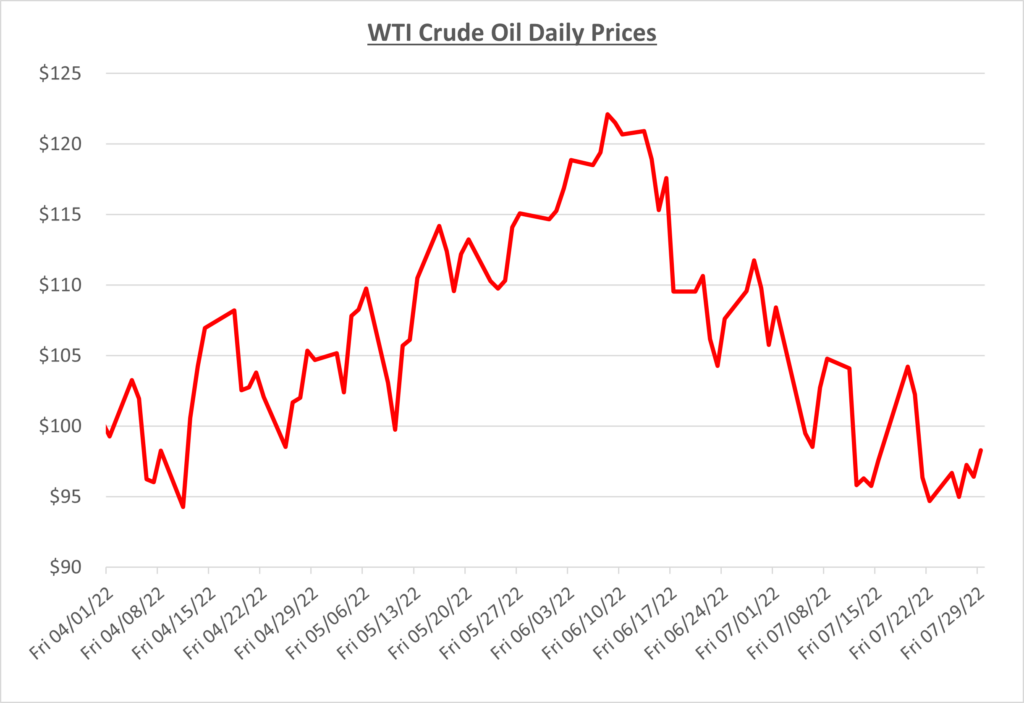

Oil and fuel prices continued their decline from June into July. Oil dropped below $100/barrel for the first time since May, which was brief when that occurred. This month, oil prices have spent more time below $100 than above, which has resulted in fuel prices cooling from their record highs at the pump. The following graph shows the daily price movements over the past three months:

Oil prices attempted to rally above $100/barrel on a few occasions in July, but they were short-lived. U.S. refineries continue to operate at a rate of almost 95% and the EIA reported several weeks of inventory builds. The slight increase in supply levels caused oil to drop by 7% on July 12th to under $96/barrel. Fears of demand dropping and a recession possibly looming (if not already here) are also causing fuel prices to drastically fall. This all happening with the news that inflation is up 9.1%, the highest seen in four decades. Overall supply remains tighter compared to prior years but may be getting some breathing room with demand shrinking.

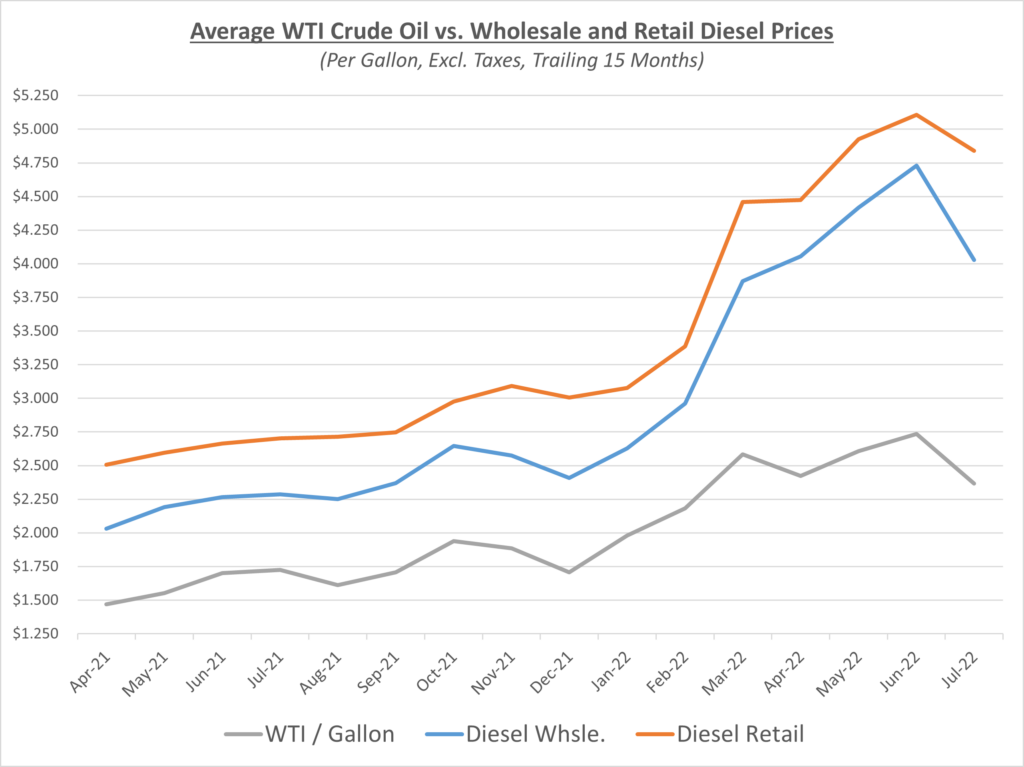

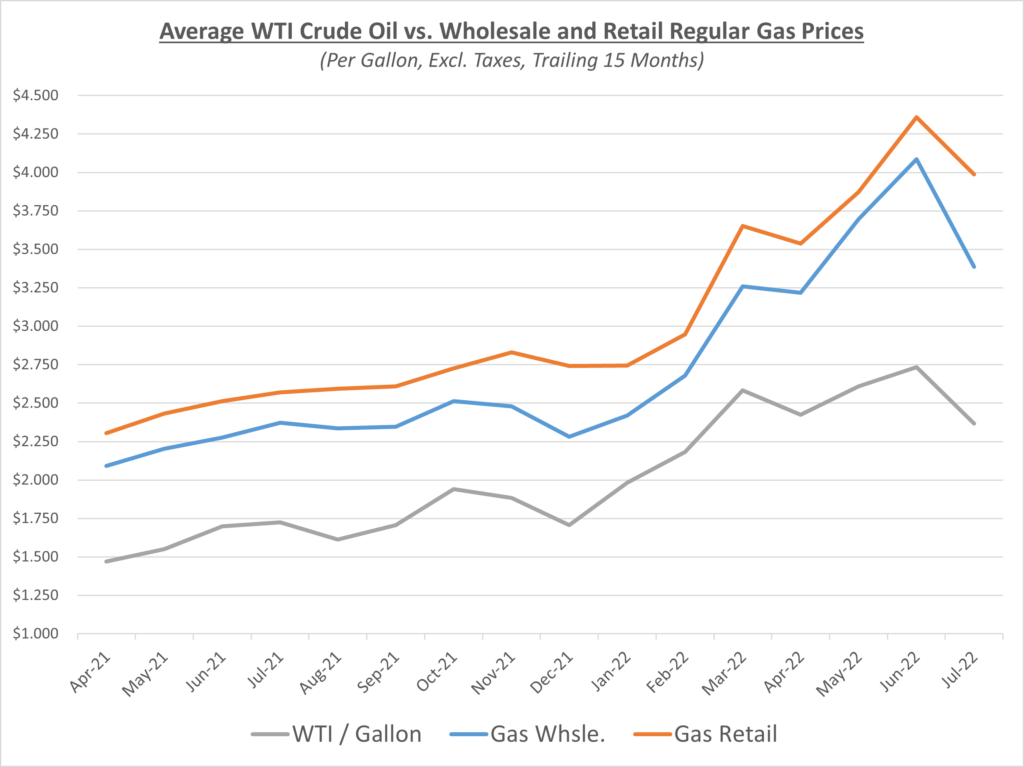

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

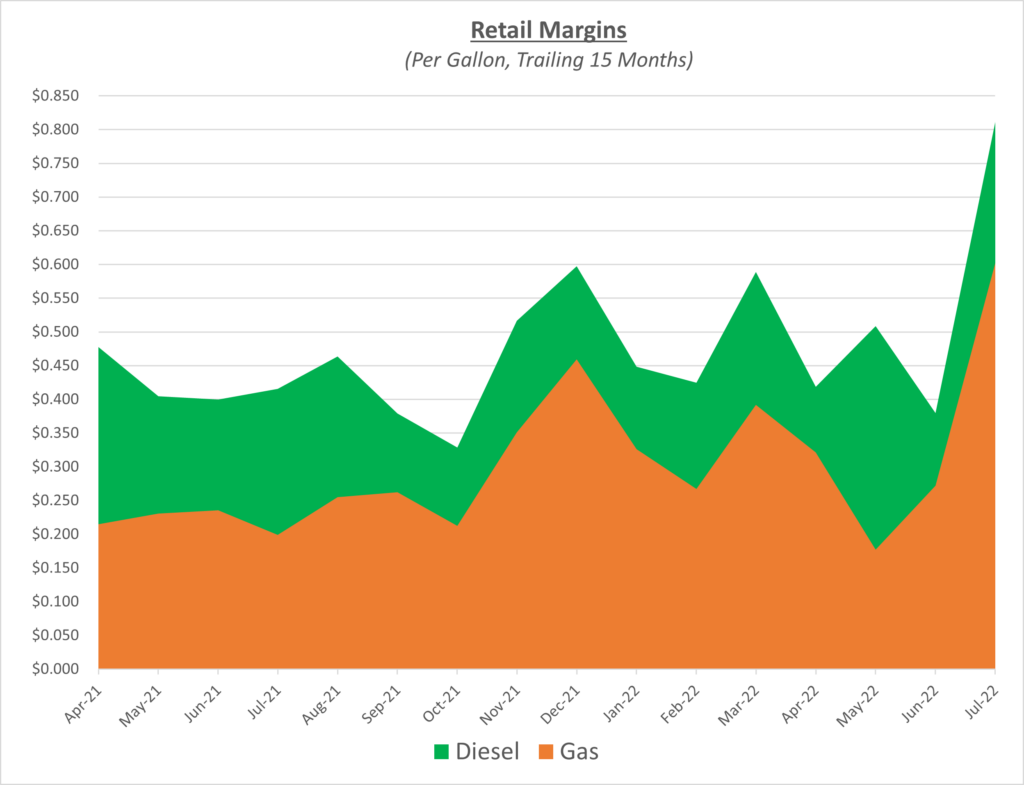

As mentioned above, both diesel and gas wholesale prices saw large declines during July. Retail prices for both products declined as well at fuel stations, but not as steep as wholesale prices, creating some very large profit margins. Diesel saw margins over $0.80/gallon and gasoline over $0.60/gallon, the highest we’ve seen in quite some time. The following graph shows the retail margins over the trailing 15 months:

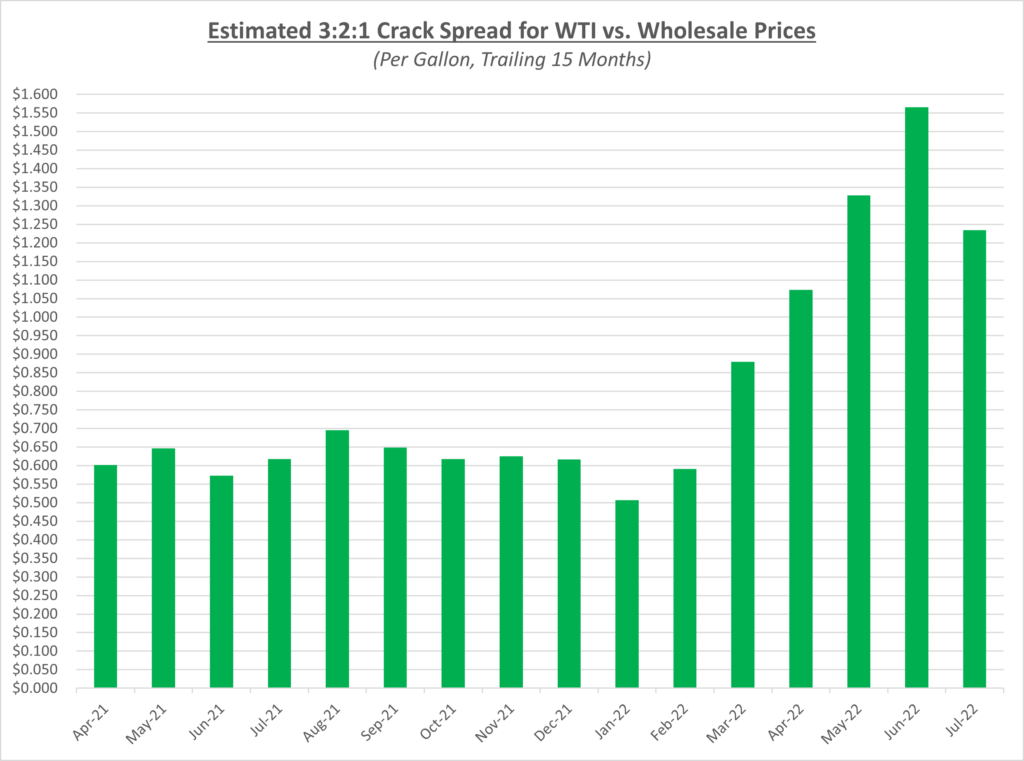

Crack spreads saw the first decrease this year during July. Spreads still remain high at over $1.23/gallon as shown in the graph below. However, if fuel prices continue to fall, so will refiner’s profits. They could look to produce more profitable fuels to protect themselves against losses of the glory days of extremely high profits from gas and diesel.

Fuel prices have continued to cool off during the heat of summer. Oil finished July at roughly $98/barrel, which was about 8% lower from where it started the month. The EIA reported crude stocks down 4.5M barrels, but it wasn’t enough to send oil prices back over the $100 mark. The national average gas price fell from $4.85/gallon last month to $4.22/gallon and diesel fell from $5.76/gallon to $5.29/gallon, according to AAA.

The U.S. announced they will stick to the original schedule of stopping the release of crude oil from the Strategic Petroleum Reservice in the fall. This was already factored into most analysts pricing predictions, so it shouldn’t have much impact on future prices.

Sokolis believes that oil prices will remain near $100/barrel for now, but as mentioned before, hurricane season is here. Any disruption to refineries could cause fuel prices to spike due to already tight fuel supply. Right now, the weight of a recession and falling demand are causing prices to fall.