Fuel Flash – December 2023

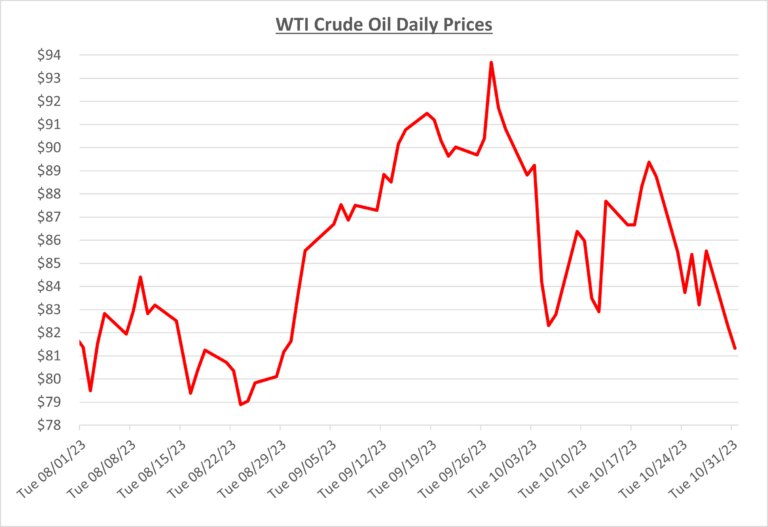

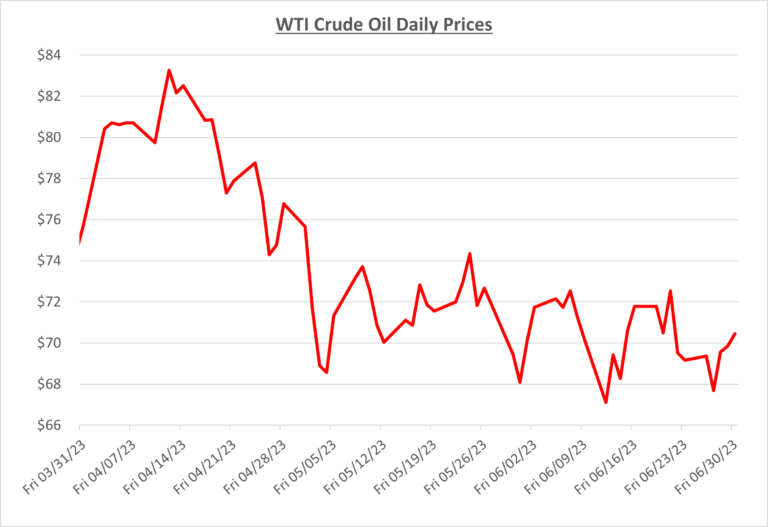

Oil prices started November above $80/barrel, but they would not hold there very long. Prices continued their downward trend from October into the $70s, where they would end up spending the rest of the month. The following graph shows the daily price movements over the past three months: OPEC+ seems keen to keep production cuts in place for the remainder