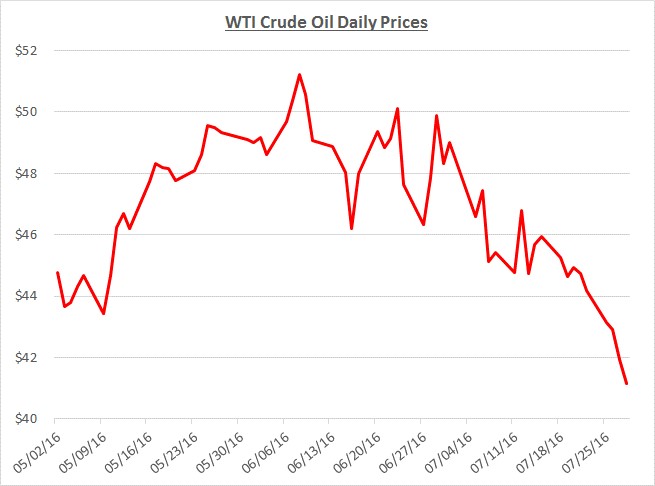

Crude oil prices experienced a steep decline in July. The downward trend was certainly significant, particularly when viewed in the context of the daily price changes over the past three months shown in the following graph:

Back in May, robust upward movement began which was primarily driven by supply disruptions. In addition, there was a greater sense of optimism that global demand could reach a balance with plentiful supplies sooner than previously anticipated. The May rally continued into the beginning of June, then began to sputter in response to turmoil in global financial markets along with fluctuations in crude and refined product inventory levels.

As July got underway, the basic fundamentals of supply and demand came back into focus. The reality of global supply being far above demand hadn’t changed significantly. OPEC nations continued to produce at record rates. In addition, despite the increase in demand from summer driving, refined product inventories have not been declining as quickly as anticipated. At this point, there seems to be less optimism that a market balance can be achieved as quickly as analysts predicted a couple months ago.

It is also noteworthy that higher prices realized near the beginning of June were enough to incentivize restarting a number of US oil rigs. This is a reminder of how quickly domestic production can resume as prices rise. This could also serve as a restraining factor on how fast prices rise in the future.

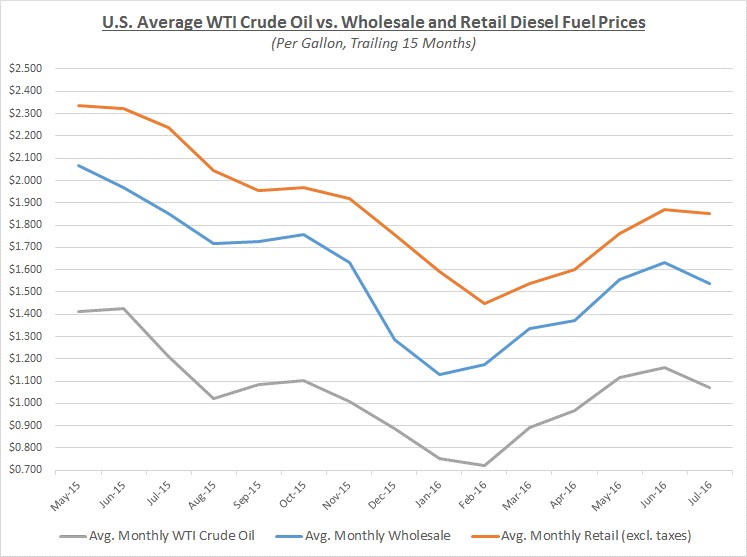

As the average oil price declined in July, wholesale prices followed but retail was slow to react. The graph below shows the movement of crude oil (converted to gallons) along with wholesale (“rack”) and retail diesel fuel prices over the trailing 15 months:

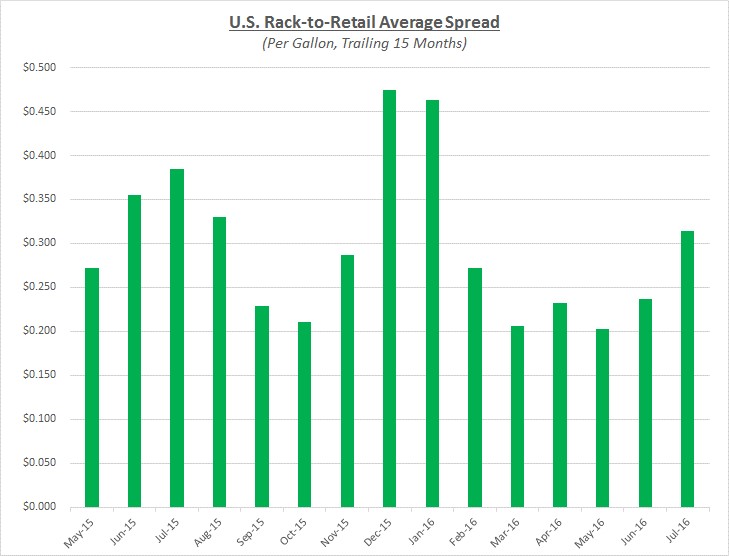

As this graph shows, retail prices lagged behind as merchants enjoyed another opportunity to maximize their margins during a period of rapidly falling prices. As the following graph shows, retail margins enjoyed a significant bump upward, although not so high that they would be considered unusual:

Due to the market changes in July, most fleets would have seen a modest decrease in their fuel costs. Looking beyond July, Sokolis anticipates oil prices will remain relatively low for the remainder of the summer followed by gradual increases during the remainder of the year.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.