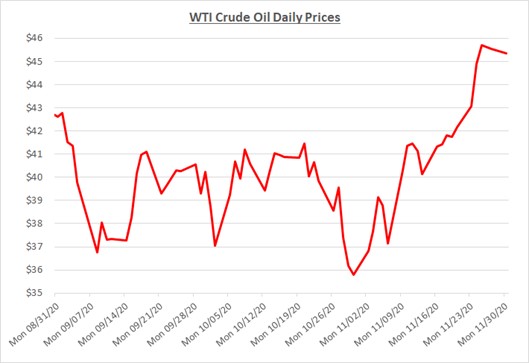

Oil prices increased sharply in November, rising over 25%. The month began with prices just under $36/barrel and ended slightly over $45. The following graph shows the daily price movements over the past three months:

The rise in oil prices started early in November after published test results for two COVID vaccine trials reflected very high efficacy. Despite a global surge in virus cases throughout November, gains in oil prices and financial markets were driven by optimism that these vaccines could be approved and distributed soon.

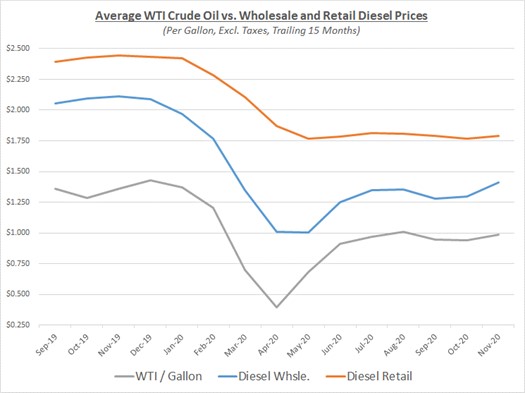

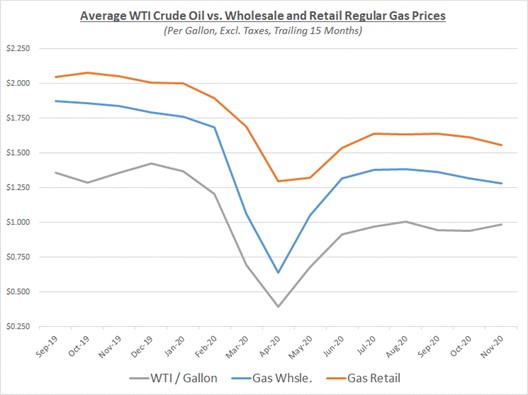

Due to the growth in oil prices throughout November, the overall average price for the month was modestly higher compared to the prior month. Despite the increase in oil prices, retail prices for refined fuels were slow to react as diesel prices remained flat while gas declined slightly. Wholesale prices for diesel did show an increase in response to the rise in oil coupled with strengthening demand. However, wholesale prices for gas declined further as demand continued to be soft along with a seasonal decline. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

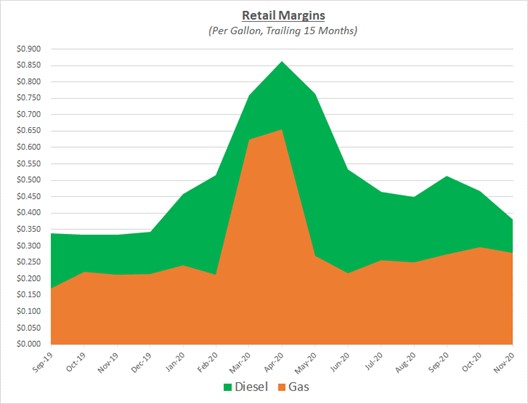

As a result of retail prices lagging wholesale for diesel, retail margins declined significantly and returned to a more typical level not seen since the end of last year. Retail margins for gas only showed a slight decline as retail and wholesale prices moved in sync. The following graph shows the retail margins over the trailing 15 months:

Looking toward the start of next year, Sokolis anticipates oil prices will continue to move upward through the $40’s. Prices could even rise above $50/barrel barring any major setbacks with rolling out the COVID vaccines. The recent increase in prices reflects how markets anticipate global economic activity and demand for oil will improve next year. Further increases may not come until several months into next year assuming a clear trend emerges showing the virus subsiding as inoculations roll out.

Meanwhile, OPEC+ has been adjusting their production levels throughout this past year in response to the weakened global oil demand. A previously agreed upon production increase was originally scheduled for January 2021 but will likely be postponed for several months since COVID restrictions continue to negatively impact demand. If OPEC+ decides to increase production around the 2nd quarter of next year assuming demand grows, it could moderate the potential for significant prices increases. Nevertheless, as a far-sighted prediction, the potential for oil to reach $60/barrel by the end of next year, roughly a 30% increase from current levels, seems plausible.