How to Choose the Best Fleet Fuel Card for Your Business

By monitoring the diesel spot price, you can find opportunities to buy diesel at a low cost. Learn more in this blog post.

By monitoring the diesel spot price, you can find opportunities to buy diesel at a low cost. Learn more in this blog post.

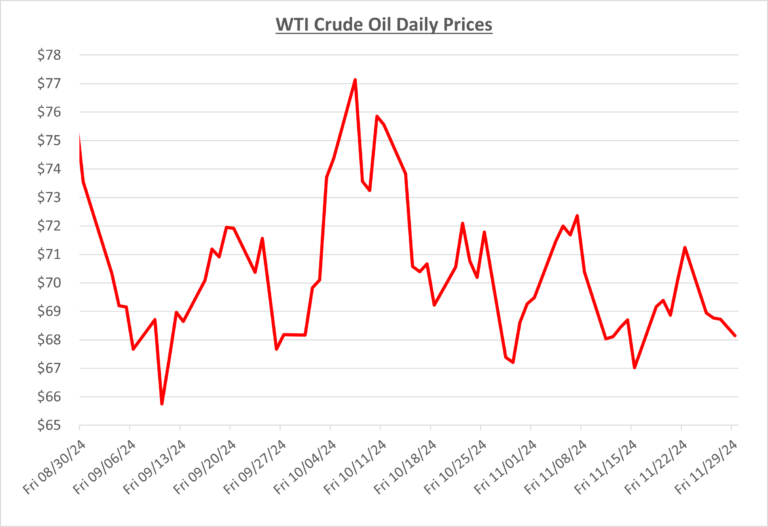

Oil prices began November in the low $70s/barrel after OPEC+ announced delaying their production increase until at least January 2025. The potential damage of Hurricane Rafael threatened to disrupt oil production, which also helped support rising oil prices for the meantime. The following graph shows the daily price movements over the past three months: By mid-month, oil prices began to

By monitoring the diesel spot price, you can find opportunities to buy diesel at a low cost. Learn more in this blog post.

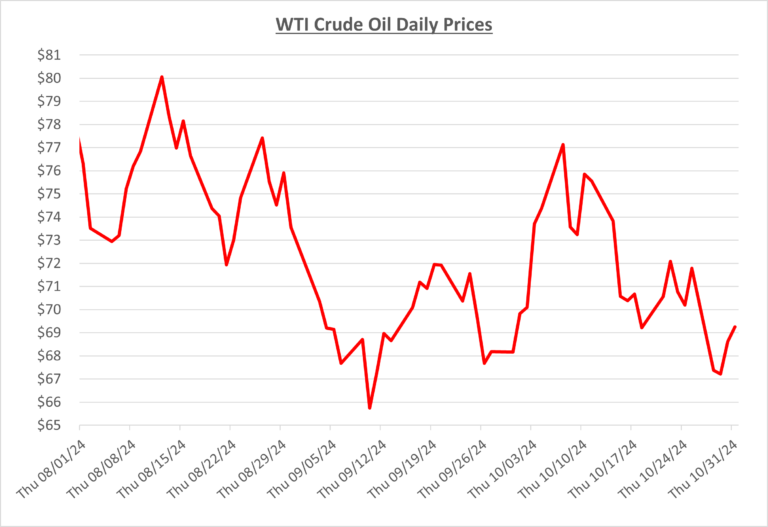

Fuel prices reversed their recent trend as oil prices elevated back into the $70s/barrel due to Iran’s missile attack on Israel. Fears of retaliation, specifically on Iran oilfields, caused prices to spike early in October as high as $77/barrel. The following graph shows the daily price movements over the past three months: By mid-month, the premium built into oil prices

By monitoring the diesel spot price, you can find opportunities to buy diesel at a low cost. Learn more in this blog post.

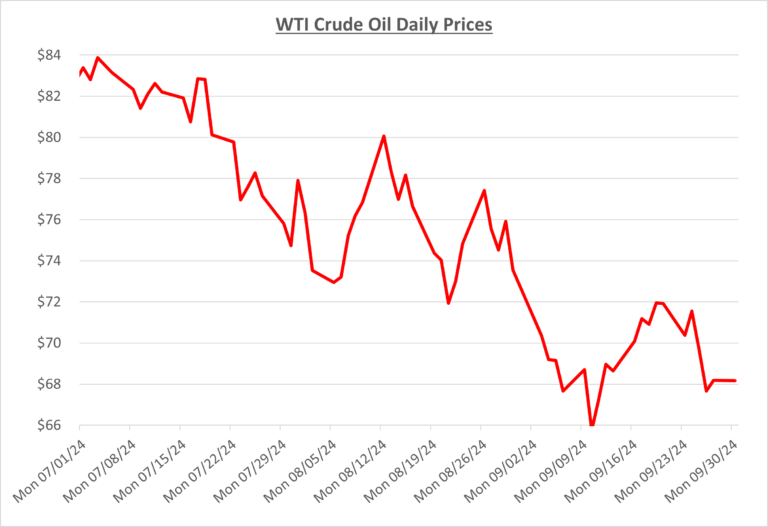

Fuel prices continued their slide into September as oil fell into the high $60s/barrel for the first time since December 2023. The market has continued to battle with poor global demand as China yet again posted weak economic numbers. This is outweighing Libya’s ongoing production shortage and forcing OPEC+ to delay their planned production increases. The following graph shows the

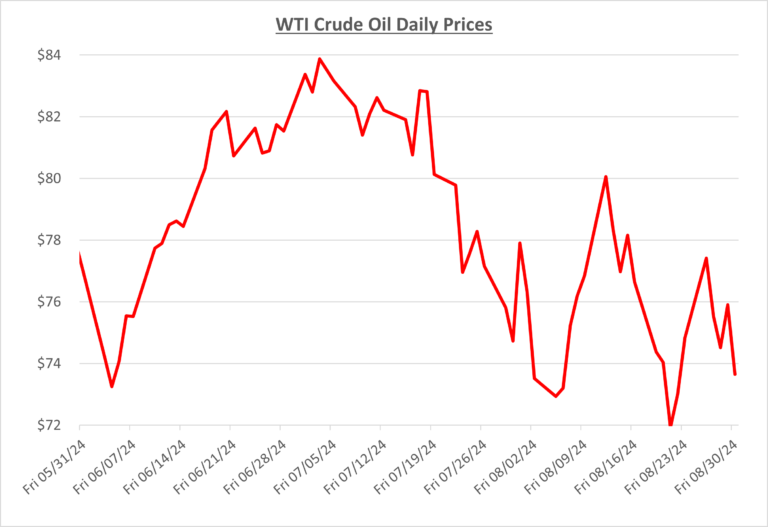

Oil prices spiked to start August but spent the rest of the month on a rollercoaster with peaks and valleys. The market is struggling with the threat of a major escalation in the Middle East and poor global demand, which is resulting in prices going up and down like a yo-yo. The following graph shows the daily price movements over

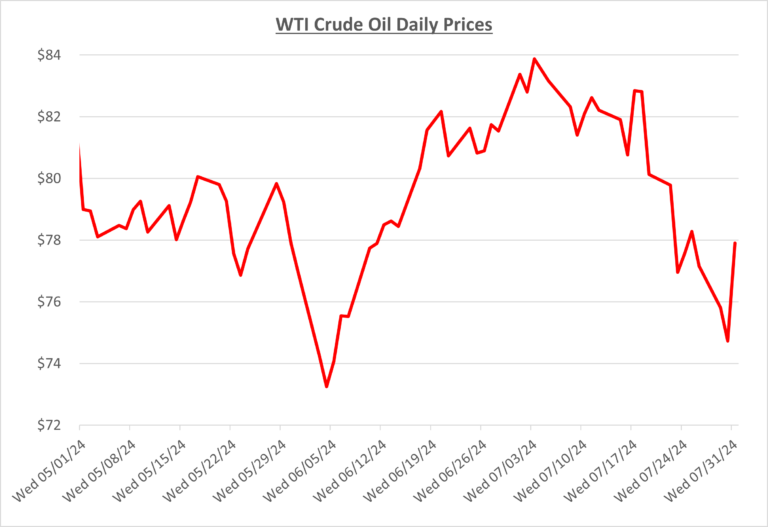

After hitting a low point in early June, oil continued to gain momentum through the beginning of July. Oil prices had their sights on the mid-$80s/barrel, but as we have seen recently, weakness in demand and oversupply has kept a lid on prices from heading even higher. The following graph shows the daily price movements over the past three months:

By monitoring the diesel spot price, you can find opportunities to buy diesel at a low cost. Learn more in this blog post.

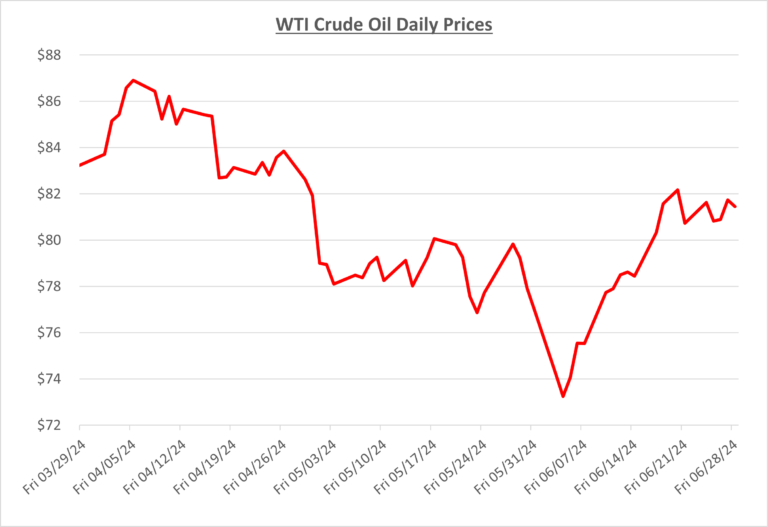

Oil prices were on a steady decline that began in April and continued through early June when prices fell below $74/barrel. Even after the OPEC+ meeting early in June where the cartel agreed to extending production cuts, demand had not been strong enough to help prices stabilize or increase. The following graph shows the daily price movements over the past

CONNECT WITH US: