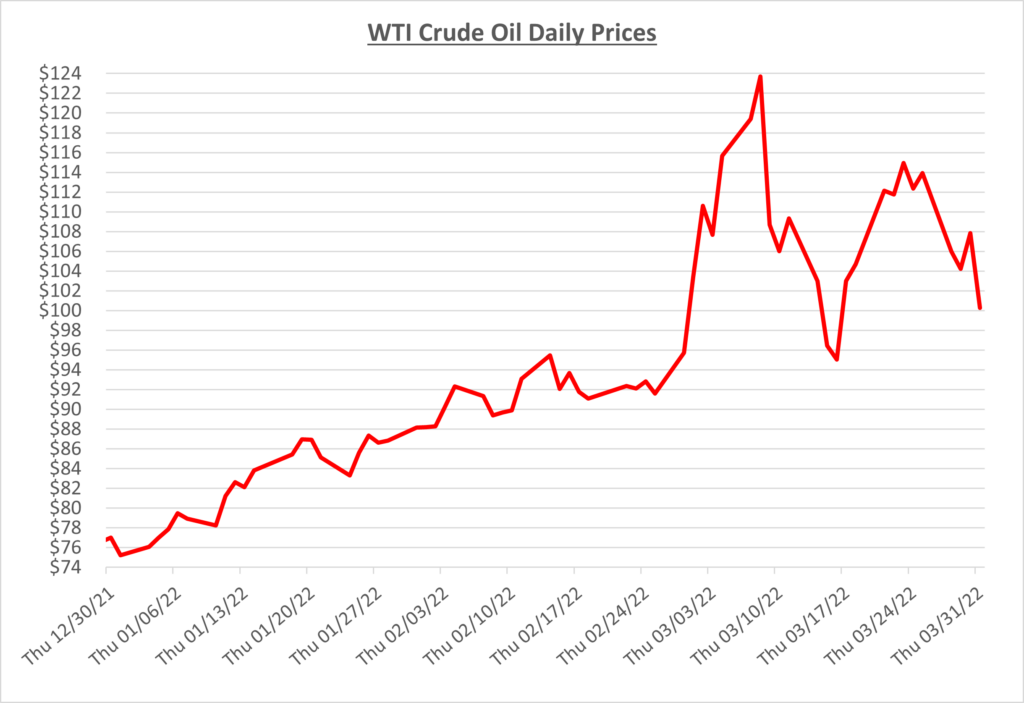

Crude oil started March above $100, and it would be a wild ride from there on. Diesel and gas had days of 50+ cents per gallon increases at the pump, putting everyone on notice that war in Ukraine might have fuel prices spiking much higher. Gas prices were well over $4/gallon nationwide, while diesel was over $5/gallon. The following graph shows the daily price movements over the past three months:

After diesel prices skyrocketed 70 cents in just one week, analysts such as JP Morgan were predicting $185/barrel oil by the end of 2022. Crude oil hit $130 March 6th (Sunday night) before cooling off Monday and closing just below $120. These are the highest marks seen since 2008. As we moved towards the middle of the month, prices began to fall as the market reevaluated the effects of the war. Signals were mixed daily on whether peace discussions were making progress between Russia and Ukraine. This left fuel prices going up and down like a yo-yo.

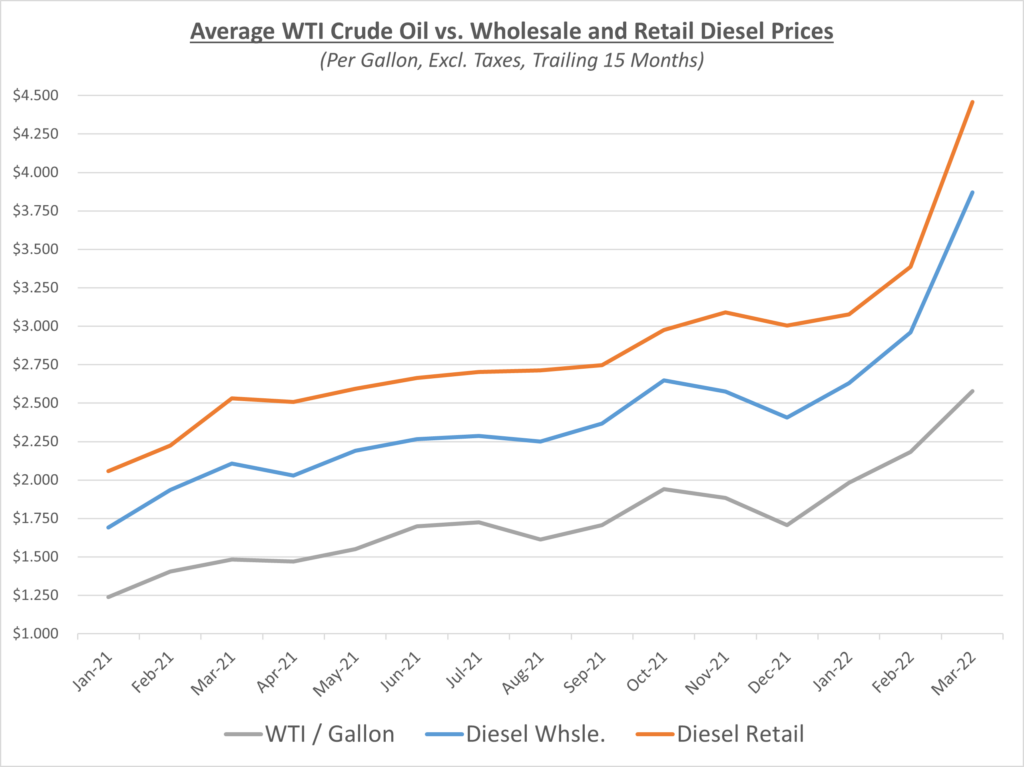

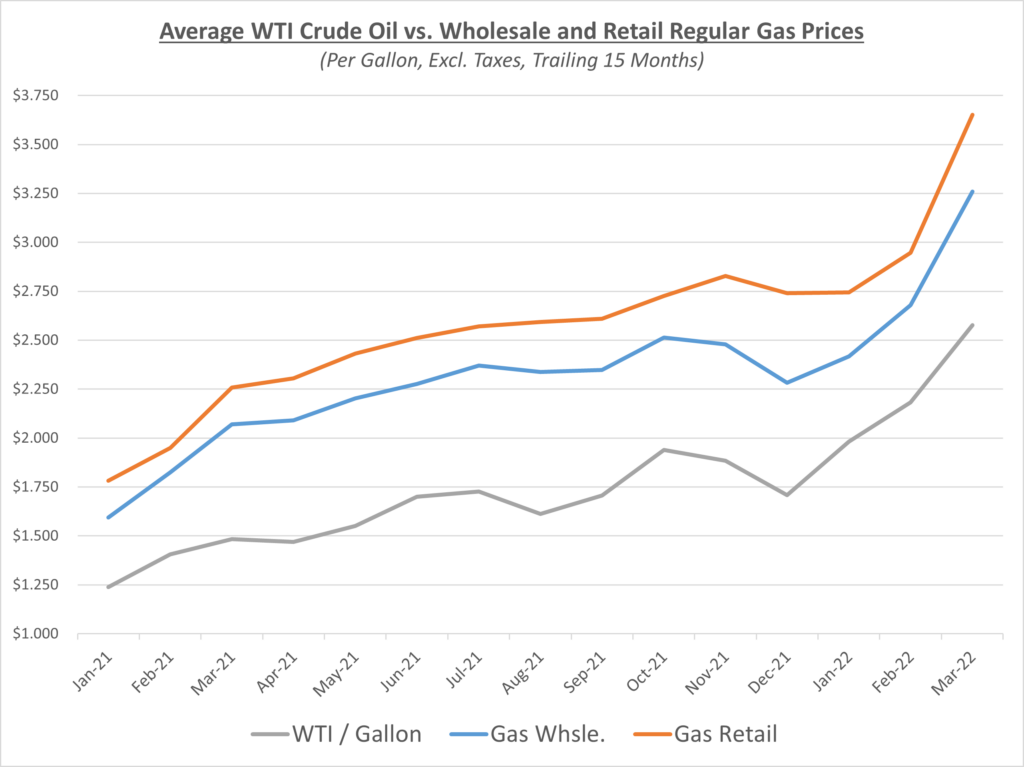

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

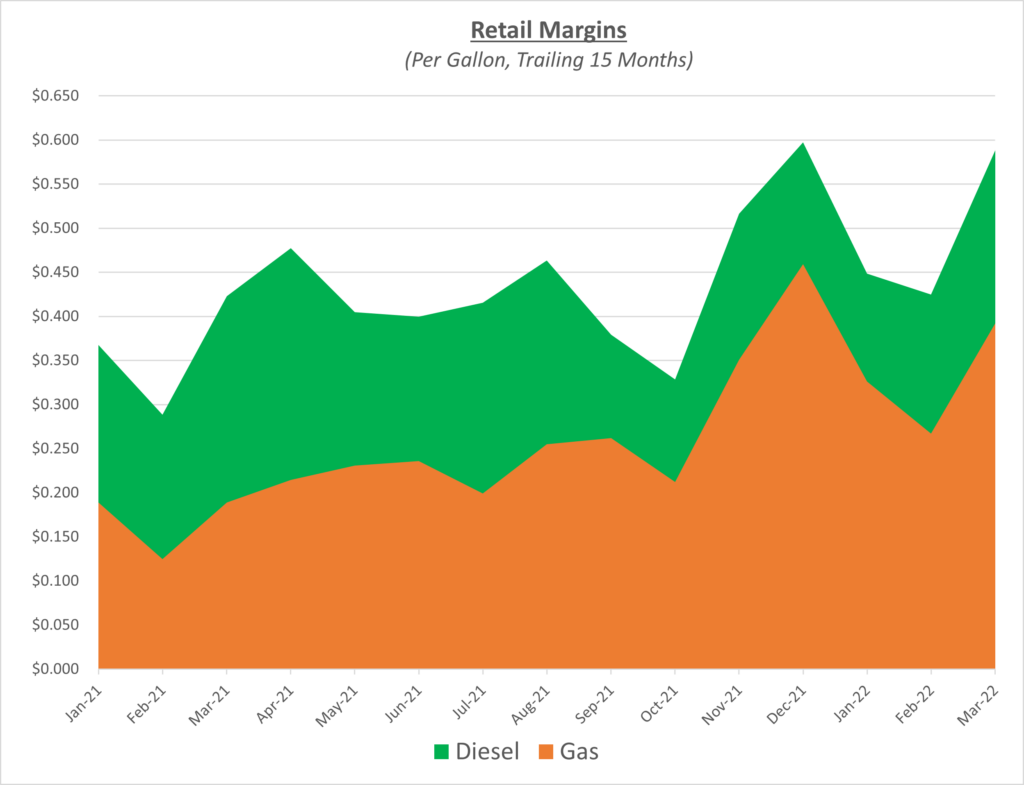

Wholesale prices continued their increase from February. However, as oil prices dropped, increased, and then dropped again, retail prices did not adjust downward. Diesel and gas prices continued their upward trend, and this created a large increase in both gas and diesel margins. The following graph shows the retail margins over the trailing 15 months:

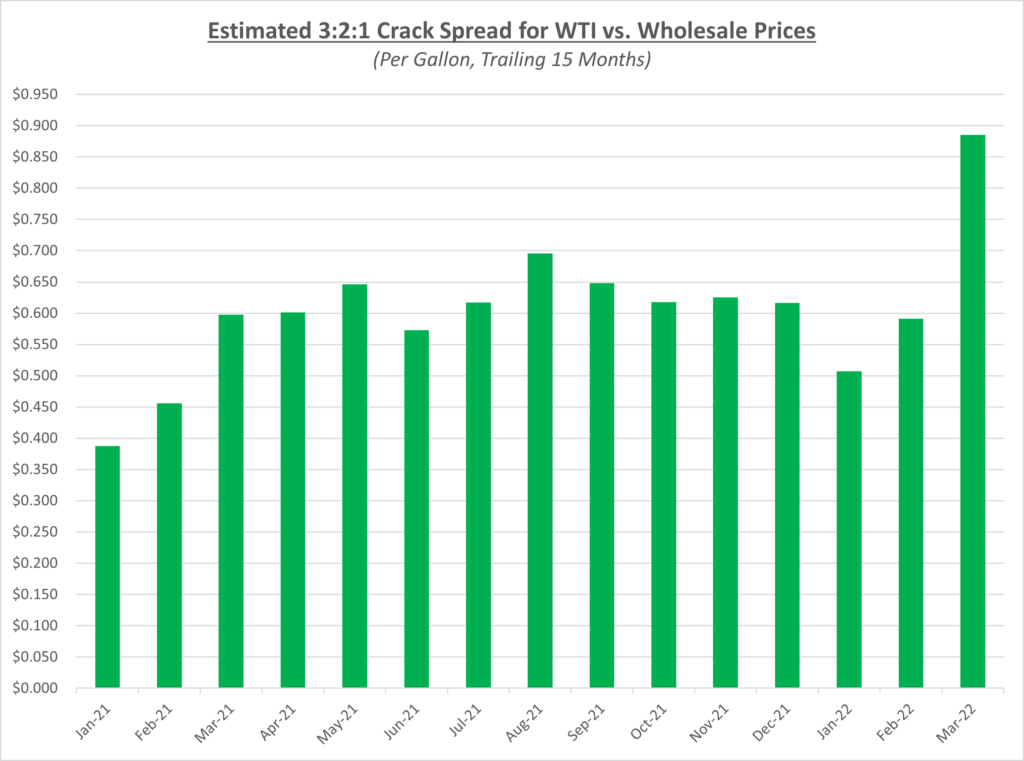

It’s been a few months since we brought up crack spreads, as there wasn’t much new happening. That changed in March where they jumped like fuel prices did to almost $0.90 as shown in the graph below. The spike in the crack spread could be attributed to concerns that diesel and gas supplies could tighten further, and therefore, commanded a higher price. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel.

Another month with the war in Ukraine continues to have its effects on fuel markets globally. In the U.S. a few states such as Connecticut, Georgia and Maryland have suspended state taxes to provide some relief to drivers. Other states are considering following in their footsteps of suspending state taxes or possibly providing rebates or stimulus to help lessen the blow of extremely high fuel prices.

As we approached the end of the month there has been some relief in prices as China went back into a lockdown due to the newest COVID variant. That would help slow demand but supply still seems to be the bigger issue. The EIA has reported back-to-back weeks of crude oil inventory draws ending March. Oil in the Strategic Petroleum Reserves (SPR) sits at its lowest level since 2002, but President Biden still introduced a plan to release 1 million barrels of oil per day from the country’s SPR for the next six months to help ease fuel prices. This is not a permanent solution but has helped get oil prices down closer to $100 for now.

Sokolis believes that oil prices will remain above $100 as long as the war in Ukraine drags on, with large fluctuations and likelihood to go much higher with any negative news.