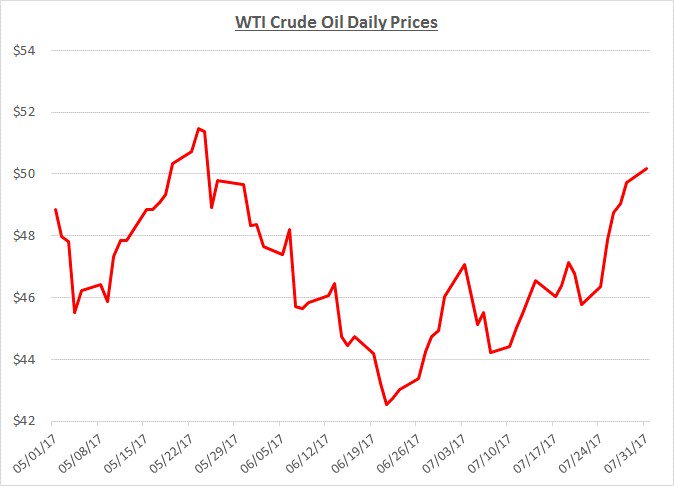

July’s oil prices closed the month at just over $50/barrel which was almost 10% higher than where they started the month. Prices sagged during the first week of July but turned upward by the second week and continued climbing for the remainder of the month. The following graph shows the daily price movements over the past three months:

The start of July followed a brief price rally near the end of June. That rally ended as headlines focused on additional growth in the number of US oil rigs along with persistently high crude and refined product inventory levels. These bearish factors indicated that rebalancing supply and demand would remain out of reach for an extended period.

After the 4th of July holiday, weekly reports began to reflect a trend of declining inventory levels and a slowdown in the growth of US rigs. In addition, as the month progressed, several OPEC countries announced new steps they were taking to reduce exports in an effort to tighten supply. Prices climbed throughout most of the month in response to this information about shrinking inventories and potential supply-side reductions.

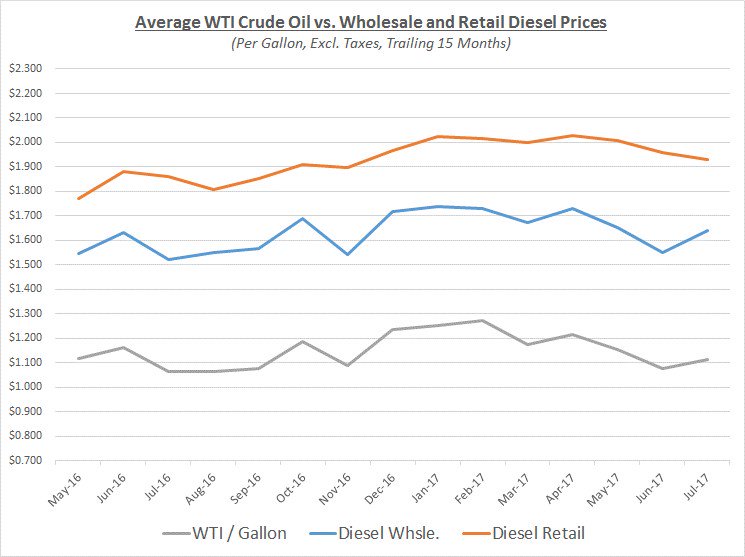

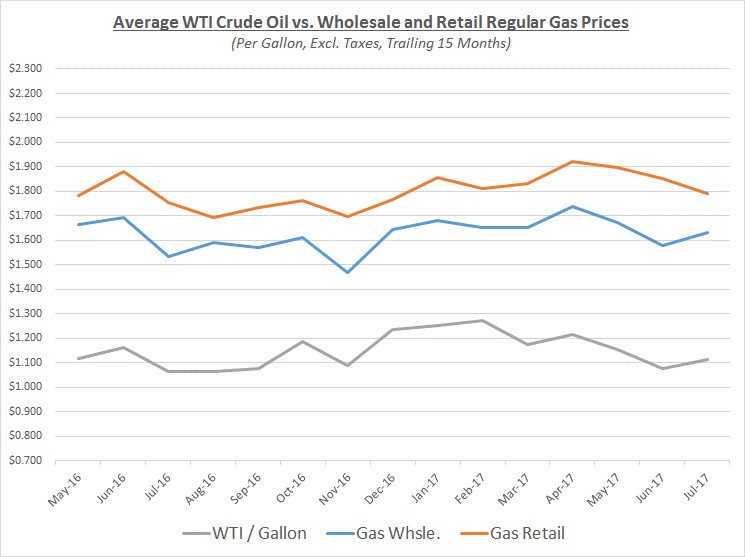

As crude prices increased during July, wholesale fuel prices showed similar gains. However, retail prices were relatively slow to react, but they were already relatively high following the period in June where wholesale prices had declined significantly. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

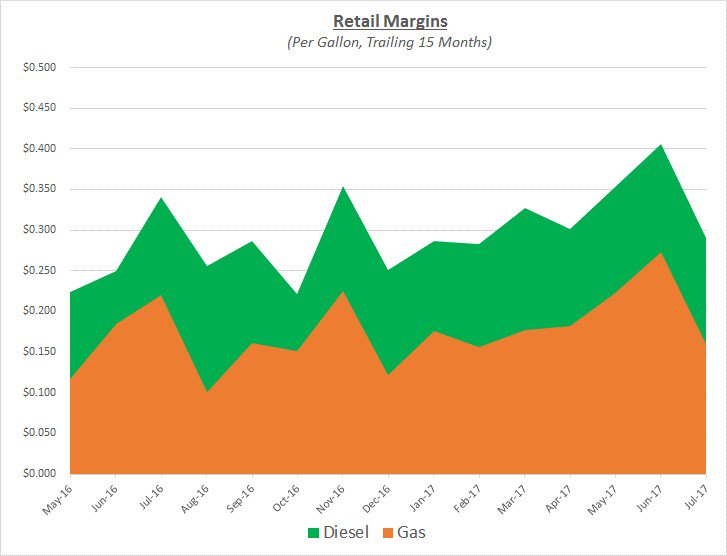

July wholesale prices for diesel and gas increased while retail prices slightly declined. This caused retail margins to return to more typical levels. The following graph shows the retail margin trends over that period:

Based on the market changes in July, fleets with retail-based purchasing deals would have seen small declines while fleets with deals based on wholesale prices would have seen modest increases compared to June.

Looking beyond July, Sokolis anticipates prices will continue to hover near $50/barrel for the remainder of the summer with some potential to climb a bit higher. Strengthening prices will be primarily dependent on continued reports of inventory reductions, slow US rig growth, along with OPEC continuing to limit their production and exports.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.