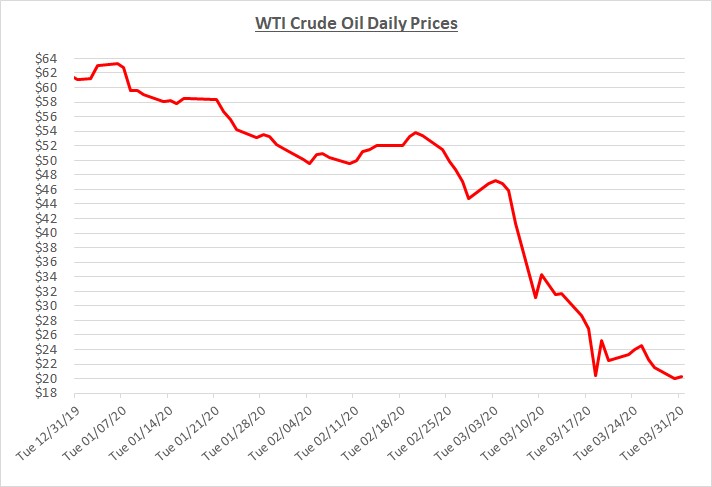

The sharp decline for oil prices that began in January has accelerated through March. Prices declined by about 60% during March, falling to roughly $20/barrel. They are now just under a third of the level where they started this year along with where they were a year ago. The following graph shows the daily price movements over the past three months:

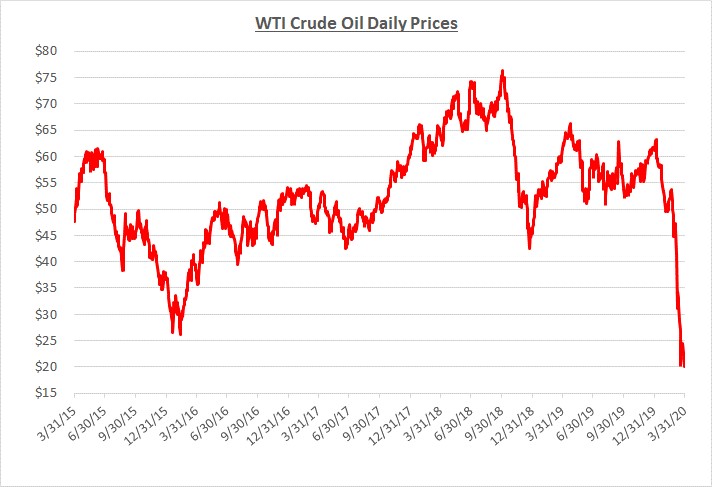

For some additional perspective on this remarkable decline, the following graph shows the daily price movements over the past five years:

From the graph above, prices have reached the lowest they’ve been since the start of 2016. They are also at one of the lowest points they’ve been since the 1998 financial crisis. Most notable is the rate of decline which may be the fastest in oil’s modern history.

The rapid decline is primarily attributable to the growing cases of COVID-19 throughout the world which have severely curtailed economic activity and the demand for oil. Prices have also been driven downward by the battle for market share between Saudi Arabia and Russia. Their disagreement about reducing oil production to try and balance the market led to Saudi Arabia’s decision to increase production during this unprecedented period of demand destruction.

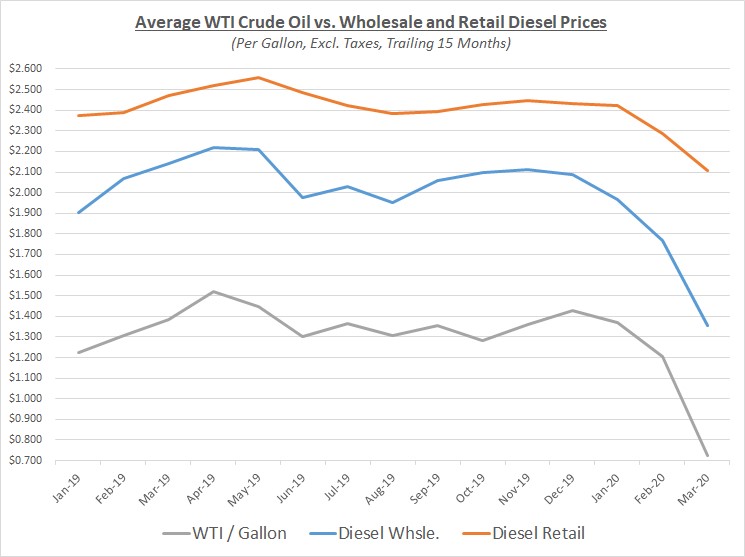

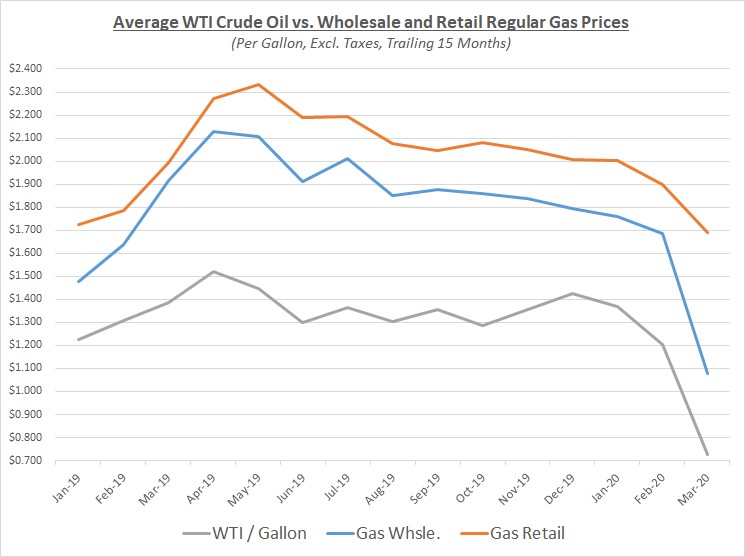

Due to the accelerated decline during March, the overall average price for oil fell significantly compared to February. Substantial declines also occurred for refined products. The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

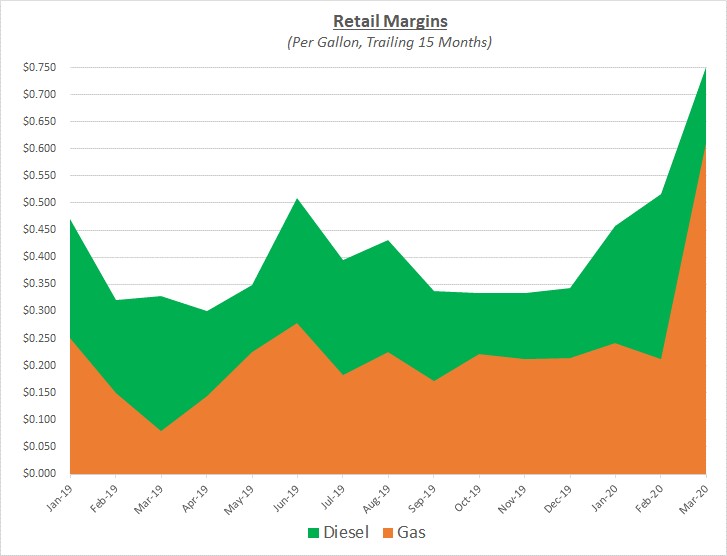

For refined fuels, the decline in retail prices was at a slower pace than wholesale. As a result, retail margins rose to unprecedented levels. The growth in retail margins is typically seen during periods of rapidly falling wholesale prices as retailers take advantage of the opportunity to increase their profits. However, under these circumstances, higher margins may be a necessity for some smaller retailers to survive as they pump fewer gallons. The following graph shows the retail margins over the trailing 15 months:

For most fleets, fuel prices should drop more than 30 cents per gallon compared to where they were just a couple months ago. Fleets with diesel deals tied to wholesale cost indexes should see a larger decline at a faster rate compared to fleets purchasing at retail. Declines for gas will be even larger because demand has been much lighter than diesel. In addition, the typical increase in gas demand during the summer will be less likely if the public is still reluctant to travel.

As the impact of the virus continues to grow, Sokolis believes that oil prices will remain at their very low levels for the foreseeable future. The market currently has too much supply from overproducing as overall demand has collapsed. Excess oil and fuel inventories are now challenging storage capacity and refineries are beginning to scale back production. However, it will still take some time for inventories to adjust unless there are any sudden changes with demand growth or OPEC+ changes its course.

With so much inventory available, Sokolis is not aware of any fuel supply concerns in the US. In addition, truck stop networks have remained open for fueling with very few exceptions. The truck stops have limited their dining options, but showers and restrooms remain available and cleaning procedures have been enhanced.

For bulk and mobile fuel suppliers, we have seen a few changes regarding pricing structures due to driver labor challenges. However, the most notable change has been related to paperwork like delivery tickets and BOLs. Many suppliers are transitioning to electronic records to avoid any in-person transfer of physical paperwork. In most cases, this is going well, but some customers still need to find a workaround for requiring a company representative to sign paperwork.

The world is grappling with an issue of enormous scale and human impact, and our thoughts go out to all who have been affected by the outbreak of the coronavirus. In addition to the obvious health concerns, there are significant financial concerns as many businesses struggle to survive and workers endure layoffs.

The team here at Sokolis recognizes how challenging this period is and feels very fortunate to have the opportunity to continue providing fuel management services to our clients. Our clients’ fleets and drivers are critical to distributing the goods and services necessary during this time. We are here and ready to do whatever we can to support them.

During 2019, months before the virus emerged, we had already made the decision to move toward a virtual office environment. By the end of 2019, our team was fully acclimated to working remotely every day. In hindsight during this difficult time, we were fortunate to have already completed the transition. We recognize many companies are now just learning how to manage a remote workforce.

The key to our ability to maintain continuity of service is based on using cloud technology that allows us to support our clients and stay connected as a team. Please continue to contact us via phone and email as usual. We’re here for you.

We will continue to monitor the fuel market for any changes and send out any additional updates if necessary. In the meantime, should you have any questions, please feel free to reach out to your primary contact at Sokolis.