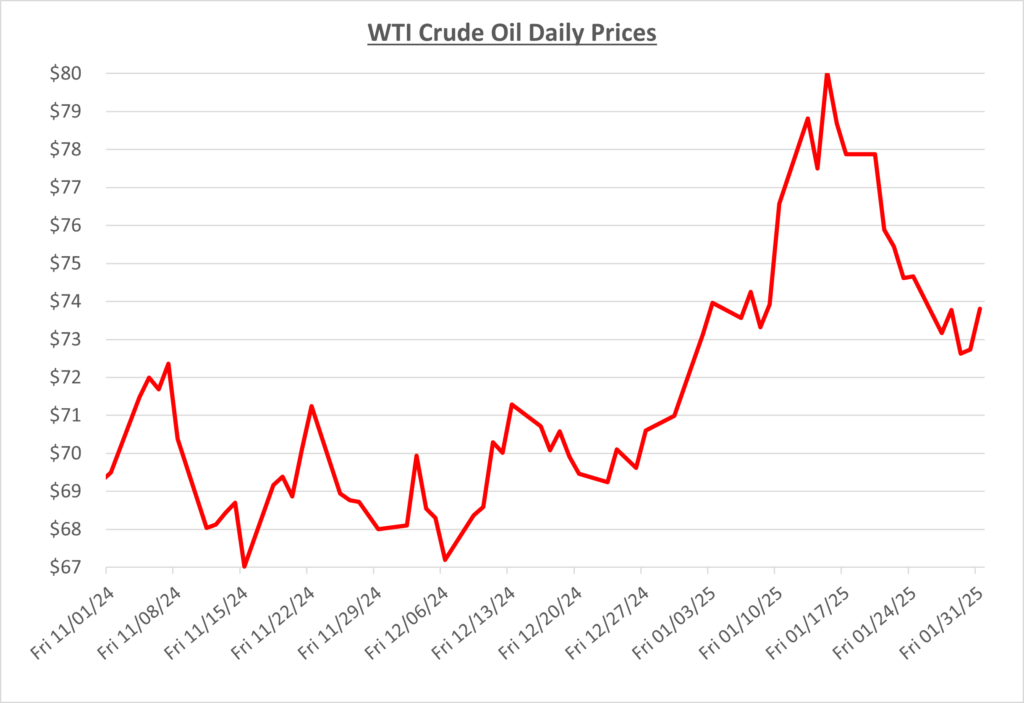

Oil prices began 2025 ascending towards $80/barrel. The main contributors being the positive economic news coming from China, as well as the coldest temperatures in the past decade across the U.S. These factors were causing oil prices to spike due to a brighter global demand picture, and the more immediate need for heating oil in the Northeast. The following graph shows the daily price movements over the past three months:

By mid-month, oil prices spiked drastically to $80/barrel, a mark not last hit since August 2024. During the final days of the Biden administration, new sanctions were placed on Russian tankers and traders. This is seen as a tool to put more economic pressure on Russia as they continue their invasion of Ukraine, with the administration doing so at a time that supply has been consistently balanced. However, this quickly caused global concern on supply as Russia has been delivering to some of the largest buyers of oil – China and India.

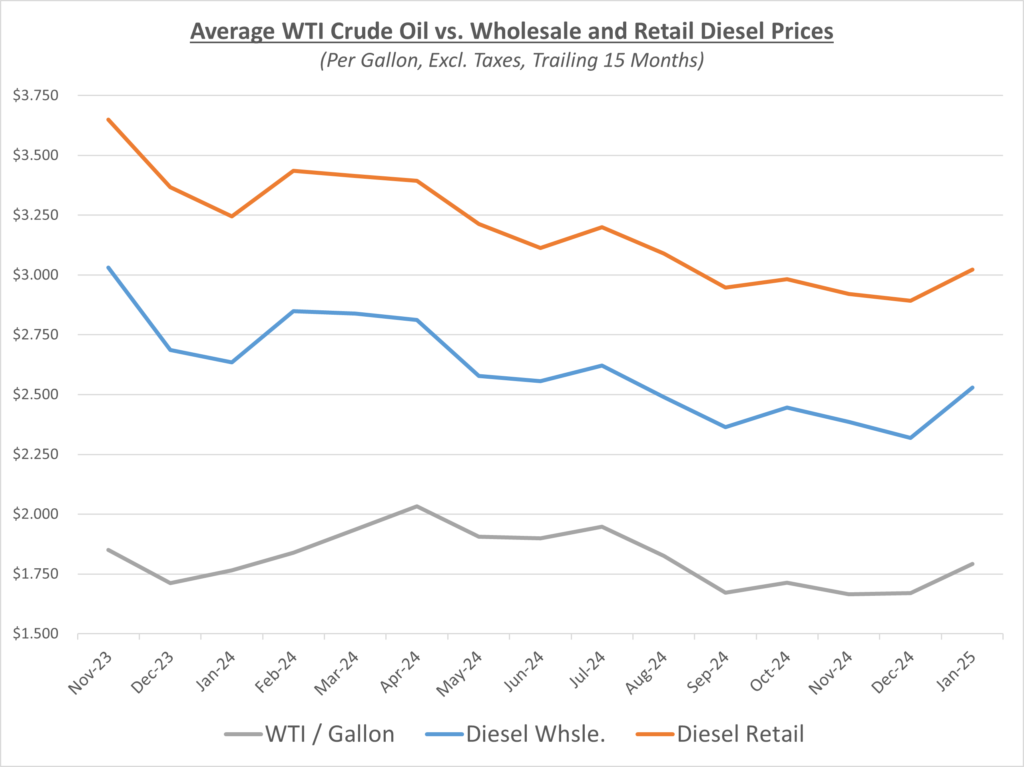

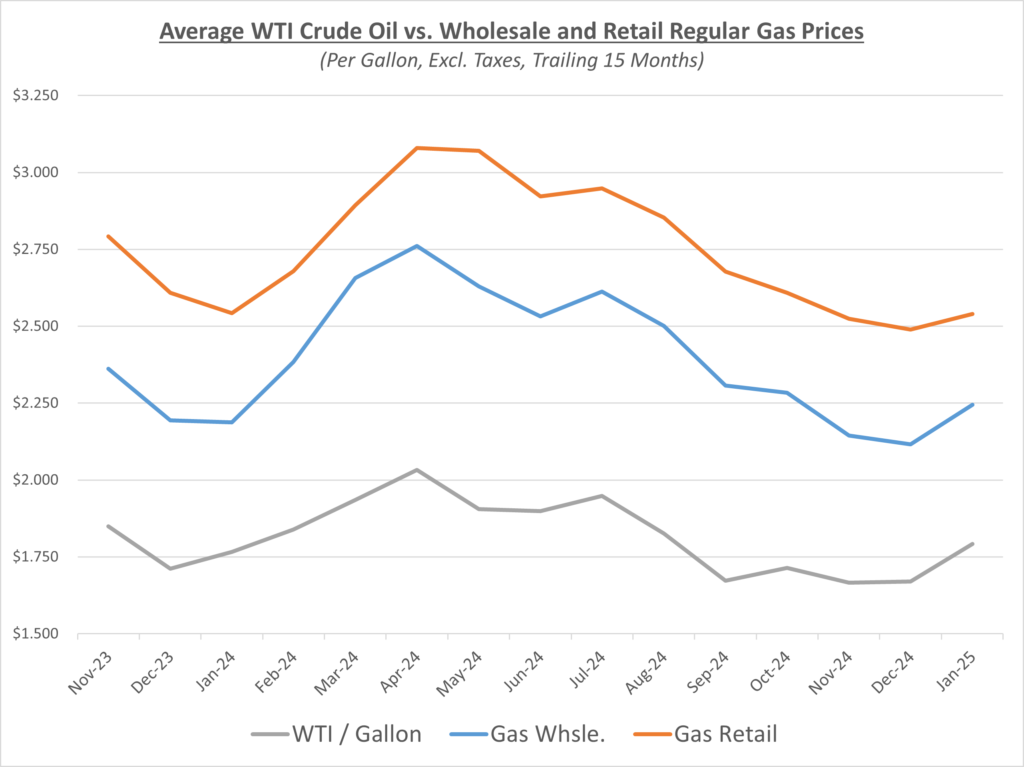

The graphs below show the movement of crude oil (converted to gallons) along with wholesale and retail fuel prices over the trailing 15 months:

In January, as expected, diesel wholesale prices spiked with oil. Retail prices rose but not as quickly, resulting in suppliers’ profit margins decreasing. Gas had a very similar story with both wholesale and retail prices surging, but wholesale outpaced retail causing profit margins to fall. The following graph shows the retail margins over the trailing 15 months:

According to AAA, the national average retail price for gas finished at $3.11/gallon in January, which is 7 cents higher than last month. The national average price for diesel finished at roughly $3.66/gallon which is an increase of $0.15 compared to December.

The Trump administration took office and quickly got to work on their vision of boosting U.S. oil and gas production, bringing fuel prices down, and refilling the strategic reserves. President Trump also called on OPEC+ to do their part on increasing production, but only time will tell if that has any direct effect on their decisions. For now, oil prices have retreated lower and finished the month under $74/barrel.

Sokolis will continue to monitor the many factors going into fuel prices. We currently anticipate that oil prices will continue to range between $70-80/barrel in the near term.