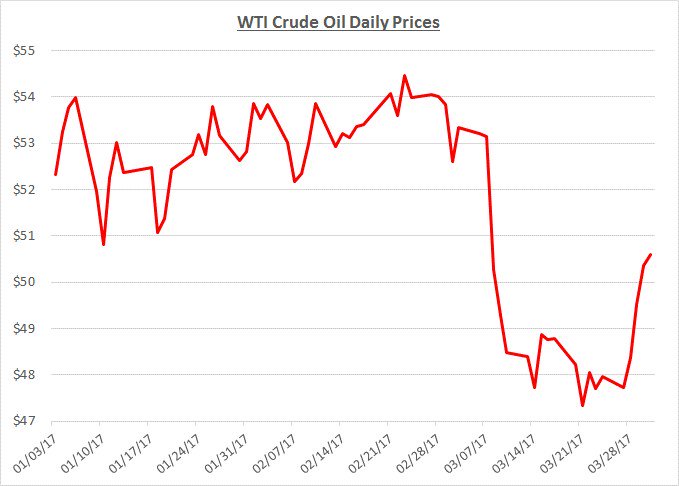

Oil prices had been trading in a narrow range between $51 and $54 per barrel from the beginning of the year until early March when prices fell rapidly. Their decline into the high $40’s was primarily attributable to increasing inventory levels despite an agreement to reduce production by OPEC and other foreign countries. The following graph shows the daily price movements over the past three months:

OPEC’s agreement to reduce production started during January 2017 and has proceeded with a very strong level of compliance. Although the agreement stimulated an increase in prices, it also provided a financial incentive for US domestic producers to resume activity. Rig counts have grown considerably over the past two months and the resulting increase in domestic production has challenged the impact of OPEC’s production cuts. The continued strength of the US dollar has also applied downward pressure on prices.

Toward the end of March, OPEC members indicated it may be necessary to extend their production cuts for an additional six months to rebalance supply and demand. Around the same time as this news was making headlines, the latest inventory reports showed a small decline in crude levels while refined products did not increase as much as anticipated. These bullish factors helped drive the price of oil back up over $50/barrel during the last few days of the month.

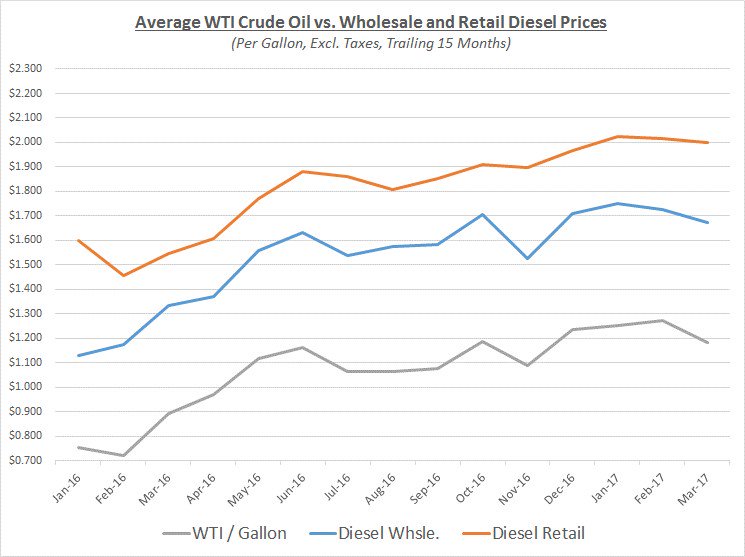

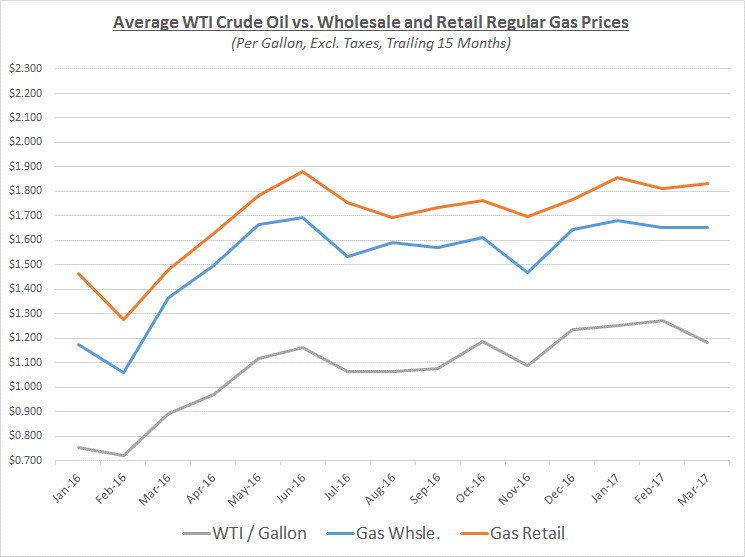

Despite the overall decline and volatility in crude prices during March, wholesale and retail diesel fuel prices only showed small declines while gas prices were relatively unchanged. The graphs below show the movement of crude (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

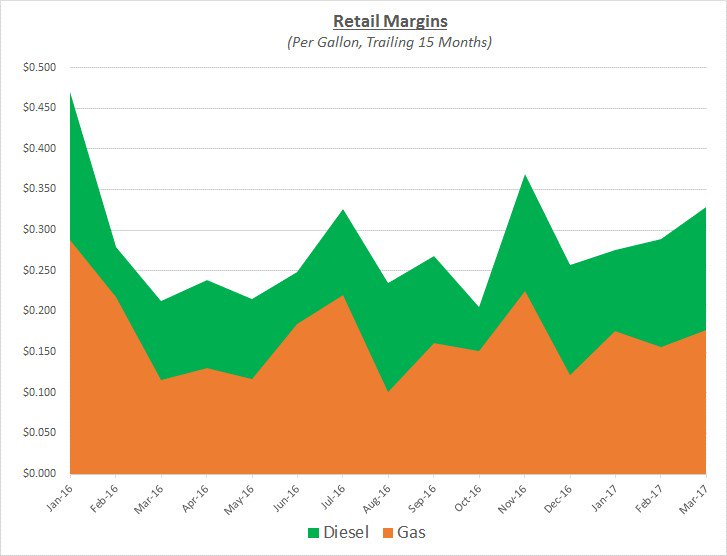

March retail prices for diesel declined slightly while wholesale followed crude more closely. For gas, retail prices increased slightly while wholesale showed no change. As a result, retail margins widened for both products as shown in the following graph:

Because of the market changes in March, most fleets would not have seen any significant changes in their prices, although diesel fleets with deals based on wholesale prices would have seen modest declines.

Looking beyond March, Sokolis anticipates oil will continue to trade near the $50/barrel level for the next several months. Crude could potentially reach the mid-$50’s if a deal is reached by OPEC to extend their production cuts. However, inventory levels will also need to show more consistent declines to achieve this higher level. During this period, growing domestic production and US economic strength will continue providing downward pricing pressure. If rig counts continue to rise and inventory levels do not subside, prices could fall back below $50/barrel.

If you’re concerned about the impact of future fuel price changes for your fleet and want to know if you’re receiving the best fuel prices possible, contact Conor Proud at Sokolis, [email protected] or 267-482-6159. We are the nation’s leading independent fuel management consulting team and can help you make sure that your fuel management program is running at peak efficiency.