Fuel Flash – August 2024

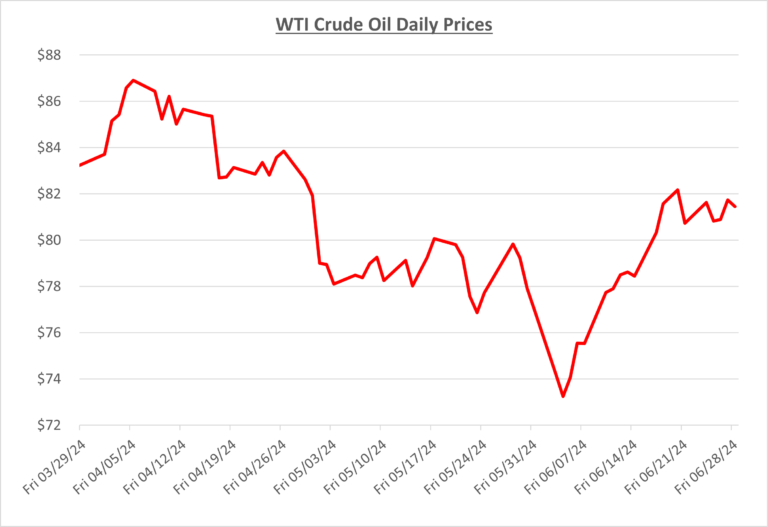

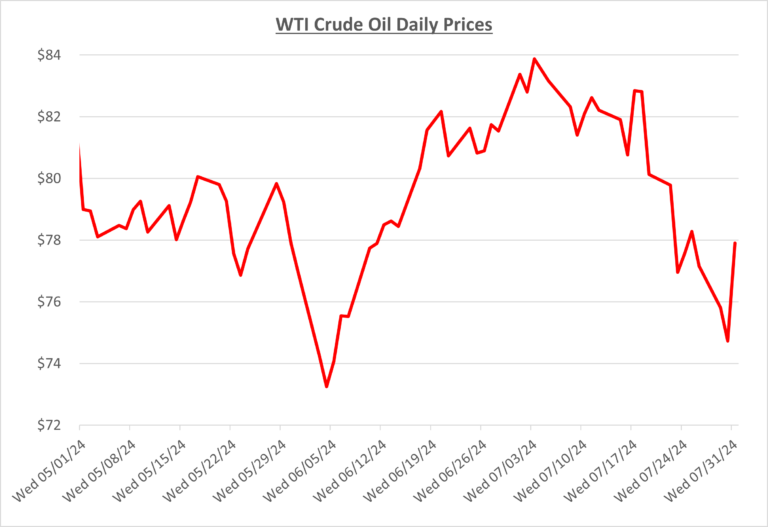

After hitting a low point in early June, oil continued to gain momentum through the beginning of July. Oil prices had their sights on the mid-$80s/barrel, but as we have seen recently, weakness in demand and oversupply has kept a lid on prices from heading even higher. The following graph shows the daily price movements over the past three months: