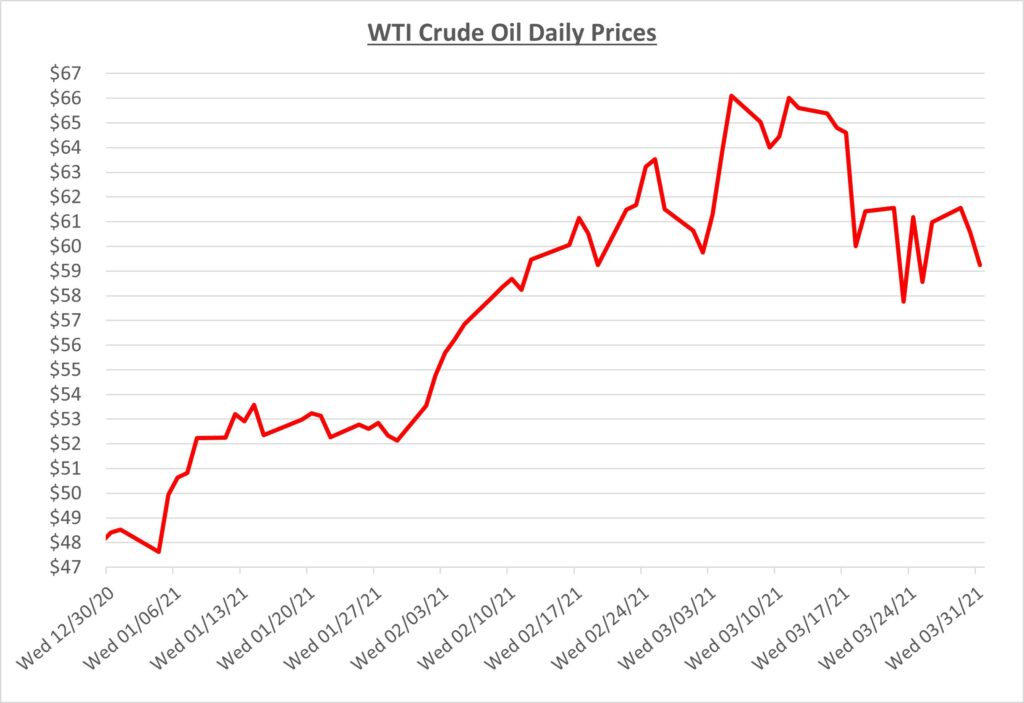

Following a rapid climb in February, oil prices lost their momentum in March. Despite some volatility during March, prices ended the month at just over $59 per barrel which was about a dollar lower than where the month started. The following graph shows the daily price movements over the past three months:

Oil prices had increased significantly during February primarily due to the continued roll out of COVID vaccines and a decline in the rate of new cases. As March began, setbacks emerged as virus numbers began rising again in some countries. Oil prices briefly fell in the first few days of March based on concerns that an economic recovery could be further off than what had been anticipated. However, prices were then given a boost when OPEC+ unexpectedly announced the group would continue their oil production restrictions while most analysts expected some easing to occur.

By the middle of the March, oil prices quickly declined by 10% as more significant setbacks occurred with the vaccines, particularly in Europe. A new wave of global cases started to grow, and some countries began to implement travel lockdowns again. For the remainder of the month, prices traded in a narrow range near $60 per barrel as traders waited for signs that the situation would get better or worse.

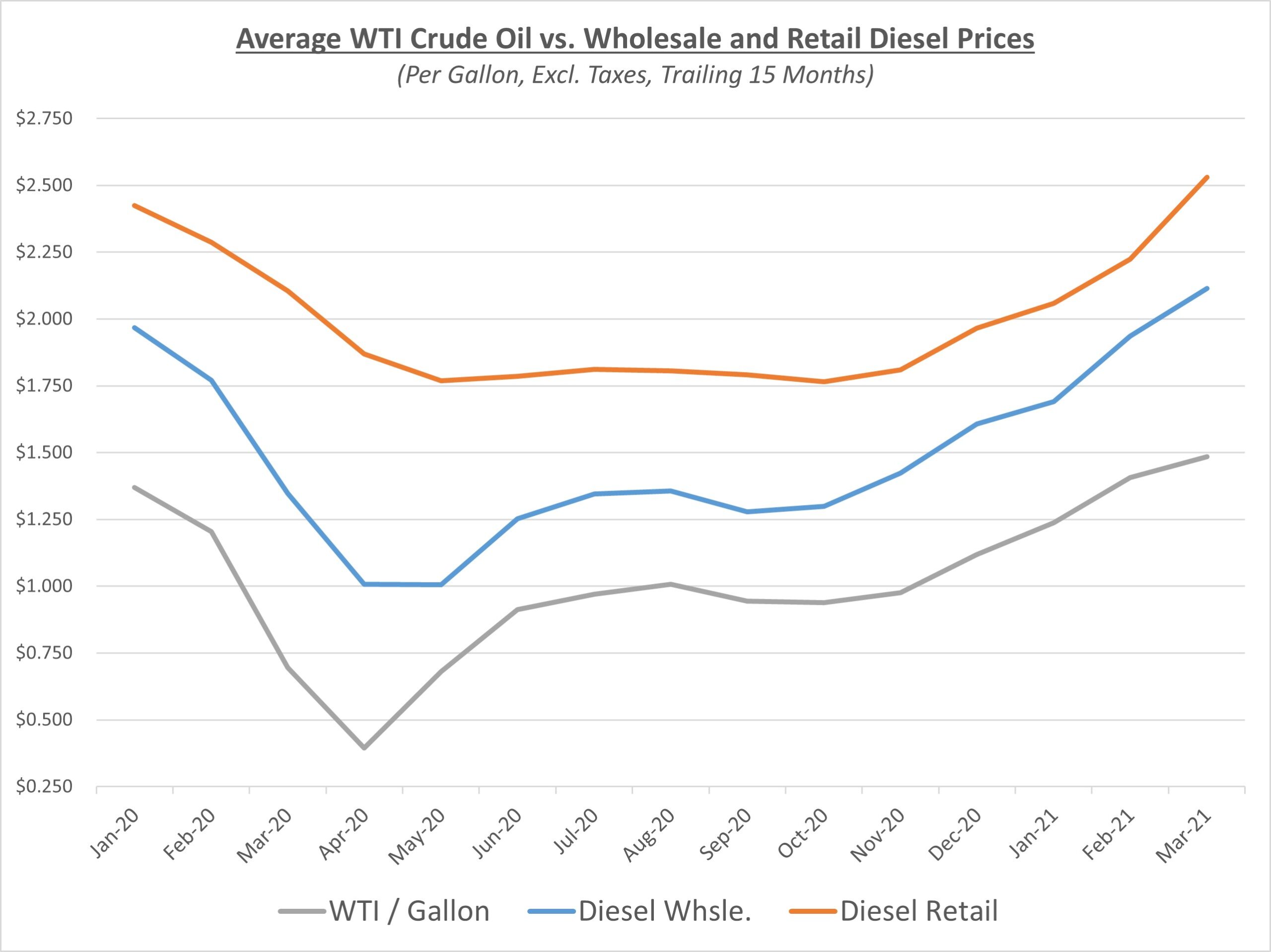

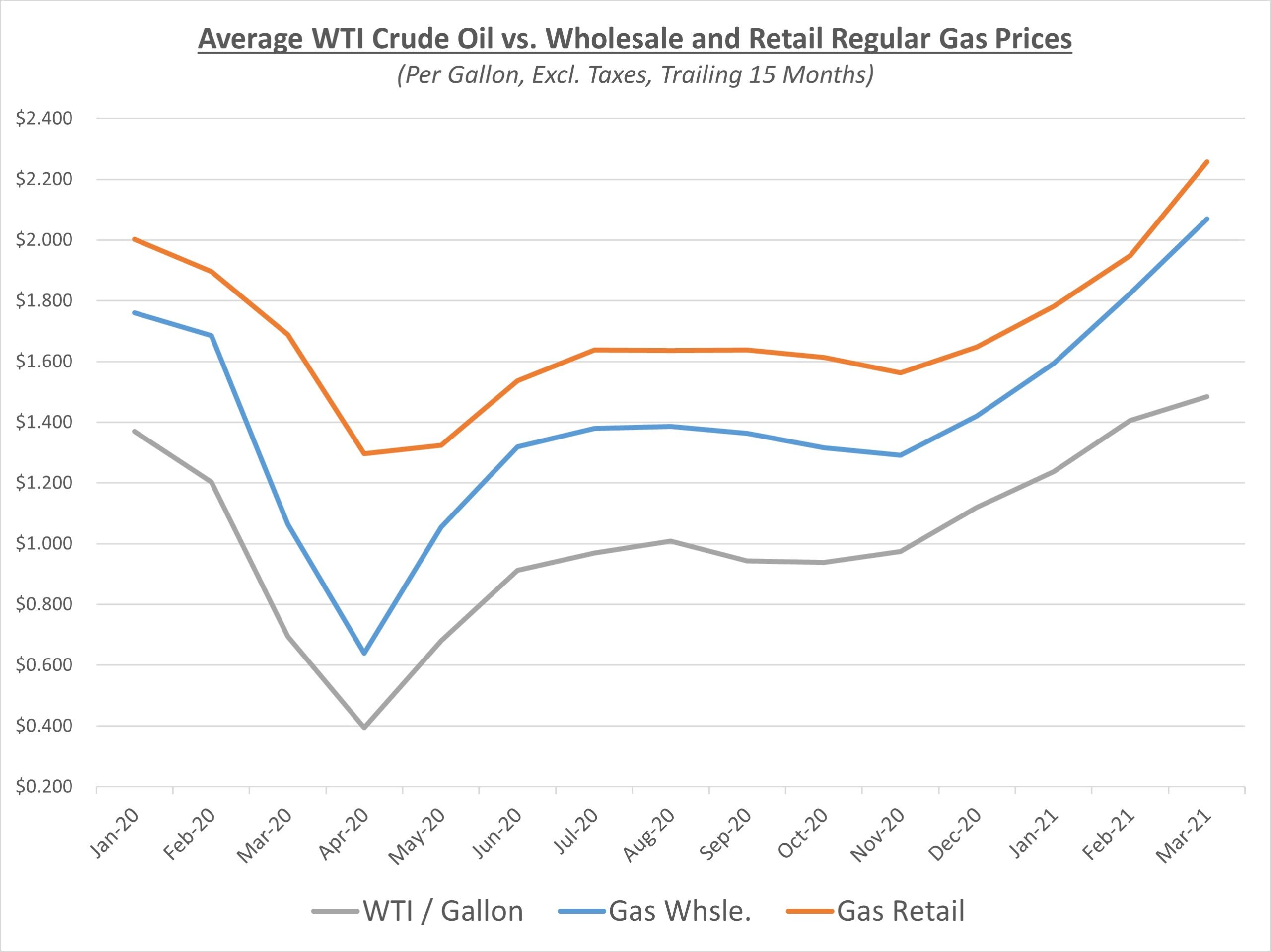

Despite the volatility in oil prices during March, the overall average price for the month was modestly higher than February. For refined fuels, average prices rose significantly higher compared to the prior month. The underlying increase in oil prices contributed to this, but a big factor was the lingering effect of the February storms in Texas which caused widespread disruptions to fuel refining and distribution. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

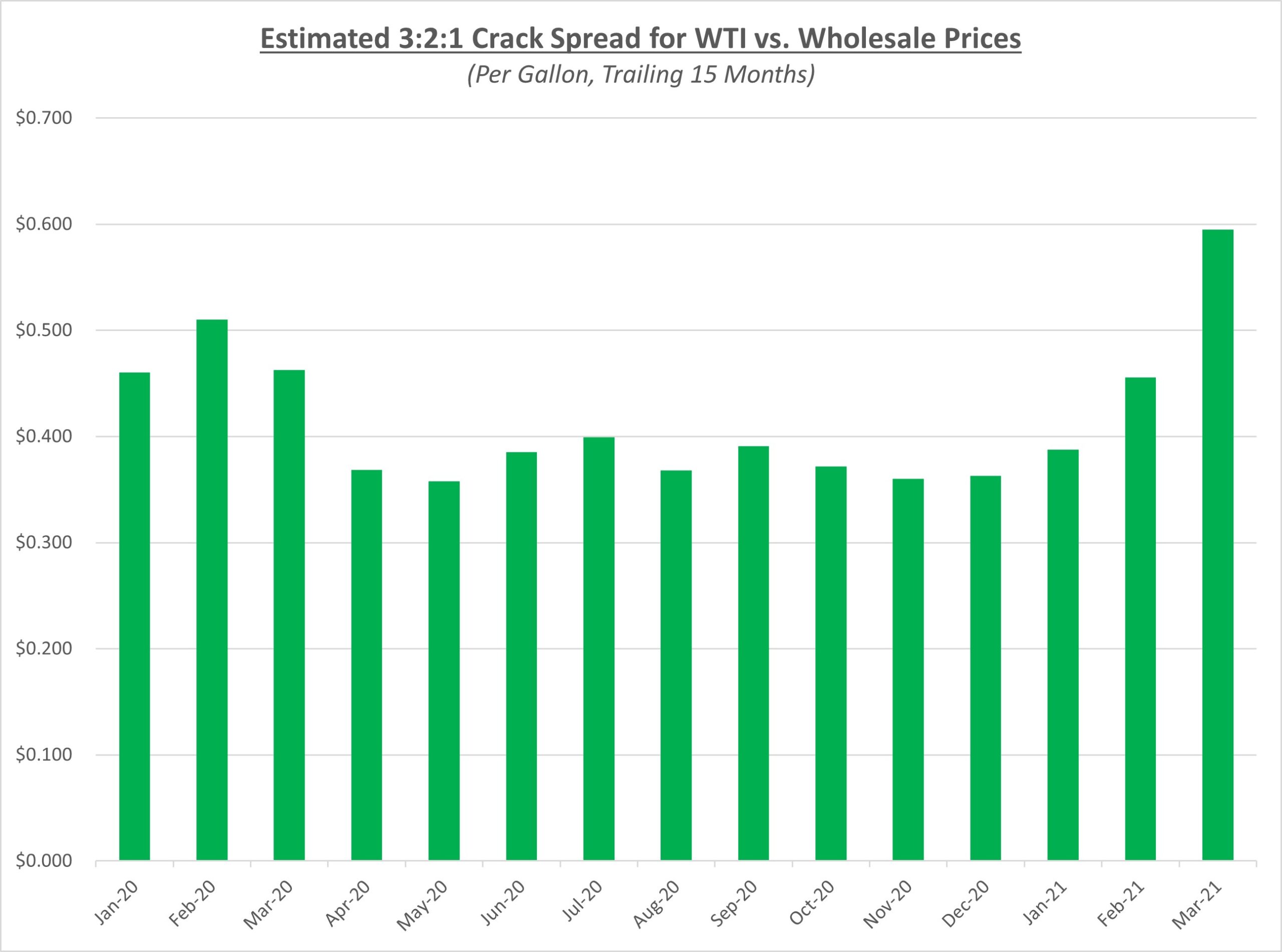

Taking a closer look at the increase in refined fuel prices versus oil, the 3-2-1 crack spread in the graph below reflects much higher margins that refiners earned in March because of tighter fuel supplies resulting from the disruptive storms. As a refresher, the 3-2-1 crack spread is based on a rough calculation that three barrels of oil can be refined into two barrels of gas and one barrel of diesel fuel.

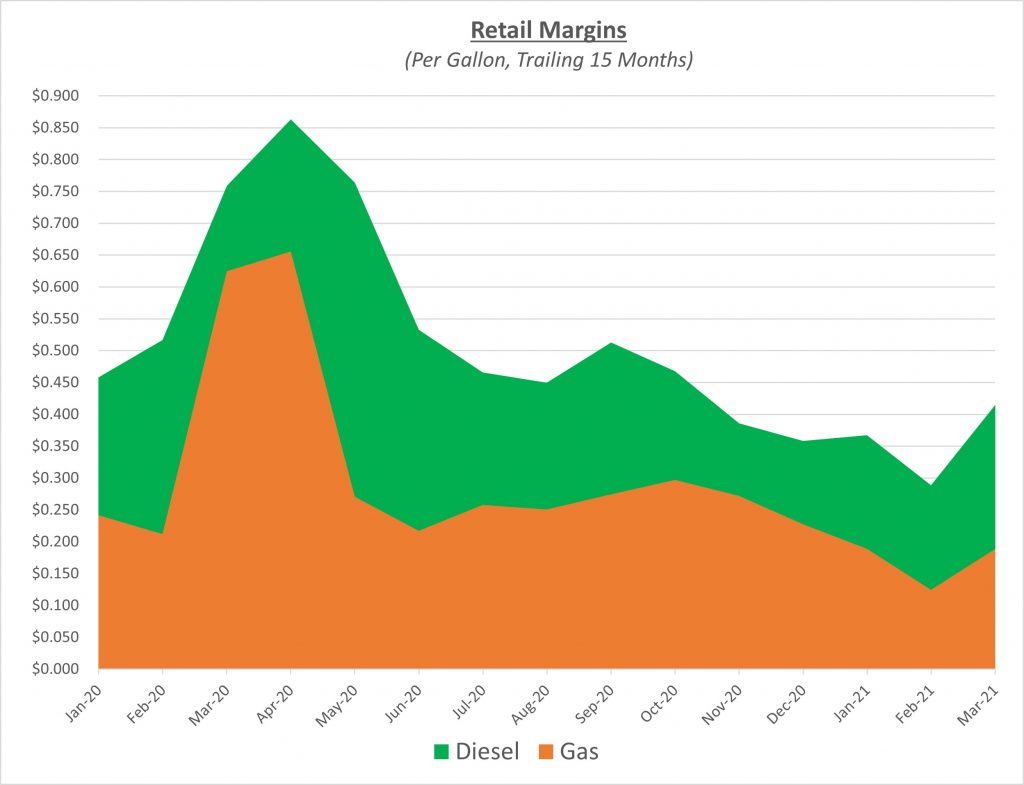

Although there were significant increases in refined fuel prices in March, wholesale prices did not go up quite as fast as retail. Wholesale fuel prices are more closely tied to the underlying cost of oil. Wider margins are typical during periods of declining oil prices which occurred during the second half of March. The growth in retail margins provided a recovery toward their more typical levels. The following graph shows the retail margins over the trailing 15 months:

As fuel prices have recently fallen and settled in the $60 per barrel range, future price movements will continue to be heavily influenced by COVID vaccine and case numbers. In addition, OPEC+ will meet again in April to reevaluate their production restrictions, but it is likely they will hold steady until more consistent demand growth is seen for the future. Until then, Sokolis believes prices will remain close to $60 per barrel in the near term. Looking further out, assuming progress is made to curtail the newest wave of global virus cases, there is greater potential for prices to resume rising through the $60’s and approach $70 rather than fall further into the $50’s.