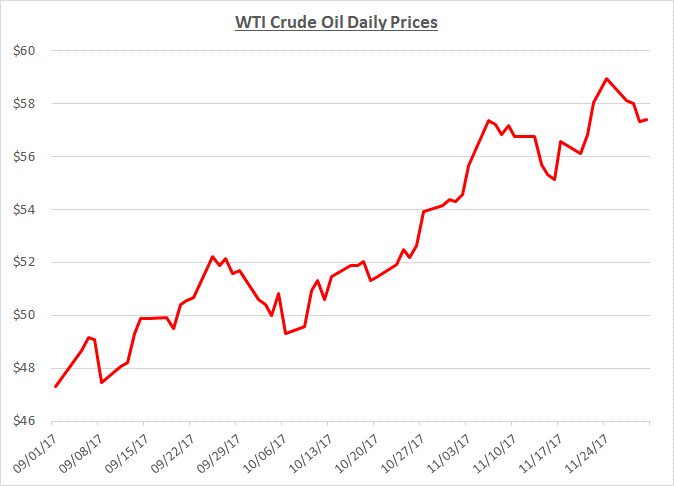

Crude oil prices gained another 6% during November and closed the month at just over $57/barrel. Prices briefly topped $59 near the end of the month and then receded slightly. Prices have now increased 21% from the start of September. The following graph shows the daily price movements over the past three months:

The continued increase in crude oil prices throughout the month was primarily due to anticipation that OPEC and other non-OPEC countries would agree to extend their production cuts through the end of 2018. The agreement was formally approved at OPEC’s meeting on November 30.

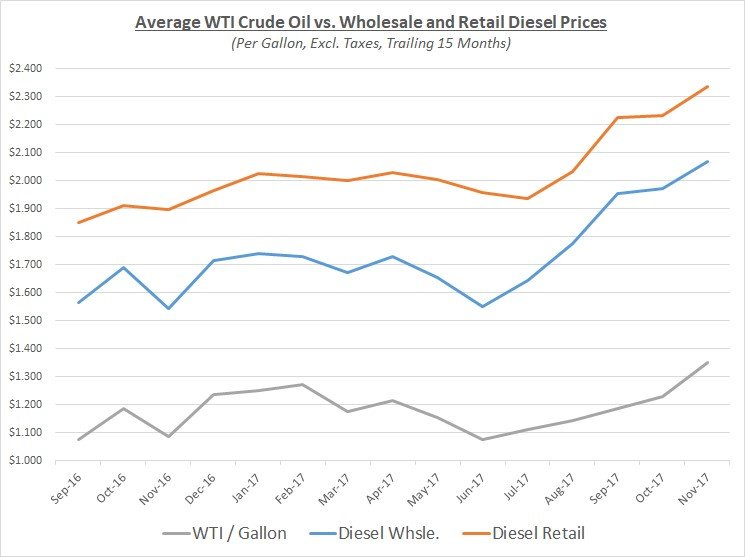

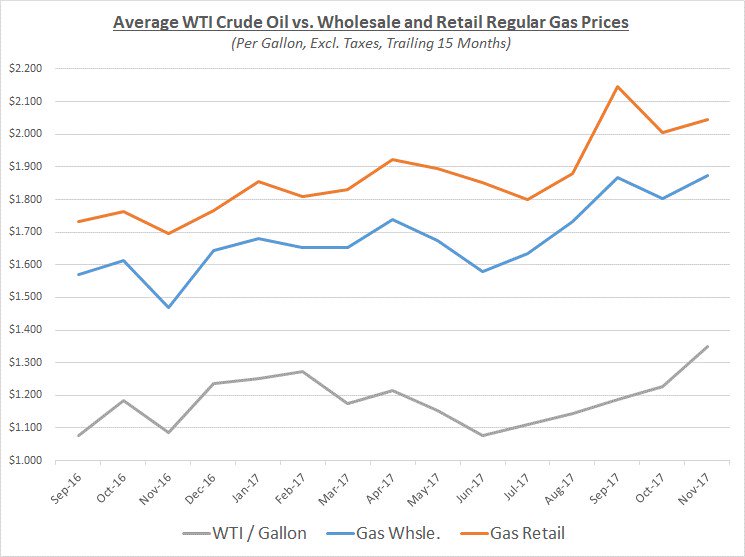

As oil prices increased during November, diesel prices also increased at a similar pace while gas only rose modestly. Demand for diesel has remained very strong throughout the past few months which has supported higher prices. Meanwhile, the demand for gas has declined following the summer driving season. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

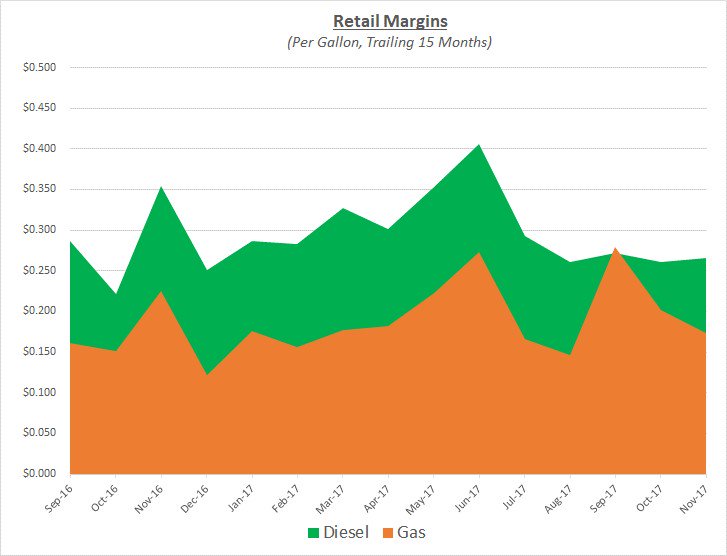

As prices have been increasing, retail margins have remained slightly lower than usual for diesel over the past few months. Gas margins are returning to their typical levels following a spike in September triggered by shortages due to the hurricanes. The following graph shows retail margins for diesel and gas over the trailing 15 months:

Wholesale and retail prices have remained at their highest levels since the summer of 2015, and looking beyond November, Sokolis anticipates crude oil prices will continue to hover in the high $50’s/barrel for the remainder of the year. There is still potential for prices to climb to $60 and beyond if compliance with the OPEC deal remains strong followed by a trend of declining inventory levels. However, based on the recent price increase, US domestic oil production will be incentivized to expand further which could limit additional significant increases in prices.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.