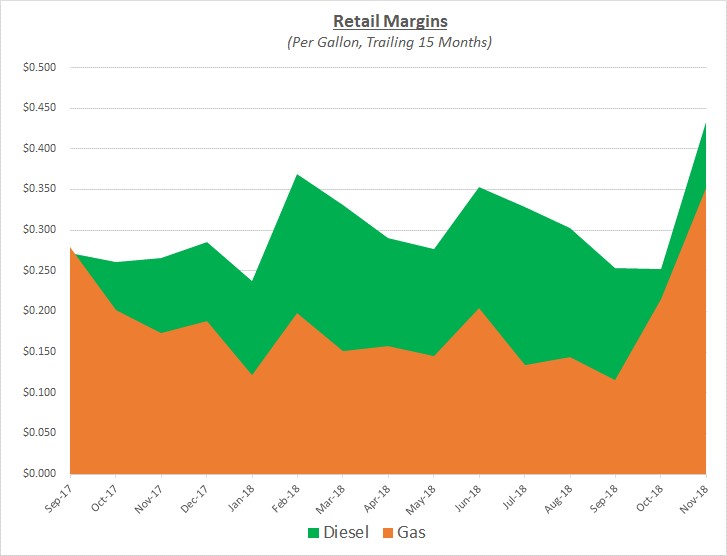

As wholesale prices decreased significantly, and at a faster rate than retail (which is not unusual during these market conditions), retail margins spiked higher. In fact, diesel margins reached their highest level since the beginning of 2016. Gas margins also rose to levels not seen in many years. The following graph shows retail margins for diesel and gas over the trailing 15 months:

At the start of December, the United States and China announced a truce in their trade war so markets may become more optimistic about a resolution in the future. In addition, an OPEC meeting is scheduled for early December and it is widely anticipated they will decide to cut production levels in an effort to balance the market and provide support for oil prices. Russia has also indicated they will support production cuts while Canada has recently taken steps to limit their production too. For all of these reasons, Sokolis anticipates crude oil prices will begin to rebound toward $60/barrel and beyond as the end of the year approaches and we look toward 2019.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.