After hitting a low point in early June, oil continued to gain momentum through the beginning of July. Oil prices had their sights on the mid-$80s/barrel, but as we have seen recently, weakness in demand and oversupply has kept a lid on prices from heading even higher. The following graph shows the daily price movements over the past three months:

The U.S. saw their first hurricane of the season, with Beryl crashing into Texas as a Category 1. The brunt of hurricane Beryl was felt in the Caribbean but was still disruptive closing ports along the Gulf Coast for a few days. Typically, this would cause supply disruptions and oil prices to head higher, but overall demand is still weak. China released disappointing data on their economy, and the holiday weekend didn’t prove to be as busy compared to last year.

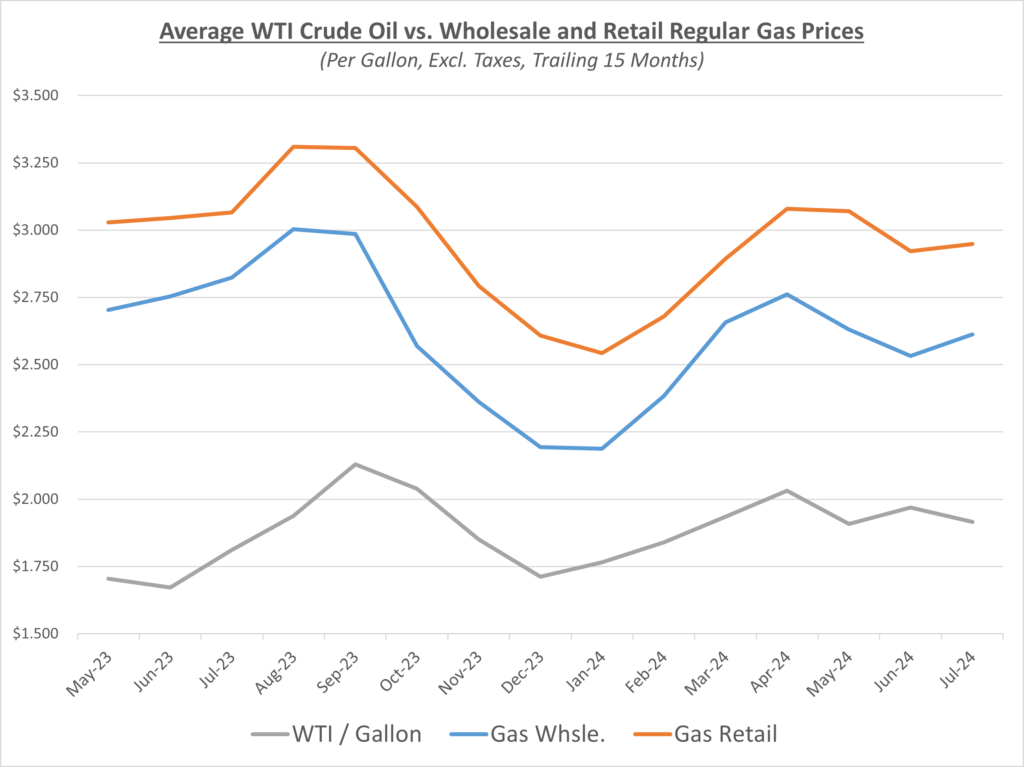

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

Diesel wholesale and retail prices both increased in July, with retail marginally outpacing wholesale and resulting in slightly increased profit margins for suppliers. Gas wholesale prices increased, but retail prices were flat and caused profit margins to decline. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average for gas prices finished at about $3.49/gallon in July, which is exactly where it was last month. Diesel prices also finished right around the same mark, ending July near $3.82/gallon. Oil prices did spike the last day of July with news reporting the death of the Hamas political leader. These escalations after hopes of a ceasefire are causing concerns for a full-blown war. These tensions have caused fears of supply to tighten and cause diesel prices to rise.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $75-85/barrel in the near term.